Samples of complaints against a bailiff for illegal withdrawal of funds

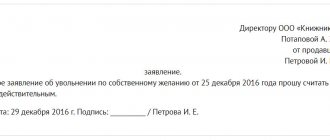

ATTENTION! Look at the completed sample complaint against a bailiff for illegal withdrawal of funds to the Prosecutor's Office:

and complaints against the bailiff for illegal withdrawal of funds, you can use the links below:

Complaint to the Prosecutor's Office against the bailiff

Realizing that at this rate the case would not move forward, we wrote an appeal to the Moscow Prosecutor's Office and a month later we received a response from them, I quote “Your rights have been violated or obstacles have been created to the exercise of your rights and the realization of legitimate interests, in accordance with Art. 4 of the Code of Administrative Proceedings of the Russian Federation, you have the right to independently apply to the court with an administrative statement of claim.”

The answer is of course short and obvious! I wonder what the Prosecutor's Office actually does? By quoting articles of law and stating obvious facts?

How to write an application correctly

An administrative complaint is written in compliance with the requirements for documents of similar content. In communication, it is important to clearly formulate what actions of the official led to the violation of the applicant’s rights.

A complaint against the actions of a bailiff in connection with the illegal write-off of funds should consist of several sequential parts:

- Description of the situation;

- A message about the actions performed by the bailiff;

- List of violated rights;

- Requests to eliminate the violation.

Attention! Among other information, it is advisable to indicate a contact telephone number so that a service representative can contact the applicant to clarify important circumstances or schedule an appointment.

The law does not provide for a special form of application to the Federal Bailiff Service. When drawing up a complaint, it is not necessary to refer to specific provisions of federal law. It is enough to clearly and meaningfully state the essence of the problem and your requirements.

Can bailiffs seize parents' property for children's debts? Read here.

However, when drawing up administrative complaints submitted to the senior bailiff, prosecutor or judicial authorities, it is necessary to take into account important nuances, namely:

- A complaint submitted to the head of the bailiff department must contain an indication of specific actions that the bailiff must take;

- In a complaint addressed to the prosecutor, it is necessary to express your disagreement with the actions of the bailiff or his inaction, and also state the requirement to conduct an inspection, identify and punish the perpetrators, and restore the violated rights of the applicant;

- A complaint to the court must necessarily contain the applicant’s demand to recognize the actions or inaction of the bailiff as illegal, as well as the obligation of the official to eliminate the violations committed. To prove the validity of the stated demands, you must provide the court with documents confirming the fact of the violation (this could be your application to the service, a response refusing to satisfy the demands, and other evidence of the official’s guilt).

We are preparing a lawsuit against bailiffs

After two weeks, an answer was received by email from the border guards that on January 29, 2020, the travel restriction was lifted (there were, of course, no new vacation vouchers attached to the letter). We began preparing a lawsuit in court, we filed a statement of claim from the two of us (two plaintiffs) and we had two defendants: the Federal Bailiff Service and the Ministry of Finance of Moscow.

At the end of February 2020, we filed a lawsuit with the Tverskoy District Court of Moscow. But the judge decided that she would not take up our case and ruled that we had filed a lawsuit in the wrong court. She gave us the ruling only in May 2020. Although we did everything correctly, we had no desire to pursue a complaint against this judge, and we took our claim, along with the ruling of the judge of the Tverskoy Court, to the Meshchansky District Court of Moscow.

In June 2020, a preliminary hearing was scheduled in the Meshchansky Court, to which, in addition to us, a representative of the Ministry of Finance came, this was the only time we saw her. I think it makes no sense to talk about the fact that meetings are held once a month and that you have to wait in stuffy steam room corridors for at least 3-5 hours to be invited to the meeting room. The windows are without handles, there are no vents, there is simply nothing to open for a fresh breath of air. There are no air conditioners in the corridors of the Meshchansky Court for all those waiting; everyone waits - sweaty and wet, apparently so that next time the desire to defend their rights will disappear. In general, in our country “everything is for the people”! The bailiffs were silent at the trial, so we still don’t know who from the FSSP set us up like that, but the fact that it was the FSSP’s fault is clear. In response to the judicial request, the border guards sent information from the registry, and it was confirmed that on November 6, 2020, “some” FSSP employee issued a decision on the temporary restriction of exit to the spouse. Questions immediately arise: “For what?” "For what?" “What are the reasons? “We still haven’t received any answers. The prosecutor's office also did not help in this matter.

