- Inga Kaysina

- 8 889

Veterans, disabled people, pensioners and other citizens classified as socially vulnerable groups are protected by the state and are entitled to various benefits. One of the most significant types of social support is compensation for medicines, which is provided to the majority of citizens who have one or more of the listed statuses. Medicines are allocated in a targeted manner, as prescribed by the attending physician. In addition to free drugs, the beneficiary also has the opportunity to return part of the money spent on the purchase of those drugs that are included in the approved list.

Legislative regulation of refunds for medicines

At the legislative level, refunds for medicines are provided in two options - individually and as a whole for the treatment received. The first case is enshrined in the Federal Regulations, the second is mentioned indirectly in regulations.

Tax Code of the Russian Federation

In the Tax Code of Russia there is Art. No. 219, establishing the types of receipt of reimbursement of expenses by individuals. Tax refunds for medicines are made by the citizen, his wife or husband, as well as children and parents.

Summary of the article:

- all amounts of insurance premiums transferred in the reporting period under the compulsory medical insurance agreement (compulsory medical insurance) are taken into account;

- Reimbursement of funds occurs on the basis of documents;

- expenses are covered in full, but subject to a maximum limit;

- It is allowed to receive a tax deduction (hereinafter referred to as TD) on behalf of a brother/sister.

PP No. 201

Social deductions are additionally referenced to PP No. 201. The resolution contains a list of medications that can be included in the refund declaration. When receiving a prescription from a doctor, experts recommend that citizens find out whether the medication is included in the group of drugs subject to NV.

You can apply for a tax deduction in the following cases:

- presence of rheumatic disease;

- use of anti-allergy medications;

- diagnosis in the central nervous system;

- tablets to prevent infection;

- taking antitumor drugs;

- purchase of vitamin complexes;

- undergoing paid diagnostics of the body;

- the patient suffered a pathology in the pelvis or gastrointestinal tract.

Watch the video: “Pensioners and other categories of citizens will be able to get their money back for medications”

Social NV has a scheme:

- Medicines included in the unified register.

- Medical services specified in the list, as well as expensive types of treatment.

- Consumables.

Decree of the Government of the Russian Federation No. 890

Taking into account the conditions of economic development in the field of providing medicines to the population, as well as the lack of dynamics in improving the quality of services, the Government of the Russian Federation approved PP No. 890.

The regulatory document establishes various measures to solve problems in healthcare:

- Carry out measures to control the availability of means for the prevention and diagnosis of medical care in pharmacies. appointments. In this case, the form of ownership of the organization does not matter. If the enterprise does not have medicines established in the unified register, then sanctions are applied to the pharmacy kiosk.

- Approval of the amount of benefits from the free cost of drugs dispensed to the population according to medical prescriptions.

- Conduct timely transfers of cash support from organizations for prescription drugs provided to citizens free of charge or at a discount.

- A list of categories of the population, as well as diseases undergoing outpatient treatment, has been established. The rule of free dispensing of tablets with a doctor's prescription is introduced for persons and means.

- Other.

Federal Law “On compulsory medical insurance in the Russian Federation” No. 326-FZ

Federal Law No. 326 does not have regulations that directly establish the possibility of making a refund for medicines from the tax authority. However, the document indicates the obligations of each citizen to enter into an agreement with an insurance company.

Signing a medical contract entitles individuals to receive free hospital care. In addition, without a compulsory medical insurance policy, a person will not be able to obtain compensation for injury at work or a tax deduction for medications.

Other legislation

Federal Law No. 147, as amended in 2020, updated the provisions of the Tax Code of Russia, in particular affecting Art. No. 219. The amended document states that any medications prescribed by a doctor are subject to income tax deduction.

In the current reporting period for NV, the following conditions must be met:

- The doctor prescribed the medicine. Confirmed with a special prescription form with a seal and a health worker’s endorsement.

- Availability of documentation indicating payment for the medicine.

Note: as of 2020, consumers do not need to compare the name of tablets in a single registry.

