Conditions for the Return of Loan Insurance to VTB Insurance

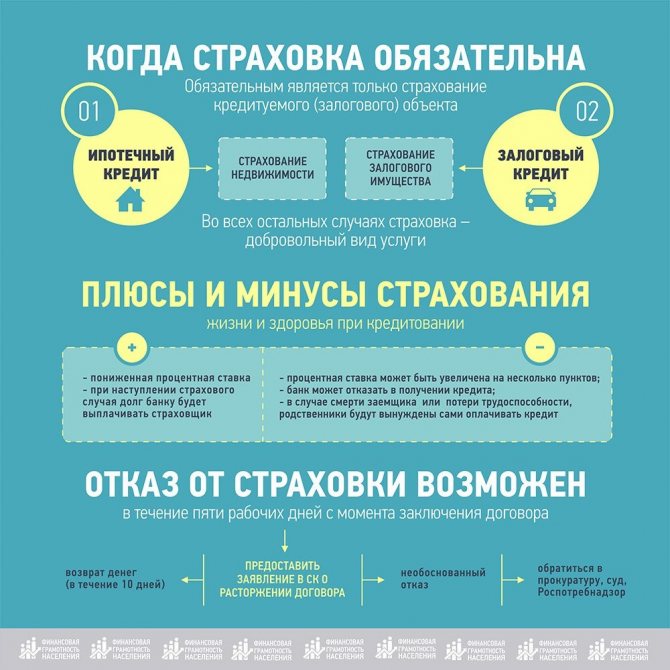

Previously, citizens could return the insurance premium only within 5 working days by contacting the insurance company.

Now the “cooling period” has been extended, and borrowers have the opportunity to get their money back within 10 business days from the date of registration of the insurance contract when receiving a loan.

What are the possible conditions for a refund of the premium:

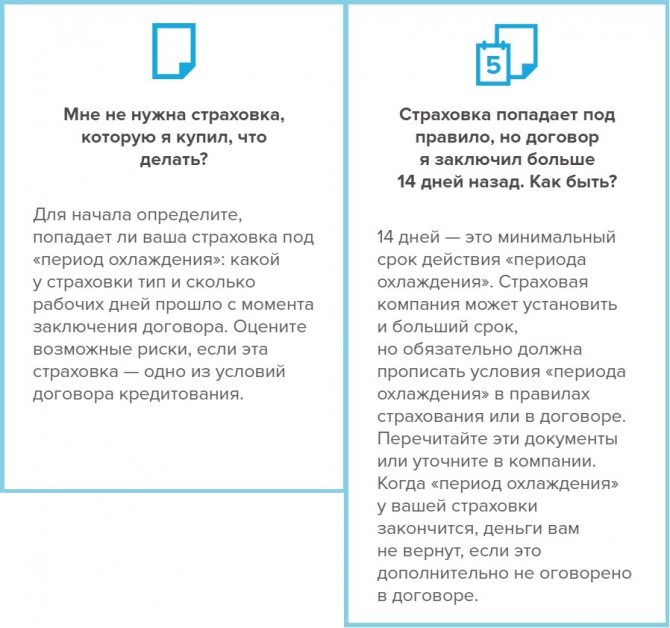

- Application within 14 calendar days from the date of drawing up the contract. The money is returned in full. For example, if the insurance amount is 100,000 rubles, it will be returned in full.

- Submitting an application after the cooling-off period. The insurance premium will be calculated in proportion to the number of days during which the insurance was valid. It will not be possible to claim the full amount.

Important! If a citizen is convinced that issuing a loan without insurance is impossible, such actions by bank employees are considered unlawful.

In this situation, you can try to achieve justice, but the lender may refuse to issue a loan without explaining the reasons. There is another option - to enter into a loan agreement and buy insurance, and then immediately submit an application for refusal.

Law on Repayment of Collective Credit Insurance – “Cooling Period”

It is not surprising, but in the insurance law Federal Law No. 4015-1 of November 27, 1992, there are no provisions that would regulate or somehow explain how to terminate an insurance contract concluded early when applying for a loan. It also does not indicate what the insured person should do if he has joined a group insurance contract and wants to withdraw from it.

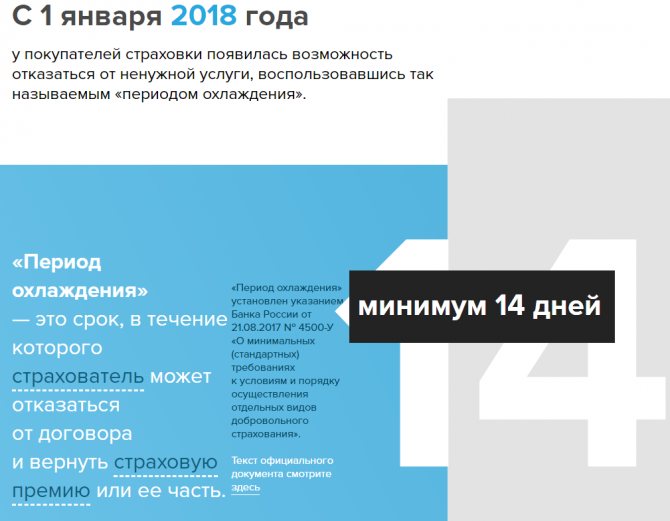

But there is Article 958 of the Civil Code of the Russian Federation (Part 2) and Directive of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U. We will look for the necessary information in them. According to clause 1 of Bank of Russia Directive No. 3854 dated November 20, 2015, the “cooling period” for the return of the insurance premium is 14 calendar days. Before the beginning of 2020, this period was equal to 5 working days.

