Why does this happen more often at Sberbank?

Sberbank does everything to make it convenient for clients to use their accounts without visiting a bank branch, which is the largest and most popular. Clients include salary card holders, as well as people receiving pensions and other social benefits. Since Sberbank is distributed throughout the country, it has more cards than other banks. Attackers know that mass mailings about blocking plastic media and other false information are sent specifically to Sber customers. Therefore, clients of this bank in 2020 most often become victims of representatives of the criminal world.

Claim to a judicial authority

lawsuit in court for free in word format

To correctly write a claim to a judicial authority, it must include information about:

- Full name of the judicial authority to which the application is sent,

- Personal data of the applicant - full name, place of registration if we are talking about an individual, name and legal address for institutions. If a document is submitted through representatives, it is also necessary to indicate their personal and passport details,

- Defendant (all available data),

- Violated rights of the applicant or the likelihood of their violation, basic requirements for the application,

- The price of the claim. In this case, the amount to be recovered or disputed is indicated,

- The circumstances on the basis of which the claim is brought,

- Evidence confirming the applicant’s position and the facts stated in the claim,

- Date of application,

- Applicant's signature.

The claim can be signed by a citizen’s representative, but only if the power of attorney authorizes him to sign and submit documents to the judicial authorities.

The magistrate court considers the case (if the value of the claim is less than 50 thousand rubles) within a month, the district court (if the value of the claim is more than 50 thousand rubles) - within 60 days.

What can scammers do if they know their SNILS number and passport details?

Double debiting of money from a card account

Situations where the same amount is debited from a card twice rarely happen. There can be many reasons for this. Most often, money leaves the account due to an error in the processing system or the work of retail outlet employees. However, there have been cases where “doubling” is a fraudulent move. Attackers temporarily slow down the transaction by using special programs, the client logs in twice (enters a PIN or SMS code), and the corresponding amount is blocked twice. The bank may not carry out the transaction, considering it suspicious, or execute it.

Savings account scams

Customers' savings accounts are under constant threat. Attackers try to gain trust and resort to various tricks using modern technologies. Getting to the depositor's information is as simple as finding out the necessary data for using a plastic card.

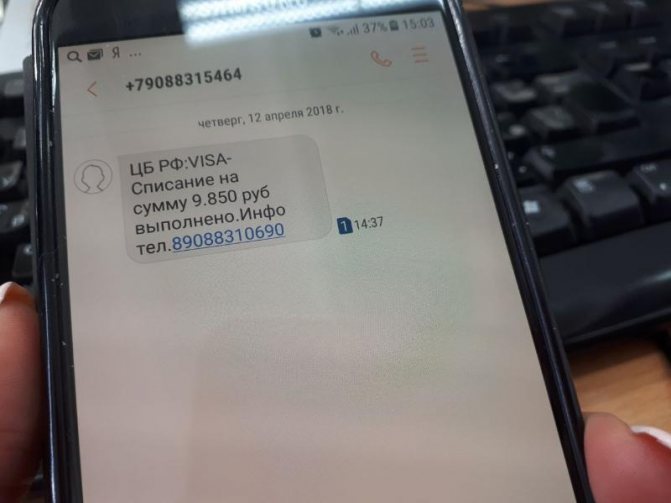

Most often, deposit owners receive SMS or calls from bank “employees”. They contain information that the client's savings are at risk. Measures must be taken immediately to protect them.

The fraudster is trying to find out the account usage limits, debit card number, and code word. After receiving the necessary information, the attacker gains access to the depositor's accounts and can dispose of them at his own discretion.

A scheme has become more frequent in which potential clients receive a call from a bank “employee” with an offer to make a deposit on favorable terms. Fraudsters spend a long time describing the benefits of the deposit, promising an inflated percentage, but only if the client completes the transaction immediately. The trusting “depositor” transfers his own funds to the account, completely unaware that they did not go to the named bank, but into the hands of fraudsters.

