"AlfaStrakhovanie" - which policies cannot be returned?

A banking organization, on the basis of Federal Law No. 353-FZ, has the right to offer the borrower a number of services to insure credit obligations when applying for a loan, but does not have the right to oblige the borrower to agree to additional conditions.

The legislation provides for a strictly defined list of loans for which credit insurance is mandatory, these include:

- Insurance against loss of property rights (title) to housing when purchasing real estate on the secondary market. The period of compulsory insurance is limited to three years, since according to the provisions of the Civil Code of the Russian Federation, after this time the limitation period expires.

- Car loans, a prerequisite for which is the issuance of a compulsory motor liability insurance (CASCO) policy. Without consent to insurance, the borrower is guaranteed to receive a refusal.

In other cases, the issuance of an insurance policy in accordance with current legislation is voluntary and cannot be forcibly imposed on the borrower without the right to refuse such services.

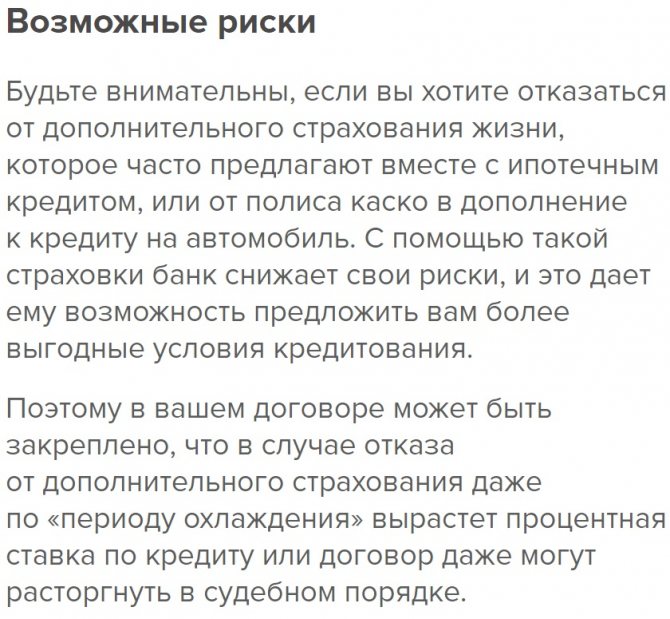

Taking out a policy is necessary for banking organizations, since it guarantees the return of borrowed funds in the event of disability or death of the borrower, therefore lenders often offer clients improved conditions:

- A reduced interest rate, which can be significantly lower than the standard rate by 2-2.5% depending on the type, size and term of the loan;

- Preferential conditions for obtaining a loan, which involve calculating the interest rate based on the amount of the actual debt, and not the total size of the loan, which allows you to reduce the rate for the entire term of debt obligations by 1.5-2 times;

- A longer lending period, which allows you to reduce monthly payments on obligations and other more favorable conditions.

The AlfaStrakhovanie group combines several divisions of the company engaged in different types of insurance activities, including AlfaStrakhovanie-Life LLC and AlfaStrakhovanie JSC.

Conditions for returning loan insurance to AlfaStrakhovanie

The main condition for the return of 100% of the insurance premium is to notify the insurance agent within the period established by law for terminating the agreement. The insurer, on its own initiative, has the right to increase the period for canceling the agreement.

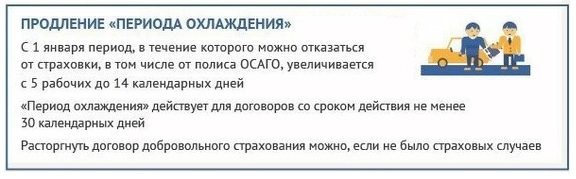

According to the Directive of the Central Bank No. 4500-U dated August 21, 2020, amendments were made to the Directive of the Central Bank No. 3854-U dated November 20, 2020 to increase the period of the “cooling period”. The minimum period for requesting cancellation of the agreement is two weeks (14 calendar days).

This grace period applies to most types of insurance, with the exception of:

- purchased for travel outside the country (to cover medical expenses if necessary);

- Green Card policy, for which separate cancellation rules are established (specified in the concluded agreement);

- required to carry out a specific professional activity (for example, notaries, auditors, etc. will not be allowed to work without an insurance contract);

- absence of Russian citizenship when a health insurance agreement is drawn up, if it was concluded to obtain a patent or for employment.

Receiving a loan is not included in the specified list of exceptions, so the return of insurance is possible and legal.

The deadline for applying for a refund of the insurance payment paid by a citizen under the AlfaStrakhovanie program is also two weeks or 10 working days. An increase in the deadline for filing an application is not provided, unless otherwise reflected in the contract or other acts of the insurance company.

As a rule, a standard contract for the provision of services is concluded between a citizen and IC AlfaStrakhovanie, therefore an increase in the cooling-off period is not provided for.

To return the insurance premium paid in accordance with the agreement with the company, the borrower must simultaneously comply with two conditions:

- Contact the insurer with a request to terminate the agreement within a period not exceeding two weeks from the date of actual payment for its services.

- To prevent the occurrence of an insurance situation in which the insurer is obliged, on the basis of a concluded agreement, to make payments in favor of the insured person.

Any signs of an insured event recorded by the insurance organization, as well as the omission of the legally established deadlines for filing an application for cancellation of a previously concluded agreement, are grounds for the insurer’s refusal to return the premium received.

How to opt out of loan insurance

The Client reserves the right not to agree to such an agreement. This is an additional service that is not regulated by the Central Bank as mandatory. But the lender may well refuse to provide a loan without fulfilling this condition. Well, the practice is widespread, so further we will talk about the situation when insurance was imposed and the loan is already in hand.

The main thing you need to know is that you can fully return your contribution only within the first 14 days from the date of receiving the loan. This period is also symbolically called the “cooling period.” Afterwards, it will be either problematic or completely impossible.

Basic conditions for the return of AlfaStrakhovanie-Life insurance

The biggest problem of our citizens is ignorance of their rights. They are prescribed in the Civil Code of the Russian Federation. Looking there, it turns out that Article 958, Part 3 says: “You can return the insurance premium in an amount proportionate to the number of unused days, based on the agreement between the two parties.”

But, if we additionally take into account clause 7.4 of the same article, the insurer reserves the right not to give the premium after the expiration of 14 days. The same can be seen in Central Bank Decree No. 3854-U.

Bottom line! You can write a refusal immediately after concluding a loan agreement or during the “cooling off period”. How to do this is below.

“AlfaStrakhovanie-Life” – return of insurance during the “cooling off period”

Agreements between individuals and AlfaStrakhovanie-Life LLC come into force from 00:00 on the day of payment of insurance obligations.