List of drugs for income tax refund on drugs

Not all medications are included in the list of drugs eligible for income tax refund for medications. To mitigate conflicts, the legislator has developed a complete list of funds subject to compensation under personal income tax in PP No. 201.

The legal document contains the names of the drugs without reference to the manufacturer, brand or other features. Therefore, one medicine has different names, and is also produced by several enterprises, including in different countries. Experts recommend that citizens pay attention to the unpatented name. For example, “metamizole sodium” is often produced under the “Analgin” logo.

The table provides a short list of medications that can be indicated in the declaration for submission to the Federal Tax Service:

Table 1.

| Group | Name |

| Preparations for administering anesthesia | Ketamine solution, liquid diethyl ether |

| Local anesthetic | All forms of Ledocaine |

| Non-narcotic analgesics | Aspirin, Ibuprofen |

| Antihistamines | Ketotifen |

| Medicines for depression | Sertraline, Amitriptyline |

| Antimicrobial | Gentamicin, Erythromycin |

| Means to combat viral infections | Acyclovir, Nevirapine in tablets or suspensions |

| Medicines for treating fungus | Itraconazole in capsules, Terbinafine, including in the form of cream |

| For osteoporosis | Calcium carbonate, Alendronic acid |

| For the treatment of anemic conditions | Folic acid, Cyanocobalamin as injections |

| For heart diseases | Valsartan, Enalapril |

| Antiseptics and disinfection | Alcohol solution of iodine, Ethanol |

| Medicines for diabetes | Insulin DlD, SrD |

| Vitamin complexes | Menadione in the form of injections, Thiamine in tablets and injections |

| Other categories |

A complete list of medications for income tax refund in 2020 is available for download here (RF RF No. 201 dated March 19, 2001, as amended).

Please note: in addition, the list of medications can be checked on the official portal of Rosminzdrav.

Categories of citizens and situations when a refund is due

Money for medicines can be returned in the form of 13 percent paid in income tax. At the legislative level, categories of beneficiaries are established that have separate preferences for processing deductions.

Pensioners

You can return money for medicines to a pensioner in accordance with the established procedure, however, compared to other groups of the population, the procedure is simplified. In addition to PP No. 201, provisions for persons on well-deserved rest are also established in Art. No. 219 Tax Code of Russia.

If a citizen purchases medicines at his own expense, he has the right to apply to the Pension Fund of the Russian Federation in his area of residence. Based on the request, the department will provide the pensioner with a partial refund for the drugs.

List of required papers:

- payment receipts for the purchase of medicines;

- prescription form filled out by the attending physician;

- statement.

Conditions, list of documents, amount and methods of obtaining a tax deduction.

A sample with the details of the department is provided by the employees of the institution. The citizen is required to enter information and submit it for review.

Disabled people

Refunds for medicines for disabled people are carried out on the basis of PP No. 890. An individual needs to make an appointment with a doctor and obtain a prescription for the medicine. Then contact the pharmacy chain and buy the drugs at your own expense.

For citizens with disabilities, preferences apply in the amount of 50% reimbursement for medicines or 100% income tax refund. In the latter case, you must contact the organization to receive insurance compensation. The algorithm of actions is identical to the procedure for sending an application to the FSS.

Cancer patients

Cancer patients need to be reimbursed for treatment, just like other benefit categories - on the basis of Art. No. 219 Tax Code of Russia. It is noteworthy that the same situation applies to non-working segments of the population.

When a patient is diagnosed with leukemia, the citizen has the right to receive timely free treatment and medications. If a doctor refuses to provide drugs at a discount, a person’s chances of healing dwindle every day. Therefore, people with cancer must understand that refusal to fill a prescription is a direct violation of their rights. In such situations, you need to send a complaint to Rosminzdrav.

Pregnant

If a woman’s pregnancy is monitored by paid doctors, and she also pays for examinations, tests and ultrasound examinations, the citizen can return the funds in the amount of 13 percent.

