Fill out an application and receive a response from the bank in just 5 minutes →

Fill out an application and receive a response from the bank in just 5 minutes →

Early repayment of a loan is the deposit of funds into the bank against the loan debt ahead of the existing monthly payment schedule. It can be either partial or complete. In the first case, not the entire amount is paid, but only a part of it. In the second case, the loan is repaid in full.

What does the law say?

This procedure is the right of any borrower, enshrined in law. The law providing for early payment of loans was introduced into force in October 2011.

Current loan offers:

| Bank | % and amount | Application |

| Eastern has more chances | From 9% to RUB 3,000,000. | Apply now |

| VTB Reliable | From 7.5% Up to 5,000,000 rub. | Apply now |

| Post Bank Solution in 1 minute | From 7.9% Up to RUB 3,000,000. | Apply now |

| Alfa Bank Solution in 2 minutes | From 7.7% Up to 5,000,000 rub. | Apply now |

| Opening Large amount | From 8.5% Up to 5,000,000 rub. | Apply now |

List of microfinance organizations issuing small first loans at 0% →

You can always see all the banks we work with here ⇒

Loan without refusal Loan with overdue Urgent on your passport Card loans at 0% Installment cards Earning money from home

Previously, the ability to repay before the end of the contract term depended on the loan agreement. Most often, additional fines and penalties were imposed, which were canceled by the law on early repayment. Read more about the right to early repayment, which every consumer of banking products has in this article.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

To repay the loan faster, you must notify the bank at least 30 days before the desired date. If the client does not indicate his intention, the bank will continue to write off payment amounts as before, and when there is not enough money in the account, fines and penalties will apply. This may negatively affect the client’s credit history; more about this here.

Later in this article:

Is it possible to return overpaid loan interest to your account if you repay it early?

Fill out an application and receive a response from the bank in just 5 minutes →

Fill out an application and receive a response from the bank in just 5 minutes →

In Russia, among the loans issued, the annuity payment system . With this payment method, all monthly amounts are equal parts. But few people think about what each monthly payment consists of.

It is the sum of two quantities: the interest part and the loan itself. With an annuity, this amount is compiled in such a way that in the first months of payments, most of the payments are interest, and, accordingly, the debt to the bank itself is smaller. Banks receive interest in advance on the loan issued.

So it turns out that if the debt is repaid early, the bank can unreasonably appropriate part of the client’s funds from the advance payments.

Current loan offers:

| Bank | % and amount | Application |

| Eastern has more chances | From 9% to RUB 3,000,000. | Apply now |

| VTB Reliable | From 7.5% Up to 5,000,000 rub. | Apply now |

| Post Bank Solution in 1 minute | From 7.9% Up to RUB 3,000,000. | Apply now |

| Alfa Bank Solution in 2 minutes | From 7.7% Up to 5,000,000 rub. | Apply now |

| Opening Large amount | From 8.5% Up to 5,000,000 rub. | Apply now |

List of microfinance organizations issuing small first loans at 0% →

You can always see all the banks we work with here ⇒

Loan without refusal Loan with overdue Urgent on your passport Card loans at 0% Installment cards Earning money from home

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

The annuity payment scheme is designed for a conscientious payer who will not delay payments and will not repay the loan ahead of schedule.

In case of early repayment, recalculation must be made. It may turn out that you paid the bank too much. After all, in fact, the client must pay the bank interest only for the period from the start of the loan until its full repayment. We talk about the specifics of repaying the contract before the deadline specified in the contract at this link.

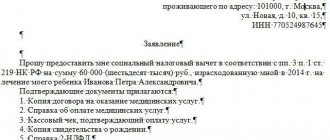

You can calculate the excess interest paid using the following scheme. For example, you took out a loan for a period of one year and repaid it in six months. Then you can calculate using the following formula how much you must pay the bank for the actual use of borrowed funds:

Interest accrued under the agreement/Loan term*Actual term = Interest payable.

From here, knowing the amount of interest actually paid, you can calculate how much extra interest you paid to the bank using the formula:

Interest actually paid - Interest payable = Interest overpaid.

In this way, you can calculate the amount that you can demand from the bank if you repay the debt ahead of schedule. Since, according to the law on early repayment, the client is obliged to pay the bank only interest for the actual use of the loan.

In case of early repayment, the bank itself usually recalculates the loan. But you can check their recalculations using any online calculator available on the Internet. You can also calculate the loan yourself using a specific formula, details at this link.

In any case, the courts will be on the side of the consumer and will oblige the bank to pay the client the amount that he overpaid.

More information on how best to act if you want to close the contract ahead of schedule is provided in this article.

You can get a cash loan right now, just select a bank:

| Up to 3 million rubles. From 9.9% Up to 5 years | Up to 5 million rubles. From 9.9% Up to 5 years | Up to 5 million rubles. From 9.9% Up to 5 years | Up to 5 million rubles. From 11.9% Up to 5 years |

Can early repayment be refused?

But it should be taken into account that there is such a thing as a moratorium on early repayment of a loan. A moratorium is a period during which the client cannot exercise the right.