The deadlines for cancellation of agreements between the policyholder and the insurance company apply to the following insurances:

- Life (health), regardless of the reason for concluding the agreement - processing a loan or the personal desire of a citizen with periodic insurance payments;

- Movable property – car;

- Real estate and property with declared value, for example, objects of art;

- Liability of owners of movable property in case of an accident;

- Liability of the insured for causing any harm to other persons or their property;

- Medical insurance, etc.

Despite the legislative establishment of a voluntary registration procedure, most banking institutions force their clients to sign an agreement with insurance companies.

To waive insurance and receive your funds, you just need to contact the bank where the loan was issued (Alfa-Bank) and submit an application for waiving insurance.

If the creditor is another financial organization, the application for refusal should be sent directly to.

Refunds must be made no later than 10 business days from the date of the client’s request or receipt of a written application.

Bank account details for transferring funds are indicated when filling out the application. This period includes the acceptance of an application for refusal of insurance, its consideration and the transfer of funds (if a positive decision on the application is made).

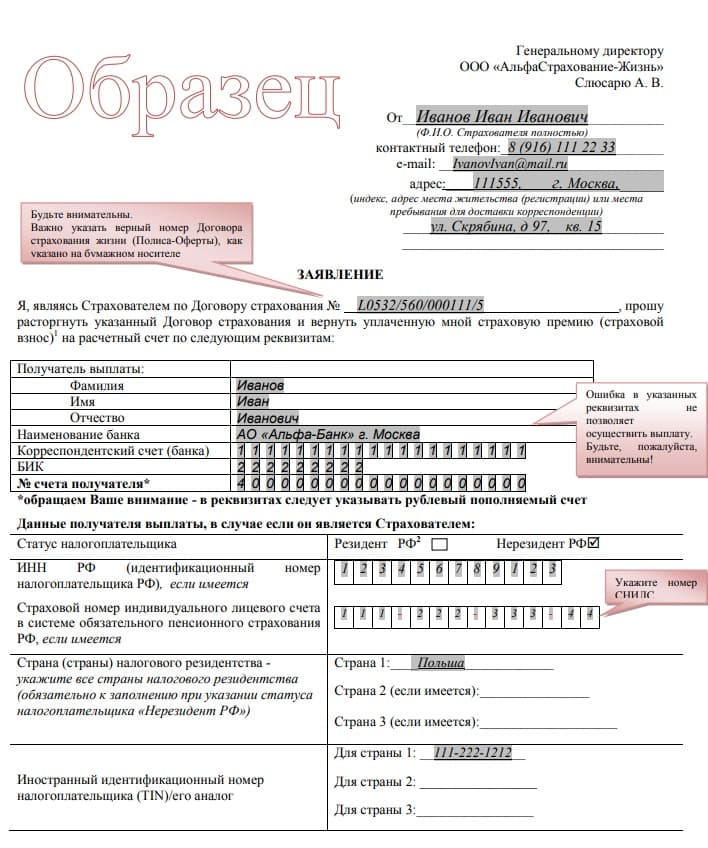

Application form for refusal to “AlfaStrakhovanie Life”

The first thing you need to do is write a refusal from AlfaStrakhovanie Life insurance. You can submit your application in writing or online.

Written statement

The application must be filled out by hand on a special form. Along with the sample, you can take it from the bank or download it from the insurer’s website. Here you need to fill in the fields:

- insurance contract number;

- payment amounts;

- dates when funds were deposited;

- details of the account to which the payment was made;

- below indicate the date when the application was drawn up (required, in case the addressee receives it after the “cooling period”) and signature.

In this case, you need to immediately provide the following documents:

- a copy of the contract for the insurance period (you need to collect all the pages. They are often scattered across several parts of the loan documentation);

- client's transfer order - a document that the bank issues as confirmation of payment of the fee. If you don’t have it on hand, you need to request it at the branch where the loan was issued;

- your details where the funds will be transferred.

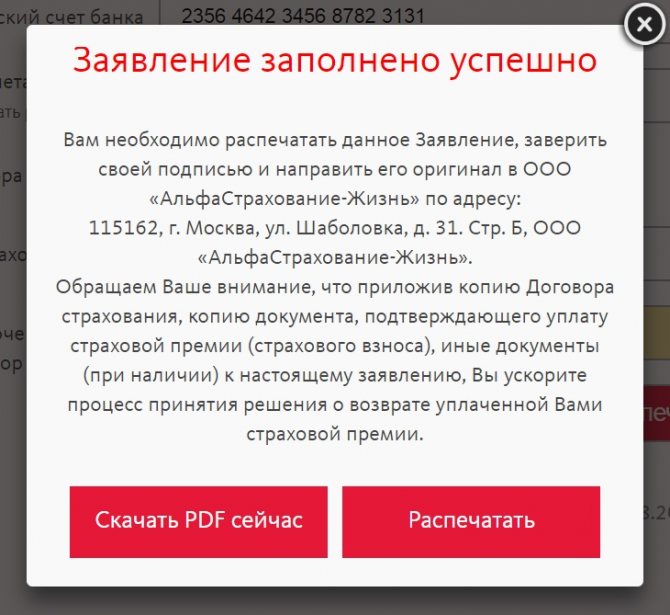

All this is carefully placed in an envelope and sent to the address: 115162, Moscow, st. Shabolovka, 31, building B, AlfaStrakhovanie-Life LLC.

Online application

The online application provides exactly the same information. Website where you can submit a petition: https://aslife.ru/client/ask/rejection/. When filling out, do not forget to select the type of contract for “Credit insurance”.

How to return loan insurance from Alfa Bank?

Submitting an application to AlfaStrakhovanie for a refund of loan insurance

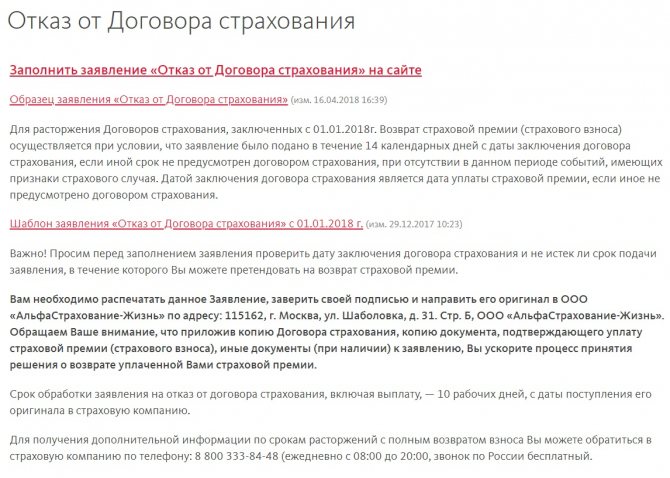

An application for termination of a previously concluded agreement with IC AlfaStrakhovanie is possible during a “cooling off period”, which is 14 calendar days from the date of payment of the insurance premium by an individual.

