Laws

- Internal Revenue Code Section 333.36. Benefits when appealing to the Supreme Court of the Russian Federation, courts of general jurisdiction, and magistrates. An exhaustive list of categories of people who are exempt from paying for collection is provided.

- Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 20, 1994 No. 10 (as amended on February 6, 2007) “Some issues of application of legislation.” An expanded interpretation of definitions and conditions leading to liability is given.

- Tax Code of the Russian Federation, Article 333.19. Amounts of state fees for cases considered by the Supreme Court of the Russian Federation, courts of general jurisdiction, and justices of the peace. Assigns an amount depending on the category of the applicant and the content of the statement of claim, prescribes clear formulas for correct calculation.

State duty to court

is a mandatory payment. Details of the state fee can be found on the website of the court where the application is being submitted. The rules for paying state fees are the same for a magistrate’s court, a city (district) court, a court of a constituent entity of the Russian Federation, as well as the Supreme Court of the Russian Federation. Let’s figure out how much to pay state fees to a court of general jurisdiction or to a magistrate’s court judge when filing a claim; how to determine its size in cases of special proceedings, when appealing decisions; who has benefits for paying the state duty. To calculate it is convenient to use: State duty calculator to the courtPayment of the state duty to the court Current data on the amount of the state duty to the court for 2020: If an application is submitted in a special proceeding or a supervisory complaint, as well as for claims that cannot be assessed , the state duty for citizens is 300 rubles. If an appeal or cassation complaint is filed, the state duty is 150 rubles. If the plaintiff files a claim that can be assessed in monetary terms, the state duty to the general court is paid depending on the price of the claim in the following amounts:

- up to 20,000 rubles - 4% of the claim price, but not less than 400 rubles; from 20,001 rubles to 100,000 rubles - 800 rubles plus 3% of the amount exceeding 20,000 rubles; from 100,001 rubles to 200,000 rubles - 3,200 rubles plus 2 % of the amount exceeding 100,000 rubles; from 200,001 rubles to 1,000,000 rubles - 5,200 rubles plus 1% of the amount exceeding 200,000 rubles; over 1,000,000 rubles - 13,200 rubles plus 0.5% of the amount exceeding 1,000,000 rubles , but not more than 60,000 rubles. If an application for a court order is submitted, the state duty will be 50% of the amount of the state duty when filing a claim of a property nature. If a claim for divorce is filed, the state duty will be 600 rubles. State duty for administrative claims Amount of state duty for in administrative cases depends on what demands are made by the administrative plaintiff and who files the administrative claim

State duty for moral damage in 2019-2020

The payment of the fee for the claim for compensation falls on the plaintiff.

Although the goal of the applicant is to receive money, compensation for moral damage within the framework of the law is recognized as non-property (Plenum Resolution No. 10). This interpretation is important for the subsequent understanding of duty calculation. So, in a claim for compensation for material damage, it will be completely different.

If your application also seeks material damage, then the fee for it will be paid separately. This means you will have to pay twice.

The filing of any claim by default is accompanied by a fee in favor of the state, unless otherwise specified by law. There are exceptions and you need to be aware of them.

When released

Following Art. 333.36 of the Tax Code, when collecting certain types of damage, the state duty may not be charged if:

- The harm was caused as a result of a crime or violation of freedom and rights, criminal prosecution.

- The interests and rights of people with disabilities are defended.

- Consumer rights have been violated.

- Labor rights are violated.

- The claim for compensation arose as a result of injury caused (or other damage to health), as well as the death of the breadwinner.

We invite you to familiarize yourself with: Crossing in the wrong place

The amount and procedure for paying state duty for compensation for moral damage is regulated by the Tax Code of the Russian Federation, in particular, Art. 333.36. There are also a number of situations when the plaintiff does not need to make this payment, among which it is noted: the harm was caused by injury or the actions fall under an article of the Criminal Code of the Russian Federation.

Since 2020, for citizens and organizations filing a statement of claim in court, a mandatory state fee has been established, the amount of which is regulated by the Tax Code of the Russian Federation. The claim is filed at the place of residence of the victim or at the location of the organization that caused the harm.

However, the legislation defines situations in which payment of state duty is not a prerequisite. Such cases are described in the following paragraphs.

Legal aspects when causing moral damage

Thanks to judicial review, it is possible to obtain compensation for damage of various kinds, and if there are often no problems with the assessment of material benefits, then compensation for intangible benefits is a controversial issue.

