Author of the article Marina Afanasyeva Tax consultant with 5 years of experience.

Hello. If the apartment was purchased only with your own cash without using a mortgage, maternity capital, etc., you can count on a tax deduction for purchase costs. In the article, I described in detail and step by step how to file a deduction, what documents to collect, how to submit them to the Federal Tax Service and how to return personal income tax.

Article 220 of the Tax Code of the Russian Federation. Property tax deductions - please read this article carefully.

→Find out for free what deductions you are entitled to and how much money you can get back. Specialists from ReturnNalog.ru will figure out for free what deductions you are entitled to and calculate how much money you can get back. Hurry up to return your taxes for 2020, otherwise they will be burned.VerniteNalog.ru

Who is entitled to a tax deduction?

- Residents of the Russian Federation who stay in the country for more than 183 days a year and pay taxes.

- Working pensioners if their income exceeds the minimum wage.

Pensioners who no longer work can also receive a deduction if they retired recently, but before that they worked and paid taxes regularly. In this case, the payment amount is calculated from income for 3 years before purchasing the apartment. Read about whether a pensioner or unemployed citizen can receive a deduction here. - Foreign citizens who are residents of the Russian Federation and pay income tax.

What conditions must be met?

Before you start collecting papers, you need to understand whether a particular case falls under the requirements for obtaining a tax deduction when buying and selling an apartment. The following categories cannot receive a tax deduction :

- Non-residents of the Russian Federation.

- Legal entities.

- Individual entrepreneurs who use the simplified tax system. About in what cases and how an individual entrepreneur can return a tax deduction from the purchase of an apartment is discussed here.

- According to Article 105.1 of the Tax Code of the Russian Federation, the deduction cannot be received by persons who are related to each other by family ties, i.e. if the transaction was made with an interdependent person (this is one of the spouses, parents, children, brothers and sisters, as well as guardians and wards).

- Persons who have already received their deduction (if the apartment was purchased before January 1, 2014) or have exhausted their limit (if they bought housing after January 1, 2014).

- Persons who work unofficially and do not pay income tax.

- Citizens who purchased housing using employer funds.

- Persons who bought an apartment with the help of maternity capital or using other government programs.

Is it possible to return personal income tax when purchasing housing for a second time?

So, how many times can you use the benefit? If you purchased a home before 2014, you can apply for the deduction once . If housing was purchased after January 1, 2014, you can claim the deduction as many times as you like until the limit of 260,000 rubles is spent.

You can claim a deduction when purchasing a 2nd apartment if the documents were not submitted when purchasing the 1st or the maximum payment amount in the first case was not reached.

Example. If 1,700,000 rubles were paid for housing, then 221,000 rubles are due as a deduction. The limit of 260,000 rubles has not been exhausted. And the remaining 39,000 rubles can be claimed when purchasing a second apartment.

How long does it take to submit documents?

There is no limitation period for filing documents for tax deductions . So, if the property was purchased several years ago, but the buyer only applied for a refund now, then he retains the right to deduct. But the declaration is submitted only for the last 3 years.

Example. The apartment was purchased five years ago. The buyer submits documents for a tax deduction. He has the right to do this, but the taxes paid will only be returned from the last three years.

Determining the timing of receipt

When can I get a tax deduction when buying an apartment?

The time to contact the tax office is no earlier than one year after:

- acquisition of real estate;

- reaching adulthood;

- official employment.

When calculating the property return, all of the above factors are applied. How long will it take to get 13 percent back from buying an apartment from your employer? When registering a property deduction from an employer, you do not need to wait for the subsequent tax period .

For example , Leonov V.S. I bought an apartment in August 2016. He can apply for an income tax refund when purchasing an apartment; the payment deadlines will be in August 2020. He will receive the right to file a deduction with the Federal Tax Service. If it is issued by the employer, the documents can be prepared starting from September 2020.

We hope you understand from what year the tax deduction for the purchase of an apartment applies. Let's move on.

Limitation periods

As stated above, there is no limitation period for the purchase of a tax deduction when purchasing an apartment. That is, it applies to future tax periods :

- until full repayment;

- until the termination of official labor activity.

Because of this, minor owners whose parents did not apply for the deduction will be able to apply for it upon reaching the age of majority and getting a job.