AlfaStrakhovanie does not provide for an extended cooling-off period, so the policyholder cannot count on a longer period of reflection and decision-making regarding cancellation or retention of insurance.

There are several ways to express your desire to terminate the insurance agreement:

- In a written form. This type of application is carried out through a personal visit to the institution by the policyholder or by sending documents using the postal service.

- In electronic form on the AlfaStrakhovanie website or by sending an application by e-mail.

There are no other ways to notify the insurance company of termination of the contract at the initiative of the policyholder. A sample application is provided by the insurer on the official website or in person.

Written statement

The application for refusal of the insurer's services must be filled out in accordance with the sample presented on the AlfaStrakhovanie IC website and sent to the company's address for receiving correspondence: 115162, Moscow, st. Shabolovka, house 31, building B.

The completed application form can be printed and filled out manually ( drive.google.com/file ) or filled out all the necessary data on the AlfaStrakhovanie website[/anchor] and printed. AlfaStrakhovanie JSC leaves the choice of the type of application for termination of the contract to the policyholder.

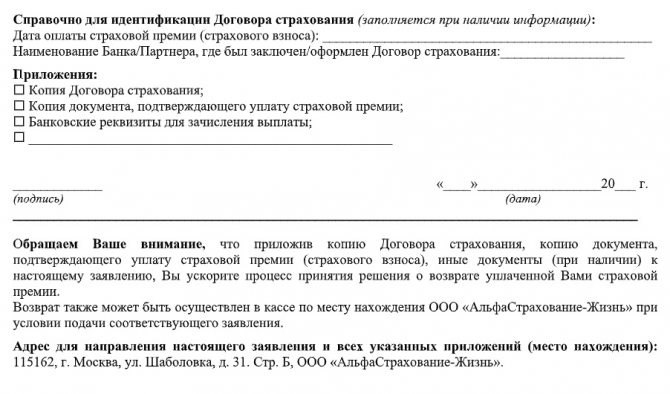

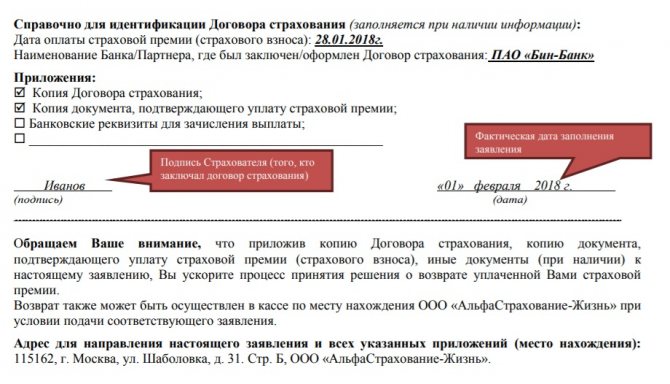

In the document sent to AlfaStrakhovanie for insurance refund, you must indicate:

- personal information about the applicant: full name, passport data (series, number, when and by whom it was issued), address, contact information (telephone number and email address);

- date of conclusion of the contract;

- the fact of familiarization with the conditions of early cancellation of insurance;

- details for sending funds in full (full full name of the recipient, current and correspondent account numbers, bank name and BIC);

- date and signature of the applicant.

Filling it out shouldn't be too difficult. But still, if they occur, a sample ( aslife.ru/shablon_zayavleniya_otkaz ) to help:

After printing out the application or using the usual form, the policyholder can contact AlfaStrakhovanie with a request to terminate the insurance policy when visiting the institution in person, as well as when sending documents through the postal service.

To provide documents in person, the applicant must come to the office of the insurance company and register an application. After registration, the citizen must be given a document confirming the acceptance of the application for consideration.

Note! A third party can also submit an application, but he will need a power of attorney from the policyholder, certified by a notary.

If sending documents by mail, you must:

- Compose an application according to the template presented on the company’s website;

- Attach the necessary documents to the application, which include: a copy of the contract and a copy of the receipt for payment of the insurance premium;

- Send by registered mail at Russian Post with a stamp indicating the date of acceptance of the letter for forwarding; the average delivery time for correspondence varies from 3 to 7 days;

- Wait for the documents to be delivered to AlfaStrakhovanie’s address and receive a response that the application has been accepted for consideration.

Often the insurance company refuses to confirm the fact of the client’s application. Therefore, sending by registered mail will be the most reliable method of filing an application for waiver of insurance.

IC "AlfaStrakhovanie" must transfer funds to the policyholder's account within 10 days from the date of receipt of the application for consideration, however, the agreement is considered terminated from the moment the documents on its cancellation are sent.

Online application

The easiest way to return loan insurance to IC AlfaStrakhovanie is to fill out an application form on the company’s website. Unfortunately, it will not be possible to send a request through your personal account for consideration, since the insurer needs the original documents.

To fill out an application online, you need to log in to the insurer’s website, then select the “Cancellation of insurance” section.

After this, the policyholder must go to the “ Ask a Question ” and only after that select the “Cancellation of the Insurance Agreement” ( aslife.ru/otkaz-ot-dogovora ) in the right corner of the screen.

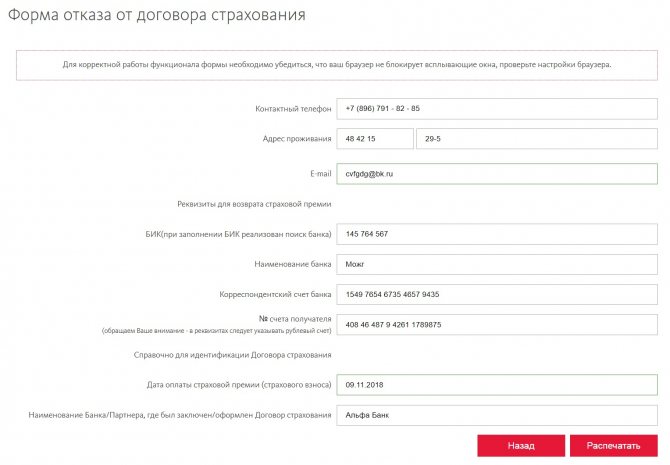

To fill out the application, do the following:

- follow the link: aslife.ru/forma-otkaza-ot-dogovora-strakhovaniya;

- fill in all empty fields.

