Home / Consumer protection / Goods / Return, exchange, elimination of defects / Refund / Money

Back

Published: 08/15/2018

Reading time: 5 min

0

2372

Many consumers, returning goods to the store and expecting to get their money back, would like to have these funds transferred back to their bank card.

Is it possible, what should the buyer do so that the money for the goods is transferred to the card, when to expect the funds to be credited, and what to do if the money has not been received?

- Conditions and grounds

- Procedure

- How long should I wait? Why not instantly?

- What if the deadline has expired?

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Conditions and grounds for refund

The Law of the Russian Federation “On the Protection of Consumer Rights” (Law “On ZPP”) provides for two main cases in which citizens have the right to return a purchase:

1) The product turned out to be of poor quality ( Article 18 ) - having found itself in such a situation, one of the demands that the buyer can make is a refund of the money paid.

In addition, the consumer has the right to demand compensation from the store for damage caused as a result of using a product containing defects.

2) Product of proper quality ( Article 25 ) - in this case, a return can be made if the product does not fit certain parameters (for example, color, style, model, size, etc.). However, there are three important conditions that such a product must meet:

- does not apply to food products,

- is not included in the list of products that are not subject to return or exchange, approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55 ,

- presence of a marketable appearance - the product must be completely new and not have any signs indicating that it has been in use.

ATTENTION . It will be possible to return money for a product of proper quality only if it is not possible to exchange it due to the lack of a similar model, style, etc. in the store.

Refund through a bank branch

If the erroneous transfer was made less than an hour ago, immediately report this error to the hotline manager.

After all, many banking transactions are not carried out immediately, so you have some time to cancel the transfer. If the error of the payment was determined after a sufficiently long period of time, then you should first determine who made the mistake - the bank or you. If this is the fault of the banking institution, then you need to come to the branch and write a statement.

If it turns out that you are to blame, then you have only one thing left to do - “forget” about the lost funds. In this situation, the only thing you can try to do is contact the person to whom the money was transferred by mistake and ask him to return the amount received.

But if we are talking about transferring money to scammers, you need to go to court. And a refund, including compensation for moral damage, is guaranteed if the court decision turns out to be positive for you.

Instructions for returning goods with money returned to the card

In order to return money for an item back to your card, you must take the following basic steps:

- Carefully package the purchased product, attaching all labels, tags, etc.

- Prepare an application addressed to the store manager.

- Collect additional documents.

- Appear to the seller, explain the situation and present a complete package of papers along with the purchased product (you can also use other delivery methods. For example, send by registered mail with acknowledgment of receipt).

- Wait for an answer.

REFERENCE . If the demand turns out to be legitimate, the store will have to transfer funds to the card within the established time frame. Otherwise, a written refusal with justification for such a decision will have to be sent to the buyer.

What documents will be required

As noted above, in order to present a demand to the seller for a refund for the purchased product, it is necessary to collect a number of documents. This list includes the following main papers:

- statement;

- check;

- results of an independent examination (if carried out).

Invalid payee details

If, when sending a payment to any legal entity, even one number or letter of the details is incorrectly specified, the payment will get stuck in the bank or go in another direction. Depending on the outcome of the situation, the way to solve the problem will depend:

- If the funds are stuck in the bank, they can be returned here. To do this, you will need to fill out an application for a refund of an erroneous payment at Sberbank and indicate the card number. You can contact any branch. In some cases, when the payment was made from a card, and the recipient with the specified details does not exist, the bank can independently return the debited amount to the account. But it will take from 10 to 30 days;

- Well, if the incorrectly specified data turns out to belong to another operating organization, then you will need to independently find out its address and apply there for a refund. In advance, you can ask the bank to issue a certificate of the completed payment, which will be ready no earlier than 24 hours from the date of the transaction. And having already submitted it and an application for a refund, you will need to indicate the card number for their crediting. Just remember that legal entities do not transfer money to the card number; you will need to provide the full details of your card product and the bank that issued it.

How can you be prudent in this case:

- Before making any payment, you must clarify the details of the payee. For example, ask for a fresh receipt. Why fresh? Now very often, enterprises and organizations change their details, dividing the circle of responsibilities between departments, offices, and payment centers. Therefore, it will never be superfluous to clarify the current details in the absence of a payment document in hand;

- Before confirming an operation carried out in the terminal or via the Internet, carefully check the entered details again. If the payment is made through a cashier, then, having received the check, without leaving the window, double-check the entered data with the cashier. Otherwise, in the future it will be more difficult to prove that it was the bank’s own mistake when transferring finances.