For example , the Kozhanov family registered housing as shared ownership for twins born in 2012. The purchase took place in 2014. Since the parents had previously used the receipt of 13% of the purchase amount, this right was legally transferred to the children. After how many years can I get a tax deduction when buying an apartment for the Kozhanovs’ children? They will be able to use it no earlier than 2030, when they turn 18, subject to official employment.

For what period of time is it issued?

Let's find out from what year you can get a tax deduction when buying an apartment. The benefit is issued annually for the previous tax period . That is, the buyer is refunded the amount of tax paid in the previous year.

Registration with the employer provides for a monthly refund of tax withholding from wages accrued for the previous month.

Having found out how long it takes to get a tax deduction when buying an apartment, let’s move on to examples .

Pelikanova V.M. and Shishakova G.V. We bought an apartment and registered it as shared ownership in 2013. Pelikanova V.M. applied for a deduction to the Federal Tax Service, registering it in 2014. At the end of this year, she was granted a refund of tax withholding for 2013, calculated from the date of registration of the share in the right to housing. Shishakova G.V. received a benefit at the place of official employment, from the moment of receiving documentation from Rosreestr, which allowed her to receive a deduction from the date of registration, already in 2013.

When to file a tax deduction for the purchase of an apartment?

The law does not provide for regulations on when you need to apply for a tax deduction after purchasing an apartment. They have the right to decide the timing of filing a tax deduction when purchasing an apartment at their own discretion, but not earlier than a year after registration with Rosreestr .

For example , Pelikanova V.M. received a registered agreement from the MFC - 09/13/13, since 09/14/14 turned out to be a day off, the declaration was submitted on 09/15/14.

When applying for a tax benefit from an employer, you do not need to submit a declaration.

How long will it take to receive it?

The declaration is submitted annually for the previous period.

How long after purchasing an apartment should I contact you? If you need a refund of a tax deduction when purchasing an apartment, the deadline for paying the entire amount of the deduction will be when the calculated amount of withholding tax is fully received by the purchaser of the home .

For example , from the share of G.V. Shishakova. a property return amount of 80 thousand rubles was accrued. Her average monthly income is 38 thousand per month. Monthly deductions retained as a tax benefit amounted to RUB 4,940. Accordingly, for the year she received 59,700 rubles per year. The balance of 20,300 was received in the first half of 2014.

Nuances in individual cases

- Where was the property purchased ? In a new building or on the secondary market - does not affect the possibility of obtaining a tax deduction. Only the documents required to be presented will differ.

- Buying a home with cash . In this case, you must provide a receipt from the seller stating that the funds have been received.

- Installment deal . You can submit documents for tax deduction several times in accordance with installment payments.

- Deal with relatives . In this case, the right to deduction is canceled.

- Buying an apartment under the DDU . The right to deduction can be used after signing the housing acceptance certificate. The deduction is calculated based on the actual expenses of each payer. If the property was purchased before January 1, 2014, the amount of the deduction is distributed among the participants in accordance with their shares.

- Buying an apartment in a house that is under construction . The deduction can be claimed after signing the transfer deed.

- Buying an apartment in joint ownership . Spouses purchasing property in joint ownership can distribute the deduction among themselves. In this case, you need to submit a copy of the marriage certificate and an agreement between the spouses on the distribution of payments.

- Buying a share of an apartment . The tax base will be the actual costs incurred by the buyer.

- Buying an apartment while on maternity leave . How to get a tax deduction if you are on maternity leave (maternity leave)? This will be possible upon returning to work or from other income subject to personal income tax.

- Purchase of an apartment by one of the spouses . Is it possible to issue a refund to someone else? The second spouse has the right to a deduction regardless of who owns the property. If the purchase amount is more than 2 million, it is advisable to divide the deduction between both spouses.

- Buying an apartment for a child . You can get a deduction when buying an apartment for a child. For minors, their legal representatives receive payments. A minor can receive a deduction upon reaching the age of majority.

There are certain nuances in obtaining a deduction when selling an apartment that has been owned for less than or more than 3 to 5 years. You can learn more about them from this article.

