Sovcombank is one of the leaders in the financial services market. The bank offers profitable loans, within which you can become the owner of property or resolve financial issues. In addition to loans, bank specialists actively issue insurance policies. Let's look at how to refuse loan insurance and get your money back profitably.

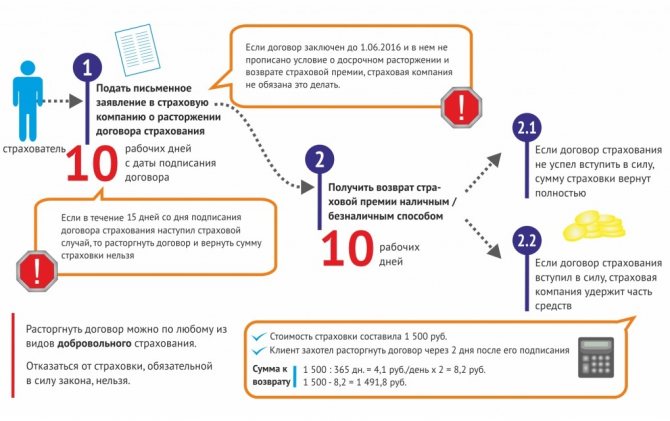

Directive of the Bank of Russia dated November 20, 2015 No. 3854-U provides for the mandatory return of the insurance premium if the insured person refuses the contract during the cooling-off period. You can return the money after it, taking into account the internal rules of the insurance company.

Submitting an Application to Sovcombank for Waiver of Loan Insurance

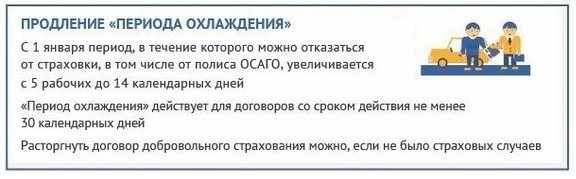

An application for termination of a previously concluded agreement with Sovcombank is possible during the “cooling off period”, which is 14 calendar days from the date of payment of the insurance premium by an individual.

There is no extended cooling-off period, so the policyholder cannot count on a longer period of reflection and decision-making regarding cancellation or retention of insurance.

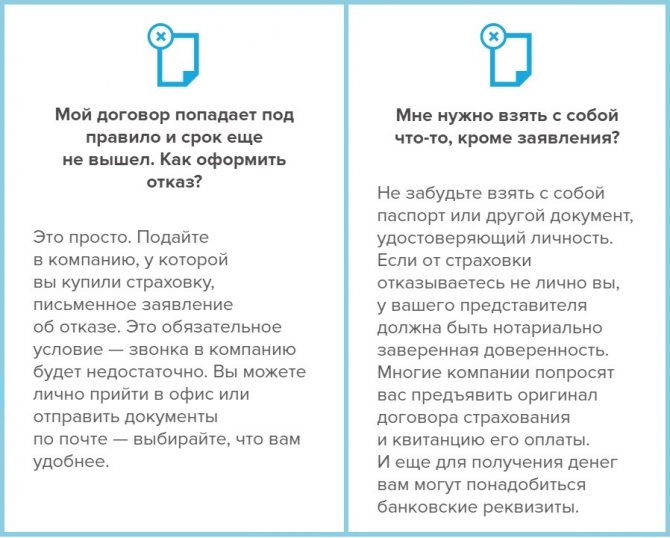

There are several ways to express your desire to terminate the insurance agreement:

- In a written form. This type of application is carried out through a personal visit to the institution by the policyholder or by sending documents using the postal service.

- Electronically on the website or by sending an application by email.

There are no other ways to notify the insurance company of termination of the contract at the initiative of the policyholder. A sample application is provided by the insurer on the official website or in person.

The application for refusal of the insurer's services must be filled out in accordance with the sample presented on the Sovcombank website and sent to the company's address for receiving correspondence.

The finished application form can be printed and filled out manually, or you can fill out all the necessary data on the website and print it out. The company leaves the choice of the type of application for termination of the contract to the policyholder.

