How to return 13 percent for medical services? This question most often worries those citizens who are already familiar with the legal opportunity to bypass taxes. In fact, the procedure is very simple, much easier than the procedure for obtaining a property deduction, which is issued when buying or selling real estate.

You just need to collect the required documents, especially the agreement on the provision of paid medical services, receipts and certificates 2-NDFL and 3-NDFL. These papers must be sent to the Federal Tax Service office at the applicant’s place of residence. Then, after 3-4 months of consideration, the money, in case of a positive decision, is sent to the citizen using the details specified in the application. But the procedure has other nuances - read about it in this article.

What is a tax deduction for treatment

A tax deduction for treatment is understood as a part of income that is not taxed and is calculated as a percentage for a citizen’s expenses on paid medical services and medicines. Citizens of the Russian Federation who receive an official salary, from which the employer pays a monthly tax to the state treasury, have the right to this. The medical institution that referred for procedures or issued documents must have a state license.

Where to go

Many citizens do not know where to return 13 percent for treatment. The answer here is extremely simple - in the same place where other tax deductions are processed. We are talking about tax authorities located in your city.

More specifically, you will need to contact the tax service of your area. Where you are registered. Sometimes you can bring documents to the relevant government authority at your actual place of residence. But it is best to contact the tax office by registration. This will save you from most problems and questions. How to return 13 percent for dental treatment and other medical care? What can be useful in this matter?

Tax deduction amount

The amount of tax deduction is formed for one year and is calculated as follows:

- You can only return the amount or part of it that was transferred to income tax.

- No more than 13% of the amount spent on treatment is returned. If we take into account that the maximum amount of social deductions is 120,000 rubles, then the calculation of 13% will be equal to 15,600 rubles.

- According to Decree of the Government of the Russian Federation dated March 19, 2001 N 201, there is a list of expensive services for which the limit of 15,600 rubles does not apply. A citizen who has received such treatment, or if his close relatives have received expensive treatment, has the opportunity to return 13% of their total cost.

Income

Do they refund 13 percent for dental treatment? Yes, such a possibility exists. But only, as already mentioned, for citizens who have income subject to income tax. These are the rules that currently apply in the Russian Federation.

The next point to consider is proof of your income. Here the tax authorities are provided with a work book, as well as a special certificate. This is the so-called form 2-NDFL. It is taken from your employer in the accounting department. And it is proof of taxable income.

By the way, the certificate must be presented in a single copy, and only in the original. No photocopies! Otherwise, you have every right to refuse to provide a deduction.

What expenses are reimbursed by the state?

Russian legislation provides a complete list of medicines and medical services for which a law-abiding taxpayer has the opportunity to receive compensation.

A tax deduction is calculated if a citizen:

- called an ambulance;

- received outpatient treatment;

- was treated in hospital;

- received health treatments in a sanatorium;

- applied for a medical examination;

- treated or prosthetic teeth using dental services that are not included in compulsory medical insurance services;

- was treated in a private medical institution.

A complete list of services and medications is contained in Decree of the Government of the Russian Federation No. 201 of March 19, 2001.

This is important to know: Is it possible to challenge a deed of gift for an apartment?

Package of documents

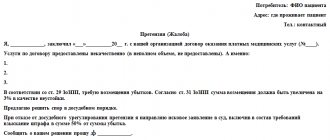

Before you start writing your application, you should collect a complete package of documents:

- You need to obtain the originals of two declarations from the employer - 3 and 2 personal income tax.

- At the clinic, you should take the original receipt of payment that was made for the services, as well as the original license under which medical activities are carried out in this clinic.

- The patient may be required to provide a copy of their passport signed “Copy is correct” and signed, as well as a copy of their Taxpayer Identification Number (TIN). If the application is submitted to return funds for the care of a child or other relative, they may be asked to provide a birth certificate, marriage certificate, etc.

Guide to receiving a deduction

In order to obtain a refund of part of the money spent on treatment, you need to collect a package of certain documents, submit it to the Federal Tax Service and wait for a positive response. From all this it becomes clear that the whole procedure is not a matter of one day.

But since 2020, this procedure has been simplified by law. Now the citizen can only collect all the necessary papers and transfer them to the employer, who pays taxes for the employees to the state treasury. He himself recalculates the final amount of wages in favor of the citizen on a monthly basis until the entire amount is paid.

Declaration of 13 percent refund for treatment

All the information that is needed to fill out the declaration form is contained in the documents prepared for submission to the Federal Tax Service. The State Tax Service has simplified this process as much as possible by posting a special program on the official website for all taxpayers in order to calculate the amount of tax. The user can only enter information in the empty fields.

It is important to note that the form must meet certain requirements. Namely: printed smoothly and without printing defects on a white sheet of A 4 paper.

