Why do banks insist on mortgage insurance?

Since the mortgage agreement assumes a long lending period and a reduced rate compared to other types of loans, banks are forced to take a number of measures that allow them to protect themselves from possible risks, the main of which is non-payment of debt. Therefore, many financial institutions refuse to issue a loan or increase the interest rate if the applicant does not want to enter into a property insurance contract.

Banks have the legal right to require real estate insurance. This power is regulated by Art. 31 Federal Law of Russia “On Mortgage”. The exception is when the contract contains other provisions.

Types of mortgage insurance

Banks offer borrowers not only compulsory insurance. Additionally, you can take out insurance:

- health and life of the payer;

- title;

- extended property insurance, which provides not only for the complete loss of the property, but also for damage to cosmetic repairs.

These types of policies may be offered by bank employees as additional services, but their purchase is not mandatory.

Property

Extended property protection will help protect the apartment not only from structural destruction, but also from other damage caused by flooding of housing by neighbors, fire, and other circumstances. Compensation in the form of a set amount here covers the cost of cosmetic repairs, valuables and equipment.

Title

This type of insurance allows the bank to protect itself from the risk of losing ownership of the collateralized property. Therefore, registration is beneficial only to the lender. The payer will not gain much from purchasing the policy.

Life and health insurance

Health insurance ensures full payment of funds if the borrower dies or becomes incapacitated. When the payer dies, the obligation to repay the loan debt to the bank passes to his heirs along with the rest of the property that they accepted by will or law. If such insurance was taken out, the insurance company will return the entire amount of the debt to the financial organization.

Is it possible to return

In Art. 31 of the Law “On Mortgage”, banks have the right to require compulsory property insurance; it is insured at the expense of the borrower. But at the same time, banks are given the opportunity to specify other conditions in the contract, that is, to provide for the absence of compulsory real estate insurance or to provide such a choice to the borrower. With this type of lending, the risk of loss and damage to property must be insured.

Free HOTLINE:

Moscow time 8 (499) 938 6124

St. Petersburg 8 (812) 425 6761

Fed 8 (800) 350 8362

It is important to understand that property insurance is a mandatory condition by law, unless there are relaxations in the contract. The return of such insurance with standard loan repayment is unlikely.

Property insurance is the only mandatory type for a loan secured by real estate; other types of agreements are voluntary. If a banking institution defines them as a mandatory condition for issuing money, then this is an imposition of services, which grossly violates Art. 25 of the Law for the Protection of Consumer Rights.

Refundable and non-refundable

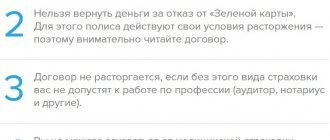

Whether mortgage insurance can be returned depends on the type of insurance. They are divided into three types - property, life and health, title:

- With property insurance, a refund of the premium paid is possible only if the loan is repaid early. In other cases, you can return the money only if the agreement with the bank does not provide for property insurance as a mandatory procedure.

- Life and health insurance of the person receiving the loan is a voluntary service. Therefore, you can refuse it at any time. If the documents are completed correctly, you can fully expect to receive a bonus.

- Title insurance provides financial protection in the event of loss of title to property. You can terminate this type of agreement at any time.

The right to refuse insurance and receive the money paid is only a possibility. It is not always advisable to do this. This is a kind of financial security in the event of force majeure. Therefore, sometimes it is not worth saving a little money if there is a risk of losing significant amounts.

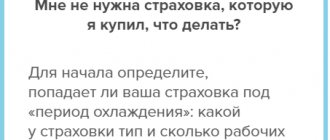

How do I get my mortgage insurance back?

When applying for a home loan, the client is told about his rights and responsibilities, but neither the bank nor the insurance company tells him whether the mortgage insurance can be returned. The insurance refund scheme depends on the type of policy purchased by the borrower. If there is a need for refusal, you should first study the terms of the contract with the insurer to find out whether it stipulates the possibility of returning the funds paid.

In case of early or planned repayment of the mortgage

Mortgage insurance paid as planned is not refundable, so you can only get your money back if you repay the loan early. The fact that insured events did not occur during the entire period of debt payment does not mean that the insurer failed to fulfill its obligations. Therefore, you can not count on payment.

The insurance is partially refunded if the mortgage is repaid early. The amount will depend on how early the entire debt was repaid. Consider an example where a home loan was taken out for a period of 30 years. The debt is paid within 15 years. And the contribution to the insurance organization amounted to 300 thousand rubles. In this case, the borrower can count on a return of ½ of the contribution, that is, 150 thousand rubles, since the company provided its services for 15 years before paying off the debt.

To get a refund, you only need to contact the office of the insurance company and fill out the appropriate application, attaching bank documentation about repayment of the mortgage in full.

Is it possible to refuse mortgage insurance?

It is not necessary to take out all three types of insurance when applying for a mortgage, but it is better to insure the collateral property. You never know what can happen to him - then prove that he is not a camel. When refusing other types of insurance, ask the bank what you will get for it.

Almost all financial organizations make it a mandatory requirement to obtain insurance for collateral; the minimum period for this service is 3 years. If the borrower does not pay the full amount at the end of the mortgage agreement, he faces a serious fine.

By refusing to insure life (health), the borrower risks receiving a loan with a higher interest rate. As for title insurance, there are no penalties for refusing such insurance. The bank does not care who will pay the debt - you or a third party who will suddenly appear and claim your property.

