Home / Complaints, courts, consumer rights / Litigation

Back

Published: September 29, 2018

Reading time: 8 min

0

338

Losing money on a bank card can be an unpleasant surprise. In an attempt to find where exactly the funds from the card went, a person may find out that they were withdrawn by bailiffs as part of enforcement proceedings.

- Legality of bailiffs writing off money from a card

- The procedure for the bailiffs to write off money from the card

- What means cannot bailiffs withdraw from a card?

- How to return money written off by a bailiff without notification

In some cases, bailiffs break the law and withdraw funds illegally.

How to find out the reason for debiting funds

According to the current legislation, on the basis of a court decision, the bailiff service has the right to seize the financial assets of the offender, withdraw funds from bank cards (including credit assets) in the amount specified in the writ of execution (with the exception - withdrawal of funds is carried out within the subsistence level ).

To find out the reasons for debiting funds from a client’s account, you must:

- Contact any territorial division of Sberbank PJSC with a passport and an application for an extended statement of account transactions. The received certificate will indicate the number of the writ of execution or court decision on the basis of which the write-off occurred.

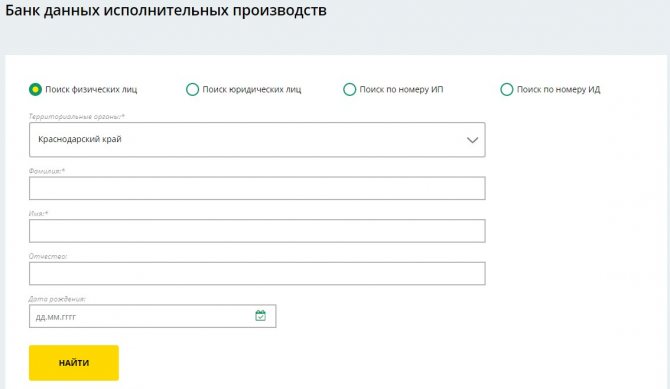

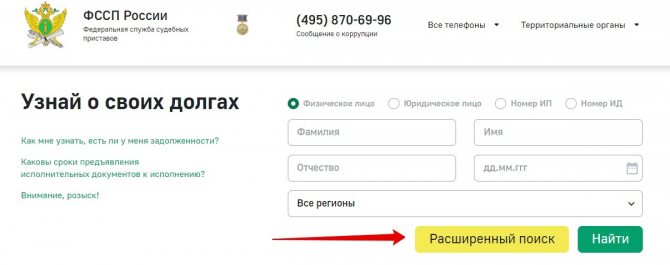

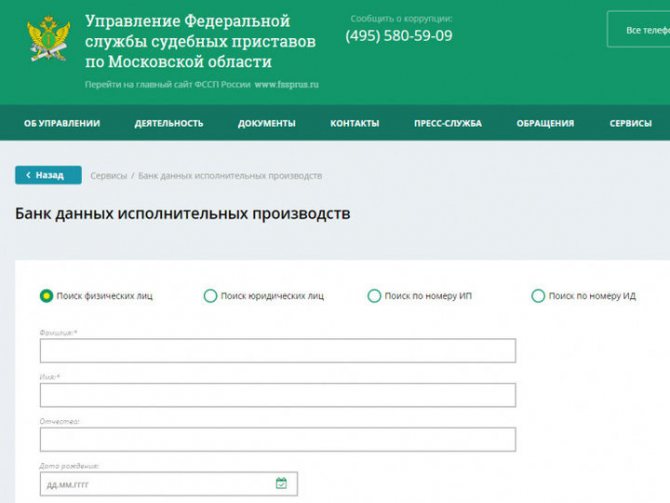

- If the funds were written off by bailiffs, you can determine the reasons for the seizure of finances through the official website of the service. In the section of the database of enforcement proceedings based on the person’s full name, you can find information about the case that has been started, as well as the territorial division of the bailiff service, where you need to contact to find out the reasons for the arrest and to return the money.

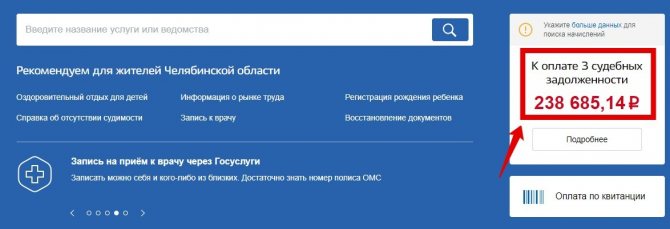

The case of enforcement proceedings can be transferred to various territorial bodies. Information on the progress of the case can be tracked via the Internet on the government services portal.