In the document sent to Sovcombank for insurance refund, you must indicate:

- personal information about the applicant: full name, passport data (series, number, when and by whom it was issued), address, contact information (telephone number and email address);

- date of conclusion of the contract;

- the fact of familiarization with the conditions of early cancellation of insurance;

- details for sending funds in full (full full name of the recipient, current and correspondent account numbers, bank name and BIC);

- date and signature of the applicant.

Applications for insurance refund:

- Within 14 days;

- In case of early repayment of the loan;

- According to OSAGO;

- Alfa insurance

- Sberbank;

- Renaissance;

- VTB Insurance;

- Consumer protection.

Sample application:

- Within 14 days;

- In case of early repayment of the loan;

- Collective insurance;

- OSAGO;

- Alfa insurance;

- Post Bank;

- Sberbank;

- Renaissance;

- VTB Insurance.

After printing out the application or using the usual form, the policyholder can contact Sovcombank with a request to terminate the insurance policy when visiting the institution in person, as well as when sending documents through the postal service.

To provide documents in person, the applicant must come to the office of the insurance company and register an application. After registration, the citizen must be given a document confirming the acceptance of the application for consideration.

Note! A third party can also submit an application, but he will need a power of attorney from the policyholder, certified by a notary.

If sending documents by mail, you must:

- Compose an application according to the template presented on the company’s website;

- Attach the necessary documents to the application, which include: a copy of the contract and a copy of the receipt for payment of the insurance premium;

- Send by registered mail at Russian Post with a stamp indicating the date of acceptance of the letter for forwarding; the average delivery time for correspondence varies from 3 to 7 days;

- Wait for the documents to be delivered to your address and receive a response that your application has been accepted for consideration.

Often the insurance company refuses to confirm the fact of the client’s application. Therefore, sending by registered mail will be the most reliable method of filing an application for waiver of insurance.

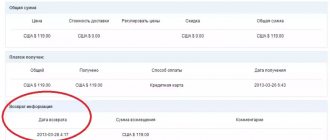

Sovcombank must transfer funds to the policyholder's account within 10 days from the date of receipt of the application for consideration, however, the agreement is considered terminated from the moment the documents on its cancellation are sent.

Is it possible to refuse the imposed Sovcombank insurance?

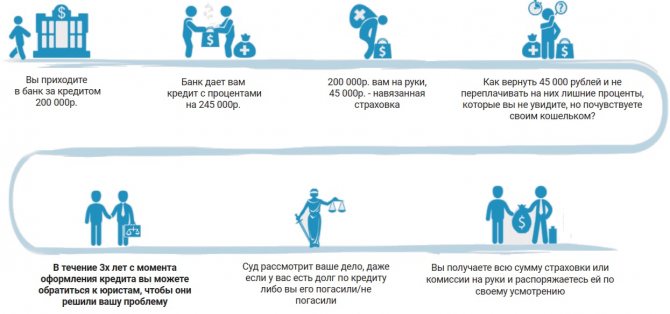

Borrowers often understand how much the loan amount and monthly payment have changed due to the policy issued only after signing the contract. The law provides for the opportunity to refuse insurance at Sovcombank or any other bank.

To do this, you must personally visit a Sovcombank branch with the following documents:

- loan agreement;

- voluntary insurance agreement;

- passport or legally identical identification document.

The bank employee is obliged to accept the application for refusal of insurance and, if necessary, explain the situation to the client. The application is drawn up simultaneously in the name of the bank and the insurance company. If the contribution was made in cash, Sovcombank is obliged to reimburse it in cash; if the premium amount is included in the body of the loan, the refund is carried out through the insurance company.

Accredited insurance companies

Before contacting a credit institution, you need to study the insurance contract. Sovcombank cooperates with various accredited insurance companies and the terms of termination may differ.

- SPAO "Ingosstrakh" - works with all types of risks and loans and concludes contracts in all regions of presence.

- LLC "Renaissance Insurance Group" - allows you to insure any loan in all branches of Sovcombank.