This period is specified in the loan agreement. If you plan to exercise this right, be sure to study it before signing the contract for the presence of a moratorium clause.

There is also such a thing as a minimum amount for early repayment of debt. It is also indicated in the loan agreement. Both the moratorium and the minimum amount exist to ensure that banks do not lose their profits. After all, according to the law, the client pays the bank only the interest that accrues on the remaining amount of the debt.

Thus, the sooner you repay the loan, the less you will overpay in interest. How the minimum contribution is determined. read here.

Full early repayment

If the loan is repaid early, the interest is recalculated by the bank. But you can check their recalculations using any online calculator available on the Internet. You can also calculate the loan yourself using a specific formula, details in this article.

| CALCULATE LOAN: | |

| Interest rate per year: | |

| Duration (months): | |

| Amount of credit: | |

| Monthly payment: | |

| Total you will pay: | |

| Overpayment on loan | |

You can use our advanced calculator with the ability to build a payment schedule and calculate early repayment on this page.

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

In case of full repayment, you need to find out in advance the remaining amount of the debt from the bank with recalculation for the desired repayment date. At this link we talk about what ways there are to find out your loan debt. Most often, this is a personal application to a bank branch; if this is not possible, you need to call the hotline.

You can get a cash loan right now, just select a bank:

Let us clarify once again that you need to find out the amount of debt and repay it every day. The reason is simple - interest can be accrued daily on the loan amount, which means that the data you received today may turn out to be unreliable information tomorrow.

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

As soon as the amount is in your account, immediately contact the bank branch to close the loan and receive a certificate of no debt. We recommend storing this document for at least 3 years.

Partial early repayment

In case of partial repayment, your monthly payment schedule must be recalculated. Depending on what is stated in the loan agreement, you may have the following options:

- reduction of payment, without changing the time of payment;

- reduction of payment time, without changing the size of the monthly payment;

- one of the options above to choose from.

As a rule, banks themselves decide which of the options they can offer you, very rarely when it is left to the choice of the borrower. For example, Sberbank only allows you to reduce the monthly payment without reducing the loan term.

Of course, it is more profitable to shorten the period for making payments, and not their size. If your bank does not provide you with this option, you should consider switching to another company for refinancing. You will get more information on how to make partial early loan repayments from this article.

Question-answer section:

2018-09-21 13:59

Alla

I took out a loan for a year, and in the third month we paid off the loan in full ahead of schedule. I took goods for 12,500, monthly payment was 1,450 rubles, in the third month I paid 12,800 (this amount was announced to me by the operator in order to completely close the loan), can I return the money for unused%? They also sold me the insurance, can I get it back too?

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Alla, they told you the amount with the interest already recalculated. And regarding insurance, you need to look in the contract - if it states the possibility of return in case of early repayment of the debt, then of course you can return it

2019-05-09 04:14

Vadim

Hello, please advise. A year ago I took out a loan from a bank for 5 years, today I repaid it in full, and they wrote off more from me than the amount that I had to repay, well, in the sense of the balance of the loan at the moment... Question: in case of early repayment, the bank has an unused interest right to hold?

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Vadim, if you repay a loan early, the bank must recalculate the amount of the debt; you cannot charge interest for the time that you did not use its money. Go to the bank, demand an explanation from management, if the recalculation is not done, go to court

2019-05-02 15:34

Alexander

Good afternoon We want to take out a car loan, and we are wondering: will the interest be recalculated if the loan is repaid early? Thank you

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Alexander, everywhere with early repayment there is a recalculation of interest. The main thing is to notify the bank in advance that you are going to make a payment greater than the amount agreed upon in the agreement

2019-02-27 09:35

Irina

Good afternoon The bank's settlement period is from the 21st to the 20th of the next month. In case of early repayment, for example, on the 26th, the bank charges interest for the full month. Are they doing the right thing?

View answer

Hide answer

Consultant for the site KreditorPro.Ru

Irina, no. Interest can only be charged for the actual time of use of the loan funds. If you are denied the correct calculation, first contact the bank branch management; if that doesn’t help, contact a lawyer or go to court.

View all questions and answers ⇒

| Up to 3 million rubles. From 9.9% Up to 5 years | Up to 5 million rubles. From 9.9% Up to 5 years | Up to 5 million rubles. From 9.9% Up to 5 years | Up to 5 million rubles. From 11.9% Up to 5 years |

04/06/2018 Information about the authors | Category: Loans

How is the overpayment formed?

It’s easy to figure out how to return overpaid interest when repaying a loan early. To do this, it is worth understanding the principles of calculation for annuity. The algorithm of actions is as follows:

- The debt is charged the rate specified in the agreement between the parties.

- Interest charges are added to the amount of debt.

- The resulting amount of funds is divided by the number of months (indicated in the contract).

- The borrower pays the same amount every month.

- A one-time payment consists of two elements - debt and interest charges. To equalize the amount of payments, the borrower pays off the minimum amount of debt in the first months, and the majority of the debt is taken up by interest payments.

If the loan recipient pays the money ahead of schedule, the amount of the overpayment is determined and part of the money already paid earlier is returned. Overpaid interest is calculated in two ways - using a special program or manually.