However, the Tax Code of Russia establishes a condition - reimbursement of money is carried out within the reporting period. Additionally, there is a limitation on the amount of compensation - 120,00 rubles. This amount indicates the maximum amount when filling out the declaration. In other words, a refund for 120 thousand rubles. is 15,600 rubles.

If a pregnant woman required an expensive operation or treatment due to complications, including a caesarean section, then the full cost is deductible. Detailed information is indicated in PP No. 201 - register of medical services.

Large families

To initiate the right to a tax deduction of money spent on medicines, official employment is required.

Income tax is deducted from the income received by an individual in the amount of thirteen percent. Benefits apply to the following large families:

- legally married spouses;

- guardian, trustee;

- adoptive parent.

For the treatment of a child

The legislation of the Russian Federation has approved a list of medications for children under 3 years of age for which funds can be returned.

The procedure has the following algorithm:

- The list of free medicines is established in PP No. 890.

- Every year in the constituent entities of Russia, regional authorities decide to formulate an additional list of drugs based on the budget.

- Pharmacy chains create a fund from which the child’s parents can receive medications with a doctor’s prescription.

- When contacting a doctor, the mother and/or father should ask whether tablets, suspensions and injections are included in the unified register. Then you need to buy medications at the pharmacy.

- At the end of the year, a declaration is submitted to the Federal Tax Service - documents confirming the costs of paying for medicines are attached to the application.

If medications were paid for by relatives

If, in fact, people close to the patient paid for treatment, rehabilitation or the purchase of medications, then a tax deduction is also allowed.

In this case, relatives are:

- husband wife;

- parent, guardians, trustees;

- children under 18 years of age, including adopted children.

In addition to the standard package of papers, copies of documents indicating blood ties must be submitted to the Federal Tax Service. For example, a child needs a birth certificate, and spouses need a marriage certificate. Additionally, a power of attorney for the purchase of medicines is issued. The paper is endorsed by a notary.

Compensation for refusal of subsidized drugs within the framework of the NSO

Pensioners entitled to monthly cash payments (MCB) are provided with an established set of social services from the state. The NSO includes:

- provision of preferential medications, medical services, free baby food;

- issuing vouchers for the treatment of diseases in sanatoriums;

- providing free travel to a sick person on intercity transport to and from the place of treatment.

The legislation establishes that NSO has a monetary value. In 2020, a set of all services costs 1075.19 rubles. Of this, 828.14 rubles are allocated for medicines. An individual can refuse the NSO completely or partially and receive monetary compensation or use free medicines as part of a social program. Only the amount not exceeding the NAS will be compensated.

- Fines for refusing vaccination

- How to quickly cure a runny nose

- 6 ways to become slim after 50

Where to go to get a refund for medicines

In addition to the Social Insurance Fund, you can apply to the Federal Tax Service and other government agencies to apply for compensation for NV. Health insurance regulations establish several types of reimbursement and support for the purchase of medicines.

At the place of work

Certain groups of individuals can apply for NV at a 13 percent rate by contacting their employer.

In most cases, these are employees of municipal enterprises and organizations:

- prosecutor's office;

- military personnel;

- investigative committee;

- Ministry of Internal Affairs;

- healthcare institutions;

- schools and other educational institutions.

To obtain up-to-date information about the nature of support and the procedure for returning money for medications, you need to contact the human resources department of the institution.

Through the tax authority

Step-by-step instructions for receiving a deduction for medications.

The legislation of the Russian Federation establishes the possibility of returning money for medicines through the tax office. Understanding the mechanism of NV allows you to understand the procedure and algorithm of actions. The right to apply for a deduction for the purchase of medicines is granted to all citizens who pay personal income tax. The essence of applying to the Federal Tax Service is the return of your own funds, and not reimbursement from the budget.

NV for medicines is part of an individual’s money transferred in the form of tax within the reporting period. In a situation where a citizen bought more medicines in 12 months than was deducted from personal income tax, then only the amount is returned at a rate of 13%.