The deduction is possible not only when purchasing a home, but also when finishing it and connecting to communication networks. In this case, it is important to keep receipts confirming expenses.

Expert opinion

Voitova Anna Anatolyevna

Experience in advising on legal issues of individuals - more than 5 years

In fact, according to the Letter of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia No. 03-04-05/23340 dated April 22, 2016, owners of new housing must provide not only documents that confirm the costs of finishing and connecting to networks, but also a document , confirming the lack of connection and finishing. As such a document, an apartment delivery certificate may be attached, which indicates the condition of the apartment. This norm applies more to new buildings than to secondary housing.

8 (800) 350-29-87Moscow

Features of the deadlines for filing a declaration and receiving 13%

Some features of property transactions entail legal features that should be taken into account when applying for a tax deduction.

Registration for a mortgage

Let's figure out when you can return the tax on the purchase of an apartment with a mortgage. In this case, registration dates are taken into account :

- property transaction;

- loan agreement.

This is dictated by the fact that in addition to the costs of purchasing a home, the owner overpays interest on the loan .

Let's find out when you can get a tax deduction after purchasing an apartment if you have taken out a loan. Receiving a tax refund from a loan agreement is allowed only after repayment of interest on the loan, in a proportionate amount . Therefore, the timing of personal income tax reimbursement when purchasing an apartment depends on when the loan is repaid.

When applying for a mortgage, a deduction of up to 3 million rubles is allowed, taking into account the payment of an annual interest rate.

Registration by a pensioner

An officially employed pensioner can apply for a deduction in the general manner.

If he doesn’t work , the terms for paying 13 percent when buying an apartment can be moved back by 3 years. In this case, he draws up a deduction after registering the agreement, but receives the withheld funds one by one for the 3 previous tax periods.

Registration for a child

Parents can receive retention for a child if they have not previously used the opportunity provided.

Otherwise, the child will be able to take advantage of the benefit, becoming a legal citizen and taxpayer of the Russian Federation.

Registration as an individual entrepreneur

Let's find out how long after purchasing an apartment you can return 13 percent for individual entrepreneurs. If housing was purchased by a person engaged in entrepreneurial activity and paid a tax of 13%, then he draws up a deduction on a general basis .

Persons using special tax regimes (USN, UTII, Unified Agricultural Tax, PSN) do not have such a right. How long does it take for the tax office to transfer the refund for the purchase of an apartment for such persons? They will be able to receive a personal income tax refund only a year after they switch to the normal income tax payment regime.

The article provides detailed provisions according to which it is easy to establish a tax deduction when purchasing an apartment: return periods. It also provides examples of the practical application of existing rules when tax can be refunded.

How is the maximum amount calculated?

Let's consider what percentage the tax office returns or, in other words, how much can be returned. The tax deduction is calculated as 13% of the property value . The maximum deduction amount is 260,000 rubles (if using a mortgage - 390,000 rubles). Those. if the price of real estate is above 2 million rubles (when buying a home with a mortgage of 3 million rubles), you cannot receive a payment greater than the accepted maximum amount. The amount from which the deduction is calculated is called the tax base.

Example. Andrey bought an apartment for 2,400,000 rubles without using a mortgage loan. 13% of this amount is 312,000 rubles (2,400,000 * 0.13). This amount exceeds the maximum; he can return only 260,000 rubles.

Example. Anna bought an apartment for 1,600,000 rubles, also without resorting to a mortgage. The refund amount is 208,000 rubles (1,600,000 * 0.13). Anna will receive it completely. And if she buys an apartment a second time, she will have a limit of 52,000 rubles.

But it should be taken into account that Anna’s salary is 30,000 rubles. The monthly income tax in this case will be 3,900 rubles (30,000 * 0.13). For 12 months - 46,800. This is the amount that Anna can return in a year.

For each calendar year, you can return the amount that the employer paid by deducting 13% from the salary of the applicant for a refund.

Are there special calculators?

You can use calculators to calculate the amount of payments. For example: https://rabotniks.ru/kalkulyator-ndfl-k-vozvratu-pri-pokupke-kvartiry/

Or a more detailed option, for example: https://vsevichety.ru/calculator

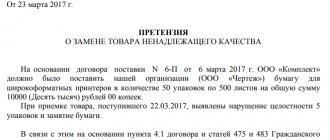

Grounds for returning money for goods according to the law

You can download the latest edition of Decree No. 924 on complex purchase objects using the link.