Attention! Modern technologies make it possible to imitate numbers of well-known banks.

Can money be stolen from a contactless card?

If a contactless card ends up in the hands of fraudsters, then yes, they can. More precisely, not to steal, but to pay for several purchases with it up to 1 thousand rubles each in retail stores. Also, all the fraud schemes described above work with contactless cards, except for data theft through ATMs, if you do not insert a card reader.

There is a rumor on the Internet that money can be stolen from cards with NFC technology by touching the terminal to a bag or pocket, for example, in public transport. Technically, this is very difficult to do, since the distance between the card and the terminal should be no more than 4 cm, and the attacker will only have a few seconds to complete the write-off procedure while the device is active.

PC viruses and internet fraud

Types of bank card fraud continue to grow. Attackers use every opportunity to withdraw funds from the victim’s account. Therefore, they often resort to Internet fraud and installing virus programs on PCs.

A common type of phishing is as follows:

- The victim's email address contains letters containing links.

- By clicking on them, the user ends up on a malicious site and may lose personal data (login, password, etc.).

Phishing

Also, smartphone owners can install a virus program on their device, for example, a duplicate of an online bank or a virus that collects confidential information. When entering his card details, the owner may not suspect that all of them will be read and transferred to fraudsters.

Internet scammers also include non-existent online stores, auctions and casinos. In addition to the main deception of purchasing goods, attackers collect the user’s entered data and pay for their own needs from their plastic cards.

How to withdraw money without a PIN code

If there is no information about the card PIN code numbers, you cannot withdraw funds from it. It should be noted that if the code is entered incorrectly three times, the account is blocked, after which the owner can only gain access to the money by personally contacting the office of the banking organization or calling the institution’s hotline.

But scammers use a variety of tricks to help withdraw money from the card:

- Purchases are made in shopping centers where a password is not required;

- If a wallet containing both the card and PIN code information is lost or stolen, it will not be difficult for the criminal to withdraw funds;

- Internet transactions are carried out using basic information on the card - number, expiration date and CVV code;

- The magnetic tape is scanned and a copy of the media is made. This is done using special equipment that is installed in ATMs located in remote areas and in some stores. Fraudsters gain access not only to the card data, but also to its PIN code.

Scammers on Avito

Avito, Yula and other sales services are an excellent breeding ground for scammers. The most common scheme used by attackers looks like this:

- A potential buyer calls an ad and expresses a desire to take the item.

- He asks not to sell the goods for now and informs about his readiness to make an advance payment.

- Having received the card number, the “buyer” calls back and says that he cannot make the payment because he lacks some data for this.

- Having received the treasured 3 digits from the back of the card, the fraudster disposes of it at his own discretion.

Attention! You cannot share your secret code with anyone, not even bank employees.

What information is needed to withdraw funds?

It is entered into the device, and subsequent operations are carried out without additional confirmation. For operations performed remotely, i.e. via the Internet, you will need much more information. At a minimum, you need to know the personal CVV (or CVC2) code indicated on the back of the card. CVV is a 3-digit number that is one of the security measures. It is often impossible to recognize it without having a physical card with you, unless the owner himself makes such a mistake and does not inform the swindler about it.

“Confirmation of data” by telephone

Knowing or not whether it is possible to withdraw money using the card number, the account owner continues to fall for the tricks of scammers. The victim's phone number may receive a message or call containing information that the person has become the lucky winner of a super prize. For the money to be credited to your account, you only need to confirm the transaction.

As a rule, in order to write off funds, the criminal has already learned the card number and the owner’s name. All that remains is to convince the victim that she must confirm the transaction over the phone.

There is another way in which a call from the “bank” is received on the account owner’s phone. The employee asks you to confirm some information: otherwise the accounts will be blocked.

Modern technologies used by criminals are constantly expanding. Now, to confirm data or transfer funds, just pick up the phone and answer: “Yes!” The voice command passes, but the money in the account disappears. Therefore, it is recommended to answer unfamiliar numbers with phrases: “I’m listening,” “Hello,” etc.