The presence of the above period must be indicated in the insurance contract. If collective insurance is taken out, the insurance company is the insurer, the bank is the policyholder, and the borrower is the insured person.

If the contract does not include return conditions, it is considered invalid in whole or in part on individual points. The insurance company has the right to independently increase the “cooling period” upward. For example, in Sberbank it is 30 days.

In Art. 958 specifies the circumstances under which it is possible to terminate the insurance contract early and return the insurance premium. This is possible if:

- the insured property is destroyed;

- the entrepreneur will cease his activities.

All! There is no word that the borrower has the right to return part of the insurance premium if he repays the loan early. Not fair? This is also the opinion of a certain Mrs. A. A. Melkova, who in 2020 filed a complaint with the Constitutional Court of the Russian Federation, in which she indicated that the provisions of Article 958 violate her constitutional rights and do not allow the return of the paid insurance premium if the contract is terminated early. But her complaint was not even considered.

Confirmation of the above is the Ruling of the Supreme Court of the Russian Federation dated October 31, 2017, thanks to which the decisions of the first two courts, which did not allow the borrower to return the premium and rejected his claims, were overturned.

- Example

Let's look at the situation in more detail...

The woman turned to the bank to apply for a consumer loan. During the procedure, she was forced into collective insurance by a “friendly” insurance company.

The amount of the premium was about 22,000 rubles; the lender took a commission for connecting to the program - about 13,000 rubles. A fee was also charged for participation in the program - 35,235 rubles.

According to the terms of the contract, the insured person has the opportunity to apply for a refund of the premium within 5 working days - this is the “cooling off period” in force at that time.

The borrower applied to the bank within the established time limit for the return of the insurance, but her demands were denied. After this, she filed a lawsuit. Having considered the cases, the court made a negative decision on the claim.

Before the court decision entered into legal force, the woman sent an appeal to a higher judicial body, but even there she received a negative response.

Subsequently, she sent a complaint for consideration to the Supreme Court of the Russian Federation, which did not agree with the decisions of the lower courts and overturned them for several reasons:

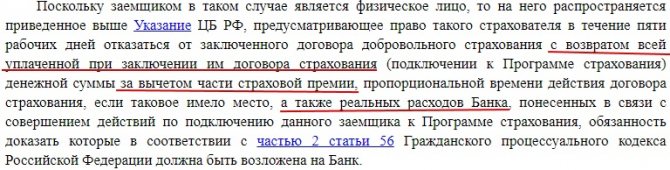

- The borrower independently paid the fee for joining the insurance program, therefore, it is he who is the policyholder, and not the bank.

- The policyholder is an individual, and he is subject to the Directive of the Central Bank of the Russian Federation. The woman applied for this within the established time frame.

- The insurance premium must be returned. When calculating, the bank has the right to deduct its own costs for drawing up the agreement and part of the premium for the period of its validity until the client submits an application.

As a result, the court made a decision to cancel the appeal ruling and return the case for retrial.

Important! If the insurance contract does not provide for the possibility of returning the premium within 14 days, it is declared invalid in court. This is a direct violation of the Directive of the Central Bank of the Russian Federation and the rights of the borrower, who is an individual.

Let us turn to the above-mentioned Directive of the Central Bank No. 3854. What is interesting here. Here are the main points of this document, which every insurer must include in the insurance contract:

- the policyholder must be an individual;

- The insurance company must include a clause in the contract that would indicate that the client (policyholder) has the right to cancel the contract within 14 days after signing the contract and return the premium paid in 100% of the amount;

- the insurer can set a “cooling off period” longer than 14 days;

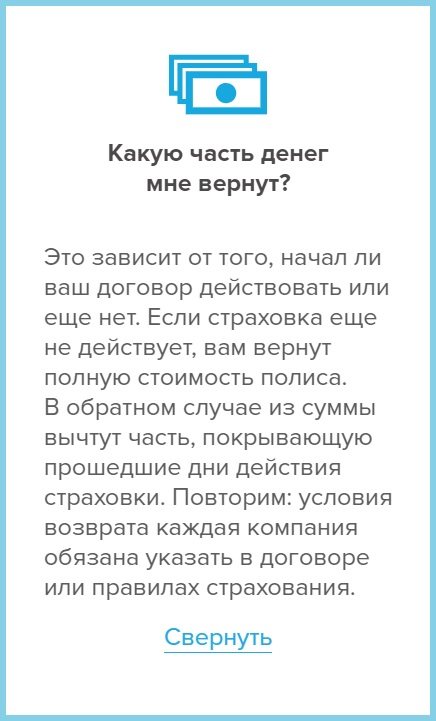

- if the insured decides to terminate the contract within 14 days and on the date of filing the application for termination the contract has not entered into force, then the insurance is returned in full.;

- if the insured decides to terminate the contract within 14 days after signing it, but the contract has already entered into force, then the insurance company retains part of the insurance premium and returns the rest to the client. The money will be returned except for those days during which the insurance was valid;

- the insurance contract is terminated as soon as the insurer receives a notice of termination from the client;

- the money must be returned within 10 days from the date of receipt of the written application. Refunds are possible in cash or to a bank account;

Another important point of this document is that all insurers must work in accordance with this instruction. If they do not include at least one of the above points in the insurance contract, then this is a serious violation, which is punishable by fines and sanctions.