On the presented page there is a standard application for refusal of insurance, as well as a sample of its completion, the following information is indicated there:

- Personal data of the policyholder – full name, date of birth, contact phone number;

- The contract number is indicated in a separate paragraph, and it is important to take into account the rules for filling it out if there are CCC or GVA codes; the possibility of considering the application depends on this;

- The citizen’s residential address, which was indicated when applying for insurance;

- Email address for sending a response to the request;

- Details for transferring funds from the insurer’s account to the applicant’s account;

- Date of payment of the insurance premium or actual commencement of the insurance agreement;

- The name of the banking institution that issued the loan.

After filling out all the fields, click “Print” or “Download PDF now.” You can view information about which address to send papers about termination of the agreement. You cannot send an application from your personal account.

Ready! As a result, you do not need to fill out the application yourself - the system itself generated the completed form.

Another way to send documents is to contact the policyholder directly by e-mail - However, you cannot send the initial request there - it can be ignored. Such circumstances will lead to missing the deadline for terminating the contract.

It is recommended to contact AlfaStrakhovanie by e-mail after sending documents by Russian Post, since regardless of the method of drawing up the application and citizens’ appeal, the insurer will need the original documents to cancel the agreement.

The application for refusal can be made in writing or electronically. Regardless of the form of the document, when submitting it to the insurance company, it is imperative to save a second copy.

It will be used as confirmation of compliance with the “cooling off period” and other legal requirements for the process of returning unnecessary insurance from AlfaStrakhovanie.

U. As a rule, their divisions are located in Alfa Bank or other partner banks.

Therefore, all questions regarding insurance can be resolved in customer support by calling the hotline: 8 800 333-84-48 (daily from 08:00 to 20:00, calls within Russia are free or by filling out the appropriate form in the “Ask a Question” section on the website.

How to disable insurance at Alfa-Bank

You can cancel your insurance after signing the contract during the so-called cooling-off period. This concept refers to the period of time during which you have the right to terminate the contract without giving a reason. This rule works for all banks, including Alfa-Bank.

From 2020, the cooling-off period for buyers of insurance policies is 2 weeks, unless otherwise specified in the contract. That is, in order to disable insurance at Alfa-Bank, you must submit an application for refusal during this time. The contract date is the date on which you paid the insurance premium. Before submitting your application, check whether the application deadline has expired.

You have the right to disable insurance if it was not a mandatory condition of the loan agreement. That is, its effect should not apply to the borrower’s property, but only to himself.

Thus, you will be able to disable the insurance imposed on you at Alfa-Bank for any type of voluntary insurance within 14 days. But do not allow an insured event to occur during this period. This will serve as a reason to refuse to turn it off and return your insurance premium.

The insurance premium refund will be calculated taking into account the days during which the contract was valid. For example, if the contract was signed 10 days ago, then the cost of these 10 days will be deducted from the total amount paid for the policy. Accordingly, the sooner you decide to turn off your insurance, the more funds will be returned to you.

So, in order to disable insurance at Alfa-Bank, you need to collect the following package of documents:

- refusal statement. It can be filled out either manually or on a computer;

- copy of the passport;

- a copy of the insurance contract;

- a receipt confirming payment of the premium.

The application must include:

- details of the insurance agreement, that is, the address of the office where you are sending the application;

- insurance premium amount;

- bank details of the account to which the funds should be returned;

- policyholder data. In addition to your passport details, please provide your phone number and actual residential address;

- date of signing the contract;

- list of applications;

- date of application and signature of the applicant.

There is a sample application on the website that you can fill out and print. This will greatly simplify the task and save you time.

How to disable insurance at Alfa Bank using a credit card or any other voluntary insurance program? You have three options:

- contact the office directly. The insurer itself, and not Alfa-Bank, handles refunds;

- send a registered letter with notification by mail to the company's address. Please attach a list of the documents you are providing to your application. Please keep the notice until your refund is issued;

- submit a refusal on the official website of the insurer.

To contact a specialist at the office, you must make two copies of the application. On each of them, the specialist must put an acceptance mark. One copy is kept with you, the other in the company’s office. Also, an insurance company employee must check the authenticity of photocopies of your documents by comparing them with the original. He attaches copies to the application; the originals are always kept with you. An official response to your application should arrive within 5 days. This can be either a refund or a refusal.

Knowing how to disable card insurance, you can save money. Most often, Alfa-Bank includes the insurance amount in the loan amount, so turning it off means significant savings.

“AlfaStrakhovanie” – is it possible to return insurance if the “cooling off period” has passed?

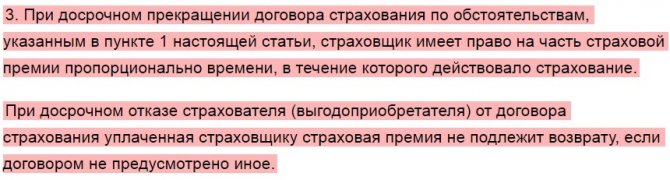

After the expiration of the application period, the law does not provide for the return of the insurance payment paid to the insurer for the provision of services. Civil legislation establishes the right of the insurance company to return part of the funds to the client, but does not force compliance with this rule.

Insurers, guided by current legal norms, do not return funds if the deadline for submitting an application for cancellation of an insurance policy is missed. The relevant provisions are specified in the agreement between the insurance company and the individual.

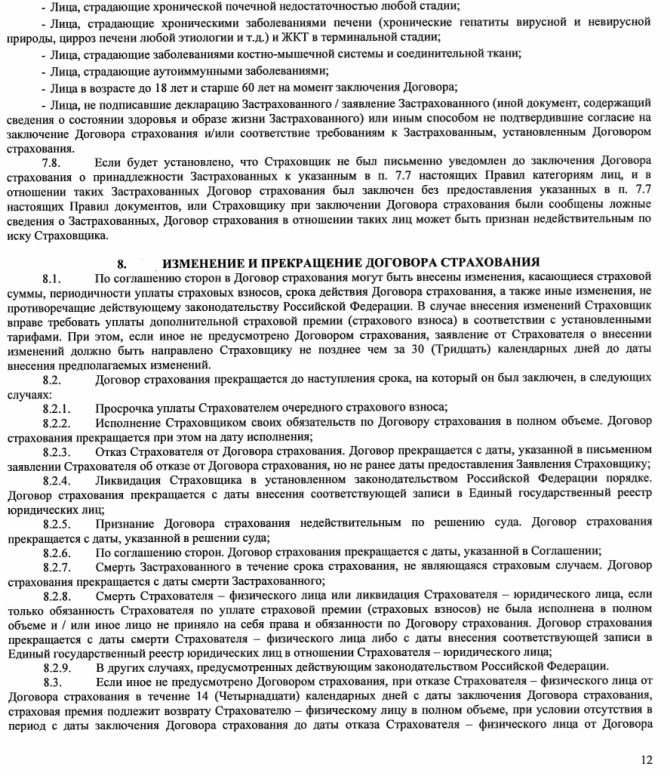

Standard Conditions No. 2 of Alpha Insurance in Section 7 provide for the following grounds for termination of the agreement:

- Fulfillment of the obligations assigned to the insurer to pay funds or fulfill obligations in the event of an insured event;

- Termination at the initiative of the policyholder;

- Liquidation of the insurer's organization;

- Recognizing the clauses of the agreement as unlawful through legal proceedings;

- In other circumstances established by the legislation of the Russian Federation.