Where can money be withdrawn from?

The execution by the bailiff of his official duties involves close cooperation with other government bodies that have comprehensive information about the presence or absence of funds and property from the debtor.

Upon official request, credit institutions provide information:

- On the availability of accounts and deposits opened in the name of the citizen, indicating the balance of each account;

- About the presence of other valuables of the debtor stored in the bank.

Currently, there are no credit institutions on the territory of the Russian Federation that do not cooperate with the FSSP. At the same time, a bank with which the federal service has entered into a cooperation agreement does not have the right to hide information about its clients if it receives an official request. For failure to comply with the requirements of the bailiff, the bank faces administrative punishment.

Federal legislation allows the write-off of funds located:

- On the debtor’s salary and debit cards;

- On personal accounts of electronic wallets;

- On stock accounts.

In addition, federal government employees have the right to write off funds from citizen’s credit accounts and cards. All property obligations of the debtor are repaid from the written-off funds.

What funds are not subject to seizure

In accordance with the federal law “On Enforcement Proceedings,” the bailiff has the right to seize the money in the account with subsequent write-off to repay the debtor’s debts. In this case, the account itself is not blocked.

Funds in the debtor's accounts, including salary and credit, are subject to seizure and write-off.

However, federal legislation provides for a list of a citizen’s financial assets that cannot be foreclosed on (Article 101 of Federal Law No. 229-FZ), namely:

- Compensation payments for damage caused to the life and health of a citizen;

- Survivor's pensions;

- Alimony payments;

- Insurance payments;

- Amounts of maternity capital;

- Social benefits for children;

- Other payments.

How to prepare?

It is worth understanding that going to court is a rather serious measure. The search for justice against an employee should not begin with this institution if there was no criminal intent in the actions of the bailiff. But everything, of course, depends on the specific situation, and only a competent lawyer will help you understand all the circumstances and determine the need to file a claim.

If, during the performance of his official duties, the bailiff exceeded his powers, or acted unlawfully, this fact should be reported to the judicial authorities as soon as possible. Although missed deadlines in this case cannot be a reason for refusing to accept an application, the law establishes a 10-day period for filing claims against the actions of SSP employees in case of violation of the rights and legitimate interests of citizens.

In addition, it is worth considering that the bailiff has the right to appeal the charges brought against him. The period for consideration of a claim against the actions of a bailiff is 10 days, but the official has 1 month from the date of completion of the proceedings to appeal the court decision. The more justified your demands are, and the greater the evidence base indicating the illegality of the actions or inaction of the bailiff, the greater your chances of defending your interests.

Reasons for withdrawing funds

An official has the right to foreclose on a citizen’s funds only within the framework of enforcement proceedings initiated against him. The basis for initiating proceedings are court decisions that have entered into legal force, as well as decisions of authorized bodies.

When a corresponding decree on seizure or write-off of funds is issued and sent to the bank, the bailiff is obliged to notify the debtor about this, that is, send him a copy of the document signed by the head of the department.

If the funds in the debtor's accounts in a particular credit institution are insufficient, the bailiff forecloses on the funds stored in other banks.

The following documents submitted to the bank may serve as grounds for writing off funds from the debtor’s accounts:

- Court statement;

- A writ of execution issued on the basis of a court decision that has entered into force;

- Resolutions of bodies performing control functions (for example, Pension Fund, Tax Inspectorate);

- Resolution of the bailiff, signed by the senior bailiff.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The actions of FSSP officials are clearly regulated by federal law, so if a bailiff violates the provisions of the law and the job description, his actions may be considered illegal. For example, in cases where funds continue to be written off after the debt has been repaid in full or after the citizen has independently repaid his debt.

The procedure for writing off money by bailiffs

Unlike the procedure for seizing property, writing off funds from accounts does not require the obligatory presence of the debtor, with the exception of sending a notification to the citizen.

In addition, in order to seize an account and write off money from it, the bailiff is not required to obtain the consent of the debtor.

As for notification, the postal service is responsible for late delivery of a registered letter to the addressee.