If we analyze the document, it turns out that according to the Directive, only individual policyholders can return the money. And borrowers who joined the group insurance program are not policyholders. Here the bank acts as a legal entity.

Therefore, this document does not apply to such persons. For a long time, insurers took advantage of this loophole in the law. But since 2018, the Supreme Court began to make decisions in which individuals were recognized as policyholders, although they were not indicated as such in the collective insurance agreement.

There are also legislative norms that borrowers who decide to terminate an insurance contract early need to know. One of the main complaints of borrowers is that they were not properly informed that insurance is a voluntary service and does not in any way affect the bank’s decision to approve a loan or not.

The bank does not have the right to force you to enter into an insurance contract. This is discussed in Art. 421 Civil Code of the Russian Federation. That is, bank employees do not have the right to refuse a loan because the borrower refuses insurance. In fact, if the borrower refused insurance, the loan was not issued to him.

How to return Collective Insurance at VTB, Sberbank and Post Bank?

When deciding to return the premium, you should keep in mind that this is only possible in a few cases:

- Submitting an application during the cooling-off period. In such a situation, the bank has no right to refuse. Before 2020 it was 5 days. From 2020 it is 2 weeks or 14 days. All return actions must be carried out during this period.

- Appeal after the “cooling-off period”, if the possibility of an insured event due to the death of the insured person or liquidation of the business has disappeared, if the business risk was insured (Article 958 of the Civil Code of the Russian Federation).

- A citizen has the right to refuse insurance at any time if the risk of an insured event has not disappeared for the above reasons, but then the premium will not be returned. When lending, this is only possible if the debt is repaid early.

As for group insurance, it is successfully canceled during the “cooling off period” or after it. The latter is possible only if there are appropriate conditions in the contract. Most often, banks do not provide clients with this opportunity, so you should apply for a refund within the first 14 days after concluding the agreement.

How Much Money Can You Get Back with Collective Insurance?

It all depends on the date of application and the terms of the contract. If an application is submitted during the cooling-off period, the premium will be refunded in full. The fee charged by the bank for processing the documentation may be deducted.

After 14 days, several options are possible:

- Some financial institutions have extended the cooling-off period. The money can be returned in full or minus the days of use of the insurance. The calculation is made individually.

- After 14 days or a “cooling period” extended at the request of the bank, the insurance cannot be returned, unless the contract provides for other conditions. Most often, insurers and insurance companies do not provide clients with this opportunity.

To avoid having to go to court, it is best to refuse insurance at the time of signing the loan agreement.

Despite the fact that a bank employee will impose insurance and explain all its advantages, as well as threaten possible refusal of lending, paying a premium for an insurance company will slightly increase the size of the loan and the overall percentage of overpayment, and it is advisable to avoid this.

- First moment

- Second point

In the Central Bank Directive No. 3854 there are 2 important points that determine the amount of the insurance premium to be returned...

If the contract is terminated within 14 days after its signing, the insurance is returned in full, unless an insured event has occurred and the insurance contract has not entered into force. A very interesting provision, which practically cancels the possibility of returning insurance at one hundred percent, and here’s why.

The contract comes into force after the money is credited to the insurance company's account. Money is transferred to the account on the day the loan is received. So when should the borrower apply to get the full amount back? Before the money is transferred! That is, he must sign the contract, for example, on December 5, but transfer the money on December 8, and submit an application for refusal of insurance on December 5, 6, 7.

And then the entire amount will be returned to him. But this is practically impossible, because in the case of collective insurance, the transfer occurs in a single payment on the day the loan is issued.

If the contract is terminated within 2 weeks after its signing, if it has entered into force, the insurance is returned in proportion to the duration of the insurance contract.

For example, an insurance contract was concluded on December 4. The money is transferred to the insurance company on the same day. The borrower decided to cancel the contract on December 6. He will get his money back minus two days.

When communicating with an employee of a financial institution, it is recommended to turn on the voice recorder so that you can later argue your complaint.

According to the law, refusal of insurance cannot be the reason for a negative response to a loan application. When faced with this, you can do any of the following:

- File a complaint with the Central Bank of the Russian Federation. The Central Bank also controls insurance activities. Contact is possible through the electronic service: cbr.ru/Reception/Message/Register . You can also attach photo, video and audio materials there. You will need to fill out an application with a detailed description of the circumstances.

- Leaving a review about the bank on major financial portals , on which the rating of lenders among consumers depends. Such portals are not official rating agencies, but citizens often read reviews of financial institutions before applying for loans. A negative rating can harm the bank's reputation and reduce the number of loans issued, and its employees will independently contact the dissatisfied customer to resolve the conflict.