Social protection bodies

The regulations provide for a number of measures aimed at supporting the population, including the unemployed:

- provision of free medicine based on the compulsory medical insurance policy;

- assistance in recovery from injury or illness;

- social adaptation after disasters and accidents.

Basic and/or additional measures are established for each situation. Reimbursement for the purchase of medicines is also included in this group. It is necessary to submit documents to the social security authorities proving that the compulsory medical insurance policy did not cover all expenses.

Contact the federal social service. insurance has the following features:

- refunds are allowed for medications necessary for the treatment of the applicant or his parents;

- the funds were spent on medicines for a spouse or child;

- the medication was prescribed by a doctor;

- availability of a compulsory medical insurance agreement.

All citizens of the Russian Federation have the right to return income tax, but subject to the following conditions:

- contract with an insurance company;

- application review period – 1 month;

- in some cases, you need to open a personal account at a financial institution to deposit money.

Another method of obtaining a deduction is also allowed, since the legislator has not established a clear framework regarding the process. That is, the method of issuing a refund remains at the discretion of the company.

Refund under compulsory medical insurance policy

There are no legal provisions establishing the insurance company’s obligations to contribute money under the compulsory medical insurance policy. Receipt of compensation or refund of income tax is carried out in cases established by the legislation of the Russian Federation.

An exception is a situation in which a citizen spends his own money on treatment.

In this case, the following conditions must be met:

- medical services are included in the unified register;

- the service was carried out in a government institution and not in a private clinic;

- payment for procedures, although the individual has insurance and a policy.

Benefits for medicines for pensioners

Citizens receiving pension subsidies are considered one of the most vulnerable categories of Russians. The state provides pensioners with different types of benefits at the federal and regional levels:

- housing;

- tax;

- for payment of housing and communal services;

- social;

- medical;

- natural;

- monetary.

Pensioners can receive an established set of social services (hereinafter referred to as SSS), which includes compensation for medications. At the legislative level, a list of medications has been established for which you can receive compensation under compulsory health insurance (CHI). Working pensioners can apply for a deduction when paying personal income tax at the tax office after purchasing medicines.

To find out what benefits and compensation a needy citizen is entitled to from regional authorities, you need to contact the local branch of the Pension Fund of the Russian Federation (hereinafter referred to as the PF of the Russian Federation).

- New measures to protect against coronavirus in the Moscow region

- Free dental prosthetics for pensioners - who is eligible, queue formation and regional programs

- How to get rid of midges in an apartment at home

Who is entitled to

The list of beneficiaries who can receive free medicines or enjoy discounts is extensive. The state provides compensation for purchased medicines to the following citizens:

- disabled people and veterans of the Great Patriotic War;

- people injured while participating in various military conflicts;

- individuals involved in the elimination of man-made accidents and disasters associated with exposure to radioactive substances;

- repressed Russians;

- heroes of Russia and the USSR;

- citizens with disabilities of groups 1 and 2, including from childhood;

- individuals belonging to the category of regional beneficiaries entitled to reimbursement of funds spent on treatment;

- Russians suffering from serious illnesses (hemophilia, multiple sclerosis, diabetes mellitus, cystic fibrosis, Gaucher disease, other ailments for which free medications are provided).

Conditions of receipt

There are the following grounds for providing compensation:

- the presence of an illness for which you can issue a refund for medicines through the tax service or the Pension Fund of the Russian Federation;

- a prescription for the required drug from a doctor from a municipal clinic in the prescribed form, in two copies;

- availability of documents proving the pensioner’s right to receive free medications.

Procedure for refunding money for medicines

Refunds for medicines are allowed provided:

- The purchase of the medicine was carried out with one’s own money. Payment receipts confirming the applicant's expenses are available.

- A person bought drugs according to a prescription received from a doctor. The form indicates the medical indications for taking the pills.

- Injections, suspensions, etc. products, as well as services, are included in the unified register PP No. 201 and are subject to tax deduction.

- During the year, the individual had the status of an official worker and received a salary subject to personal income tax.