In accordance with the Law “On Protection of Consumer Rights”, money is not refunded for some products in the following cases:

- if defects in the product arose due to the fault of the consumer. For example, incorrect use of the purchased item, improper storage, and so on;

- if the purchased product has expired the warranty period or expiration date.

According to the law, in order to receive the money paid, grounds for returning the money are required. The reasons are: In accordance with Russian law, the seller is obliged to return the money if there is no suitable replacement and it is unknown when it will go on sale. Is it possible to refuse repairs under warranty and get my money back?

According to the provisions of this law, if within 20 days from the date of filing a claim with the seller, the product is not repaired and is not replaced with a similar item, then the buyer has the right to demand from the seller:

- compensation for consumer expenses incurred when eliminating defects in the product;

- price reduction;

- refund of money previously paid for the purchase.

The refund period for cash payments ranges from 3 to 10 days.

List of required documents

You need to take the collection of documents seriously so that you don’t have to resubmit them later. The general package of documents includes :

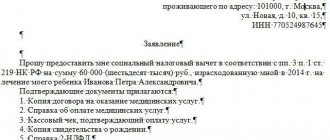

- Application according to the established form for obtaining a tax deduction.

- A copy of your passport.

- Apartment purchase and sale agreement and a copy thereof.

- A certificate from the employer about earnings for the past year in form 2-NDFL.

- Documents confirming the right to property: a copy of the state certificate. registration of ownership or an act of transfer of an apartment, if it was purchased in a house under construction on the principle of shared participation.

- A copy of the Taxpayer Identification Number.

- Declaration of annual income for the previous year in form 3-NDFL.

- A receipt proving that the seller received his money. Or other documents proving the fact of payment:

- receipt;

- withdrawal slip;

- current account statement.

- Details of the current account into which the applicant wants to receive his money.

- If an apartment is purchased for a child, a birth certificate is required.

- When purchasing with a mortgage, you need a loan document, which must be obtained from the bank. And evidence that the borrower is repaying the loan.

All copies must be confirmed by originals.

Stage No. 1 – Collecting documents

Advice - in order to receive a deduction faster, it is better to fill out the application in advance and submit it along with the declaration and other documents. The list of documents is specified in paragraphs. 6 clause 3 and in clause 7 art. 220 Tax Code of the Russian Federation.

- Tax return 3-NFDL (original);

Tax return form 3-NDFL from the official website of the Tax ServiceThis is the most important document, because the deduction amount is calculated on the basis of the declaration. I have plans to write instructions on how to fill out a declaration. As soon as it is ready, I will insert a link to it here.

If you don’t want to fill out the declaration yourself, you can leave it to the specialists at the Kwork freelance exchange. The price of the service is from 500 rubles. Using the filter, select a contractor (for example, with a reputation of 5 points or more), pay for the service and he will get to work. If your order is executed poorly, the exchange guarantees a refund.

If you need free legal advice, write online to the lawyer on the right or call the following numbers (24 hours a day, seven days a week for all regions of the Russian Federation): 8 (499) 938-45-78 - Moscow and region; 8 (812) 425-62-89 — St. Petersburg and region; 8 (800) 350-24-83 — all regions of the Russian Federation.

- Certificate of income in form 2-NDFL for a year or several years (original);

You need to get it from your employer's accounting department. They know exactly what kind of certificate this is. It indicates the amount that the employer withheld as personal income tax from the employee’s salaries for the year (or several years). Do not confuse it with the 3-NDFL declaration, these are completely different documents. - Application for a deduction (original);

Of. name – application for a refund of overpaid tax. In the application, you must indicate the details of a bank account (not a bank card), into which the tax office will transfer the money as a deduction. Usually citizens indicate their salary account, but you can indicate any account in any other Russian bank. The main thing is that it is in rubles and registered in the full name of the recipient of the deduction. The deduction money can be spent absolutely at your own discretion.Other articles

Tax deduction for a purchased apartment - calculations, maximum amount, how it is paid. Using this link you can find out how many times you can get a property tax deduction.