- Appeal to Rospotrebnadzor due to non-compliance with the conditions of Art. 32 Federal Law upon actual payment of services to the policyholder. This is also true for refunds in case of early repayment of debt.

Important! When talking with a bank employee, it is recommended to write down his full name. In the future, such data may be needed as evidence that the client is right during an internal investigation, if a citizen files a complaint or leaves negative feedback.

Is the Commission returned if Collective Insurance is canceled?

Often the commission for joining an insurance program is either greater than the insurance premium or equal to it. Therefore, a reasonable question arises: is it returned along with the insurance premium?

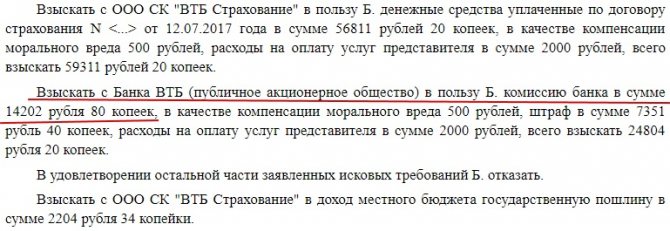

The position of the courts is ambiguous. Some recognize the insurer’s obligation to return, along with the insurance premium, the commission for the provision of the service if the contract is terminated during the “cooling off period”, for example, this is the definition:

- Perm Regional Court dated February 21, 2018 No. 33-1785/2018.

Others believe that the commission is non-refundable:

- Ruling of the Orenburg Court dated November 15, 2018 in case No. 33-8880/2018;

- Determination of the Supreme Court of the Russian Federation dated October 31, 2017 No. 49-KG17-24;

Therefore, everything depends on the specific court. But it is necessary to file a demand to return the bank commission in a lawsuit.

"VTB Insurance" - Return of Insurance within 14 Days

The “cooling period” should be understood as the time given to the insured person to cancel the contract, provided that during this period no insured event occurred and he did not receive compensation payments from the insurance company.

In the Russian Federation, the “cooling period” is 14 calendar days. At this time, you can contact the insurance company office with a request for a full refund of the premium. The money is transferred within 10 days to the client’s bank account if the company’s response is positive.

According to the law, lenders do not have the right to force clients to purchase insurance in order to obtain a positive response on a loan.

If the borrower refuses insurance, the bank may increase the cost of the loan by increasing the interest rate. Such actions are legal, because The lender has the right to independently determine the conditions for issuing loans.

VTB Bank cooperates with IC VTB Insurance. There are two types of contracts – individual and collective.

It is easier to terminate an individual insurance contract, because it identifies only one person, and a refund is possible even if the loan is outstanding.

Everything becomes more complicated when a collective agreement is drawn up. It includes several citizens entitled to compensation payments. A 100% refund is due only after full repayment of the debt. In other cases, the issue is considered individually and depends on many aspects.

- the “cooling period” has not expired;

- an individual, not a collective, agreement has been drawn up.

Note! Banks reserve the right to refuse approval of loans without giving reasons. If a citizen initially opposes insurance, theoretically this could become the basis for a negative response from the lender. It is best to apply for a loan first and then apply for repayment.

Is it possible to return VTB Insurance after the Cooling Period?

After 14 calendar days, a return is allowed if the client has not received an insurance premium and one of the following conditions is met:

- the loan is repaid ahead of schedule;

- the loan is not repaid, the recourse is carried out after a “cooling period”.

All VTB lending programs offer different conditions. It is recommended to find an insurance contract and carefully read the return conditions. If it states that the borrower agrees and payments are impossible in any situations, you should go to court to challenge the points of the document.

Is it possible to return VTB Insurance if the Loan is Closed on Time?

Timely repayment of credit debt does not mean the possibility of returning insurance. In such a situation, there is no point in filing an application: according to the law, the insurer’s obligations terminate simultaneously with the termination of the contract.

This means that even if the client was not compensated, it will not be possible to get the money paid back.

In April, I received a pre-approved loan offer, just in time. I had to buy real estate and this amount was missing. Having contacted the office, a Bank employee drew my attention to the fact that I can take out a loan ONLY with an insurance service, which is exactly 20% of the loan amount, in general, quite a lot, as much as 80,000 rubles, and in addition this amount is added to the amount loan (as they call the body of the loan), accordingly, interest will also be charged on this amount. Roughly speaking, the bank sells the service on credit. Having visited 2 offices in the city, the answer was similar, I was denied a loan WITHOUT insurance. Then, having collected my thoughts and armed with a phone with video recording turned on, I went to one of the offices. Naturally, when applying for a loan, the Bank employee repeatedly repeated that the insurance was supposedly non-refundable and even pointed his finger at the contract where this was stated. And this is really SPECIFIED, the premium is non-refundable BUT after the contract comes into force. When I began to look at the contract in detail, right on the first page of this “Policy” the VALIDITY OF THE INSURANCE AGREEMENT is indicated from 00.00 hours after payment of the insurance premium (i.e. after receiving the loan in hand). This meant that I had the whole day to refuse this service and invalidate the contract, because. it comes into force “Like in a fairy tale about Cinderella” at 00 hours 00 minutes! When I got to work, I printed 2 applications (the first in VTB 24, the second in VTB Insurance). I found a sample application at this link https://100i1kredit.ru/straxovanie/vozmozhen-li-otkaz-ot-straxovki-po-kreditu-vtb-24.html Naturally, I made adjustments to the application and this is:

1) You must take a statement from the account from which the money for insurance was debited and indicate this exact account in the application! 2) I ask you to consider the insurance agreement between me and VTB Insurance (and not the bank as indicated in the sample) invalid.. 3) Be sure to indicate in the application the VALIDITY TERM of the INSURANCE AGREEMENT directly copied from the One-time Premium policy!