The funds are written off after the bailiff performs the following sequential actions provided for by law:

- Initiation of enforcement proceedings on the basis of a writ of execution received by the service;

- Sending an initiation order to the debtor;

- Sending requests to credit institutions for the availability of accounts opened in the name of the debtor;

- Issuance of a resolution on the arrest and write-off of funds in accounts (sent to the bank and the debtor for notification);

- Issuing and sending to the credit institution a resolution to lift the arrest if the written-off funds were sufficient to repay the debt.

Important! If the amount written off was not enough, funds will be written off until the debt is fully repaid.

At the same time, in accordance with the new rules, the bank is not obliged to notify the client about the debiting of funds. Therefore, information about the write-off can only be obtained upon a written request sent to the bank or the territorial division of the FSSP.

Where to go

There are three authorities to which you can contact in case of violation of rights by employees of the federal service:

- Service management. In accordance with the hierarchy established, each employee of the service is primarily subordinate to his superior (senior bailiff of the department). When filing a complaint in the order of subordination, be prepared for the fact that the assessment of the bailiff’s actions may turn out to be biased. If you are unsure, it is better to contact the supervisory authority.

- To the prosecutor's office. This is a more effective method, since the competence of the prosecutor’s office includes the function of monitoring the activities of government bodies, including the divisions of the FSSP. Upon a written request from a citizen, the prosecutor's office is obliged to verify the legality of the official's actions. The period for considering a complaint and sending a response, as a rule, does not exceed thirty days. Since the prosecutor is not vested with the authority to cancel decisions made by officials, in practice two options are possible: either the bailiff, on the proposal of the prosecutor, will cancel the decision himself, or the prosecutor’s office will go to court.

- To the court. If the actions of the bailiff violate the rights of a citizen, this is the most effective way to recognize them as illegal and restore your rights. It is important to remember the procedural deadlines for filing a complaint with the court. This can be done no later than ten days from the moment the violation was discovered. The period is calculated from the date of the decision, if the citizen learned about it immediately, or from the date of notification, if it became known from a letter sent to the debtor. Please remember that missing a deadline without good reason may result in your complaint being rejected.

What to do if too much money is seized?

Debtors often encounter situations where bailiffs request too large sums. As a result, there is no money left on the card at all. In this case, it is important to react as quickly as possible. First of all, the funds are blocked in the debtor’s account for a while and only then are written off. If you have time to submit a request for a refund before the transfer (within three days), you can get your money back quickly. Otherwise you will have to wait a long time.

Important

You can quickly return the money within three days after it is blocked on the debtor’s account, before transfer.

To receive a refund, you must submit an application directly to the executive service. What to do if the bailiffs did not respond to the application? File a complaint with one of the following authorities:

- to the prosecutor's office;

- chief bailiff or head of department.

Next you need to go to court. The statement of claim is considered by the court for no longer than 10 days, after which a decision is made on a partial refund. If you have a difficult financial situation related to life circumstances, you can achieve a write-off of no more than 30% of the profit.

Ways to file a complaint

You can submit a complaint about the actions of the bailiff in one of the following ways:

- On a personal visit;

- Through the Internet;

- By post (registered mail with notification and a list of attachments);

- Through a proxy (representative).

If the complaint is submitted in person, you must have a copy or a second copy with you, on which the authorized person of the government body must put a mark of acceptance.

If the complaint is sent by mail, it must be sent by registered mail with notification. After the letter is delivered, the applicant will receive a return notification with a signature and date of receipt. If copies of supporting documents are sent along with the application, it is advisable to make an inventory of the internal contents of the envelope.

When sending a complaint via the Internet, you can use a standard document template. The complaint will arrive faster, but the likelihood of its consideration is much lower. That is why lawyers recommend using more reliable delivery methods.

If it is not possible to personally visit the authorized body, filing a complaint through a representative is permitted. To do this, you must attach a copy of the notarized power of attorney to your application.

Responsibility of bailiffs

Like any other person vested with authority, the bailiff is responsible for violation of the law.

The employer of the offending employee has the right to apply one of the following disciplinary penalties to him:

In case of inadequacy for the position held, the employee may be dismissed.

In addition, an official who has committed a gross violation of current legislation is subject to administrative or criminal liability.