- Passport (original + copies);

Copies of the main passport page and registration page will be required. By law, copies are not required to be submitted, but all tax inspectors require them. It's easier to make copies than to argue with them. - Certificate of registration of ownership or extract from the Unified State Register of Real Estate;

If there is a certificate of registration of rights, then an original and a copy are submitted.Since July 2020, certificates have not been issued, but instead, an extract from the Unified State Register of Real Estate on the main characteristics of the property (formerly an extract from the Unified State Register) is issued. The property in our case is a purchased apartment. Therefore, if you don’t have the certificate on hand, you need to submit a paper extract from the Unified State Register of Real Estate with a stamp. How and where to get a paper extract from the Unified State Register of Real Estate.

When purchasing an apartment in a new building under a DDU or assignment, it is not necessary to submit a certificate or an extract from the Unified State Register of Real Estate. Those. You can already receive a deduction for an apartment in a new building, even if it has not yet been registered as property. But only after signing the transfer and acceptance certificate. More on this below.

- Agreement of purchase and sale (if the apartment was purchased on the secondary market) or agreement of equity participation or assignment (when purchasing an apartment in a building under construction/new building);

Originals and copies of each page are submitted. If the purchase and sale agreement is lost, the owner can obtain it from the MFC or from a notary (if it was in notarized form). - The act of acceptance and transfer of a shared construction project , if the apartment was purchased in a house under construction/new building (original and copies of each page);

- Documents confirming the transfer of money to the seller, i.e. payment for the purchase of an apartment;

If the money was transferred to the seller in cash or through a safe deposit box, there must be a receipt from the seller (copy and original). Sometimes it happens that after transferring money, buyers do not require a receipt from sellers, or buyers simply lost it. Unfortunately, without this receipt, the tax office will refuse to issue a deduction. Therefore, buyers will have to find sellers so that they write a receipt by hand and backdated (to the date on which the amount was transferred). There is no other way out.When making a non-cash transfer of money from the buyer's account to the seller's account (also through a letter of credit), you will need not a receipt, but a bank statement (original). It often happens that payment to the seller was made from the bank account of only one of the buyers (owners), although all buyers incurred the costs of the purchase. Therefore, in order for other owners to receive a deduction, they need to write in their own hand, in a simple and free form, a power of attorney to transfer their part of the money to the buyer from whose bank account the money was transferred to the seller.

→Find out for free what deductions you are entitled to and how much money you can get back. Specialists from ReturnNalog.ru will figure out for free what deductions you are entitled to and calculate how much money you can get back. Hurry up to return your taxes for 2020, otherwise they will be burned.VerniteNalog.ru

- If the apartment was purchased during marriage , you will additionally need: Marriage certificate (original and copy);

- Application for distribution of property deduction between spouses (original);

According to paragraphs. 3 p. 2 art. 220 of the Tax Code of the Russian Federation, if spouses bought an apartment and registered it as joint ownership, or registered it only for one of the spouses, they can distribute the deduction in any proportions - more details. For example, one spouse 70%, the other 30%. Up to 100% and 0%. Application and completed sample.

- Birth certificate if the child is under 14 years old, or passport if between 14 and 18 years old. Originals and copies are needed;

In the application for the distribution of property deductions, you must fill out the proportion - 0% for the child, and his share of the deduction in any proportion for both parents or one of them at will (50 to 50, 30 to 70, 100 to 0). The child does not lose the right to receive a deduction in the future.

Step-by-step instructions: how to get a deduction?

How to register with an employer?

- It is necessary to collect copies of the documents described above and fill out a standard application to the tax office to confirm the right to receive a tax deduction.

- Within approximately 30 days, the applicant will receive a notification from the tax office about the right to deduction.

- You can contact your employer after purchasing a home and receiving a notification from the tax office.

- After this, the employer’s accounting department stops deducting income tax, paying the amount in full. This will continue until the refund limit is completed. If this did not happen within a year, then next year you need to perform the procedure again.

The advantage of the method is that you don’t have to wait until the end of the year and get a deduction based on your current earnings .

How to return 13 percent through the Federal Tax Service?

You can contact the inspectorate only after the end of the tax period, i.e. from the beginning of next year after the year of home purchase.