Next, the actions were as follows: first of all, I contacted VTB Insurance (provided a copy of the contract, an EXTRACT on which you can see the amount written off against the insurance, and of course my application). A VTB Insurance employee put the incoming number, his stamp, and the TIME of acceptance on my sample application. Next, I went to VTB 24, the same procedure, only you need to write a claim on their form. The answer from VTB 24 did not take long to arrive and what was my surprise when they refused to return me and did not terminate the contract.

As for VTB insurance, they were more reasonable, after 20 days I received a call and of course they recognized the contract as INVALID, I signed a termination agreement and my money returned to where it was written off from!

I hope my review will be useful to someone! Don't be afraid to take risks, especially since the risk is justified!

"VTB" - Return of Insurance upon Early Loan Repayment

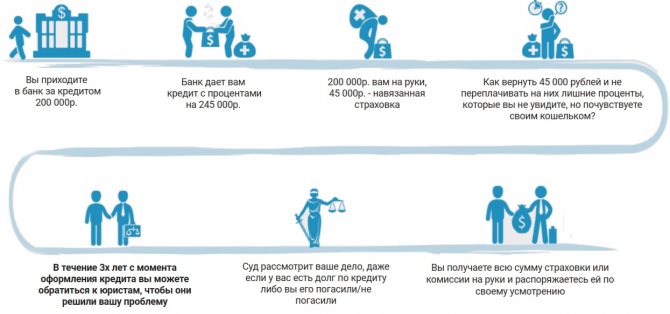

When applying for a consumer loan, the cost of insurance is paid by the client in a lump sum by inclusion in the total amount of the loan, or is transferred monthly as part of mandatory payments, which, in addition to insurance, includes principal and interest.

In the first case, the refund is made for the periods in which the borrower was supposed to make monthly payments, but due to the repayment of the debt, this obligation ceased for him.

For example, if the loan is valid until May 2020, but is closed in June 2020, you will be able to receive funds for the period from 07/2018 to 05/2020.

If insurance is included in the amount of mandatory payments on a loan based on the installment plan, it will not be possible to return it due to early repayment. The amount of contributions here is calculated for each month, and refunds of unpaid money are not made. Refunds of premiums for past periods are not permitted.

Submitting an Application to VTB Bank for Refund of Loan Insurance

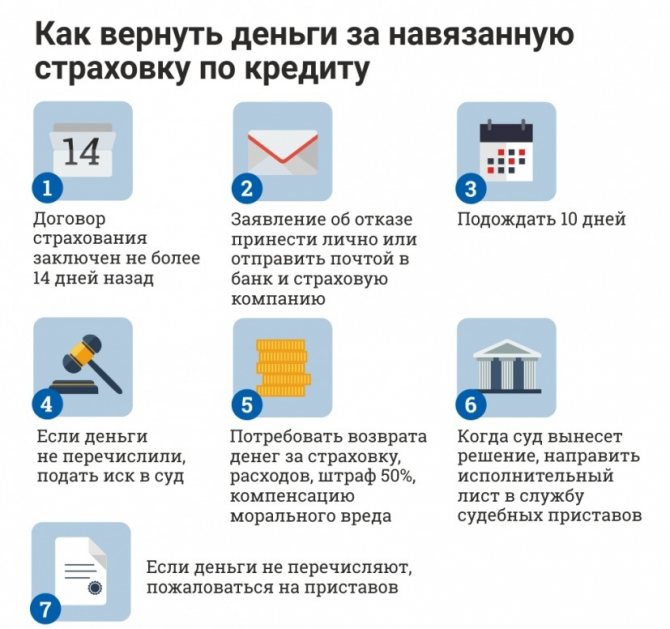

To return VTB Insurance insurance, you need to perform several actions:

- Collect a list of documents. This includes a passport, a loan agreement, and an insurance agreement.

- Submit documents along with the application to the Investigative Committee in person, via Russian Post or online.

- Wait for an answer. Money is transferred within 10 calendar days after a positive decision is made.

In some cases, no refund is provided, but the amount owed is reduced.

“VTB 24” – Fill out an Application for Refund of Loan Insurance

A blank application form can be downloaded from the website: vtbins.ru . Filling out the document manually is not allowed - it must be drawn up according to the form.

What information will be needed to write an application:

Full name, information from the passport, registration address, telephone number of the insured person;- date and number of the insurance contract;

- reason (for example, the possibility of an insured event has disappeared, the insurance risk has decreased, and other factors);

- a list of attached documents;

- independently calculated amount of insurance premium for the unexpired term of the contract;

- method of paying the premium - to a current account or through the insurance company's cash desk;

- current account details;

- date of preparation and signature of the applicant.

you can follow the link:

- Returns within a 14 day cooling off period;

- Repayment after early repayment of the loan.