Amount amount

The return of income tax for medicines is classified as a social deduction in accordance with Article No. 219, paragraph 1, sub. No. 3 Tax Code of Russia. The volume of NV on this basis is no more than 120 thousand rubles. in 12 months

The applicant may be subject to the sale of medicines for the maximum amount, but the Federal Tax Service is authorized to return only a rate of 13%. That is, the citizen will receive 15 thousand 600 rubles.

Calculation example

In case of receipt of income within the reporting period below the limit of 120,000 rubles, the return of the deduction is carried out upon the fact of the withheld tax.

For example, O. S. Pavlyuchenko is classified as “diabetic”. In 2020, I received wages for 12 months - 98,000 rubles. I bought medicines in the amount of 120 thousand rubles. Accordingly, RUR 12,740 is subject to refund. (98000 x 13%).

Preparation of documentation for the tax authority

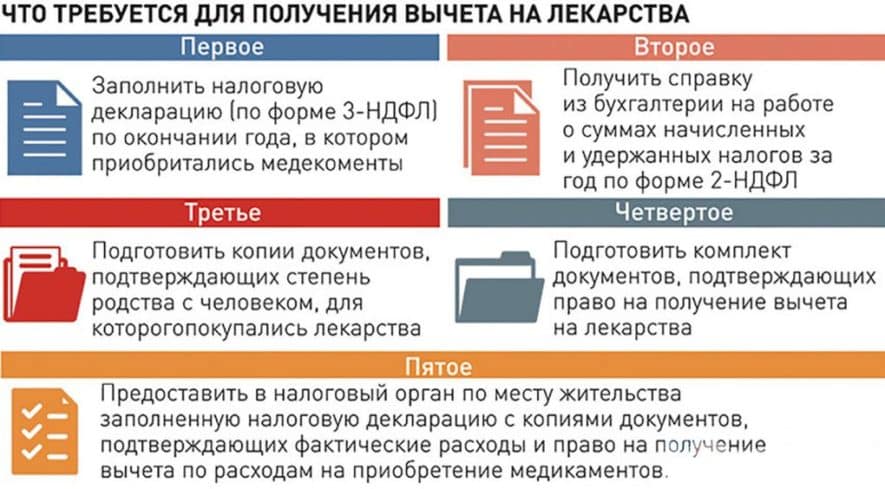

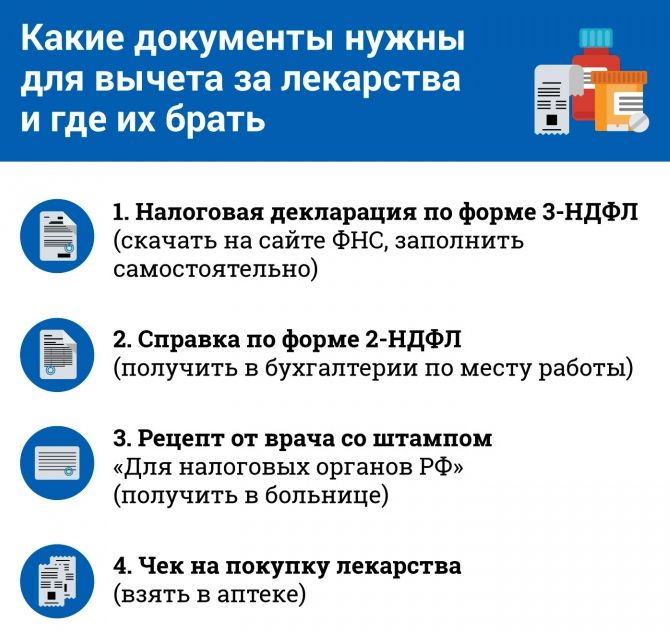

To submit an application for a tax deduction to the Federal Tax Service, a declaration in Form 3-NDFL must be submitted. Documents are additionally requested from the insurance company. Experts note that in a number of situations citizens encounter difficulties in registration. To avoid mistakes, it is recommended to contact department employees or paid consultants.

