All participants in legal relations have rights and obligations. They are regulated by current legislation. The interaction between an employee and an employer is no exception. Having decided to hire an employee, an entrepreneur must study the labor rights and responsibilities of the employee . They are reflected in the Labor Code of the Russian Federation. Violation of established norms is fraught with sanctions. We will talk further about how to ensure the fundamental rights of workers, about duties and responsibilities, and possible consequences in case of failure to comply with the requirements.

Current legislation regulating the rights and obligations of employees and employers

The law protects the rights and interests of workers who decide to work for an employer. The main legal act regulating the peculiarities of the relationship between the parties is the Labor Code. The main categories of employees are reflected in Chapter 4 of the Labor Code of the Russian Federation.

The list included:

- minors;

- temporarily unemployed persons;

- disabled people;

- women with children;

- shift workers;

- persons working in shifts.

Each category has special legal nuances. An employment contract is concluded with employers. Its main aspects are reflected in chapters 11-13 of the Labor Code of the Russian Federation. The fourteenth chapter states that the rights and interests of workers must be taken into account when fulfilling labor obligations. Personal information is not subject to disclosure.

Rights of workers in accordance with the law

The specifics of interaction between the parties are reflected in the Employment Agreement. It also fixes a point regarding the rights and obligations of employees. Before signing the document, you need to read this section.

The list of basic rights of workers under the Labor Code includes:

- the ability to conclude an agreement on acceptable terms;

- the right to receive exactly the position reflected in the agreement;

- the right to wages and rest;

- the right to accurate information about the workplace, working conditions and the specifics of its payment;

- the right to receive training from the employer;

- the opportunity to participate in a trade union;

- the right to protect interests;

- the right to compensation for damage if it was caused during the performance of work duties;

- the right to pension and social insurance.

The employer pays personal income tax for the employee in the amount of 13%. This is the only deduction that can be taken from wages. The amount cannot be reduced.

Video

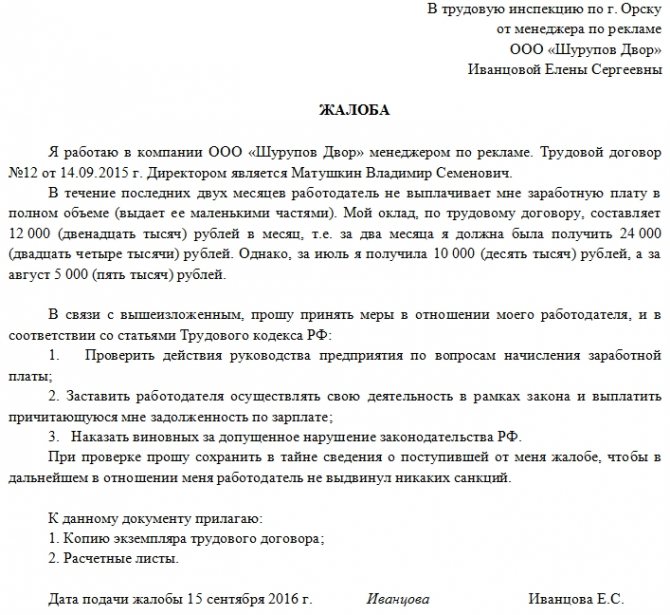

Where to go

If the employer’s behavior infringes on the interests of the worker, you should notify:

- to a trade union organization or commission for resolving labor disputes;

- labor inspection;

- prosecution authorities;

- court.

To do this, you must draw up a complaint (application), which must contain:

- addressee's name;

- FULL NAME. and the position of the applicant;

- statement of factual circumstances;

- indication of violation;

- date and signature of the applicant.

You can attach supporting documents, audio or video recordings to your complaint.

A statement of infringement of rights may be signed:

- individual employee;

- the whole team or a separate group.

If the violations committed by the employer have signs of a criminal offense (in the case of fraud or threats against the employee), you should contact the police with a corresponding statement.

Ways to ensure workers' rights

The responsibility to respect the interests of employees rests with the employer. The rights of the employee under the Labor Code are placed above all else. However, the company's interests are also protected.

The employer is obliged:

- conclude an employment or collective agreement by mutual consent;

- provide the employee with a workplace and tools to complete the task. All materials are purchased at the expense of the company;

- transfer wages at least twice a month on the due date;

- establish a work and rest schedule, following the current regulations;

- promptly provide information to the employee regarding the fulfillment of labor obligations, income, days off and vacation;

- pay for advanced training, if there is a need for such;

- do not interfere with the employee’s desire to participate in trade union organizations;

- listen to suggestions for improving the company’s performance;

- resolve emerging conflicts;

- provide compensation for harm caused to an employee during the performance of labor obligations;

- ensure social insurance of a person by providing contributions to funds.