The document is completed in one copy. After submission by the IC employee, a notice of acceptance of the documents is issued indicating the date.

When drawing up an application, it is important to adhere to the following rules:

- The document must be filled out in blue or black ink only. The use of markers, felt-tip pens, and pencils is not permitted.

- Handwriting should be clear. If there are significant errors, omissions or corrections that distort information, the document may not be accepted.

- Specific requirements are indicated according to the sample. Inclusion of additional information not provided for in the template is prohibited.

Also, grounds for refusal to satisfy an application may be the content of profanity in it or the provision of an incomplete set of documents.

“VTB 24” – Take the Application Personally to the Office for a Money Refund

The best option is to provide all the documents yourself to the Investigative Committee office. You can find out the address on the company’s official website by selecting your city in the “Contacts” .

Another way is to submit documents by registered mail with acknowledgment of receipt and a list of the contents. The letter is sent to the address of the UK, but the countdown of the consideration period begins not from the moment of sending, but from the date of receipt of the notification.

The third option is a visit to the IC office by a legal representative. The same documents are required as for the applicant himself, but in addition a notarized power of attorney is provided. Information about it is entered into the application form.

The fourth method is to send scanned documentation to [email protected] . An electronic signature will be required on the application. This option is considered unreliable: there is a possibility that the letter will be lost in a public folder, and the recipient simply will not read it.

Refusal to Refund the Insurance Premium under the Collective Insurance Agreement

First of all, if you refuse, you should find out a few things:

- how does the bank justify its negative decision;

- what are the terms of return under the contract;

- whether the contract was concluded without violating legal norms;

- whether the “cooling period” has been missed and whether it is possible to apply for payments after it.

If the borrower believes that he was refused unreasonably, he can first file a complaint with Rospotrebnadzor.

If, after an inspection, a government agency has drawn up an order to eliminate violations obliging the citizen to return the bonus, but the requirements have not been met, a repeated complaint is filed for failure to comply with the terms of the order, and then the creditor may be held administratively liable.

After submitting your application, wait 10 days. If they refuse to return the money, write a pre-trial claim and send it to the bank and insurance company.

- pre-trial claim: drive.google.com/file/d/pretenzia .

The claim must indicate:

- in the header - the name of the bank and the name of the insurance company, and the address of both organizations. Here is the client’s data: his full name, address, phone number;

- in the text: when the loan agreement was concluded and for what amount, when the application for the provision of the service “connection to the insurance program” was signed;

- amount of service. If possible, the amount of commission and insurance premium;

- excerpt from Directive of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U (clauses 1 and 8);

- information about when the application for refusal to participate in the insurance program was sent. Indicate that the application was either refused to be accepted or ignored. Please indicate how the application was sent;

- excerpts from the ruling in case No. 49 KG17-24, which indicate that the insured is the borrower himself, and not the bank.

At the end, write: “I ask you to return the bank commission within 10 days after receiving the claim in the amount of such and such.” The amount of the commission is indicated in the application.

Also be sure to include your details. The money can be returned to any bank account, including a credit account. In this case, you can repay part of the loan early. The claim must be accompanied by copies of: passport, application for refusal to participate in the insurance program, check and inventories (to the bank and insurer).

All that remains is to sign the claim and date it. Don't forget to keep a copy of it for yourself. If a pre-trial claim does not help to return the money, then there is only one option left - going to court.

"VTB Insurance" - Refusal of Insurance and Refund of Money Through Court

If the insured person receives a negative response to the refund application, this can be challenged in court. First you need to decide what exactly violates the SC:

- The refusal was received when applying during the cooling-off period; insurance is not collective. Such actions are illegal. According to Decree of the Central Bank of the Russian Federation dated November 20, 2015 No. 3854-U, the policyholder has the right to contact the insurance company within 14 days, and the refund is made in full. It is permissible to provide the insurance company with a longer “cooling off period” under the contract.

- Accrual of additional commissions without the client’s consent.

- The presence in the contract of clauses that contradict the norms of law: the establishment of conditions for compulsory insurance, the absence of cost calculations, etc.

The challenge takes place in the district court. The procedure looks like this:

- The plaintiff files a lawsuit to challenge the decision of the insurance company to refuse to return the insurance, citing legal norms that were violated by the insurer. The application is drawn up in two copies: one is handed over to the court secretary, the second is marked with acceptance - it is returned to the plaintiff.

- The parties to the proceedings receive notification of the start of the trial with the date of the first meeting.

- According to Art. 154 of the Code of Civil Procedure of the Russian Federation, civil cases are considered for no more than two months. Based on the results, a court decision is drawn up, on the basis of which the Investigative Committee must act.

pre-trial claim: drive.google.com/file/d/pretenzia .

The result of consideration of the claim may be partial or complete satisfaction of the plaintiff’s demands, but a refusal with reasons is also possible. If the plaintiff does not agree with them, before the court decision enters into legal force, the challenge is carried out on appeal. After entry, a cassation is submitted.