Terms for returning money to the card

The Law of the Russian Federation “On ZPP” provides for different terms for returning money to the card. They mainly depend on the reason for making such a requirement.

So, the store is obliged to transfer funds within the following periods of time:

- no later than 10 days from the date of receipt of the application from the buyer - for goods in which a deficiency has been identified, as well as those purchased remotely ( Article 22, paragraph 5, paragraph 4, Article 26.1 );

- no later than 3 days from the date of return of the product - this period is valid for goods of proper quality ( clause 2 of Article 25 ).

IMPORTANT . The seller should keep in mind that for delaying the deadlines allotted for returning money for a low-quality product, he may be charged a penalty in the amount of 1% of the total cost of the product (Clause 1 of Article 23 of the Law of the Russian Federation “On ZPP”).

Refund via Sberbank Online

The developers of the service program took into account the possibility of returning money to clients.

Therefore, online payment transactions are not processed instantly. And if they were executed after 21.00, then the process of their full implementation will be launched only after 9.00 the next morning. So throughout the night you have the opportunity to cancel the payment. The presence of the status “Executed by the bank” indicates that the transaction process has not yet begun. You need to select the transfer operation of interest and then click on the “Cancel” button, after which the money will be returned to your account.

If there are statuses “The application was about”, “Rejected by the bank”, the money will also remain in place. If you are convinced that the transfer has been completed, then you need to contact the bank via the hotline or come to the branch in person.

As you can see, it is quite possible to return money sent by mistake, provided that you use these instructions correctly.

What to do if the money is not returned

In practice, sometimes there are cases when the store management does not want to return the money for the goods and in every possible way ignores the buyer’s request. If you find yourself in such a situation, you can take the following actions:

- Prepare a complaint and send it to Rospotrebnadzor - one of the functions of this body is to monitor compliance with the norms of the Law of the Russian Federation “On ZPP”. Upon receipt of a complaint, Rospotrebnadzor employees will be required to conduct an inspection and, if a violation is detected, bring the culprit to justice.

- To file a claim in court for violation of the consumer’s legitimate interests - such a right follows from the content of Art. 17 of the above-mentioned Law of the Russian Federation. At the same time, you can include in your claim not only a demand for the return of money for the product, but also a penalty for late satisfaction of the consumer’s request, as well as recovery of compensation for moral damage.

REFERENCE . If an application is filed with the court, the plaintiff is exempt from paying the state fee ( Clause 3, Article 17 of the Law of the Russian Federation “On ZPP”).

Thus, the terms for returning money for purchased goods, including by crediting to a bank card, are fully regulated by the legislation in force in the field of protecting the interests of buyers. However, the specific period of time will differ depending on the reason why the consumer wants to return the product back to the seller.

When can transferred money be returned?

The client can return his money back to the Sberbank card subject to the following conditions:

- The product you bought in the store turned out to be of poor quality.

- When purchasing goods in a store, the amount required to be paid for technical reasons was either debited from the account without ever reaching the seller, or was debited twice.

- You paid with a card for a purchase in an online store, but a few hours after paying for the goods, you canceled your order and want to return the money.

Important! In all of the above cases, you have the right to count on a refund.

However, take into account the following nuances: you will not be able to return the money if you transferred it to scammers on your own initiative or made a mistake when indicating the recipient’s details when making an online payment. But you still have the opportunity to contact the police or the bank’s hotline with a request for a refund, if 24 hours have not yet passed after making the transfer or payment.

So, if you have established that in the current situation you have the right to claim a refund, then you must come to the branch of Sberbank of the Russian Federation where the plastic card was issued. By contacting a branch employee, you need to write an application requesting a refund and submit it to the bank for consideration.

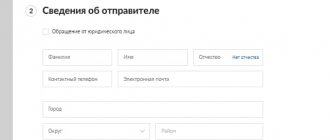

You can prepare an application in advance using one of the templates found on the Internet, since there is no strictly prescribed form for such applications. However, there are points that must be specified:

- Full name and position title of the person who heads the bank branch or heads the head office.

- Cardholder's name:

- bank details of a plastic card;

- the amount of funds indicating the reasons for their return;

- date and signature.