The employer makes any changes to the employment contract only with the consent of the employee. The provisions reflected in the agreement cannot contradict the norms of the Labor Code of the Russian Federation.

Employment contract form

Additional rights granted to an employee under the Labor Code

The basic rights of an employee are reflected in the Labor Code of the Russian Federation. Failure to comply with them is strictly punishable. However, it is acceptable to include rights and obligations in an employment contract. This is possible only if the new provision does not contradict the norms of current legislation.

Please note: Information is recorded by agreement with the employee. The corresponding norm is reflected in the contract. Changes are fixed by local regulations. They are signed by the employee and the employer. The company cannot adjust the provisions of the agreement solely at its own request.

Present duties and responsibilities that the employee bears under the Labor Code

Like the rights, the duties of employees are fixed by the Labor Code of the Russian Federation. The provisions are reflected in Article 21 of the above-mentioned legal act. They are also recorded in the contract.

Video

The list of responsibilities includes:

- performance of work in accordance with the contract;

- compliance with the internal regulations of the organization and discipline;

- compliance with safety regulations;

- incurring financial liability, if provided for;

- proper performance of job duties;

- notifying management about the occurrence of a risk of accidents or other danger.

The employee’s responsibilities under the Labor Code of the Russian Federation are fixed in the employment contract in the form of a table or list. It provides a brief description of the functions that the employee must perform. The full list is recorded in the job description. Chapter 9 of the Labor Code fixes the financial responsibility of the employee to the employer. It is divided into 2 types - individual and collective. In the first case, a specific employee bears financial responsibility to the organization. If responsibility is collective, a whole team of employees is responsible for the safety of valuables. If damage is caused, liability is distributed proportionally or equally.

The employee’s financial liability to the employer can be full or limited. In the first case, repayment is made of all losses incurred by an employee of the enterprise during the performance of labor functions. The corresponding type is most often used if work is carried out in banks or other financial organizations.

Please note: Other companies usually provide for partial financial liability of the employee to the employer. In this case, the employee repays losses only to a certain extent. To do this, a percentage of the amount of damage is deducted from the employee’s salary. The corresponding rule is enshrined in Chapter 39 of the Labor Code of the Russian Federation. The price of the property decreases annually by the depreciation percentage. The corresponding provision is also fixed in the employment contract.

The employee bears financial responsibility if he is 18 years old and a corresponding agreement has been signed or the fact has been reflected in the employment contract. If a liability agreement is signed, the employee is responsible for the company’s property on an equal basis with the employer. Compensation for damages occurs in proportion to fault. If an employer has violated the rights of an employee and has not complied with the provisions of the employment contract and the law, the person may go to court to protect his rights and interests. However, it is not always possible to achieve a positive solution. Typically, a similar situation arises in cases where the drafting of an employment contract was carried out with violations. If the document included information about which the person was not notified, you can defend your interests by contacting a lawyer.

Video

Work without registration as an individual entrepreneur or LLC

This violation relates to economic crimes - namely, illegal business activities. If you have opened an online store, but have not registered as an individual entrepreneur or LLC, then you are at great risk. In addition to the illegal activity itself, you will thereby violate a number of other requirements: you will not be able to issue checks to customers (after all, the online cash register must be registered with a company that you actually do not own), pay taxes (from a non-existent company?), employ employees (where?) . And suppliers are wary of private owners, preferring to cooperate with individual entrepreneurs or legal entities.

It is clear that many people work this way - there are a lot of shops on social networks that are run by private individuals, but this is not a reason to break the law. There is also an opinion that if your income is less than 100 thousand per month, you don’t have to register anything. In fact, this is not true: illegal business activity is when you constantly make a profit and do not pay taxes . Checking the owner of such a store is as easy as shelling pears - and both the tax office and the department for combating economic crimes can do this.

What are we risking?

- Fines from the Department of Economic Crimes: 500-2000 rubles.

- Fines from the tax office: if you started a business and have not registered as an individual entrepreneur - from 20,000 rubles, if you have been doing this for more than 3 months - from 40,000 rubles or 20 percent of the profit. We wrote more about this in the article about online store inspections.

Guarantees provided and obligations of the employee under the Labor Code

The employer who hires the employee is obliged to provide him with a workplace and appropriate materials. The company establishes internal regulations and specifics of remuneration. If violations occur, the rights and interests of the employee are protected by the Labor Code of the Russian Federation. Guarantees are enshrined in Article 220 of the Labor Code of Russia. If the company is closed or does not operate for any reason and it is not the employee's fault, the person retains the right to receive wages. Moreover, its size remains the same as reflected in the employment contract. If a position held by an employee is temporarily closed, the employer will provide the employee with another position. However, the right to the basic salary is retained.