Actions in case of refusal to return funds to the card by the bank

In some cases, the bank may refuse to return withdrawn funds. This happens if the organization does not believe in the innocence of the owner. The point is not that the citizen is associated with scammers, but that he most likely gave the information on the card himself (out of ignorance).

Fraudsters may ask for information over the phone

What to do if the bank refuses to return the money

If your request for a refund is refused, it is recommended to do the following:

- Ask the bank for a written refusal with the specified reasons.

- If there is no paper or unclear explanations, you can go to court, where you will need to describe the situation.

Attention! If a person is not guilty and is able to prove his non-participation, then the court takes his side and makes a decision in his favor.

How to prove that funds were debited from the account without the client’s knowledge

According to the updated law, a citizen is not required to prove that the funds were written off against his will. On the contrary, the bank must prove that it was the person who applied who spent these funds.

As a result, the bank cannot refuse to return the stolen funds, with the exception of certain cases (if there is suspicion). Therefore, by law, the organization must deal with incorrect translations.

Refunds occur in most cases within 2-3 weeks. Sometimes the bank delays with the transfer, so if you wait for a long time, it is recommended to clarify the information with the organization. If she continues to delay the transfer, she will have to go to the courts and file a lawsuit. As a rule, you have to wait a long time when a large amount has disappeared from your account.

Attention! After receiving a refund request from the cardholder, the bank is required by law to return it within seven days. But not everyone does this.

A notification about the write-off of finances is sent to the phone, which should alert the owner of the plastic card.

Gemini SIM cards

Double cards can be obtained in different ways. The easiest way to get a double is for employees of cellular communication stores. But not every employee is ready to take such a dubious and dangerous act. Most often, twin SIM cards are obtained in a different way:

- A man loses his passport.

- The criminal finds it and goes to the cell phone store with a demand to restore the SIM card.

- If the number was linked to an online bank, then the attacker has some time to work and withdraw money.

As a rule, doubles do not work for a long time, since the mobile operator blocks one of them before the real client has time to complain.

There is also a method for cloning SIM cards. To do this, the original SIM card must get to the attacker for some time (if the phone is lost, etc.). This is technically difficult, so such schemes are rarely used.

What's happened

, as a rule, is activated at the moment when a plastic card is issued; for this it is necessary to register the client’s phone number in the system.

Attention! The service provides the ability to manage card accounts using mobile communication tools:

- The client is notified of all transactions with money via SMS;

- When carrying out transactions via the Internet, you must confirm your identity by entering in a special line the code sent via SMS to the phone number registered in the system;

- Using simple manipulations with digital combinations, the client can obtain information about all of his bank accounts;

- Due to the fact that the client is instantly notified of all operations related to the withdrawal of money, while indicating the place and time of their execution, the citizen in the event of loss or theft of the card will have an additional opportunity to establish the identity of the criminal who carried out the procedure, since at all ATMs and cash registers CCTV cameras are installed in the stores.

Despite the fact that the service has many advantages, when using it, a citizen runs the risk of encountering scammers.

How scammers gain access to hidden information

Almost all plastic card holders are concerned about whether fraudsters can withdraw money from the card. The main thing is that the attacker must gain access to the account owner’s hidden information. A criminal can obtain them in a variety of ways, from direct deception of the user to the introduction of modern technologies.

Distributing virus programs under the pretext of a “popular game” or a mandatory update for smartphones is a new, yet rarely used method. Having installed “know-how” on his device, the victim does not even suspect that within 20 minutes all data from the phone, including account details, logins and passwords, will be read and transferred to the fraudster as soon as possible.