Important! In order to correctly fill out all points of the application, it is best to come to the bank branch in person and draw up this document under the guidance of a specialist. The application must be submitted along with a photocopy of the receipt indicating payment for the goods or services in case of return of the goods, and a copy of the return application sent to the store.

The procedure for returning money to a Sberbank card usually lasts 30 days. But if the transaction was canceled on the same day by calling the hotline, then you can hope to reduce this standard period to 2-3 days.

Possibility of receiving compensation through the Federal Tax Service

It is important to note that it is now possible to absolutely legally receive monetary compensation for your purchases directly through the Federal Tax Service.

And the conversation is not about the purchase of real estate or medicines, for which a tax deduction is due - compensation is possible for the purchase of food, clothing and other necessary goods.

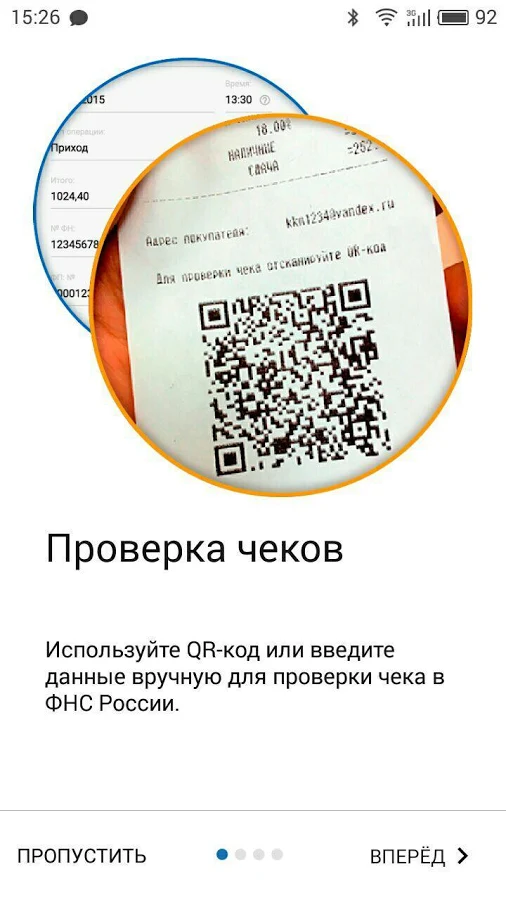

It is likely that many citizens have noticed that recently retail outlets have begun issuing cash receipts in a different form - a QR code is now required at the end of the receipt.

This is due to the transition of retail outlets to online cash registers, which allow the generation of an electronic receipt. Data about each check entered at this cash register is sent to the tax service, which allows it to control cash transactions remotely.

But electronic checks are convenient not only for the Federal Tax Service: for us, ordinary citizens, they have also opened up several new opportunities.

How long should I wait for enrollment?

The timing of enrollment is influenced by several factors. The first thing that affects is the efficiency of accounting. The buyer’s application can be transferred to the financial institution either after 3 days or after a week.

The most efficient bank is VTB24. In this bank, money is returned within 12 days. If the funds are not returned for too long, you need to visit the Pyaterochka accounting department or the bank to find out at what stage the whole process is.

If you return the product on the day it was purchased, the card procedure is simply cancelled. In this case, the money is credited to the account as quickly as possible.

- Related Posts

- How and when did the Pyaterochka logo change?

- How can you block or unblock a “Vyruchai” card?

- Instructions for installing the Pyaterochka mobile application

« Previous entry

Loyalty program from Sberbank

“Thank you” is a bonus program for any purchases where you pay with a card. It is a cashback option for Sberbank cardholders. Here, bonuses are not money, but points, where 1 point is equal to 1 ruble.

How to activate

To start enjoying all the benefits of this program, you need to use one of the ways to activate it:

- Using SMS, since every bank client can use the Mobile Bank application. To connect to the service, you need to send an SMS to number 900 with the text Thank you NNNN2, but instead of NNNN enter the last four digits of the card number. After this, you will receive a response in the form of a code, which in a certain form #КККК3 must be sent to number 900, instead of КККК you need to enter the sent code;

- Use Sberbank Online. On your personal page you need to find the “Bonus program” item, click on it and register.

- Using an ATM.

You need to insert a card into the ATM, enter your PIN code and find the page for connecting to the bonus program. After filling out a short form and confirmation, it will become available to you.