Typos and errors in the prepared document may cause a refusal and, therefore, delay the time of receipt of funds. In addition, the tax authorities may perceive some information written with errors as knowingly false and impose penalties on the applicant.

We submit the collected papers for verification

There are two ways to transfer documents to the Federal Tax Service:

Method one:

Come to the tax office and personally hand over all documents to the tax inspector, who is considered responsible for the citizen’s affairs. The employee will immediately check the documents for errors, and if there are any, he will definitely point them out and recommend ways to correct them. The disadvantage of this method is that it takes a lot of time, which every working person values. And the plus is that all errors are immediately checked by a specialist.

Method two:

Send the package of papers by mail in the form of a valuable letter with a completed inventory and notification of receipt. In this situation, it is recommended that the inventory be drawn up in two copies so that one remains in the applicant’s hands. This is done in case the letter is lost during delivery by the postal service.

The disadvantage of this method is that if an error is made when filling out the documents, a notification about this will come along with a response after a desk check. And this is approximately 2-3 months. A plus can be considered the small amount of time for submitting papers, which only takes to get to the post office.

This is important to know: Write a complaint to the Department of Education

We are waiting for the verdict of the tax service

After the application with all the documents attached to it has been received from the citizen by the tax service for processing, specialists carry out a desk audit on them. Upon completion of this inspection, the applicant receives a written notification within 10 days. This document contains the final results.

If the answer is negative, the letter will necessarily indicate the reasons and legal grounds for the refusal. During the inspection, service specialists may have questions for the applicant that require immediate appearance and clarification.

Once the verification process is completed, the applicant will need to wait another month. It is during this period that funds are credited to the taxpayer's savings account.

Examples of personal income tax returns

Refunds for treatment can be made on a general basis, that is, based on a maximum amount of 120,000 rubles, or for the provision of expensive services, when the tax refund is based on the total amount for services. The list of services that are classified as expensive is regulated by tax legislation. It can be :

- surgical treatment of congenital anomalies;

- organ transplantation;

- ECO;

- treatment of hereditary diseases, etc.

The full list can be found on the official website of the Federal Tax Service.

The certificate issued by a medical institution must indicate a code that determines the category of service. Code 1 refers to low-cost services and code 2 refers to high-cost services.

Tax refund for dental prosthetics

There may be some controversy regarding the issue of dental prosthetics. This service is often greatly needed by people of retirement age. The Ministry of Health considers this service as expensive and includes it in the appropriate list. At the same time, the state tax service has a different opinion on this matter and does not include dental prosthetics in its list of expensive services, even despite the code indicated in the certificate issued by the dentist.

For example:

Citizen Sorokin S.A. I went to the dentist with a prosthetic problem and ended up paying 190,000 rubles. The management of the clinic indicated code 2 in the certificate issued to the citizen. Sorokin S.A., being a non-working pensioner, cannot claim a tax deduction himself. But his son, being a working, law-abiding taxpayer who paid for these services, can apply for a deduction. According to the coding specified in the certificate, the service is expensive, so the pensioner’s son applied for an appropriate deduction from the Federal Tax Service. The amount, according to his calculations, was 24,700 rubles. But the tax service refused the request and agreed only to a social deduction in the amount of 15,600 rubles.

Tax refund for sanatorium treatment

If treatment is carried out in a sanatorium, then only medical procedures and costs of medications can be taken into account. All other expenses, such as accommodation, food, travel, etc. cannot be taken into account.

Confirmation of payment can be a voucher from a travel agency that has a license to carry out this activity.

For example:

The daughter of a pensioner T.I. Gushchina I bought a ticket to the sanatorium. The mother is a non-working pensioner. The amount that the daughter paid for the trip was 50,000 rubles for 10 days. During the examination, an elderly woman was diagnosed with a disease that required urgent treatment. The doctor prescribed a medicine, the cost of one package was 700 rubles. Having submitted to the tax application a certificate from the sanatorium indicating the amount of services and medicines of 20,000 rubles, a prescription from a doctor and a copy of the license, the daughter issued a deduction in the amount of 2,600 rubles. The Federal Tax Service approved this request, despite the fact that the receipt for payment for the drugs was lost.

This is important to know: Fine for tinting 2020 new law

Tax refund for the purchase of medicines

If a non-working pensioner has the right to a tax refund on his own or through his children, he can apply for a tax refund for expenses on medicines if they are included in the list specified by law. You just need to present a receipt and a prescription from your doctor.

For example:

Lonely pensioner Denisov Yu.L. Every month he spends 4,500 rubles on medicines. Of these, the prices for medicines that are included in the list amount to 4,200 rubles. It turns out that 54,000 rubles are spent per year. This is a large amount for a pensioner. In this case, he has the right to a refund of part of the money spent, since he rents out a room in a dorm for 8,000 rubles, and he lives in an apartment. His annual tax is 12,480 rubles. This means that the amount of the annual deduction will be 6552 rubles.