There are many reasons for opening enforcement proceedings and forced collection of finances: traffic police fines, non-payment of alimony, outstanding loan debts, late utility bills, non-payment of taxes, etc., therefore, an Internet user should register on the government services website to receive timely information.

How to find out why bailiffs wrote off money from a Sberbank card without warning

If an unplanned deduction of money from a credit card was discovered, then most likely this occurred as a result of the activities of the executive branch. How to check where exactly the money went?

- Since you won’t be able to see the purpose of the write-off on your own, you must first visit the nearest Sberbank branch and contact the manager to receive detailed information on the card.

- To do this, you will need to present the card itself and your passport. You will also have to write an application for the provision of such a service.

- The resulting printout will display all actions performed on the account during the specified period of time. Including write-offs. In this case, the time, type of operation, amount and details for which the deduction was made will be indicated.

The column with the recipient's details will reflect information on enforcement proceedings if the write-off occurred on the initiative of the executive branch.

When the client guesses the reason for the write-off, the issue can be closed, although it is better to still visit the bailiff and clarify what exactly led to such consequences.

If a bank client does not suspect that enforcement proceedings have been initiated in his name, it is mandatory to come to the SSP branch. There are often situations when bailiffs take funds illegally or for payments that have already been made. Can money be written off for a fine paid? This is quite possible, due to the fact that bailiffs do not always promptly receive information about payments made, so in some situations it is worth presenting documentary evidence of payment of the debt.

A visit to the SSP will finally clarify the situation. They are obliged, upon first request, to provide information about in whose favor and on what basis the debit from the banking product was made. If the client disagrees with the measures taken, he must provide evidence that the debt has already been paid by him on his own and initiate the return of the deducted funds.

How to get your money back

If funds are written off without reason for debts that were previously repaid, the funds may be returned.

What you will need: documents confirming payment of the debt, passport.

Procedure:

- Obtain a certificate from the territorial bailiff office stating that the write-off of finances was erroneous and the calculations were made; the individual has no debt obligations (a document confirming the fact of payment of the debt, for example, a bank statement, may be required).

- Bring documents confirming the payment and a certificate from the bailiffs to the bank branch, write an application for a refund.

There are cases when money is written off illegally, for example, under loan agreements to which the client has no relation. In this situation, it will be necessary to collect all the information about the illegality of the write-off, write a complaint against the FSSP contractor and apply to the court. Within 10 working days, the application will be reviewed and a decision will be made to initiate proceedings or refuse.

If funds related to these types of payments have been written off, you must contact the FSSP with documents confirming the illegal write-off of funds.

There is a list of income that is prohibited from being written off by law. These types of income include, for example, maternity capital and social payments.

How long does it take to get a refund?

Funds collected from the debtor by the bailiff service are initially transferred to the FSSP account, from which they must be transferred or issued in cash to the recoverer within 5 banking days. In the event that the funds were written off incorrectly and were not transferred to the claimant, they are returned immediately after the termination of enforcement proceedings based on the application (the law does not provide for an exact period for returning the money to the account).

If the debtor turned to the bailiffs after the funds were transferred to the collector, the procedure for returning the funds begins, which must be dealt with by the bailiffs themselves, who contact the collector with an application for the return of the erroneously transferred funds.

The time frame for returning money collected from a person by mistake is not regulated in any way by law, so receiving financial assets back may take a long time.

How is money withdrawn?

Initially, the debtor is invited to voluntarily repay his debt to the budget, the traffic police, spouses and other creditors. If this does not happen, the debtor's property is seized. Cards and bank accounts have the greatest value as highly liquid assets. According to the provisions of the law, the defendant is provided with a written warning about the content of the claimant's claims. 5 days are given for voluntary repayment of the debt. In case of refusal or impossibility to make payment, the bailiffs begin to act independently.

In which case it will not be possible to return the written-off money?

In order for the illegally written off money to be returned, it is necessary to submit an application to the FSSP within ten days from the date of the decision to recover funds or from the moment when the person was notified of the decision made to recover funds. This ten-day period for accepting an appeal is enshrined in the Federal Law “On Enforcement Proceedings” No. 229 of October 2, 2007.