In practice, cases of bringing employees to disciplinary liability are not very common. This is explained by a shortage of personnel and low pay for civil servants. That is why each qualified employee of the department is on a special account, and disciplinary sanctions are rarely applied by the employer.

How an account is seized

When the Federal Bailiff Service (hereinafter referred to as the FSSP) has a writ of execution for the collection of funds, it begins to search for his accounts in credit institutions. This occurs by sending requests with a resolution to the banks in the debtor’s region of residence. Or already existing details are used (for example, if the account is a salary account, and the place of work is reflected in the court case, or if the FSSP already has the citizen’s data in its file cabinet). In the event that a credit institution has accounts of the specified person, the bank’s legal service checks the legality of the grounds and makes an arrest. (How to complain to the FSSP - read this article.)

The bank is obliged to execute the resolution immediately, that is, on the same day when the document with the demand is sent, in accordance with paragraph 3 of Article 81 of the Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 299-FZ) . In this case, the insufficiency of the amount required to fulfill the obligation does not play a role.

Grounds for seizing an account

The following authorities are authorized to impose restrictive measures on bank accounts:

- Tax Service (applies only to legal entities and individual entrepreneurs; the accounts of individuals can only be seized through the court).

- FSSP - most often acts as an authorized body that carries out this procedure within the framework of enforcement proceedings on the basis of a court decision or order, both for individuals and legal entities.

- Judicial authorities imposing restrictive measures on the accounts of individuals in criminal proceedings

Measures to seize an account vary for individuals and enterprises of any form of ownership.

For individuals:

- Within the framework of criminal proceedings (Article 115 of the Code of Criminal Procedure), when these measures are used for interim purposes for the execution of a sentence for a suspect or accused, as well as in cases where persons are not suspects, but there is reason to believe that their property was obtained as a result of a crime , or used to finance terrorism. The decision is made by the court at the request of the investigative authorities. These reasons are quite rare.

- As part of a civil or administrative process, when a court decision has been made and enforcement proceedings are underway. Most often it concerns cases related to unpaid loan obligations, utility payments, fines or alimony and other civil claims for the collection of funds. In this case, it is legitimate to call this process collection of funds, but since the term “account seizure” is widely used in popular sources, this article will mean “seizure” including collection measures.

For legal entities:

- In arbitration proceedings between legal entities and individual entrepreneurs as an interim measure for the fulfillment of obligations (Article 80 of Law No. 229-FZ) or as an independent measure to limit all actions with finances (Clause 5 of Article 68 of Law No. 229-FZ). The executors are the FSSP.

- In case of non-fulfillment of tax obligations or failure to provide tax reporting by companies.

How to file a claim?

An application to appeal the action/inaction/decision of a bailiff is submitted to the district court in which he performs his duties. It can be submitted within 10 days; the beginning of the period is fixed on the day when the applicant learns of a violation of his own rights.

If the deadline is missed, the opportunity to challenge the bailiff’s decisions still remains - along with the administrative claim, a petition should be filed to restore the claim period. Without a request, the application will not be considered.

The situation with determining the period is complicated if the person’s inaction is appealed. Then one should rely on the supposed moment when the applicant could have learned about the inaction.

In some cases, it makes sense to file an administrative claim with higher authorities. It is better to resort to this option if the bailiff performs actions that go beyond the scope of enforcement proceedings.

This is a justified move, since the bailiff does not have the right to perform actions that go beyond the scope of enforcement proceedings. Such a decision will also be justified if the person who committed the actions subject to appeal has not been reliably identified (it is not clear).

Sometimes it becomes useful to familiarize yourself with information about enforcement proceedings before writing a statement of claim. To receive materials, you must complete and submit an application for review; it is also written according to the sample.

How to find out the reason

Since banks are prohibited from warning clients about restrictive measures on an account, this may come as a complete surprise to a person. This is most often found out when trying to carry out any operation to withdraw or transfer money.

In the event that it is unknown why the arrest occurred, it is necessary:

- check with the bank the number of the enforcement proceedings within which the bailiffs acted;

- on the website fssprus.ru find this case and find out what specific obligations are presented for execution;

- Contact your local FSSP office to clarify the circumstances.