For tax deductions for medicines, there is a list of documents approved by the Tax Code of Russia:

- sales receipts;

- prescription forms;

- photocopy of medical books;

- a medical report from the attending doctor or hospital - drawn up on a special form indicating the diagnosis.

Declaration

To accept an application for consideration by the Federal Tax Service, a citizen must submit a declaration of income received in Form 3-NDFL.

Rules:

- The forms are provided at the tax department office at the individual’s residential address.

- You can use the State Services portal to fill out a declaration. Access is provided through a registered personal account.

- On the official web page of the Federal Tax Service there is software (online) that allows you to fill out the form correctly.

Note: when entering information into the declaration using the handwritten method, use a ballpoint pen with blue ink. Experts recommend using block letters.

Declaration information:

- The reporting period for which you need to receive a tax deduction. It is not allowed to issue an IC for the current 12 months, i.e. in 2020, the declaration is submitted for the years 18 and 17.

- Entering information about your place of work.

- In the column “Total amount of income” the wages from which income tax was deducted (13%) are recorded.

- An indication of the withheld rate (thirteen percent) - this point is important, because the Federal Tax Service needs to know the tax base.

Completing an application for a refund

The application can be drawn up on the day of application to the Federal Tax Service - if the necessary papers and information are available. The form can be obtained from the tax office.

As a rule, the document takes the form of a template in which you need to enter the following information:

- the amount of funds spent on the purchase of medicines;

- adding the phrase “Please make a deduction”;

- attach a completed declaration and papers indicating payment for medicines.

Return deadlines

After an individual submits a declaration, the Federal Tax Service Inspectorate initiates a desk audit. The duration of the procedure is a maximum of three months. In the case where an application was submitted to receive a deduction for purchased medications, then after consideration, the funds are transferred to the account within 30 days. In the situation of sending a declaration at the end of a desk audit and establishing preferences for social income, thirteen percent are transferred a month later.

Citizens of the Russian Federation have the right to use tax deductions in relation to official income. Refunds for medicines or paid medical services occur in the manner established by the legislator. Until 2020, NV was available only for medications approved in PP No. 201. In the current reporting period, the Government of the Russian Federation decided to lift restrictions. Therefore, any drugs are allowed to be deducted, including aspirin. The only condition is that the tablets must be prescribed by the attending doctor on a prescription form.

Watch the video: “13 percent return for medications and medical products On the protection of consumer rights” about returning items without a tag or box, but with a receipt, under warranty and without

Is it possible to return money spent on medicines?

Let's find out how to get a personal income tax deduction for purchased medications and what is needed for this.

– They said in the news that personal income tax can be reimbursed for medications purchased at the pharmacy. What documents must be provided to the tax office for a refund?

The Tax Code of the Russian Federation provides for five types of tax deductions:

- standard (prescribed to disabled people, veterans, families with minor children, etc.);

- social (for training, treatment);

- property (when selling or buying movable and immovable property);

- professional (provided to individual entrepreneurs with a general taxation system, people working under a civil contract, etc.);

- investment.

To receive a tax deduction, several conditions must be met:

1. you must be a tax resident of the Russian Federation (that is, you live in Russia for at least 183 days a year);

2. you must have income subject to personal income tax;

3. the services for which you want to issue a deduction were provided in the same year when the taxable income was (that is, if last year you were, for example, on maternity leave and paid for treatment during the same period, then you will be denied a tax deduction, since maternity leave is not subject to income tax);

4. Payment must be made at your own expense: when paying at the expense of charitable organizations, maternity capital, etc.

On this topic

How can I get my money back for treatment?

3998

your tax deduction will not be approved;

5. All expenses must have supporting documents.

Expenses for medicines are included in social tax deductions. Previously, it was possible to return part of the money for medications only if they were included in a special list approved by Resolution 201 of the Russian Government. However, on June 17, 2019, the President of Russia signed a bill amending the Tax Code. Now you can get a portion of the money spent back for all medications purchased as prescribed by a doctor.