Please note: If a danger to life and health is found while performing a job function, the employee has the right to refuse to perform work until the current situation is eliminated. The person is transferred to a less dangerous place. If the position is unavailable, the employee is sent on paid leave. If the person has previously used the corresponding opportunity, additional rest is provided at the expense of the employer.

The idle period is paid in accordance with the tariffs established by the employer. The amount cannot be less than the minimum wage in the region. If an employee does not want to fulfill obligations because his health or other employees have been harmed, the company cannot bring the person to disciplinary action.

Video

When a person is injured or his property becomes unusable due to the performance of a job function, the need to pay compensation falls on the employer. If the company refuses to pay compensation, the person has the right to go to court. Additionally, it is allowed to claim for material damage. It is permissible to use any methods to assert rights if they do not contradict the norms of current legislation. So, it is permissible to involve a lawyer.

Responsibility borne by the employee to the employer for failure to fulfill duties

The employee is obliged to comply with the provisions of the employment contract. If they are not followed, the employee will be held accountable.

It comes in the following types:

- disciplinary;

- administrative;

- criminal;

- material.

First of all, the employer is obliged to assess the severity of the employee’s disciplinary offense. If the employee’s actions did not lead to undesirable consequences, it is necessary to limit oneself to only a verbal remark.

Video

The concept of financial liability is given in Article 238 of the Labor Code of the Russian Federation. It rests with the employee who has entered into an agreement with the employer. The person must compensate for damage caused during the performance of duties. However, if the employer himself is to blame for the situation, it will not be possible to recover funds from the employee. Lost profits are not recognized as losses.

Please note: In accordance with Article 243 of the Labor Code of the Russian Federation, the employee bears full financial responsibility. This means that the person is obliged to compensate the entire amount of losses caused. However, in a number of situations, liability is limited to the size of the citizen’s salary.

A person may be held administratively liable if the provisions of the Code of Administrative Offenses of the Russian Federation are violated. Typically, it involves persons working illegally on the territory of the Russian Federation. However, the Labor Code provides a list of persons who cannot be fired.

The list includes:

- parents of one or more children under 3 years of age;

- single parents raising a child under 14 years of age;

- a person raising a minor citizen who has lost his parents;

- women carrying a child or on maternity leave;

- parents with a disabled minor child;

- other citizens who are protected by law.

Video

Prosecutor's office

At the request of the employee, an independent inspection of the employer’s activities may be initiated, or a complaint may be submitted to the Labor Inspectorate for consideration.

A form is possible.

Sending an application to the prosecutor's office has the following advantages:

- she has the right not only to check the facts of the complaint, but also to conduct a comprehensive audit of the employer;

- may initiate both administrative and criminal liability;

- If a violation is detected once, it has the right to conduct inspections at certain intervals to prevent recurrences.

Responsibility of employers for violation of rights

The employer also bears financial responsibility to the employee.

Compensation is paid in the following cases:

- illegal dismissal occurred;

- the company does not comply with the requirements of regulatory authorities on labor protection;

- the employee suffered moral damage;

- the employer does not pay wages, sick leave or vacation pay;

- disciplinary action was taken without justification.

If the employer delays wages for more than 15 days, compensation is awarded in the amount of 1/150 of the salary. Additionally, criminal liability is provided. It proposes a fine, imprisonment for up to five years, forced labor and suspension of activities. Thus, the rights and obligations of the employer under the Labor Code of the Russian Federation should not violate the rights of the employee.

Labour Inspectorate

The government body specializing in protecting the rights granted by the Labor Code is the Federal Service for Labor and Employment.

The employee can file a complaint;

- to the Federal Service itself;

- to a territorial unit;

- through the official website of the Federal Service for Labor and Employment (rostrud.ru).

The consideration of the complaint on its merits will be carried out by the state inspector of the territorial unit in the region in which the employer is registered or operates.

A form is possible.

Upon receipt of the complaint, an investigation is initiated. It can be carried out in the form:

- sending a written request addressed to the manager about the need to provide explanations and documents;

- visit of a state inspector to the employer’s location with receipt of explanations and documents on the spot.

For failure to provide information at the request of the inspector, the manager may be held liable in the form of a fine.

At the end of the inspection, the state inspector makes one of the following decisions:

- on eliminating the identified violation and bringing to responsibility;

- about the absence of an offense.

The most common reason for contacting the Labor Inspectorate is violation of the procedure and timing of payment of wages or illegal dismissal.