According to the provisions of clause 5.5 of Section 5 of Conditions No. 2 for life and health insurance, if the policyholder has not terminated the contract with the insurer during the “cooling off period,” then its provisions are considered fully fulfilled, regardless of the loan repayment period or the absence of insured events.

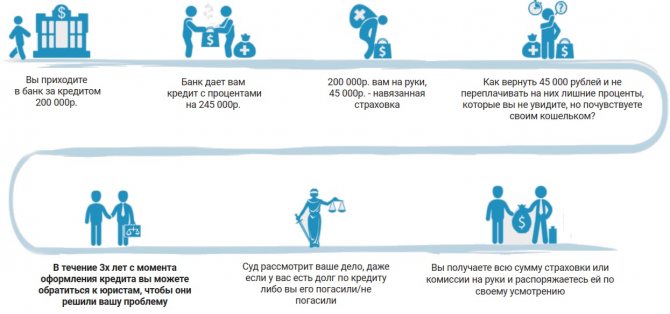

In such a case, the refund will be issued through the court. It should be borne in mind that you should not count on a large amount, because:

- the legal process takes time;

- the company will claim that funds during the contract period were used to provide insurance.

However, some amount will be returned, and exactly how much money will be transferred depends on the cost of insurance and the number of days that have passed since the conclusion of the contract.

To protect your interests in court, you can refer to the fact that the fact that insurance was included in the loan amount was unknown to you, or you can point out that the service was imposed.

But these facts are quite difficult to confirm. Success is possible if the credit agreement or loan application already contained consent to insurance.

In this case, the insurance premium is automatically included in the amount of borrowed money issued. In other cases, you will need evidence of the imposition of the service or the absence of information about it. Their role may include witness testimony, audio/video recordings, etc.

"AlfaStrakhovanie" - termination upon early repayment of the loan

In accordance with Art. 958 of the Civil Code of the Russian Federation, the client can return the insurance premium upon early repayment of his loan obligations only in one case - if such a right is enshrined in the agreement.

Alfastrakhovanie does not include such a clause in its contracts, so it will not be possible to return the money by closing the debt ahead of schedule.

Refund of the insured amount when concluding an agreement with IC AlfaStrakhovanie is possible only during the first 14 calendar days from the date of commencement of the contract. The starting point is considered to be 00 o'clock on the day when the full payment of the insurance premium was made.

In accordance with the provisions of clause 7.4 of Section 7 of Conditions No. 2 of Alpha Life and Health Insurance of a citizen, in case of early repayment of loan obligations, the insurance premium is not refundable, and clause 5.5 of Section 5 establishes that the insurer’s obligations are fulfilled in full.

These provisions contain additions “unless otherwise provided in the insurance contract,” however, the composition of the standard agreement has no exceptions and additional provisions, the Policy offer is valid on a general basis without refund of the insurance premium.

Civil legislation enshrines the right of the insurer not to return the premium amount to a citizen if he filed a claim after the “cooling-off period.” The policyholder retains the right to terminate the agreement before the end of its validity period without receiving compensation.

The policyholder also retains the right to appeal to the court. The basis is any discrepancy between the provisions of the contract and current legislation, as well as infringement of the rights and legitimate interests of an individual by the insurance company.

- There are also precedents (successful legal disputes)

- Continuation

Particularly interesting is the Determination of the Judicial Collegium for Civil Cases of the Armed Forces of the Russian Federation dated May 22, 2020 No. 78-KG18-18 in the case of one citizen who repaid her loan ahead of schedule.

The bottom line is this: the insurer did not return her premium in proportion to the “unused” days. The citizen appealed to the court of first instance - it refused to satisfy her demands, then to the court of appeal, which also refused.

And only the Supreme Court of the Russian Federation did not agree with the decisions made and ordered the insurer to pay the premium for “unused” days.

When rendering its verdict, the Supreme Court noted that, according to the terms of the insurance contract, the insured amount is equal to 100% of the amount of debt under the loan agreement.

Since at the time of early repayment this debt became zero, the insured amount also became zero. This means that there is no point in insurance, in which the payment of insurance compensation is impossible.

It is also interesting that the RF Armed Forces noted that the norm of Part 1 of Art. 958 of the Code is still dispositive, not imperative. That is, not only the destruction of property or termination of business activity is the basis for proportional compensation of the insurance premium.

In relation to this case, this norm should be interpreted as “disappearance of insurance risks” (since the insurer no longer has the obligation to provide insurance compensation).

How to return insurance

There are several ways to cancel your Alfa Insurance policy:

- At the design stage.

- Return during the "cooling off period".

- During long-term loan repayment, if provided for in the agreement.

But before you decide to go through the refusal procedure, you need to consider several important points:

- to what extent is insurance a mandatory part of the lending agreement?

- how its absence affects the size of the loan rate: perhaps without it the rate will increase significantly;

- whether the amount of refund of insurance premiums will be sufficient to waste time and money on this.

Having decided on the answers to these questions, you can choose the procedure that is most suitable for each specific case.

Refusal at the loan application stage

The legislation of the Russian Federation, in particular the Civil Code, prohibits forcing consumers to take out compulsory life and health insurance. Otherwise, the service is considered imposed and can be successfully challenged in court.

When applying for a loan at Alfa Bank, it is quite possible to refuse the loan insurance, which is offered by the insurance company at the stage preceding the conclusion of the contract, using the above-mentioned provision of the law.

ATTENTION! In turn, the bank can offer the borrower higher rates if he does not want to buy an insurance policy.

It is lower interest rates that are the main reason why most clients agree to purchase a policy and then look for other ways to get out of it.

Refusal after receiving a loan

The Central Bank of the Russian Federation, by its resolution of 2020, regulated the refusal of an already purchased policy in accordance with Article 935 of the Civil Code of the Russian Federation, which prohibits imposing on citizens the obligation to insure their life and health.