Mistakes that are made in enforcement proceedings

Since several stages pass from the issuance of a court decision to the transfer of information to the bank, bureaucratic oversights occur, as a result of which a citizen or legal entity remains the victim. Please pay attention to the following points:

- Failed identification error. This happens because when filling out the order, the bailiff is required to indicate only the full name and date of birth, as a result of which random coincidences occur or erroneous data is provided.

- Double arrest or double penalty. In such cases, the reason is the bailiff’s mistake: the amount of the collection was written off twice. It also happens that the debtor paid the debt, but the amount has already been written off. These errors are corrected during the proceedings, and the money is credited back.

- Collection of a debt from funds that, according to law, cannot be seized. This situation is not uncommon because the bank and the FSSP are not obliged to find out the origin of the funds. Therefore, only the citizen himself can challenge this action.

Which accounts are not subject to seizure?

According to Art. 81 of Law No. 229-FZ, executive bodies do not have the right to impose restrictions and penalties on the following funds of individuals relating to social support for vulnerable groups of the population:

- child care benefits, including amounts of money transferred as alimony;

- maternity capital funds;

- insurance benefits, with the exception of old-age and disability pensions;

- one-time payments of financial assistance accrued in connection with emergency circumstances, natural disasters, etc.;

- amounts allocated for compensation for harm to health, for reimbursement of funds to disabled people for treatment and vouchers for sanatorium-resort holidays;

- funeral benefits and on the death of the breadwinner.

What if there are not enough funds to cover the debt?

If there is not enough money in the debtor's account, deductions are temporarily suspended and resumed from the moment income appears. This procedure can last quite a long time - until the entire debt is covered in full.

Info

Thus, the seizure of a pension card is a completely possible phenomenon, which is regulated by law. The enforcement service has the right to collect no more than 50% of the debtor’s income. If this amount is exceeded, you can apply for a refund, as well as a complaint and legal action in case of refusal or neglect by the bailiffs. Complaints must be accepted by the heads of executive institutions or employees of the prosecutor's office.

The arrest can be completely lifted only by returning the entire debt. First of all, funds are withdrawn for alimony or compensation for harm to health - then all other types. However, this is not the only way to pay off debts. By contacting the bailiff in a timely manner, you can agree on installment payments or deferred payments.

How the debtor must be notified by law

First of all, the citizen must be notified of the judicial proceedings against him according to the regulations defined in Article 113 of the Code of Civil Procedure of the Russian Federation. Then the bailiffs who opened enforcement proceedings must comply with the following conditions, according to Article 26-27 of Law No. 229-FZ:

- A summons with notification of the commencement of enforcement proceedings is handed over to the debtor personally or sent by mail.

- The period allotted for the voluntary execution of a court decision has passed (usually 30 days).

- There are no sufficient funds to pay the amount being collected.

However, situations when a citizen is not notified of any stage of the procedure and is immediately faced with seizure (collection) of property still happen.

How to remove a seizure from an account

In order to lift the ban on the use of funds or challenge the collection, first of all, it is necessary to find out whether they were made lawfully - whether there were legal grounds, or whether an error occurred. If a penalty or a ban on the use of funds is imposed incorrectly, then this action should be challenged. Most often, legal grounds are still present. Then the simplest solution is to pay off the debt that is being collected by the bailiffs. If the amount of debt is large and it is not possible to pay it at once, or the bank has frozen funds that are not subject to seizure, or as a result of the imposition of these measures you have been left without a livelihood, you can appeal the decision. To do this, follow the algorithm described below.

Amortization

When the reason for the seizure of a bank account is known and the citizen agrees with the legality of the grounds, you can independently eliminate the reason for the prohibitive measures and pay off the existing debt according to the details indicated on the FSSP website in the case of this enforcement proceeding. The debtor's actions will be as follows:

- payment of the debt amount;

- submitting a payment document (paper or electronic receipt) to the FSSP department in your case;

- closing the case by the bailiff and sending a decree to lift the arrest to the bank.

The difficulties faced by citizens in such cases are related to the fact that the bailiff may not immediately send the resolution to the bank, and the debtor himself does not have the right to send a copy of this document, since the ban on spending money is lifted only by the authorities that imposed it. In this situation, you will have to wait a few days.