The consideration of such cases, depending on the amount of the claim, is handled by magistrates or district courts. The state fee for a claim for moral damages is calculated before filing an application with the appropriate authorities.

Before going to court to recover damages, you need to accurately determine the following points:

- who are the accused? who are the persons who caused the damage;

- evidence of the suffering itself;

- the causal relationship between those responsible and the suffering that ensued;

- type of non-material damage;

- the amount of compensation you can claim.

The full list of intangible benefits for which one can claim compensation for losses is determined by Art.

150 of the Civil Code of the Russian Federation. In general terms, intangible damage can be characterized as: violation, oppression and infringement of the rights and benefits of individuals that do not have a property expression, including humiliation, suffering, discredit, anger, discomfort, physical pain, despair suffered by the victim due to the actions committed by the accused . The amount of state duty, when collecting moral damages, is calculated based on the amount of compensation; to correctly determine its amount, not only the subjective assessment of the injured party is taken into account, but also objective data on the degree of physical and moral suffering, based on the vital importance of the good that became the subject of the crime. The nature, scope and severity of the consequences of the offense are also taken into account.

What does the value depend on?

The amount of the state fee for a claim for compensation for moral damage is directly dependent on the entity that submits the application.

According to Art. 333.19 of the Tax Code of the Russian Federation, an individual is required to pay a fee of 100 rubles, and legal entities - 2000 rubles.

Article 333.19 of the Tax Code of the Russian Federation “Amounts of state duty in cases considered by the Supreme Court of the Russian Federation, courts of general jurisdiction, and justices of the peace”

Unlike material damage, which is calculated as a percentage, in addition to a constant rate, moral damage will be paid at a fixed rate. For individuals, a claim is subject to a fee of 300 rubles, for legal entities – 6,000 rubles. If you fall under preferential categories, then the calculation will begin only if the claim amount exceeds 1,000,000 rubles. Further calculations are similar to a standard claim for damages.

State fee calculator for court

A simple and quick calculator for state fees in court in 2020.

For free. The exact result in accordance with Article 333.19 of the Tax Code of the Russian Federation as amended for 2020. When calculating property claims you will need: Determining the value of the claim.

More information about what a state duty is, how to pay it, payment benefits: State duty to court. Quick calculation of state duty 2020, enter the price of the claim: state duty to court: rub. State duty calculator 2020: Filing a statement of claim Filing an application for a court order Filing an application in cases of special proceedings Filing a statement of claim for divorce Filing an appealThe state duty calculator is suitable for calculating the state duty in:

- on administrative claims;

- justices of the peace;

- to regional, regional, republican courts, to the Moscow City Court, to the St. Petersburg City Court;

- district (city courts) for civil cases;

- to the Supreme Court of the Russian Federation.

Use our court fee calculator.

You can easily calculate the amount of state duty yourself. To do this, select the duty category, indicate (if necessary) the price of the claim and receive the amount of the state duty that must be paid when filing a claim in court. How to use the state duty calculator in a court of general jurisdiction

- determine what application we file in court

- The result obtained using the state duty calculator, in the form of a sum of money, is paid at the bank, using the court details

- we indicate whether a citizen or organization (legal entity) will pay the state duty calculated using the state duty calculator

- enter the claim price for property claims into the state duty calculator

An example of calculating the state duty. For example, using the state duty calculator, you need to calculate the amount of payment when collecting the amount of debt under a loan agreement of 55,000 rubles. Select the line in the calculator: “Filing a statement of claim”, then “Property nature, subject to

How to calculate the size correctly

You need to pay attention to the amount of the claim and the type of damage. The state fee for a claim is always standard; its amount is stated above. If there is also material damage in the appeal, then the amount is calculated in accordance with Art. NK 333.19.

The state duty in this category of cases will be charged only over 1 million rubles. For amounts up to a million, the duty payment requirement does not apply.

Let’s say the amount of the claim for failure to satisfy consumer rights in pre-trial proceedings, together with the fine, amounted to 1,350,000 rubles. According to the Tax Code, you must first calculate the duty for the entire amount, then per million and subtract the smaller from the larger.

We invite you to read: Refusal of inheritance in favor of another heir: is it possible to renounce inherited property in the interests of other persons when inheriting by law or by will

Calculation of duty on 1,350,000: 13200 0.5%*350000=14950

Per million: 5200 8000=13200

We calculate the difference 14950-13200=1750. This amount is the state duty on the claim.