Bank card fraud

An attacker can also find out the data by conducting a “sociological” survey. A fraudster or a group of people calls potential clients and offers to take a survey (pension topic, medical examination, etc.). As a result of the conversation, the interlocutor extorts data for the scam. In small towns, criminals go door to door and work according to the same algorithm, trying to find out all the necessary information. Trusting citizens, especially pensioners, are happy to provide secret information. Most often, scammers, having gained access to accounts, wait some time after the survey, and only then begin to carry out their plans.

The most dangerous situation is when the criminal acts as part of an entire group. He may have assistants among bank employees, call center employees, and cellular operators. In this case, the fraudster gets direct access to all hidden information of any citizen and owner of the plastic media.

How to protect yourself

To avoid scammers, follow a few rules:

- Don’t tell anyone your card details, especially if they call from the bank - real employees already have all the necessary information.

- Don't send money to strangers. If friends ask for a loan, make sure it’s really them.

- Attackers can manage money on your card through mobile banking if they gain access to the phone that is linked to it. Therefore, when changing a SIM card or losing your phone, be sure to disconnect your mobile bank from your old number.

- To receive a transfer, instead of a card number, indicate the phone number associated with it.

- Get a virtual card for online purchases. Transfer to it exactly the amount necessary for payment.

- Set limits on all cards.

- Do not download unknown applications or click on dubious links.

- Connect your card to the Secure Code service.

- When entering your PIN code at an ATM or at a cash register, cover the keyboard with your hand - attackers will not be able to steal funds from your card without a PIN code and SMS confirmation unless you transfer the money to them yourself.

If you enter personal data, for example, login and password for your personal online banking account, make sure that the website address is correct.

Where to go if money is stolen from your card

If you discover that fraudsters are withdrawing money from your bank card, do not panic. The main thing is to remain calm and take some action. Two structures can help solve the problem - the police and the bank. Procedure:

- First you need to contact the financial institution and explain the situation. To do this, you need to call the hotline.

- Block accounts. You will need to provide the employee with your passport details, security question, etc.

- Visit the bank and write a statement asking to cancel the transaction and express disagreement with it. The application must be drawn up in 2 copies. This will be needed for further possible recourse to court.

- If possible, provide the bank with evidence of fraud. This could be a screenshot of correspondence with criminals, an extract from a mobile operator, etc.

After the bank accepts the application, the countdown begins, during which the financial institution must make a decision on compensation or not compensation for damage. By law, the period for making a decision should not exceed 120 days. In most cases, the bank responds within 20-30 days.

In parallel with contacting the bank, you need to write a statement to the police. Employees must begin record keeping and investigation into fraudulent activity. Most often, at this stage, the police and the bank interact, which dramatically increases the chances of catching the criminals.

Switching to a new operator or number

Similar situations are possible: when changing or re-registering a number, and there is no statement from the user about changing confidential data. We should not exclude the influence of the human factor - an accidental or deliberate error by service personnel.

How to cancel a number? Write two statements asking to disconnect the old number and connect the new number. Otherwise, the possibility of uncontrolled connection to the mobile bank of eight foreign numbers will remain.

Money stolen in this way can be returned in rare cases, proving the guilt of the operators in deliberate fraud with the number.

How to return money withdrawn from your card by fraudsters

Large banks such as VTB, Post Bank and Sberbank have good security services and are attentive to their clients. Smaller organizations operating in the Russian Federation, for example, online banks, do not even have representative offices in the regions. Therefore, all negotiations with them take place remotely, which sharply reduces the possibility of a refund.

Most often, only those victims who try to provide themselves with legal and legal protection have a chance of success, not limiting themselves to one call to the bank. And also those whose damage amounted to at least 40-50 thousand rubles, since the police are not so scrupulous about smaller amounts.

Additional actions

When sending a complaint to the bank, also file a statement with the police. The document must contain a detailed description of the current situation, with a detailed indication of the circumstances surrounding the incident. The document is submitted in two copies, for registration with law enforcement agencies and with a note of receipt for yourself.

Based on the submitted applications, the cyber police are taking measures to catch the attackers. In particular, the police:

- contact the bank to provide information about the transactions under investigation;

- When cashing out money through ATMs/terminals, they examine video from surveillance cameras, interview witnesses, and the victim.