An appeal is possible through a higher court, but the objection is filed with the judicial body that made the dissatisfactory decision. After considering the case on appeal, the court adopts an appeal ruling, orders a review, or cancels the court decision.

If the decision of the district court is disputed, you should contact the regional court. The final decision may be the Supreme Court of the Russian Federation. His verdict comes into force immediately after registration and is not subject to appeal.

Instructions for waiving insurance after applying for a loan at VTB

Starting from October-November 2020, when applying for a consumer loan at VTB Bank (formerly VTB 24), connection to the collective insurance program concluded between the bank and VTB Insurance, as a rule, is not carried out (if a connection to the collective insurance program is issued, the refusal is carried out in general order - more details in the article on our website). Attachment to a collective program has been replaced by the registration of an independent insurance contract under the “Financial Reserve” program, which has a number of varieties.

The main innovation is the determination of the loan rate as the difference between the base interest rate and the discount, which at the time of writing is up to 7.1% (clause 4.2 of individual lending conditions at the time of writing).

Let's look at an example: when applying for a loan, a bank sets a rate of 10.9%, while indicating that the base interest rate is 18% and the discount rate is 7.1.

At the same time, in order to receive a discount, a number of conditions related to life and health insurance are established (clause 26 of individual lending conditions), namely:

- implementation of life and health insurance for an insured amount not less than the amount of debt;

- conclusion of an agreement with an insurance company that meets the Bank's requirements.

The use of a mechanism that provides for an increase in the loan rate in the absence of a life insurance contract has previously been successfully used in mortgage lending programs.

Thus, refusal of insurance according to the standard scheme in the absence of life insurance will lead to a refusal to provide a discount and a significant increase in the loan rate. You can avoid rate increases and save significantly on insurance by following the 3-step instructions below. Please note that all actions must be completed strictly within 14 days - after applying for a loan from VTB, act immediately.

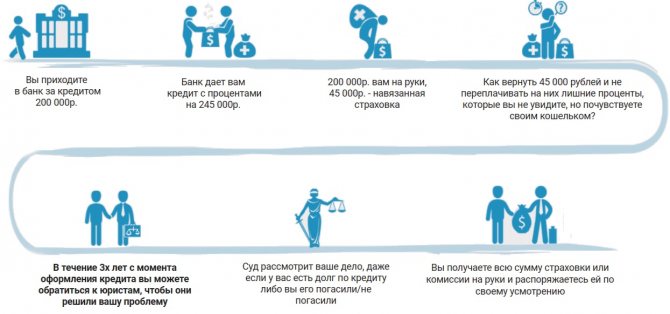

Taking out life insurance from another company

Before sending a refusal of insurance and an application for a refund to the insurance company (usually VTB Insurance), you should take out insurance from another insurer on more favorable terms. In particular, imposed insurance for a loan amount of 1 million rubles. averages 200 thousand rubles. for the entire loan term, and in case of early repayment of the debt amount, no refund of the insurance premium is made.

To maintain the discount, it is enough to take out insurance from another insurer. Please note that the insurance company must be accredited by the bank and included in the list of companies that meet the bank's requirements and posted in a PDF file on the official website.

Call the company, explain that the borrower needs insurance for a consumer loan and specify the cost of insurance. Choose the cheapest option and get insurance. Note that insurance for 1 million rubles. per year on average ranges from 6 to 15 thousand rubles, which is clearly less than the insurance conditions imposed by the bank. The most loyal cost of insurance is in companies such as Rosgosstrakh, Alfa Insurance, RESO-GARANTIA or Renaissance Insurance, the calculation for which can be made at the official insurer.

The cost of insurance is influenced by various factors, such as: age, profession, participation in active sports, marital status, presence of diseases, etc.

Please note that if the loan amount exceeds 300 thousand, then approval of the insurance conditions may take up to 3 days. You should not submit a refusal of insurance before the date of concluding a new insurance contract with another insurer.

Notification of the bank about the conclusion of an insurance contract

After drawing up an insurance contract on more favorable terms, send a notification to the bank, to which attach a copy of the contract certified by the insurer and a receipt for payment of the insurance premium. Take the message to the branch where the loan was issued or send it to the bank by post.

Please include the following information in your notice:

- recipient's name (bank information);

- name of the applicant/borrower;

- information about when, where and under what conditions the loan agreement was executed;

- information about the newly concluded insurance contract;

- the consequences of non-compliance by the bank with the terms of the loan and an increase in the interest rate on the loan;

- borrower's signature and date of preparation.

You can download a message to the bank about executing an agreement with another insurer and the inadmissibility of refusing to apply a discount at the following link: Sample letter about refusing insurance to a bank and concluding a new agreement

Please note that insurance and such notification must be provided on an annual basis until the expiration of the newly issued insurance. If the loan is repaid ahead of schedule, there is no need to extend the insurance for a new term. Losses on the insurance premium in this case will be minimal, especially if full early repayment is planned at the end of the insurance issued for the year.

Sending a loan insurance waiver letter

If an agreement is concluded with VTB Insurance under the “Financial Reserve” program, as well as on similar terms with another insurance company, a letter of refusal should be sent specifically to the insurer. Sending a refusal of insurance and an application for a refund to the bank is incorrect, since the credit institution is not a party to the insurance, despite the fact that the policy was actually issued by the bank.