According to this document, the insured person has 14 calendar days (this is called the “cooling off period”) during which he can return the policy and receive his money back over the next 10 days.

IMPORTANT! You should not wait until the very end of this period, since some contracts provide for payment for those days when the contract was still in force.

In order to return Alfa Insurance insurance, you need to fill out an application according to the sample, which can be downloaded here or on the company’s website. Attach to it:

- Insurance contract.

- A copy of the fee payment receipt.

- A copy of your passport.

Send this package of documents to the address of the main office of AlfaStrakhovanie-Life Insurance Company.

Refusal for early repayment

In case of early repayment of the loan, if the insured event has not yet occurred, the client has the right to receive the money back for the period that remains until the end of the contract.

The Civil Code in Article 958 states that such a return of part of the insurance premium is possible only if the insurer has undertaken an obligation to do so in the contract.

If there is no such clause in the agreement with Alfastrakhovaniye, then the only way to get the money back is to file a lawsuit.

ATTENTION! You can apply to the courts either for the return of the entire amount of the insurance premium, if the client is able to prove the imposition of the service, or only for that part that is due for the period between the early repayment of the loan and the end of the insurance period.

Is it possible to return AlfaStrakhovanie insurance if the loan is closed on time?

In accordance with clause 5.5 of Section 5 and clause 7.4 of Section 7 of Conditions No. 2, when issuing an AlfaInsurance Policy Offer, payment of loan obligations on time without the occurrence of an insured event is not the basis for returning the amount of the insurance premium to the policyholder.

The agreement between an individual and the insurer terminates on the basis of clause 7.1 of Section 7 of Conditions No. 2, and contractual obligations are recognized as fully fulfilled. Refunds of insurance premiums are not permitted.

Similar provisions are established by federal legislation, so court proceedings regarding such disputes can only end with a decision refusing to satisfy the applicant’s claims.

Cash is the income of the insurer.

Thus, the refusal of the insurance company to return money after timely repayment of the loan is legal.

"AlfaStrakhovanie" - refund of money for insurance through the court

Refunds for obtaining insurance through legal proceedings are carried out after all other methods have been exhausted, when the insurance company has refused and the policyholder has no other options to return the remuneration paid.

The grounds for going to court are:

- Early repayment of loan obligations;

- Inability to use an insurance policy;

- Cancellation of the Policy offer with the insurance company, in which the Insurer refused to return the reward received;

- Compulsory insurance when applying for a loan.

The advantages of going to court are that the following factors are taken into account:

- lack of explanation to the plaintiff about the procedure for refusing insurance and his ignorance of his rights;

- automatic inclusion of insurance in the loan agreement;

- imposition of services by bank employees when applying for a loan.

When considering the case on the merits, the court may require the provision of other documents and evidence from the plaintiff or defendant in order to make the most fair decision on the stated dispute.

The policyholder will need the following documents:

- Statement of claim;

- Passport or other identification document;

- Loan agreement;

- Insurance policy;

- An extract on loan repayment, if the basis for going to court was the refusal of the insurance company to pay part of the insurance premium for early repayment of the loan;

- A copy of the policyholder's application for termination of the agreement between him and the insurer;

- Official refusal of the insurer to return the funds paid by the citizen;

- A receipt or other document confirming payment of the state fee.

Civil law does not prohibit independent representation of one’s interests, however, if there are conflicts between citizens and insurance companies, a lawyer is needed. Citizens will not be able to file a claim, and it will also be difficult to compete with the insurer’s professional lawyers.

If the statement of claim is drawn up in violation of the current civil procedural legislation, it will be rejected, indicating the justifications and errors. It is not a fact that when filing a new claim, other inaccuracies and errors will not be discovered.

A qualified lawyer will help you defend your rights and increase the likelihood of success in your legal case. If a line of defense is built and all the necessary documents are collected to convince the judge that he is right, the plaintiff not only will not lose anything, but will also be able to make money from the insurance company’s reluctance to follow the letter of the law.

Nuances of insurance return

Since many citizens do not know their rights and rarely get their way through the courts, the insurance company often refuses to return funds. In this case, you should use the following tips.

OSAGO insurance from Alfa Bank

What to do if the insurance company refuses to pay

The borrower must contact the insurance company and request a written explanation indicating the reasons for the refusal. After this, you need to collect all available documents on the loan and the conclusion of an agreement with AlfaStrakhovanie and contact Rospotrebnadzor.

Challenging in Rospotrebnadzor

You don’t even need to leave your home to contact a government agency. The application can be submitted online. It is advisable to upload the entire package of documents along with it. This is usually enough for the insurance company to immediately transfer the money to the claimant's account.

If the applicant's appeal contradicts Art. 958 of the Civil Code of the Russian Federation, the application will be rejected with an explanatory comment.

Going to court

Usually, an appeal to Rospotrebnadzor is enough to clarify the conflict situation and the matter does not go to court. Therefore, after a refusal from a government agency, the applicant should study the legislative framework more carefully so as not to incur the costs of legal proceedings.

How to terminate the insurance of IC "AlfaStrakhovanie Life" - features

Banking organizations may establish a mandatory condition for obtaining a loan - concluding an agreement with an insurance company. In the presence of such a situation, it is almost impossible to cancel bilateral obligations with IC AlfaStrakhovanie without any sanctions from the bank.

Credit insurance can be provided in several ways:

- Conclusion of an agreement between an individual (borrower of funds) and the insurer;

- An agreement between a lender and an insurer in which the borrower joins an existing group insurance program.

Cancellation of an insurance policy when concluding a separate contract will not entail negative consequences. If there is a mandatory insurance provision, the refusal of which may be considered a violation of the terms of the loan, can seriously change the attitude towards the borrower.

The lender can initiate the cancellation of the loan agreement and oblige the borrower to repay the borrowed funds before the specified period, as well as change the terms of the loan, for example, raise the rate.

The borrower has the opportunity to cancel the agreement with the insurance company voluntarily or in court, so you must first write an application to the bank with which the loan obligations have been established and to the insurance company.

You must contact us within two weeks. Usually banks accommodate clients halfway, and the loan amount is reduced by the amount of imposed insurance obligations, but if this does not happen, then the borrower needs to go to court and resolve the dispute there.

When is an insurance contract considered terminated?

If the parties voluntarily agree to cancel the insurance policy, the contract for the provision of services is considered terminated from the moment the application is submitted by the citizen. If the institutions refuse to terminate, the court will decide the end of the dispute.

If the court takes the borrower’s side, then the contract is considered terminated either from the moment the corresponding application is filed in the name of the insurance company, or from the date the statement of claim is filed. It all depends on whether the citizen files a claim with the insurer.

