Is it possible to return money transferred to scammers?

Recovering stolen funds is possible, but it is not easy. However, there are several options:

- A citizen who has transferred funds to scammers has one day to contact the banking system to cancel the payment. To do this, you must have a payment receipt with you. This option is also suitable in case of transferring funds to a bank card.

- The deceived person must understand that turning to debt collectors is undesirable. He may be deceived again. A lawyer will be a suitable option; he will help you competently draw up a complaint.

- The victim can contact the banking organization to have a reverse transfer made. Remember that such a request will be considered for up to one month. To draw it up, you must provide all checks and receipts for funds transferred to scammers.

In reality, the banking organization does not always facilitate the return of funds. If you refuse, contact law enforcement agencies and demand that a criminal case be initiated for fraud. This is recommended when transferring significant funds.

The decision to initiate a case is made within three days. If it is initiated, the fraudster will be caught within two months.

The actions of telephone scammers are qualified under Art. 159 of the Criminal Code of the Russian Federation as fraud, i.e. intentional actions aimed at stealing someone else's property or acquiring the right to someone else's property through deception or abuse of trust.

Where to complain about police inaction

The main link in the judicial procedure is the activities of the police, in particular the search. The police must, based on an official request to the bank, identify the person who received the payment. The need for this is obvious, because it is impossible to conduct business against an unidentified person. If the police fail to carry out their activities, you will have to write a statement to the prosecutor's office, describing the circumstances of the case and mentioning contacting the police.

The request to prosecutors should be that law enforcement officers be required to do their job. In any case, regardless of whether the fraudster is punished in accordance with the Criminal Code or not, his identity will become known, which allows him to file a civil lawsuit.

This is important to know: How to return the cost of an MTPL policy when selling a car

Steps to take if you become a victim of a telephone scam

If a citizen believes that he has become a victim of telephone fraud, he must contact the internal affairs authorities with a corresponding statement. The statement should describe all the circumstances of the event in as much detail as possible. In addition, you should report the fact of telephone fraud to the subscriber service of the mobile operator that services the criminal’s number. If a citizen, for example, transferred a sum of money over a mobile network, then the operator’s adoption of emergency measures may allow him to block the transfer and return the money.

In order to avoid becoming such a victim, you must follow certain rules. For example:

- If you receive a call asking for urgent financial assistance for a person known to the citizen (an acquaintance, relative, etc.), you should not make a decision immediately, following the lead of the caller, but check the information received from him by calling back the above-mentioned persons, or contact them in other ways;

- You cannot provide personal information or bank card details over the phone, which could be used by criminals for illegal actions;

- You cannot call back a number if it is unfamiliar, etc.

Refund

Those who have transferred a large amount often turn to the police and the court to get the funds back. To do this, a statement must be written to the police about the fact of fraud. All information is indicated there, because... it will help you catch the scammer faster. Remember that law enforcement agencies do not have the right to refuse to accept an application.

In practice, the case may not go to trial. In some cases, there is not enough information about the scammer. In this case, it is extremely difficult to return lost funds. There remains hope for a competent lawyer who is ready to fully engage in drawing up the application.

It is worth highlighting Internet fraud. Websites that offer the purchase of goods at a reduced price are quite common. Many people are attracted to such proposals. Refunds are extremely difficult, because... The period of existence of such sites usually does not exceed several days.

Refund bank online

The citizen who made the transfer to the fraudster can return these funds. This service is available from many banking organizations. One of them is Sberbank. Before sending the amount of money, the money is in a special reserve. Funds are sent to the recipient at 9 am the next day. During this time, it is possible to cancel the operation.

Remember that the banking organization cannot independently return the money after the transfer is completed. Such an operation can only be carried out through the courts. Therefore, you should not blame the bank, because... he is only an intermediary.

To increase the chance of getting your money back, you must leave all known information about the scammer (correspondence on social networks, phone numbers and account numbers). The amount of information increases the chance of getting your money back.

Refund through court

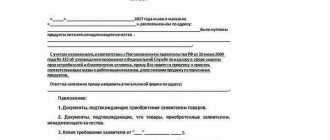

You can get your funds back in court. The court accepts any evidence, including electronic and Internet data.

If:

- There was an erroneous payment, then unjust enrichment is claimed. Unjust enrichment means acquisition not based on law or transaction. As a general rule, this money can be returned (Article 1102 of the Civil Code).

- Funds were paid for goods or services, then the fact of a contractual relationship is established. It must be said that the money was not transferred by mistake, but to account for the conclusion of relevant transactions.

The sender of the funds proves that they were debited, and the recipient must prove the grounds for their crediting.

How to protect yourself from scammers?

It is very easy to fall for the trick of scammers, because... they try to hide. Websites often appear with a description of a particular company with customer reviews. But before purchasing a product online, you should check the information.

Information can be verified through the official website of the Federal Tax Service. If you don’t have the details of the right company, you should think about making a purchase. It is recommended to purchase products from companies that have existed for more than a year. It is also better to find information about the company's reputation.

It is worth paying attention to Yandex. Market". It is used by people to sell their things. Before purchasing, you must first check the website address. You only need to visit official sites, because... others may be fraudulent.

As for the official website address, scammers can create copies of it. The address allows you to discover such a site. Any change in it, even one character, indicates a copy.