If the deadlines were violated, the complaint will not be accepted and the money will not be returned.

The exception is situations where a person could not file a complaint, for example, while in a hospital or outside the Russian Federation. In this case, it is required to provide evidence that the deadline for filing a complaint was violated for objective reasons.

Let's figure out why we were written off

Often citizens do not even know that they have become debtors. For example, if a person lives in another city, different from his place of registration, and has not received a decision to collect a fine. Meanwhile, traffic police officers are turning to bailiffs to collect the debt.

Thanks to the gosuslugi.ru service, you can quickly track data on court debts.

You can also check the information on the website fssprus.ru; the search in the service is carried out by last name, first name, patronymic or enforcement proceedings number. The resource is intended for citizens, legal entities, and individual entrepreneurs.

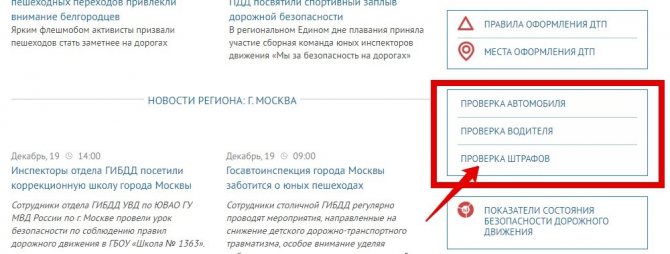

Questions often arise when it turns out that bailiffs, without warning, wrote off money from a Sberbank card for a traffic police fine. To avoid unpleasant surprises, you should track information about unpaid fines on the traffic police website.rf.

You can personally contact the bailiff service and ask to familiarize yourself with the initiated enforcement proceedings.

Through the website nalog.ru you can check data on existing tax debts.

To collect debts, bailiffs make a request to a financial institution and receive a list of the debtor’s accounts indicating the amount of money in the account. Sends a resolution stating how much a person owes for alimony or other obligations.

The bank will transfer funds in the amount specified in the resolution to the FSSP account.

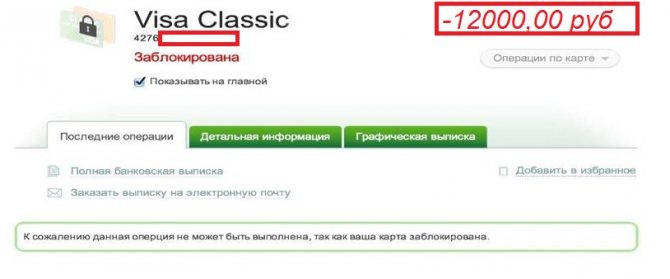

What to do if your card is seized

When a debtor’s bank card is seized, the client’s access to using the card itself and managing funds in the bank account is blocked. The required amount of money is written off in favor of the bailiffs on the basis of a writ of execution or a court decision. The FSSP service is not obliged to notify the debtor of the planned arrest, so this situation may occur unexpectedly.

Do bailiffs have the right to withdraw money from a bank card?

In addition to the question of how to find out why bailiffs withdrew money from a Sberbank card, many are interested in the legality of such decisions.

Irina Bolshakova

Bank loan officer

In 1 minute! Let's calculate overpayments using a calculator. We will offer a sea of profitable offers on loans, credits and cards, very flexible conditions. Shall we try?)

The work of bailiffs is based on the fact that there is a need to find the debtor and his property and forcibly seize funds to cover the resulting debt, on the basis of a writ of execution. At the initial stage, the debtor receives notifications and, provided that the instructions are fulfilled in good faith, the proceedings are completed. If the debtor refuses to pay, the bailiffs are forced to resort to extreme measures. These include: search for the debtor, seizure of property and other collection measures.

There are many reasons for initiating enforcement proceedings and compulsory collection. This could be: no payment for a traffic police fine, alimony, loans, utility bills, and the like.

If a person ignores offers to voluntarily repay the debt, his financial resources are seized. If there is money in the account that can repay the debt in full, it is written off and the arrest is removed from the accounts. These actions are supported by law and do not entail a violation of established standards, except in cases where the money is withdrawn without good reason: repeatedly or for a non-existent loan or a fine.