How can you use the “Thank You” loyalty program?

When paying for any purchase you make at any retail outlet, 0.5% of the entire amount spent will be credited to your bonus account.

But it is more profitable to purchase various goods in stores with which Sberbank has a partnership agreement, then up to 50% of the purchase amount will be returned to your additional account.

What is cashback at Sberbank?

Many partner stores regularly hold promotions where your percentage of deductions to your bonus account will be slightly higher.

Program partners

Trademarks that are partners, when paying with them, you will definitely receive bonuses to your additional account:

- WESTWING

- ELENA FURS

- BIGLION

- BORK

- COM

- NORDMAN

- YVES ROCHER

- Bicycle Country

- Maximum;

- Siberia;

- Daughters and sons;

- Euroset.

How to get a credit card with cashback? Detailed instructions follow the link.

This is not the entire list; full information about the partners of the bonus program and what percentage of return they have on the amount can be found on the bank’s website. Or ask the seller if their store is on the list of bank partners.

How it works?

The application is built on the principle of online verification: the check that was issued to the consumer is compared with the information that the retail outlet itself provided about this check to the tax service.

To do this, you need to scan the QR code on the check using the application or manually enter the details of your check. If information about it is available from the Federal Tax Service, the application will approve the check and confirm that it is legal.

Sberbank clients can return 25% of the cost of purchases

Miscellaneous 09/18/2018 | 0

A person uses 10% of his brain, just like his smartphone. Today I went grocery shopping and got 25% of the purchase price back on my card using the app. Not with points, not with bonuses, but with regular rubles. How to do it?

I recently received a new debit card. It was high time to do this: the old salary card had no interest on the balance, and instead of cashback there were bonus points.

After adding the card to my mobile bank, I received an offer to select categories of stores with increased cashback accrual. I chose transportation and groceries as these are the main expenses. And I made a mistake: Lenta, Auchan, Pyaterochka and Okay are not included in the program. This means that 1% of the products will be returned to the card, no more.

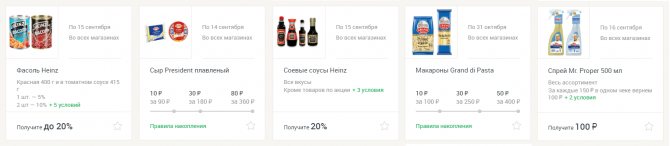

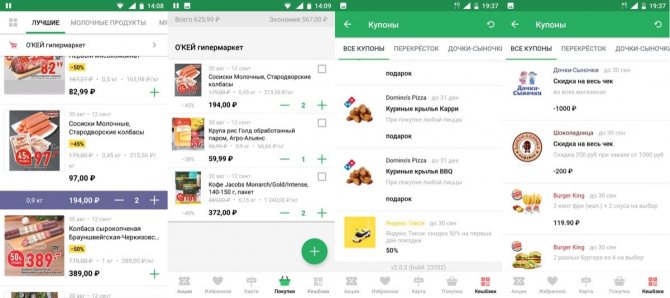

Having made this conclusion, I forgot about cashback for a while. And I remembered it again when I was offered to test the Edadil application. The principle of its operation consists of three steps: buy the product, scan the receipt, get a refund. Considering that cashback can also be obtained in case of cash payment, it looks tempting. But this is all theory; I’ll tell you better how it happened in practice.

I started by making a grocery list, which I advise you to do before going to the store. This is the simplest saving. Even if you buy something extra even with a list of products (this is my case:), then take with you exactly enough money for the purchase, with a small margin. This way you don’t leave yourself the chance to spend beyond your budget.

Next, I opened the application, went to the “cashback” section and noted the products from which you can get it. It is important to pay attention to the conditions for receiving cashback from a particular product. For example: cashback for 2 packages is 10%, and for three or more packages - 20%. Or a more common condition: for goods costing from 100 ₽ to 249 ₽ a cashback of 10 ₽ will be credited, and over 250 ₽ it will be 30 ₽.

After reviewing the conditions, I slightly changed the quantities of some products in the list to achieve maximum savings.

Now with the untouched part of the list, for which there is no cashback, we go to the “promotions” section. There will be no refund on the card for these items, but there is an opportunity to save a lot of money. But remember: everything is good in moderation, a low price should not push you to buy a product you don’t need. This is the main reason why you need to go to the store with a shopping list - there is less scope for spontaneous purchases.