For labor disputes

The employer illegally withheld the dismissed employee’s book for 3 months. He, in turn, could not find a job. The citizen filed a lawsuit asking for compensation for moral damages in the amount of 240 thousand rubles. There is no state duty required here.

In case of an accident

The driver hit a man getting out of a nearby car. The victim filed a claim for compensation for material damage through administrative proceedings and moral damage. There is no duty charged for the latter; the material fee will be calculated using the formulas from Art. 333.19 Tax Code.

State fee calculator for court

You are here » » The state court fee calculator calculates the amount required to be paid when filing a claim of a property nature, subject to assessment, in accordance with Articles 333.19 and 333.21 of the Tax Code of the Russian Federation.

Calculations are current for 2020. All the latest changes to the Tax Code that came into force on January 29, 2010, as well as changes introduced by Law No. 41-FZ dated April 5, 2010 (came into force on May 7, 2010) were taken into account.

The state duty cannot exceed 60,000 rubles. for magistrates' courts and general jurisdiction, and 200,000 rubles.

for arbitration courts. Price of claim, rub.: State duty, rub.: Price of claim, rub.: State duty, rub.: Calculations are current for 2020.

All the latest changes to the Tax Code that came into force on January 29, 2010, as well as changes introduced by Law No. 41-FZ dated April 5, 2010 (came into force on May 7, 2010) were taken into account. The claim price can be entered using mathematical functions, for example, or ; The state duty cannot exceed 60,000 rubles.

for magistrates' courts and general jurisdiction, and 200,000 rubles.

for arbitration courts. When filing a claim of a non-property nature in court, payment of a state fee is also required.

But its size in this case will be fixed (determined by the Tax Code of the Russian Federation). According to Article 333 of the Tax Code of the Russian Federation, state duty payers are individuals and legal entities who filed the claim. Or the defendant, in case of loss, if the plaintiff is exempt from paying the fee.

In some cases, the following are exempt from paying state duty:

- plaintiffs when filing claims: for the collection of arrears of wages, alimony, compensation for moral and property damage caused by a crime.

- low-income citizens

- WWII participants

- budgetary organizations

- mass media

- Heroes of the Soviet Union and Russia

If there are difficulties in determining the value of the claim, the amount of the fee is preliminarily established by the judge. The missing part of the fee is paid after it is accurately determined based on the results of the court decision.

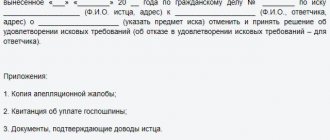

Procedure, documents

Before writing a statement of claim, you need to know that going to court is possible only in 2 cases: when there is an intangible nature of the violation or other types of moral damage. Please note: the court will not consider the case until the statement of claim is filed and the state fee is paid.

Conditions for submitting such an application:

- You only need to file a claim against an individual in the plaintiff’s city, and you should send your application there;

- when writing to a legal entity, it is easier to submit documents to a court located near the company or enterprise (the culprit).

It is also necessary to understand that in order to resolve the issue as quickly as possible, you need to go to the district court. The fact is that only the courts of first instance can deal with the decision; the magistrates will not help here. But for more serious issues, such as criminal damage, you will need to go to the regional court.

At the same time, the legislation does not oblige the plaintiff to write an application using special forms; it is desirable that it have the following points:

- full name of the court where the documents are sent;

- information about the parties to the conflict (for individuals it is enough to write down the full name and passport data, for a legal entity - the name of the organization);

- the required amount of the claim;

- the defendant must provide documentation on which the company operates (including all previous points).

Also, for the trial, it is necessary to collect a folder of documents that should be submitted along with the statement of claim. First of all, you will need evidence of advance payment of the state duty or documents giving a deferment for this action. Acts and various papers confirming the fact of damage received from the defendant. You will also need to make a copy of the statement of claim.

If, for any reason, the plaintiff cannot sign the statement of claim on his own, he will need to draw up a power of attorney for the guarantor.

What is paid off first: alimony or moral damage?

At the same time, as the applicant notes, the provision of part six of Article 15 of the Law of the Russian Federation “On the Fundamentals of the Tax System in the Russian Federation”, concerning the procedure for writing off funds, on the contrary, creates advantages for requirements ensuring the formation of the state budget to the detriment of the interests of persons working under employment agreements (contracts), which does not correspond to the constitutional obligation to pay remuneration for labor guaranteed by Article 37 (Part 3) of the Constitution of the Russian Federation.