An application for cancellation of life insurance should be sent to the branch of the insurance company in your region or to the central office of the insurer. If any controversial situations arise, we recommend that you duplicate the application to the central office of the insurer indicated on the policy that is subject to termination.

When preparing your application, please note that the loan insurance waiver form is a written document containing the following information:

- name of the addressee (information about the insurance company);

- information about the applicant/borrower, who is the policyholder in the insurance contract;

- information about the concluded insurance contract (number, date, name of the program, etc.);

- requirement for termination of insurance and return of funds within 10 days;

- details for transferring the insurance premium;

- liability of the insurer in case of refusal to return funds voluntarily;

- policyholder's signature and date.

You can refuse insurance from VTB Insurance using the following link: Application form for refusing insurance from VTB Insurance

If a question arises about what documents are needed to cancel insurance, we note that you should send the original policy. When sending an insurance waiver by mail, make an inventory of the attachment, and be sure to keep a copy of the document for yourself. If the policy bears a typographical stamp from the insurer, it is sufficient to attach a copy of the contract.

In case of refusal of insurance in accordance with clause 8 of Bank of Russia Directive No. 3854-U dated November 20, 2015, the insurance company must voluntarily return the funds paid as an insurance premium in full. If the requirement is not fulfilled voluntarily, the funds, in accordance with established judicial practice, will be recovered in court, taking into account a 50% fine.

How to return Insurance on a VTB Loan - Features of the Loan

Funds are not transferred to the card. If a collective insurance agreement was concluded between the bank, the borrower and the insurance company, an application for waiver of collective insurance is submitted. The application is submitted using the same form; you will need to indicate the details of the policy and contract.

When is the Agreement with VTB Insurance considered terminated?

The contract is terminated when the application is received by the insurance company if the insurer responds positively.

If insurance is disputed in court, everything depends on the court's decision. Most often, the contract is also recognized as terminated from the moment of the first application of the insured person, if the actions of the insurance company are considered unlawful by the court.

"VTB Insurance" - Refusal to Refund Money under the Agreement, What to Do?

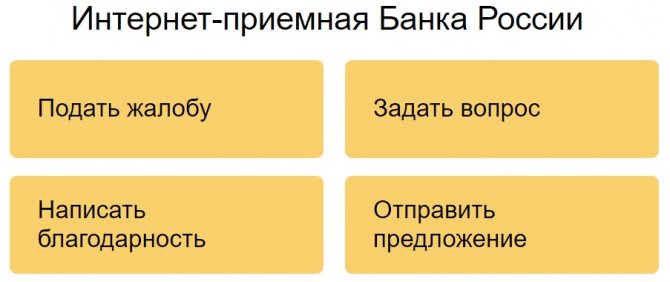

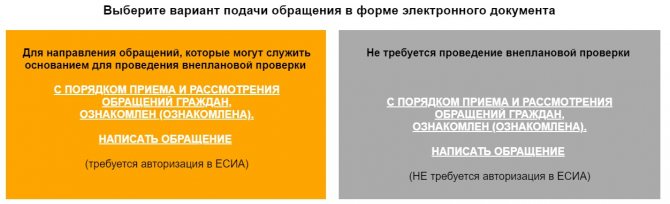

There are two options here - challenging the refusal in court or filing a complaint on the website of the Central Bank of the Russian Federation ( www.cbr.ru ). To leave an email request, you must do the following:

- Go to the main page, go to the “Internet reception” section.

- Select “Submit a complaint”, then “Insurance organizations” and “Other”.

- In the “Product” field, select “Life Insurance”.

- Indicate the name of the insurance company, select your region of residence.

- Write the text of the complaint. It specifies all the circumstances in detail: when the contract was concluded, under what circumstances. Personal information is entered.

- At the bottom of the page, fill in the fields with the number and date of execution of the contract, and indicate the address of the conclusion.

- Scanned documents must be attached to the electronic complaint: passport and contracts.

Help from a Lawyer for the Recovery of Collective Loan Insurance

In 99% of cases, banks already have established forms of collective agreements with insurance companies for signing with clients. They are written by professional lawyers who know how to avoid paying premiums legally.

- Most often, lawyers appeal to clients’ ignorance of the law, and such agreements exclude the possibility of receiving money even during the “cooling off period,” which is a violation of the Directive of the Central Bank of the Russian Federation.

- Another option is to draw up a form of agreement with the possibility of paying premiums within 14 days, but subject to the client meeting certain conditions, which is also considered incorrect.

- The third problem that courts have to face when resolving disputes about the return of premiums is the untimely application of citizens for a refund.

- If they miss the deadlines and the contract does not contain the possibility of paying money after a “cooling off period,” the only option is to terminate the insurance contract. Funds paid are not refundable.

All of the above is a good reason to involve “your” lawyer in the transaction. Despite the fact that the bank will immediately offer its copy of the contract, the specialist himself will find the “pitfalls” and, if they do not suit the borrower, it is better to refuse insurance.

When refusing insurance, financial institutions make negative decisions on loans without explaining the reasons. The lawyer will also help to understand this situation before the trial or represent the client’s interests in court if he himself is involved in the situation.