However, if you have taken out a mortgage not for a new home, but for a secondary one, title insurance will not hurt. During the three years for which the agreement is concluded, other “heirs” may appear who will lay claim to this housing.

But in any case, the borrower can demand the return of mortgage insurance, and banks and insurers do not have the right to impose the service. In cases where there is coercion into insurance, a citizen can contact a lawyer to change the clauses of the contract and return the money. But, as practice shows, this rarely happens.

Formula and calculation

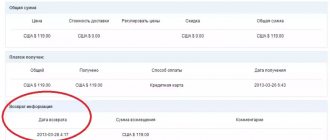

Let's look at an example. The policy was issued from 06/01/2019 to 06/30/2019. The amount of the insurance premium reached 20 thousand rubles. In December 2019, the loan was repaid ahead of schedule, and the payer immediately turned to the insurer for a partial refund.

We calculate the amount of compensation using the formula S=P/12*N, where:

- S—size of payment;

- 12 - number of months;

- P - contribution to the insurance company for the year;

- N is the number of remaining months that have not been used.

We substitute the numbers from the example: 20,000 / 12 x 6 = 10,000 rubles.

Borrower's actions in case of insurer's refusal

There are situations when the policyholder receives an unreasonable refusal in response to demands for a refund. In this situation it is necessary:

- Submit an application to the insurance company for an explanation of the refusal, indicating that the response is needed in writing.

- Attach a copy of the application for payment and the decision on it, as well as accompanying documents to the completed form.

It is advisable to report the reasons that forced the policyholder to apply for compensation. In some situations, if the client’s request is justified, the funds are returned to him, even if this is not provided for in the contract.

Supporting documentation:

- applicant's passport;

- housing loan agreement;

- agreed repayment schedule;

- document from the bank confirming full payment of the debt (certificate);

- policy;

- title certificate for real estate.

You should also take your account details with you. If the decision is positive, the funds will be transferred to him.

How to return insurance: refinancing, imposed services

Debt refinancing is carried out in order to obtain better mortgage conditions - for example, reducing interest while reducing payment terms. In this case, we are talking about insurance of mortgaged property, because it belongs to the bank and remains pledged to it. But the borrower may find more favorable mortgage conditions and has the right to refinance, transfer the debt to another bank.

But in order to refinance the debt, you need to issue a refund of the funds paid for insurance at the first bank. To do this you need:

- contact the bank where the agreement was drawn up and declare your intention to refinance the debt in another bank;

- contact the insurance company with a request to terminate the contract and return part of the insured amount;

- refinance the debt and renew the insurance contract;

- apply for a new mortgage loan.

Many people are interested in the question of how to refuse insurance if it was imposed by the bank. But the problem is that we can't get justice if we don't have evidence. This case is one of those where it is almost impossible to prove that you were forced to sign an agreement. Therefore, forget about this idea, although the law says that imposed services are considered invalid.

Even if the mortgage agreement stipulates the possibility of returning the insurance amount, there may be bad faith on the part of the insurance company or bank. That is, you may simply be refused to return the funds paid without explanation. Here you can’t do without lawyers and court hearings. But don’t forget to collect more documents in your favor: requirements for reasons for refusal, copies of payments, grounds for return, account for transferring funds (if you win).

Sources:

On measures to protect pledged property

About insurance of pledged property

On the protection of pledged property from claims of third parties

Algorithm of actions for return

The insurance money can be returned only after the encumbrance on the mortgaged apartment is removed. The action diagram looks like this:

- Filling out an application in 2 copies at the insurance organization (according to the established template).

- If you receive a refusal, it is worth having a written response. In case of payment of a smaller amount than planned, you must request a calculation (full reporting of the insurer's expenses during the term of the agreement).

- Drawing up a claim and submitting it to the insurance company. The text should indicate a reference to the Civil Code of the Russian Federation No. 958. The complaint must be registered with an official note on the completed form.

- Filing a claim in court. All documents are attached to the application: refusal, claim, policy, contract, receipts for the entire period, etc.

Reviews from policyholders defending their rights in court show that the courts are favorable and satisfy more than 70% of the plaintiffs' claims.

If your application for a refund is refused, it is recommended to file a complaint with the prosecutor’s office or the Central Bank of Russia (which issues licenses to insurance organizations).

Return of insurance after the death of the borrower

If the debtor took out life and health insurance, then upon his death his relatives, naturally, will not have to pay insurance premiums, the debt will be closed. If insurance has not been issued, then all obligations under the mortgage are transferred to them, but from the date of entry into inheritance rights.

New owners (heirs) can return part of the insurance amount if they are not satisfied with something. In this case, the amount of the refund depends on the unused time of the insurer's services. For example, if the borrower died a year before the end of the insurance period, then the amount that was paid for the year of guarantees and was not used for insurance services is calculated.

To get some of your mortgage insurance back, you need to:

- inform the insurance company about the death of the debtor;

- re-register the mortgage agreement for the new owner (after they take possession of their rights);

- notify the insurance company about the refusal of insurance;

- write an application for a refund of part of the money.

Let us remind you that the right of inheritance begins 6 months after the death of the testator. At the same time, the heirs must have all the documents proving their relationship with the deceased. Guardians (adoptive parents) decide all issues for minor heirs, and they will also deal with issues of repaying the mortgage debt.