Labor disputes and state duty

If the damage from the accident was compensated by the insurance company, the vehicle will be restored at its expense.

Expert opinion

Lawyer Alexander Vasiliev comments

If the payment was made by the insurance company of the person at fault for the accident, the owner of the vehicle can recover the missing funds in court directly from the person at fault or from his insurance company. In this case, the state duty is paid in the usual amount, as when filing a property claim.

If your own insurer underpaid for an accident, it will be the defendant in the claim. If the plaintiff is a citizen who insured his own car, he can take advantage of the exemption for payment of state duty provided by the Tax Code of the Russian Federation for plaintiffs - consumers:

- claims in the amount of up to 1 million rubles are exempt from state duty;

- for claims exceeding this amount, the state duty is paid only on the excess amount - 0.5%, but not more than 60 thousand rubles (clauses 2 and 3 of Article 333.36 of the Tax Code of the Russian Federation).

The article provides general legal norms. Please seek legal advice to answer your specific question.

8 ext. 741 (all regions)

7 ext. 741 (Moscow)

7 ext. 741 (St. Petersburg)

Clause 1 Art. 333.36 of the Tax Code determines that claims for the restoration of labor rights are filed without paying tax. At the same time, Art. 393 of the Labor Code makes an adjustment that only employees are exempt from state duty. Employers are not provided with tax exemption benefits.

An employee who has suffered moral damage caused by the following violations is exempt from state duty:

- unmotivated refusal to hire;

- wrongful dismissal;

- delay in payment of wages;

- illegal imposition of fines;

- non-payment of bonuses and compensations;

- other violations of labor legislation.

State duty for compensation for moral damage

We will start from the fact that you have concluded a purchase and sale transaction, then: In your purchase and sale agreement (which, of course, must be registered) there must be a column indicating who is registered in the apartment being sold and when they undertake to deregister, or, Perhaps, for some reason, they retain the right of lifelong residence or so: ". 4. The apartment has not yet been sold to anyone, not given as a gift, not mortgaged, is not in dispute and is not under arrest (ban). No one is registered in the apartment. “First, read your contract. And most importantly, if you are already the owner of this apartment, then you are required to register there. But I repeat again: the transaction must be registered and you must have the appropriate documents in your hands: a certificate of ownership and a registered purchase and sale agreement... If the documents are in order and, according to the contract, the previous owners agreed to deregister, then you can go to court to protect your rights, but when filing a claim, you pay the state fee. “In court”, among other things, you have the right to recover from the defendants the damage caused to you and legal costs - fees

Statement of claim for recovery for moral suffering

You have the right to sue your offender who caused you moral or physical suffering in accordance with Art. 151 Civil Code of the Russian Federation. It is this article that provides the legal basis for the court to accept your application and consider all the details of the case.

Usually the court always makes its decision in favor of the victim, determining the punishment for the violator of his rights.

However, bailiffs and experts still take into account all the circumstances of the incident:

- degree of guilt of the offender;

- the magnitude of moral suffering;

- degree of physical suffering;

- individual characteristics of the injured party;

- other circumstances.

If the amount of compensation for moral damage is determined by the court, based on the degree of physical damage and mental suffering, as well as the guilt of the offender, then the case should be described in great detail in the statement of claim.

Moreover, you should indicate all your vivid emotional experiences that accompanied the incident and caused you harm, even at the level of the nervous system.

When filing a claim, you must fill out an application form that contains the following information:

- In the upper right corner, fill in the name of the court to which the victim wants to apply.

- The next line of the header of the application form indicates the details of the victim as the plaintiff. Usually the full name, address and telephone number of the plaintiff are written down.

- Next, the same information about the defendant or defendants is filled in, depending on the number of people who violated the rights of the plaintiff.

- After the title of the document – “Statement of Claim for Recovery of Moral Damage” – a date is placed.

- Then all the circumstances of the incident are described in detail.

- After detailing the laws that give you the right to go to court for damages, you notify the court that you believe you have suffered harm in the form of physical injury and mental suffering.

- The plaintiff indicates the amount of compensation for moral damage, which, in his opinion, can satisfy him.

- You should also indicate the amount of your expenses that you incurred during treatment, using the services of your representative or lawyer.

- Then in the “I ask” section you write that you want the court to collect:

- from the defendant in your favor a certain amount of compensation for moral damage;

- from the defendant in your favor the amount of payment of state duty for moral damage;

- from the defendant in your favor the amount of expenses spent on the services of a representative.