What to do if your life insurance claim is refused?

As we have already indicated above, within 14 days you can safely cancel the life insurance contract and get back the entire amount of the premium paid.

If the application was submitted by the policyholder or his representative by proxy in accordance with all the rules, the entire set of documents was attached, the insured event did not occur within these 14 days, but still a refusal was received, then it is necessary:

- draw up a pre-trial claim demanding elimination of violations of the law;

- At the same time, you can complain to the regulator (button “Make a complaint"(cbr.ru/Reception/Message) in the Internet reception on the official website of the Central Bank of the Russian Federation).

- write a negative review on the website banki.ru : banki.ru/insurance/alfastrahovaniezhizn (usually the insurance company monitors its reputation and will quickly return the funds).

After following the pre-trial appeal procedure and in the absence of a decision on payment from the insurance company, there is only one way - to court.

If AlfaStrakhovanie refuses to return the insurance premium, the dispute must be resolved in court. The legislation does not provide for other ways to resolve the conflict regarding paid funds.

To go to court, you need to collect the necessary package of documents and pay a state fee, which is calculated based on the amount of funds being returned. The amount of state duty in cases of insurance return varies from 400 to several tens of thousands of rubles.

The calculation is made based on the provisions of paragraphs. 1 clause 1 art. 333.19 Tax Code of the Russian Federation.

Does AlfaStrakhovanie really comply with legal requirements?

To answer this question, it is necessary to analyze the Rules for voluntary life and health insurance of borrowers, approved by Order of the General Director of AlfaStrakhovanie-Life LLC A. V. Slyusar dated December 4, 2020 No. 196 (hereinafter referred to as the Rules).

In clause 8.3. The rules say that within 14 days from the date of commencement of the insurance contract, the policyholder has the right to refuse to fulfill it - and return the funds.

A prerequisite is the absence of insured events that occurred from the date of conclusion of the agreement to the date of submission of the application for refusal.

Refunds are made within 10 working days using the method chosen by the policyholder:

- in cash at the insurer's office;

- non-cash to bank details.

As we can see, Alpha fully complies with legal requirements (judging by the Rules), but sometimes violates the deadline for the refund procedure.

Deadline for canceling insurance at AlfaStrakhovanie-Life

In accordance with the instructions of the Central Bank of the Russian Federation, the period during which you can refuse the imposed insurance is 14 days.

14 days – return period

Accept claims and get free legal advice today!

Call: Moscow St. Petersburg +7 812 467-37-84Hotline in the Russian Federation 8 800 350-83-09 (free)

Solve the problem now - a correct and justified complaint is the key to success!

At the same time, the AlfaStrakhovanie-Life Insurance Company has the right to set a longer period for return, for example 30 days. A provision regarding this must be contained in the insurance contract. But in practice this happens very rarely.

How to count days correctly

If the question arises about how to correctly count days when refusing insurance, you need to refer to the provisions of Chapter 11 of the Civil Code of the Russian Federation “Calculation of terms.

Thus, this period refers to periods calculated in days.

| Conditions | Ending |

| when does it start | the next day after the conclusion of the contract |

| when does it expire | on the last day of the term inclusive |

| if it expires on a non-business day | postponed to the next business day |

| exact time up to an hour | expires at the hour when the insurance company ceases the corresponding operations |

If you submitted an application on the last day, and AlfaStrakhovanie-Life does not accept it on the basis that the corresponding operations are no longer carried out, then you should adhere to the following algorithm:

- ask for the rules for carrying out such operations in writing, approved by the insurance organization AlfaStrakhovanie-Life itself or by the Central Bank of the Russian Federation;

- if you are not provided with the rules, call the Central Bank of the Russian Federation at 8-800-250-40-72;

- if the above actions do not help, you need to go to the post office and send an application by mail - check the recipient’s address in the insurance contract, legal address: Moscow

Written statements and notices submitted to the communications organization before twenty-four hours of the last day of the deadline are considered made on time - part 2 of Art. 194 Civil Code of the Russian Federation

Cancellation of insurance after 14 days

It often happens that you want to withdraw from insurance, but 14 days have already passed. In this case, the “cooling” rule no longer applies, and a different approach is necessary.

But you should not immediately go to court; first of all, it is advisable to try to resolve your issue through contractual means:

You can almost always return an item! The main thing is to know the procedure and use the law correctly. Get information for free from lawyers via chat (bottom right ↘️) or via this link.

- find the insurance contract and carefully study it, there should be a clause regulating the period for refusal of insurance, perhaps it is more than 14 days by law - if you return more according to the general scheme;

- contact AlfaStrakhovanie-Life and find out if termination is possible as part of customer loyalty.

Contacts AlfaStrakhovanie-Life: tel; fax: 8 (495) 785-08-88; www.aslife.ru

It is important to know that you can return the insurance if 14 days have passed only in the event of the loss of the insured property for reasons that are not an insured event - clause 1 of Art. 958 of the Civil Code of the Russian Federation. In this case, the refund amount is calculated based on the time during which the insurance was valid.

But is it possible to refuse an insurance contract for other reasons? Of course yes, but there is an important point: in case of voluntary cancellation of the insurance contract, the money paid is subject to return only if this is specified in the contract - clause 3 of Art. 958 Civil Code of the Russian Federation