As a rule, such investigations are carried out in parallel and in cooperation with the bank's security service.

If there is no result of the investigation, the victim has the right to file a second complaint with the bank, on the basis of which a second appeal is drawn up to the recipient bank with a request for a refund.

To whom will the bank definitely return the money illegally debited from the card?

It is difficult to return money written off from your account. In order to protect yourself, banks recommend insuring your savings. Only in this case will all illegal expenses be fully reimbursed.

Based on judicial practice, it can also be noted that money is returned to those clients who were in the same city, and the payment from a plastic carrier occurred several hundred kilometers away. In this case, the victim must contact the bank immediately, immediately after the transaction, and not a few days later.

How to choose a secure card

Thus, it turns out that if a person knows the card number, then he can easily write off funds from it, and in order to carry out this operation, there is no need to look for all the other data about the card owner, because this can be done quite easily. You now know how scammers can easily find out the full name of the card owner and how you can independently choose the expiration date of someone else’s card.

What can be said in favor of protection from such unlawful actions? It’s quite easy to protect yourself from Internet scammers - you just need to use cards like Maestro Momentum or Cirrus . Such cards are issued by Sberbank, and without additional security information, a stranger will not be able to withdraw or transfer funds from your card, or make a purchase online.

In addition, it is worth thinking about which ATMs you use when withdrawing funds. It is best to use those devices that are located in Sberbank offices or those that you use constantly and consider them to be verified. Fraudsters will not be able to install a skimmer reader on such ATMs, so such devices are the most secure.

As for security measures, in addition to those listed, it is also worth paying attention to the fact that you need to use resources for Internet banking with great caution. Fraudsters do not sit still and are constantly improving their skills in sophisticated theft of money from cards.

Nowadays it is very popular to create viral forms of pages that are a complete copy of popular resources for paying for services or goods. These include social networks, online stores, banking websites, etc. You should always look carefully at the website address and compare it with the original. If you notice differences in them, then know that they are trying to deceive you!

Protection methods for payment card holders

Having clarified the question of whether it is possible to withdraw money if you know the card number, you need to remember about methods of preventing criminal acts. To do this you just need to follow some rules:

- Install an antivirus on your device and update it periodically.

- Download programs only from official sites.

- Do not click on suspicious links.

- Use trusted ATMs.

- Do not insert plastic media into suspicious terminals.

- When entering data on websites, check the accuracy of your email address to avoid falling for the tricks of phishing scammers.

- Do not disclose your CVV and card PIN to third parties.

Bank card protection

By following simple precautions, you can reduce the risk of losing your savings.

Claim to the bank

There is no prescribed form for a claim.

However, when drawing up a paper, certain rules must be followed:

- It is necessary to indicate the person to whom the document is sent (if the citizen does not know the last name, he simply writes: “To the head” and indicates the name of the institution);

- Information about the applicant (full name) is entered;

- The name of the document (“Claim”) is written in the center of the sheet;

- The main part should contain a description of the situation and a description of the circumstances and actions that violate the client’s rights. The essence should be stated concisely, indicating only those details that are relevant to the application under consideration. It is also necessary to observe chronology and logically express your thoughts: indicate the exact dates of the events that occurred, data of the workers with whom the citizen contacted when trying to resolve the issue, etc.;

- Afterwards it is indicated that, based on the provisions of the Law “On the Protection of Consumer Rights”, the citizen requests consideration of the application no later than 10 days after it was received. Next, the citizen lists the ways to send him a response, indicates his residence address, email and telephone number for communication (employees of the institution may need this to receive clarifications or additional information about him from the client);

- The date of compilation is placed at the end, after which the applicant signs the text.