- Signature and date.

- List of documents attached to the application.

The state duty for moral damage in 2020 must be paid for the consideration of a case of a non-property nature.

Defendants in the lawsuit

Based on Art. 1064 of the Civil Code of the Russian Federation, the damage caused by the defendant to the victim is compensated first in full in the amount determined by the final decision of the court.

Defendants can cause damage to their victim by infringing on personal and non-material rights, which are listed in Art. 150 Civil Code of the Russian Federation:

- right to life and health;

- the right to honor, dignity;

- inviolability – personal and one’s home;

- the right to leave a good name, both your own and that of your loved ones;

- reputation – personal, professional or official;

- the right to maintain private or family secrets;

- other benefits and rights.

Every citizen of the Russian Federation has the rights to the above benefits, and therefore their infringement is recognized by the court as an offense. Whatever the case, the defendant compensates for damages determined by the court, all expenses of the plaintiff, as well as expenses such as, for example, state duty when collecting moral damages in an accident.

Any offense is punishable by moral damages in the form of financial compensation by the offender or other punishment.

Based on Art. 28 of the Code of Civil Procedure of the Russian Federation, the victim can file a claim to apply to the court for protection at the place of residence of the defendant, if he is an individual or legal entity.

If the location of the defendant is not known to the victim, then a claim can be filed at the location of the defendant’s property or at his last place of residence.

If there is no information at all about the offender, then a search for the offender is organized through law enforcement agencies.

What documents do you need to collect for your application?

Along with the statement of claim, the court must also submit other documents that must be drawn up as an appendix to the claim.

These are, as a rule, the following applications in the form of originals and copies:

- A copy of the statement of claim itself.

- A copy of the identity card - passport of the person submitting the application.

- Original and copy of the receipt confirming payment of the state duty for the moral claim.

- Copies of all documents important for consideration, revealing all the details and significant details of the events of the incident.

- Power of attorney of the person who will represent the interests of the plaintiff in court.

This is important to know: Deadlines for filing a claim in court in a civil case

Documents that could give a complete picture of the severity of the damage caused could be:

- medical examinations;

- doctor's reports;

- certificates from ambulance or emergency room paramedics;

- witness statements;

- data from surveillance cameras, recorders, and from the scene of the incident;

- everything that can help the investigation reveal and confirm the circumstances of the case, substantiate everything that the victim described in the statement of claim.

Which court is the paper filed in?

If you were harmed in a situation of attack by hooligans or during an accident, you should not go to a military or magistrate court; it is enough to file a claim with the district judicial authority.

Based on Art. Chapter 24 3 of the Code of Civil Procedure of the Russian Federation No. 138-FZ dated November 14, 2002, all applications for compensation for moral suffering are subject to consideration in a district court of general jurisdiction.

Read about moral damages for causing harm to health here.

They are also considered by arbitration courts because they have jurisdiction over civil cases. Therefore, the first instance will always be the immediate district judicial body.

What should be the procedure for going to court?

To file a claim for moral damages in court, you must follow the order of paying the state fee, submitting the application itself and other documents.

Follow the simple procedure for going to court:

- Find and determine the court in which you can file a claim for compensation for moral damages.

- Then fill out the claim form or draw it up yourself using the standard form.

- The next stage is payment of the state fee.

- Submit the completed application, receipt of payment of the state fee and a number of necessary attachments to the court.

After accepting your application, the court will review the case, possibly schedule a hearing, and send a notice to your address.

How is the claim price calculated?

Before independently determining the amount of compensation for damage caused by moral and physical suffering, you need to understand what kind of moral losses you suffered. To do this, you must preserve any evidence that proves you suffered.

The legislation does not provide for an exact calculation of the cost of a claim because this is done by the judicial authority, and the final price of the claim will be approved or refuted by a court decision.

Practice shows that, on average, repayment of costs when causing harm of a moral nature ranges from several hundred to several thousand rubles.

Moreover, if you request an amount of a million rubles, then the court may quite reasonably reduce its amount. The categories for determining the amount of compensation are moral suffering, the degree of which completely depends on the individual perception of the victim and psychological characteristics.

As well as the magnitude of the defendant’s guilt and the criteria of fairness and reasonableness. At the same time, compensation is intended to eliminate negative emotions and negative experiences of what happened due to the unlawful actions of the offender.