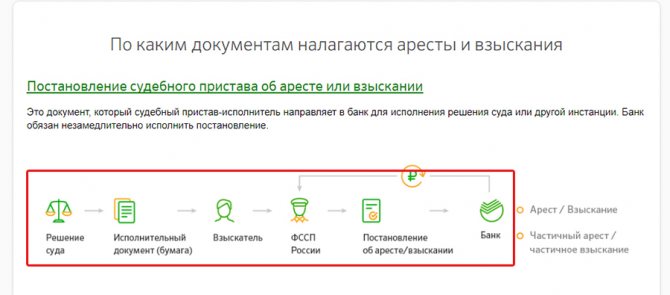

How to seize accounts in Sberbank

When a seizure is made, the client’s access to using the card or account is blocked, and the required amount of funds is forcibly written off in accordance with the law. Bailiffs are not required to notify the client about the planned arrest; most often this happens suddenly and unexpectedly.

Funds on the card are seized in the following order:

- The plaintiff is trying to collect funds voluntarily by calling and notifying the debtor;

- If the debtor refuses to repay the debt, then the plaintiff has the right to go to court, based on a positive court decision to repay the debt, the bailiffs open enforcement proceedings.

- If the debtor also refuses to repay the debt, the bailiff service sends an application to all banking institutions in order to obtain information about the state of the debtor’s financial assets: the availability of funds on cards, deposits.

- Upon receipt of a request from bailiffs, the bank is obliged to provide the requested information as soon as possible.

- Based on the court decision, the bailiffs give the bank an order to block the debtor’s existing accounts and write off funds to pay off the debt.

Can disability benefits and other social benefits be withdrawn?

Not all assets owned by the debtor are subject to recovery to satisfy obligations. According to the Law “On Enforcement Proceedings”, the following types of income remain inviolable:

- amounts paid for personal injury;

- payments to persons injured or disabled;

- compensation payments to victims of natural disasters or other emergency situations;

- upon loss of a breadwinner;

- insurance payments, with the exception of accrual of insurance pensions for old age or disability;

- alimony payments;

- other cash accruals in accordance with the provisions of Art. 101 of the Law “On Enforcement Proceedings”.

Taking into account the above, we can conclude that the amounts of benefits can be withdrawn to pay off the debt on a general basis.

You need to know : Does a bailiff have the right to seize a pension: conditions, interest and withdrawal

Actions to take when a card is blocked by bailiffs

If you know the reason why a bank card was blocked by bailiffs, you must adhere to the following instructions:

- Pay off existing debt in any available way:

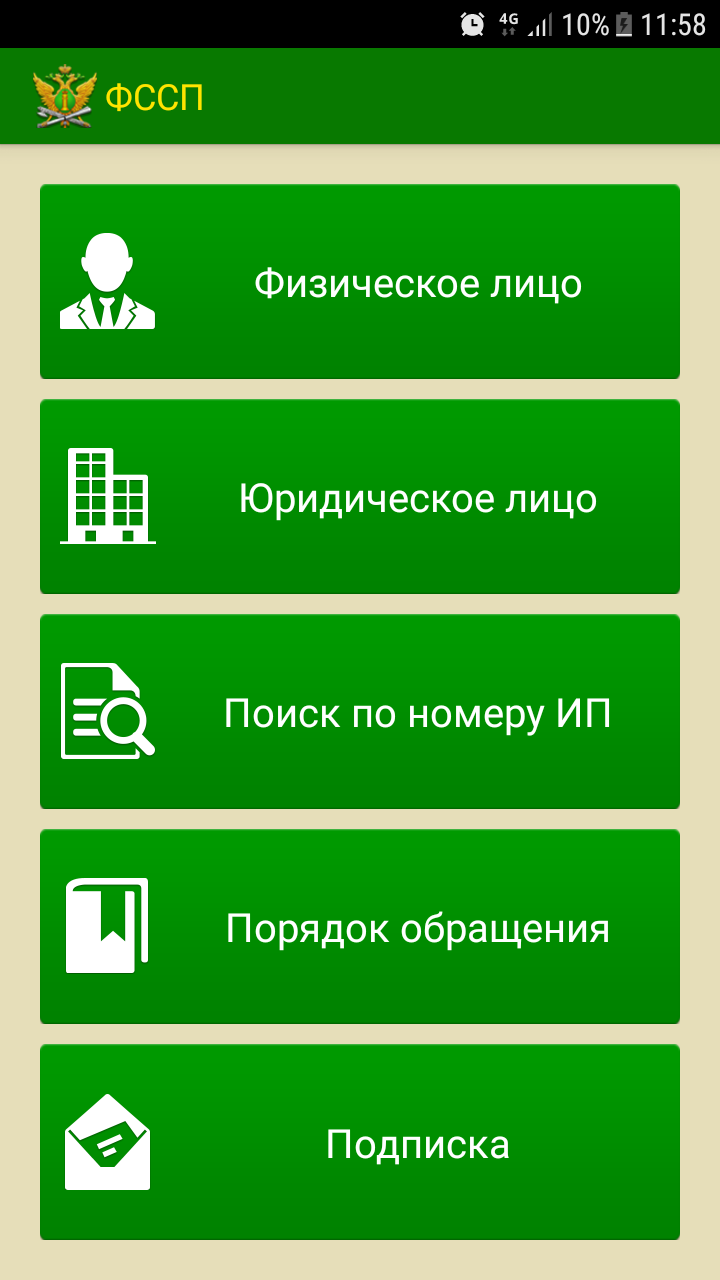

- Online through the service Data Bank of Enforcement Proceedings;

- From a mobile phone account;

- Through the FSSP mobile application

- Through Sberbank online;

- Using an instant payment terminal or ATM;

- When you contact the bank in person (you can print a receipt through the service of the bank for enforcement proceedings);

- Directly to the bailiff.

- When the bailiffs see that the debt has been repaid, they will issue a demand to the servicing bank to unblock the client’s account. As a rule, an entry in the data bank is deleted within 3-7 days from the date of payment of the debt.

- If there is no available amount to fully repay the debt, then funds will be debited from the account until the debt is fully repaid. After this, the card will be unlocked.

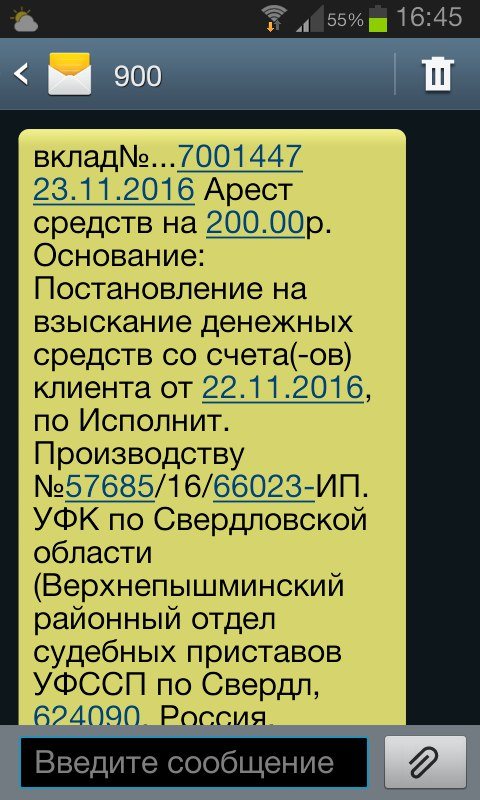

SMS notifications from bailiffs in Sberbank

There are several ways to obtain information about the presence/absence of debt of individuals:

- Data Bank of Enforcement Proceedings;

- Personal appeal to the bailiff service;

- Official website of government services;

- FSSP mobile application.

The FSSP service has the right to use SMS notifications to persons participating in legal proceedings only with their consent to this type of notification. Consent must be confirmed by a receipt.

Recently, cases of a new type of fraud have become more frequent - SMS mailings from the bailiff service, as well as messages from Sberbank about the seizure of property. The SMS attachment contains a viral link, clicking on which automatically debits funds from the bank card attached to the mobile phone number.

Sberbank can only send messages about debiting funds; the bank does not send information about the seizure of property, therefore, if you receive dubious messages, you must urgently call Sberbank PJSC on the hotline (the numbers are indicated on the bank card) or contact the FSSP.

Execution procedure

Bailiffs are appointed to execute the court decision and begin searching for information about the debtor. Bailiffs contact the bank, collect information about its financial situation: credit, debit, deposit accounts. Since the majority of the Russian population uses the services of Sberbank, obtaining information about the right person is not difficult for a government agency.

Credit and debit cards can also be of material interest, then the bailiffs send a request to the bank and seize existing accounts with further seizure. Sberbank has no right to refuse to execute a court decision.

Bailiffs often withdraw money from a Sberbank card without notification - what to do if you did not find out about this immediately and is it possible to return the funds.