Liability for fraud

Bringing fraudsters to justice is difficult. Villains have certain knowledge and intelligence and try not to make mistakes. Therefore, it takes a huge amount of time to find criminals, and law enforcement agencies are not always able to punish them. The legislation of the Russian Federation provides for different types of punishment for fraud, which depend on the severity of the crime.

Article 159 provides for punishment for the following illegal actions:

- Stealing someone else's property.

- Acquiring rights to it by fraud.

- Committing deception by a person using his official position.

In connection with the expansion of the scope of activity of criminals in Ch. 21 of Article 159 of the Criminal Code of the Russian Federation have been supplemented with the introduction of new types of fraud - fraud with plastic cards, passbooks, savings accounts, and loan processing.

Criminal liability

The legislation of the Russian Federation provides for preventive measures and liability for extortion and fraudulent crimes, which apply to persons over the age of 16 years. In this case, attention is drawn to the amount of damage:

- Minor - up to 250,000 rubles.

- Significant - over 250,000 rubles.

- Large – up to RUB 1,000,000.

Depending on the presence or absence of aggravating circumstances, Article 159.3 of the Criminal Code of the Russian Federation provides for different types of punishment:

- Under Part 1 of Article 159.3 - a fine or compulsory work for up to 360 hours, correctional labor for up to 12 months, restriction of freedom for up to 2 years, arrest for up to 4 months.

- Under Part 2 of Article 159.3 - compulsory labor, a fine or forced labor for up to 5 years, correctional labor for up to 2 years, imprisonment for up to 4 years.

- Under Part 3 of Article 159.3, a fine, forced labor for up to 5 years, and arrest for up to 5 years are possible.

- Part 4 of Article 159.3 provides for imprisonment for up to 10 years with or without the obligation to pay a fine.

If a criminal uses a duplicate plastic carrier, he faces liability under Article 159.1. The punishment provided for by the norm is a fine of up to 120 thousand rubles. or compulsory or correctional labor, arrest for up to 4 months or restriction of freedom for up to 2 years.

Administrative punishment

Article 159 of the Criminal Code of the Russian Federation provides for administrative punishment for fraud if a person is accused of one crime and the amount of damage is less than 30,000 rubles. The offender may be assigned:

- fine;

- seizure of funds used to commit fraud;

- House arrest;

- restriction of freedom for 15 days;

- warning;

- compulsory or corrective labor.

Most often (according to statistics), vulnerable categories of citizens, which include pensioners, become victims of fraudsters. Due to age and low Internet literacy, it is this part of the population that becomes the main target of criminals. Most pensioners transfer money themselves, having heard a terrible story that their loved one got into an unpleasant situation, from which he will be able to get out after transferring the funds.

Contacting the Police

In order for the application to be accepted by law enforcement authorities, certain rules must be followed. The easiest way would be to call the police to draw up a report and fill out the form in their presence or state the circumstances on a blank sheet of paper.

If this is not possible for any reason, the following conditions must be observed:

- An application requesting to initiate a criminal case can be written in one’s own hand or using any printing technology;

- The application must be written addressed to the head of the police department to which the citizen applied, indicating the full name, position and name of the department in the upper right corner of the sheet;

- Then the citizen’s data is indicated (full name, place of residence and contact telephone number);

- Indicate the name of the document below in the center of the sheet - “Application”;

- Describe what happened, indicating the date, time and place, and also list in detail all the circumstances that would allow the incident to be classified as a criminal offense, namely fraud;

- Based on the events described and the fact of causing property damage, you need to ask to initiate a criminal case on the basis of the relevant article and return the stolen funds;

- Photo, audio and video recordings, and other documents confirming what happened must be listed in the application and submitted to the police along with this application.

Attention! After presenting all the information, you must enter the date of the application and sign.

The duty of the investigator (inquirer, other employee of the investigative bodies) is to receive, conduct an inspection, and make a decision regarding the report of a crime within 3 days from the date of its submission. According to part 3 of Art. 144 of the Code of Criminal Procedure of the Russian Federation, it is possible to extend the period to 10 days.