Can I get a deduction for all purchased medications?

Despite the changes, there are still some conditions for obtaining a tax deduction for medicines.

Firstly, as a general rule, you must have documents confirming payment - checks. Secondly, the prescription of a medicine by a doctor must be confirmed by a written prescription.

.

At the same time, there is a special procedure for prescribing medications and receiving a tax deduction for them. It was approved by order of the Ministry of Health No. 289. So, the doctor must write you two prescriptions

according to form No. 107-1/u: one for the pharmacy, the second for the tax office.

Note:

The order of the Ministry of Health mentions form No. 107/u, but it has lost force, and now a new form of the prescription form has been approved - No. 107-1/u.

The prescription intended for the tax office is stamped “For the tax authorities of the Russian Federation, Taxpayer INN.” The form must bear the doctor’s signature, his personal seal and the seal of the institution.

Who can get a tax deduction for medicines?

All payment documents must be issued in the name of the person who will issue the tax deduction. The only exception here is spouses, since their expenses and income are considered common. That is, for example, if the wife paid for the medicines, then the husband can apply for a deduction.

On this topic

How to return part of the money for a purchased apartment?

4409

In addition, you can apply for a tax deduction if you bought medicines not only for yourself, but also for close relatives: spouse, minor children or parents.

How much money can you get back through a tax deduction?

The social deduction has a limitation: you can return 13% of the amount spent from a maximum of 120 thousand rubles per calendar year. That is, the maximum refund amount is 15,600 rubles. You cannot transfer the “balance” of the deduction to another year.

Let's do the math with an example. Let's say you receive a salary of 25,000 rubles per month. In a year you will earn 300,000 rubles.

You will pay 13% to the state in the form of personal income tax:

300,000 x 0.13 = 39,000 rubles.

This year you bought medicines for a total amount of 10,000 rubles. When applying for a deduction, the tax office will recalculate your personal income tax and subtract this amount from your income for the year:

(300,000 - 10,000) x 0.13 = 37,700 rubles.

That's how much you should have paid in taxes, not 39 thousand. This overpayment will be returned to you:

39,000 - 37,700 = 1,300 rubles.

You can receive this money either through your employer (in this case, income taxes will simply not be deducted from you until the full amount of the deduction is returned), or through the tax office, by submitting the documents yourself.

Please note that you can apply for a tax deduction next year after paying for medications, that is, in 2019 - for drugs paid for in 2020. You can also apply for a tax deduction for the three previous years at once: in 2020, you can return money for 2020, 2020 and 2020 at once. Of course, if you have all the necessary documents.

What documents will be needed?

1. Prescription forms in the prescribed form (see above).

2. Documents confirming payment for medicines (checks, cash receipts, payment orders, etc.).

3. Certificate of income in form 2-NDFL (you will need it to fill out the declaration, you do not need to attach it separately to the package of documents).

4. Declaration 3-NDFL (if you are filing a tax deduction for three years at once, then the declaration must be completed separately for each year).

5. A certificate confirming your right to receive social deductions (if you receive a deduction through your employer. In this case, you do not need to fill out a declaration in Form 3-NDFL).

6. Statement.

7. Details of the account to which the deduction will be transferred (if received through the tax office).

Briefly about the main thing:

1. Expenses for medicines are considered social tax deductions. You can return part of these funds only if prescriptions for the drugs were written out in the prescribed form and you have kept all the receipts.

2. Payment documents must be issued in the name of the person who will apply for the deduction. The only exception here is spouses.

3. You can apply for a deduction if you bought medicines for yourself, your spouse, minor children or parents.

4. The maximum refund amount is 15,600 rubles per year for everything

social deductions.

5. You can apply for the deduction in the next calendar year. You can also apply for a deduction for the previous three years.

If you have questions that concern you, write to us and we will try to answer them. you can here.

Photo: deseretnews.com

On this topic

5074

How to get a tax deduction for kindergarten?