What methods do scammers use?

Fraudsters are constantly coming up with new methods. People need to know them so as not to fall for their trick in the future. The following methods are known:

- Call the victim. The scammer may introduce himself as a daughter or son and ask the parents to urgently transfer money. In such a situation, it is important to make sure that it is not someone else calling. In case of transfer, you should not count on a refund.

- Blocking a bank card. Sometimes you may receive messages about your bank card being blocked. To unblock, you need to transfer funds to the specified number. Banking organizations do not use this method.

These are just some of the scam methods. Nowadays, most deception occurs on the Internet. It is important to verify information before making any transactions.

Bank card security

Bank card security is an important point that should not be neglected. The fact is that it’s not for nothing that banks create additional passwords, authorizations and linking cards to phone numbers. All this is done in order to protect our clients as much as possible from fraudulent transactions. Customer safety is the most important thing in the work of any financial institution, and the protection of savings should be at the maximum level.

Therefore, a citizen should not neglect his security and confidentiality when applying for a payment bank card. It is worth considering that the number of fraudulent transactions increases every year and therefore you need to be prepared for anything.

Choose complex passwords, ask your bank manager about the security levels, and do not conduct transactions with dubious persons. You should not give your passwords to anyone, even if it is your relative or loved one.

Internet fraud

The most common and unsafe include:

- Anything that creates a feeling of pity. In such cases, the information is usually not checked, because emotions have a strong influence, and a person may not translate, but help in dissemination. Disclosure is carried out through verification of information and long-term observation.

- Personalized information. Before deception, attackers study the object for further use of the information received. So, after studying the hacked correspondence, the fraudster will use it. He will ask for financial assistance, arguing its necessity. You can expose him by calling a person directly on his phone.

- Clicking on malicious links that do not require entering information. So, you can connect a paid subscription and become infected with a virus. Funds can also be transferred from a linked card. The disclosure is made by checking the characters in the resource address. If the transition was completed and seemed suspicious, you should immediately check your phone. A timely detected threat will ensure security.

Unauthorized withdrawal of funds from the card

In the modern world it is very difficult to imagine your life without a bank plastic card. It makes life much easier for many people and is a convenient way to pay for purchases. Most citizens of the Russian Federation have, of course, thought about how scammers can deceive and withdraw money from a card.

It is worth noting that knowing only the card number cannot be used, for this you will need the following information:

- Full name of the account owner.

- Three-digit code on the back of the card.

- Card expiry date.

Therefore, all bank employees warn that cardholders do not disclose this information to anyone. Even the bank employees themselves are not authorized to receive such information.

Moreover, the card has additional protections. These are various passwords, code words, a link to a phone number or email.

Responsibility for telephone fraud

Telephone fraud, depending on the size of the stolen item and other circumstances of the act (for example, whether there are signs of a crime or not), may result in administrative or criminal liability.

Based on Part 1 of Art. 7.27 of the Code of Administrative Offenses of the Russian Federation, petty theft of someone else’s property, the value of which does not exceed one thousand rubles, by theft, fraud, misappropriation or embezzlement in the absence of signs of a crime shall entail the imposition of an administrative fine in the amount of up to five times the value of the stolen property, but not less than one thousand rubles, or administrative arrest for a period of up to fifteen days, or compulsory work for a period of up to fifty hours. According to Part 2 of this article, petty theft of someone else's property worth more than one thousand rubles, but not more than two thousand five hundred rubles, through theft, fraud, misappropriation or embezzlement in the absence of signs of a crime shall entail the imposition of an administrative fine in the amount of up to five times the value of the stolen property, but not less three thousand rubles, or administrative arrest for a period of ten to fifteen days, or compulsory work for a period of up to one hundred and twenty hours.

In addition, on the basis of Art. 7.27.1 of the Code of Administrative Offenses of the Russian Federation, causing property damage to the owner or other owner of property by deception or abuse of trust in the absence of signs of a criminal offense shall entail the imposition of an administrative fine in the amount of up to five times the cost of the damage caused, but not less than five thousand rubles. Article 159 of the Criminal Code of the Russian Federation provides for various types of criminal liability for fraud, depending on specific circumstances.

According to Part 1 of this article, fraud is punishable by a fine in the amount of up to one hundred twenty thousand rubles or in the amount of the wages or other income of the convicted person for a period of up to one year, or by compulsory labor for a period of up to three hundred and sixty hours, or by corrective labor for a period of up to one year, or restriction of freedom for a term of up to two years, or forced labor for a term of up to two years, or arrest for a term of up to four months, or imprisonment for a term of up to two years.

The qualifying signs of telephone fraud, for example, are the following:

- committed by a group of persons by prior conspiracy, as well as causing significant damage to a citizen;

- committed by a person using his official position, as well as on a large scale, etc. These and other signs specified in Part 2 - 7 of Art. 159 of the Criminal Code of the Russian Federation, entail more severe liability up to imprisonment for up to ten years.

If the actions of a person in fraud, embezzlement or embezzlement, although formally containing signs of the specified crime, due to their insignificance did not pose a public danger, then the court terminates the criminal case on the basis of Part 2 of Art. 14 of the Criminal Code of the Russian Federation (clause 33 of the Resolution of the Plenum No. 48).