What to do if your salary card is seized: instructions

In any unforeseen situation, you should act according to a proven and legally developed algorithm. The first question will be how to remove the seizure from a salary card.

In this case, you should determine the reason why it is blocked. As stated above, there can be many of them.

Having established this fact, a number of measures are taken that will solve the unpleasant issue. Then you need to study the current regulatory framework and decide where to turn first.

Information about a possible debt can be checked on the website of the FSSP of the Russian Federation, in the “Bank of Enforcement Proceedings” section. And also one of the organizations that can quickly clarify this situation is a bank. Based on the data received from this institution, it will be possible to proceed further.

Step 1. Contact the bank

As mentioned above, most often the arrest is imposed by bailiffs by a court decision, which automatically forwards it to a financial organization. It is best to visit the head office of the institution at your place of residence, where all information is accumulated. This is usually the customer service department.

It is advisable to write a statement stating the essence of your problem. The bank will be required to respond to a written request and prepare a reasoned response within the time limits established by law.

The bank, upon the client’s request, must issue the following documents:

- a certificate on the basis of what and by what authority the arrest was imposed;

- statement with information on the status of the personal account.

Documents must be signed by an authorized employee and stamped by the financial institution. When the reason for the blocking is clear, we move on to the second step.

Step 2. We take documents at the place of work

The next step is to visit the place of work, where you need to contact the accounting department or the human resources department.

Specialists must issue:

- A document indicating the position held and in which organization the person works.

- Details of the current account to which wages are transferred.

It is important here that the manager’s signature and “wet seal” are affixed. They must fully reflect information about the employer.

The documents must indicate:

- name of the institution, TIN and OGRN;

- legal address;

- Full name of the head;

- the position held by the person applying.

People often ask why it is necessary to take a statement of the personal account number where the salary is transferred, because the bank will provide its details.

The document received from the place of work will indicate that it is the salary that is being calculated, and not other payments, which is important when applying to the FSSP. Therefore, the bailiffs will not have any additional clarifications.

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

Ask a question

You need to know this! When receiving certificates from your place of work or from a bank, you should check that they are filled out correctly. There should be no inaccuracies, omissions, errors, or discrepancies.

Step 3. We write a statement to the bailiff

Having collected all the necessary documents, you need to contact the bailiff service at your place of residence. It is best to come on the appointment day.

Any actions of these officials are carried out on the basis of an established enforcement case. Therefore, the first thing you need to do is write an application to remove the seizure from your salary card.

The document must indicate:

- name of the branch and location of the FSSP;

- surname, name and patronymic of the bailiff conducting the court case, passport details of the applicant;

- the day, month and year when the production was opened, as well as its registration number;

- place of registration (residence) of the applying citizen;

- card details and legal address of the issuing bank.

You can also submit an application to familiarize yourself with the materials of the enforcement proceedings. The debtor must be familiarized with the documents held by the bailiff for execution. After reviewing the case, he will be informed about the basis on which the arrest was imposed and by what court.

After all formalities have been completed and the applicant has provided all the necessary evidence, the FSSP management will review the situation and make a decision to unblock.

Corresponding collections will be carried out in other ways - usually through the deduction of a fixed amount from the debtor's wages.

Application to remove seizure from salary card

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

Ask a question

Must know! If a court order was issued and the debtor did not know about it, it is possible to cancel it. To do this, you need to contact the magistrate court that issued it with an application to cancel the court order.

Step 4. We receive the resolution and submit the documents to the bank

After all the documents are handed over to the bailiff, he is obliged to remove the seizure from the salary card. After all, according to the law, the amount of deductions from income cannot be higher than 50%, maximum 70%. The bailiff does not have the right to withdraw the entire salary from the account.

A decision is made to lift the arrest. Having presented it at the bank, you need to write an application to unblock the account. Within three days, the financial institution must remove the restrictions.

Subsequently, the bailiff will hand over the writ of execution to the employer, who must transfer part of the salary to the FSSP account. Accordingly, the debt will be repaid.

Appealing the seizure of accounts: algorithm

If the arrest or collection was carried out illegally, or the bailiff service does not lift this ban, although the obligations have already been fulfilled, the citizen has the right to challenge both the court decision and the actions of the FSSP.