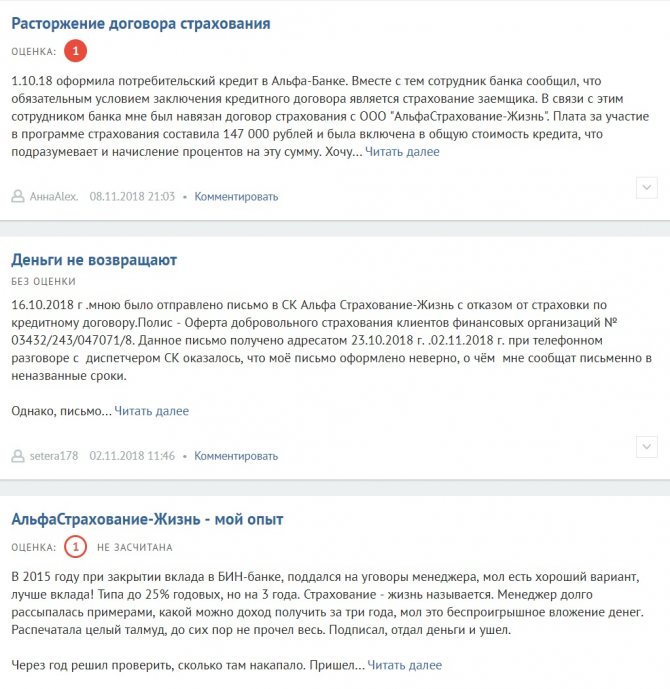

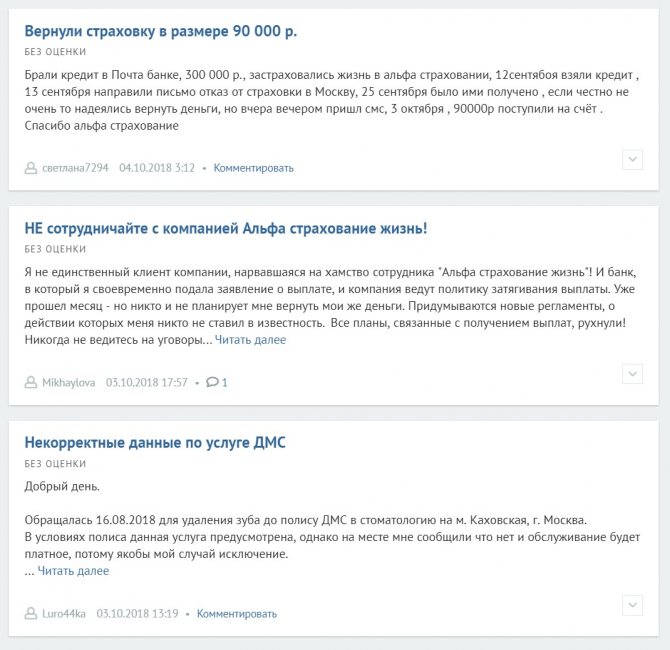

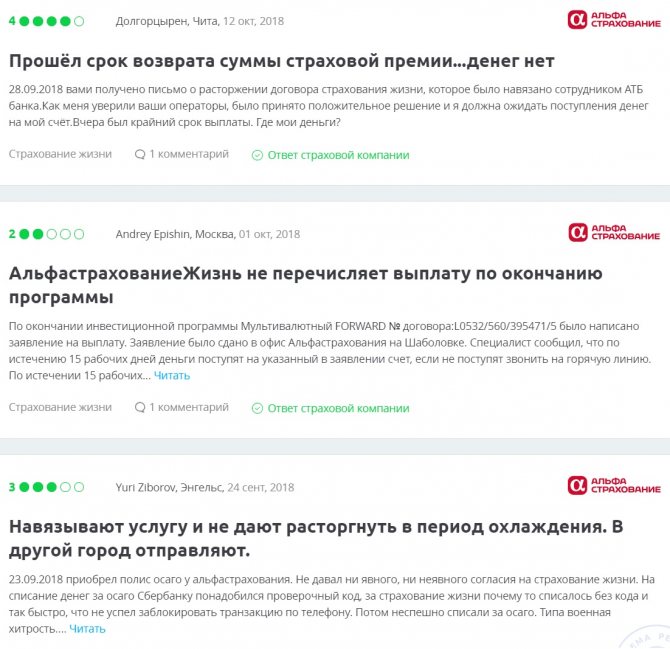

Reviews about the return of insurance "AlfaStrakhovanie"

Customer reviews are an important indicator of an insurance company. As for this company, they are mostly negative. Most clients complain about:

- refusal to return insurance;

- lack of response from the company to the application for termination of the contract;

- failure to comply with deadlines for consideration of requests to annul the agreement;

- misrepresentation by company employees;

- policy of delaying payment.

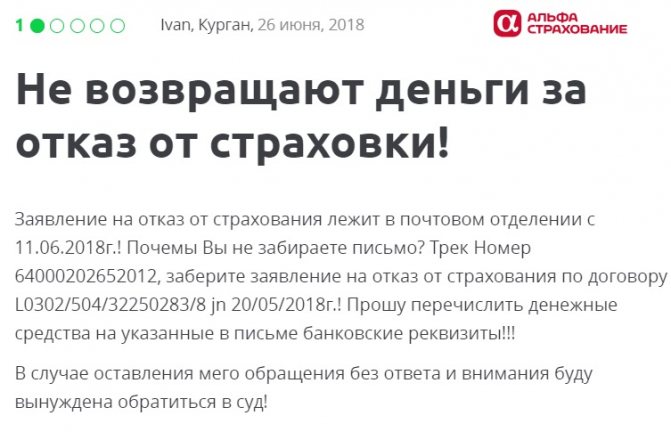

For example, one person writes (spelling and punctuation of the authors of the reviews have been preserved - editor's note) that Alpha employees, who are responsible for receiving and processing incoming correspondence, simply do not pick up the application for refusal of insurance from the post office.

Here is another borrower who says that 4 days after the loan and insurance were issued, he refused the latter.

Almost a month (the review was published on June 24, and the insurer received a registered letter on May 29) has passed since the refusal was received, but Alfa has not taken any measures to return it.

The citizen intends to go to court to force the recovery of illegally retained funds.

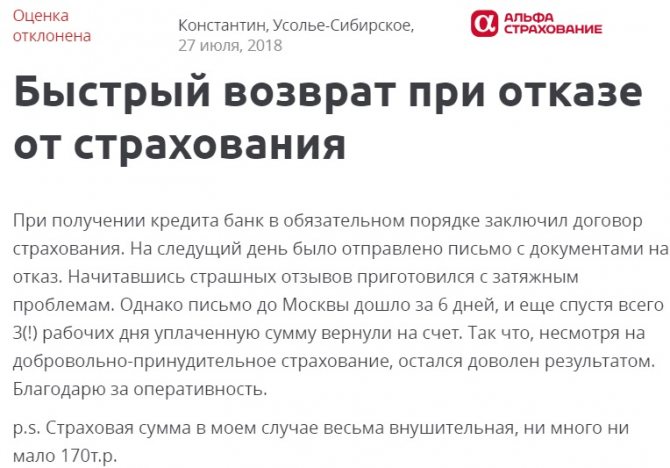

Despite a lot of negative reviews, there are also positive ones. For example, one citizen writes that he had already mentally prepared for litigation, but everything went smoothly.

Many cannot reach the hotline number listed on the official website of AlfaStrakhovanie; others expect a refund more than 10 days after receiving the insurance documents, which is a violation of current legislation.

Most often, difficulties are resolved when policyholders contact the insurance company by email, as well as when leaving negative reviews on the Internet portal Banki.ru, which is an independent portal about banks and banking organizations.

You can view reviews or leave your own on the portal: banki.ru/insurance/alfastrahovaniezhizn.

You can view reviews or leave your own on the portal: sravni.ru/strahovanie-zhizni/otzyvy.