- It is necessary to collect the required documents, fill out an application, Form 3-NDFL, and provide the details where the money needs to be transferred. The entire package is submitted to the tax office.

- The tax authorities consider the case for 3 months.

- If the answer is yes, the applicant for the deduction will receive the amount of total tax paid for the previous year.

In the taxpayer’s personal account

- Log in to the taxpayer's account.

- Obtain an electronic signature verification key certificate.

- Fill out the 3-NDFL declaration.

- Upload the required documents (list above). Make a description for each document.

- Enter the password for the electronic signature and send the documents.

- You can monitor the progress of the inspection online. If the verification is completed, this will be noted in your personal account. After completing the check, you can generate a return application. There you need to fill in the details, enter a password and send the document.

Procedure for submitting an application to the MFC

- Make an appointment or come and get a ticket using the electronic queue.

- Submit the 3-NDFL declaration and other necessary documents.

- Fill out an application for a deduction.

- Receive a receipt for documents acceptance.

- At the appointed time, arrive at the tax office with your passport.

Through the State Services portal

- Log in to the site.

- Fill out the 3-NDFL declaration.

- Make an appointment with the tax office.

When should the money be returned if the goods are returned within 14 days?

The content of the article

Items can be returned at a later date only under one of the following conditions:

- the seller did not meet the deadline allocated to him to eliminate the faults;

- the product cannot be repaired;

- if the item cannot be used for more than 30 days each year within the warranty period.

If the buyer wishes to terminate the contract and requires a refund, the seller must comply with such requirements within 10 days. What products can be returned? As a general rule, the buyer has the right to return the goods within 14 days.

- cars;

- motorcycles;

- boats;

- helicopters;

- false home appliances;

- air conditioners;

- means of communication;

- computer;

- TV equipment.

According to the articles of the ZPP law, defective or low-quality complex products can be exchanged within the first 15 days. After this, only service repairs are possible.

The absence of a sales or cash receipt is also not considered a sufficient basis for the seller’s refusal to satisfy such a buyer’s requirement (see. This period begins from the moment the consumer writes to the seller.

True, the consumer must prove the presence of a defect.

If we are talking about a technically complex device, then the time frame for returning a purchase will be different. If the buyer identifies a defect, he must file a claim within 15 days.

Payment terms

According to the law (Article 78 of the Tax Code), this period is 1 month after filing an application with the tax office. However, Article 88 of the Tax Code says that a refund is possible only after the verification of documents is completed, which by law lasts no more than 3 months.

This is the maximum period after which the applicant for a deduction must either transfer funds or provide a justified reason for the refusal. However, if the application for deduction was written after verification, the period may extend for another 1 month. Without an application, a refund is not possible .

Returning goods to the store - how long can I return the goods?

Many people have heard about the right to return, but not everyone knows how to exercise this right in everyday life.

Let us consider the situations of returning high-quality and low-quality goods in more detail. Most buyers have only general information, knowing that high-quality goods can be exchanged within 14 days, and low-quality goods within two years.

To return a purchase, you must follow the normal return procedure. If the store is unwilling to accept the purchase back or has doubts about the validity of the replacement, it is necessary to write a complaint in which the consumer is obliged to state his reasons.

Technically complex products include:

- cars;

- motorcycles;

- boats;

- helicopters;

- false home appliances;

- air conditioners;

- means of communication;

- computer;

- TV equipment.

Returning goods of good quality to the store within 14 days, in accordance with the consumer protection law, allows you to request a refund or make an exchange in kind. In the case of high-quality products, an important condition is the correct reason for the exchange.

Products belonging to the following groups cannot be returned:

- food;

- medicinal;

- individual hygiene products.

The returned purchase must be intact and have no signs of wear or use; it must have labels, tags, and seals.

Its content includes the following items:

Grounds for refusal

If you are denied a deduction, you will be sent a statement explaining the reasons for the refusal. If the refusal does not seem justified, you can contact a higher department of the Federal Tax Service or the court. What could be the reasons for refusal?

- All documents are missing.

- The rules for purchasing real estate are not followed.

- The right to tax deduction is reused.