- When a debtor does not agree with a court decision (ruling), he appeals directly to the judicial authorities, namely to a higher court.

- When the grounds are legal, but the actions of the bailiff are unlawful or the person wants to change the collection procedure, release money that is not subject to seizure or reduce the monthly amount written off, you should first contact the FSSP, and if this does not help, then the actions of the bailiff can be challenged in court.

Grounds for application

Speaking about administrative claims against the actions or inaction of bailiffs, it is worth understanding that in order to file such a complaint with the judicial authorities, there must be clear grounds. If the claim does not have a legal basis, the plaintiff may be held liable for abuse of the right to appeal.

Of course, the most common complaint against bailiffs is debtors who feel that the behavior of employees in the framework of debt collection activities is unlawful. But there are also complaints about the inaction of SSP employees. So, for example, a bailiff, whose duties include searching for the alimony, may refer to the impossibility of collection due to the absence of the debtor at the place of registration. Here the complainant will be the claimant, since we are talking about failure to fulfill the duties of an employee of the SSP.

All official duties and rights of bailiffs are enshrined in Federal Law No. 118, namely in Article 12. There is also Resolution of the Plenum of the Supreme Court of the Russian Federation dated November 17, 2015 N 50 “On the application of legislation by courts when considering certain issues arising during enforcement proceedings ”, where parts 8 – 16 set out the procedure for challenging the actions and inactions of the bailiff. If you are going to file an administrative claim against a bailiff, then the first thing you need to do is read the text of the legislation. By contacting a lawyer who has experience in drafting such statements, you will be able to prepare a claim and send it to court much faster. If you get a reliable lawyer, you can trust him to support your case and significantly increase your chances of success.

Contacting the FSSP

To challenge an unlawful action or inaction of FSSP employees, you should first contact the executive officer. To do this you need:

- Obtain a copy of the arrest order from the bank. The document must indicate the person who is conducting the specific enforcement proceedings.

- Check the phone number at your local office and make an appointment; you can also do this on the website fssprus.ru.

- Prepare a package of documents confirming the applicant’s authority.

How to file an appeal against a decision

The package of documents must include:

- A copy of the resolution.

- Identity document.

- An application addressed to the bailiff, which briefly describes the essence of the appeal;

- Documents proving your rights. It can be:

- an account statement confirming the origin of your funds, which cannot be subject to seizure;

- 2-NDFL certificate from the employer, necessary to determine the amount of income and the amount to be collected (no more than 50%);

- an extract confirming the amount written off if the collection was made unlawfully;

- confirmation of debt repayment - a receipt or other payment document in cases where the debt is repaid but the restriction has not been lifted, or when a double write-off has occurred.

If contacting the bailiff does not help, you must appeal his actions to the territorial authority with the head of the department. Here you can complain about the seizure of a bank account.

Complaint to court

The higher authorities supervising the work of the FSSP are:

The most common way to challenge the actions of the FSSP is through the court . To do this, it is necessary to prepare all the documents listed in the previous paragraph, attach to them an application addressed to the FSSP employee and an appeal against the decision. In addition, you need to prepare a statement of claim. To win a court case, the evidence base must be collected and all procedural nuances must be observed.

- A claim is filed in an arbitration court when the plaintiff is a legal entity or individual entrepreneur.

- A claim is filed in a court of general jurisdiction when the plaintiff is an individual. In most cases, at the place of residence or stay of the plaintiff.

The claim must include the following information:

- name of the court;

- Full name, date of birth of the plaintiff;

- seized account number;

- description of the essence of the case: circumstances, reasons why the actions of the FSSP authorities are illegal;

- details of the defendant - name of the FSSP unit, full name of the bailiff;

- a list of documents attached to the case.

The card has been seized - what to do?

The pensioner must be initially warned about the opening of enforcement proceedings and given the opportunity to voluntarily repay the debt. You can ask for installments and other repayment methods. If this is not possible, all that remains is to write off money from the pension card, but in an amount not exceeding 50% of the total income. For your own safety, it is better to make a statement. Has a large-scale arrest already occurred? You must apply for a refund.

Advice

To solve all the difficulties, you need to find out in advance who your contractor is. You can use the help desk or the FSSP service. Find out contact details, make an appointment with the contractor to further resolve the problem.