So, everything is ready, we go to the store and buy everything strictly according to the list. By the way, I forgot to mention, the shopping list itself can also be kept in the application. And don’t just write down “cheese, butter, buckwheat,” but select specific promotional products from a specific store and add them to the list.

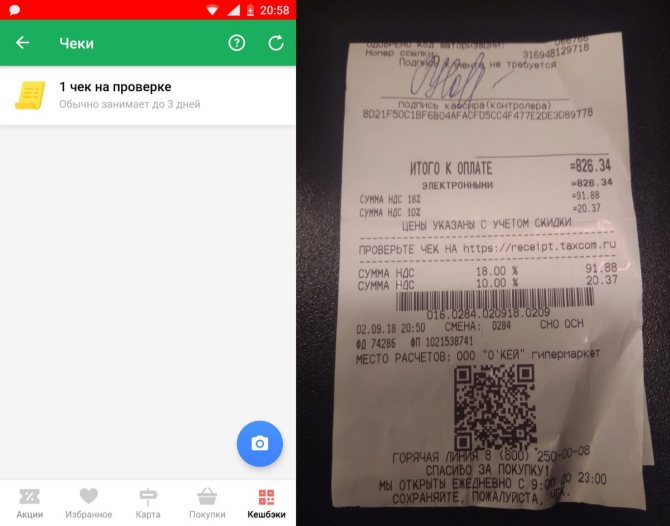

At the checkout after the purchase, we take the receipt and check that it has a square QR code. It must be scanned by the application within 24 hours after purchase. All is ready. The check has been sent for verification, it is written that this process takes a maximum of 3 days (my check was checked within 24 hours). Such a long period is necessary to check all the conditions and protect yourself from scammers.

Another interesting point: you can also get cashback when paying in cash. Yes, that's right, even though it's unusual. The only difference is that you need to have time to scan the receipt not 24 hours in advance, as when paying by card, but 3 hours after the purchase.

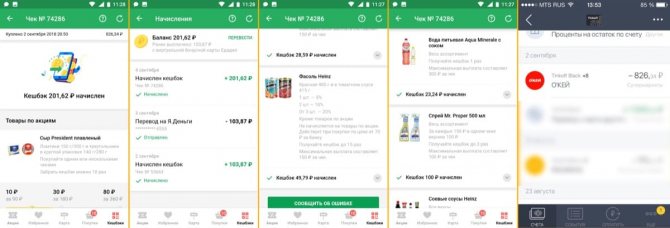

What cashback did I receive and what conclusions did I draw?

The next day after going to the Edadil store, I returned 201.62 rubles from a purchase worth 826 rubles. The cashback was 24%, which is very impressive. Of course, this result will not happen every time. To test, I mainly took cashback products that I intended to buy only on my next trip to the store. But this is not as important as the fact that you can now return money from purchasing products, and in a tangible amount. And now a small bonus: in addition to the cashback from Edadil, I also got 1% back from the cashback program of my bank card.

Conclusions that I made using the application:

- You can consistently save about 15% on products through cashback, promotions and coupons.

- Cashback is a better type of savings than promotional items: the old price before the promotion is not always indicated honestly and the “impressive” discount is actually 1-2%.

- The size of the benefit directly depends on your attention and time spent on planning purchases.

In conclusion, I advise you to try using the application yourself, your experience is better than anyone else’s, especially since now there are a number of cashbacks and coupons that will be of interest to almost everyone.

Previously, Sberbank provided an email address to quickly resolve any problems.

Attention! Until July 26, everyone can receive a Xiaomi Mi Band 5 sports bracelet for free, spending only 2 minutes on it.

Join us on Google News , Twitter, Facebook, VKontakte, YouTube and RSS to stay up to date with the latest news from the world of future technologies.

AKKet.com Telegram channel

Receive notifications about new materials directly in the messenger - on iOS, Windows, Android and Linux.

MoneyEdidPersonal experienceRussiaSberankTips

Mobile application of the Federal Tax Service

Several years ago, the tax service launched a special mobile application “Checking Receipts”, through which each of us can check whether the seller has deceived him.

And not so long ago, the Federal Tax Service announced that the application had been modernized - and now, among other things, it allows you to receive cashback for purchases and various bonuses for participating in promotions of manufacturers and trade organizations (official information from the Federal Tax Service dated July 14, 2020 “About mobile application "Checking receipts").