If the deficiencies can be reversed, you can resubmit your documents . Although the matter involves paperwork and requires spending a lot of time and energy on it, it will be useful. After all, additional money can be spent on renovating a new home or buying furniture.

If you find an error, please select a piece of text and press Ctrl+Enter.

Within how many days will the money be returned for returning the goods?

Other documents that may be needed in court:

- Documents confirming the purchase of goods (receipts, contracts).

- An invoice confirming the delivery of goods to the seller for inspection.

- Information about additional costs (credit, delivery).

- Pre-trial claim to the seller (if any).

Information You can demand in court from the selling party not only the return of the cost of the goods, but also compensation for moral damage, late fees, and legal costs. To competently file a claim in court, you should be guided by the following rules: Situations in which we need to return goods to the store are not uncommon.

This could be clothes or shoes that are not your size, or food that has expired. However, not all sellers fulfill their obligations and are in no hurry to return funds, even if they are obligated. Such actions are clearly a violation, since the procedure and period for returning money is clearly stated in the Law “On the Protection of Consumer Rights”.

Therefore, collect all the information about the seller in advance; it is located on the company’s information stand or on the Internet.

- The product has not yet been used.

- There is no violation of seals or labels.

- There are checks and other payment documents.

- The consumer properties of the product are not lost.

- The appearance has not changed.

When an item cannot be exchanged on the day of purchase because a similar item is not in stock, the buyer has 2 options:

- Exchange the item later when the desired item arrives in the store.

- Refund the price of the product at the time of sale.

The refund period is 3 days.

In cash or any non-cash method.

Bottom line: you can return money only when there is no option to exchange for a similar product, but with different properties. However, in practice, problems with returning money for any unused product usually do not arise.

Returning goods, how long do I have to return the money for the goods?

Refunds for goods, terms of return and exchange of goods

If a consumer discovers defects in a product and submits a request to replace it, the seller (manufacturer, authorized organization or authorized individual entrepreneur, importer) is obliged to replace such product within seven days

from the date of presentation of the specified requirement by the consumer, and if it is necessary to additionally check the quality of such goods by the seller (manufacturer, authorized organization or authorized individual entrepreneur, importer) - within twenty days from the date of presentation of the specified requirement (clause 1 Article 21 Replacement of goods of inadequate quality).

The consumer has the right to exchange the product for a similar one on the day of contacting the seller. If a similar product is not on sale on the day the consumer contacts the seller, the consumer has the right to refuse

to execute the sales contract and demand a refund of the amount of money paid for the specified product. The consumer's request for a refund of the amount of money paid for the specified product must be satisfied within three days from the date of return of the specified product.

By agreement between the consumer and the seller, an exchange of goods may be provided when a similar product goes on sale. The seller is obliged to immediately inform the consumer about the availability of a similar product for sale (clause 2, Article 25 The consumer’s right to exchange goods of proper quality).

- During fifteen days

in relation to technically complex goods (Resolution of the Government of the Russian Federation of November 10, 2014 No. 924).

After this period

these requirements are subject to satisfaction in one of the following cases (Article 18 of the Law “On Protection of Consumer Rights”):- detection of a significant defect in a product (section “Significant defect in a product (work, service), defect in a technically complex product” of Resolution of the Plenum of the Supreme Court of the Russian Federation dated June 28, 2012 N 17 “On consideration by courts of civil cases in disputes regarding the protection of consumer rights”);

- violation of the deadlines established by this law for eliminating product defects;

- the impossibility of using the product during each year of the warranty period in total for more than thirty days due to repeated elimination of its various deficiencies.

- During the warranty period or expiration date

.

In relation to goods for which warranty periods or expiration dates have not been established, the consumer has the right to make these demands if defects in the goods are discovered within a reasonable time, but within two years

from the date of their transfer to the consumer, unless longer periods are established by law or contract. (Article 19 of the Law “On Protection of Consumer Rights”)

The product you purchased did not suit you and you want to return the money for the product in 2020, but don’t know how to do it? There are many nuances in this matter: whether the product was of proper quality or inadequate (defective / low-quality), whether you want to exchange the product or just return the money for the product, what are the terms for returning the product, what types of goods cannot be returned, and how to return the product step by step. That is why our lawyers located in Cheboksary have prepared this material for you so that you know what rights you have.