- Soglasie Insurance Company LLC provides insurance for all possible programs in any of its branches and offices.

- SPAO "Resso-Garantiya" cooperates with Sovcombank in insuring all types of lending in each of the regions where the credit institution operates.

- Alfastrakhovanie OJSC works only with automobile insurance and is available in all regions of its presence.

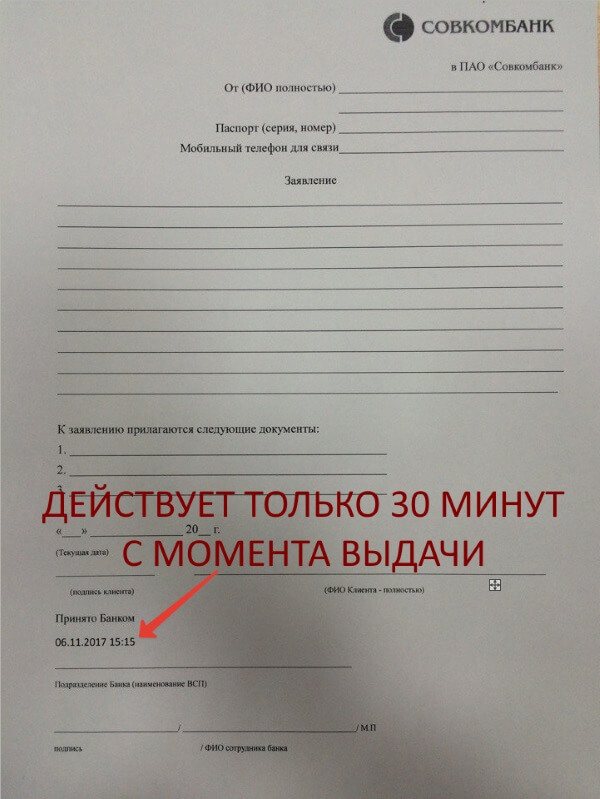

Application for termination of the insurance contract

An application for waiver of insurance when receiving a loan from Sovcombank is drawn up during a personal visit to the bank. You won’t be able to download it in advance and bring it to the office. The application is valid for 30 minutes from the moment it is printed. Each form is stamped with the date and time. These are the rules of the bank. After completing the documents, the loan insurance will be returned to Sovcombank no later than 21 days after its receipt.

Application form for waiver of insurance when applying for a loan.

There are 3 options for the outcome of the event:

- it is impossible to terminate the agreement;

- early repayment (the amount of the contribution is returned, proportional to the past payment period);

- refusal within 5-30 days after concluding an agreement with the bank.

"Sovcombank" - Which Policies Cannot Be Returned According to the Law?

A banking organization, on the basis of Federal Law No. 353-FZ, has the right to offer the borrower a number of services to insure credit obligations when applying for a loan, but does not have the right to oblige the borrower to agree to additional conditions.

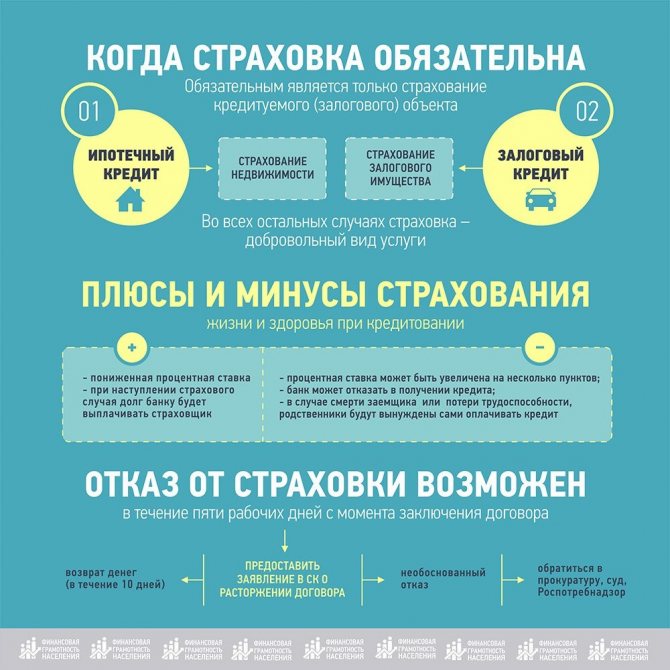

The legislation provides for a strictly defined list of loans for which credit insurance is mandatory, these include:

- Insurance against loss of property rights (title) to housing when purchasing real estate on the secondary market. The period of compulsory insurance is limited to three years, since according to the provisions of the Civil Code of the Russian Federation, after this time the limitation period expires.

- Car loans, a prerequisite for which is the issuance of a compulsory motor liability insurance (CASCO) policy. Without consent to insurance, the borrower is guaranteed to receive a refusal.

In other cases, the issuance of an insurance policy in accordance with current legislation is voluntary and cannot be forcibly imposed on the borrower without the right to refuse such services.

Taking out a policy is necessary for banking organizations, since it guarantees the return of borrowed funds in the event of disability or death of the borrower, therefore lenders often offer clients improved conditions:

- A reduced interest rate, which can be significantly lower than the standard rate by 2-2.5% depending on the type, size and term of the loan;

- Preferential conditions for obtaining a loan, which involve calculating the interest rate based on the amount of the actual debt, and not the total size of the loan, which allows you to reduce the rate for the entire term of debt obligations by 1.5-2 times;

- A longer lending period, which allows you to reduce monthly payments on obligations and other more favorable conditions.

Conditions for Refund of Loan Insurance at Sovcombank

The main condition for the return of 100% of the insurance premium is to notify the insurance agent within the period established by law for terminating the agreement. The insurer, on its own initiative, has the right to increase the period for canceling the agreement.

According to the Directive of the Central Bank No. 4500-U dated August 21, 2020, amendments were made to the Directive of the Central Bank No. 3854-U dated November 20, 2020 to increase the period of the “cooling period”. The minimum period for requesting cancellation of the agreement is two weeks (14 calendar days).

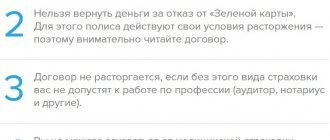

This grace period applies to most types of insurance, with the exception of:

- purchased for travel outside the country (to cover medical expenses if necessary);

- Green Card policy, for which separate cancellation rules are established (specified in the concluded agreement);

- required to carry out a specific professional activity (for example, notaries, auditors, etc. will not be allowed to work without an insurance contract);

- absence of Russian citizenship when a health insurance agreement is drawn up, if it was concluded to obtain a patent or for employment.

Receiving a loan is not included in the specified list of exceptions, so the return of insurance is possible and legal.

The deadline for applying for a refund of an insurance payment paid by a citizen under the Sovcombank program is also two weeks or 10 working days. An increase in the deadline for filing an application is not provided, unless otherwise reflected in the contract or other acts of the insurance company.

As a rule, a standard contract for the provision of services is concluded between a citizen and Sovcombank, so there is no provision for an increase in the cooling period.

To return the insurance premium paid in accordance with the agreement with the company, the borrower must simultaneously comply with two conditions:

- Contact the insurer with a request to terminate the agreement within a period not exceeding two weeks from the date of actual payment for its services.

- To prevent the occurrence of an insurance situation in which the insurer is obliged, on the basis of a concluded agreement, to make payments in favor of the insured person.

Any signs of an insured event recorded by the insurance organization, as well as the omission of the legally established deadlines for filing an application for cancellation of a previously concluded agreement, are grounds for the insurer’s refusal to return the premium received.

"Sovcombank" - Refund of Insurance within 14 Days

Agreements between individuals and the insurance company come into force from 00:00 on the day of payment of insurance obligations.

The deadlines for cancellation of agreements between the policyholder and the insurance company apply to the following insurances:

- Life (health), regardless of the reason for concluding the agreement - processing a loan or the personal desire of a citizen with periodic insurance payments;

- Movable property – car;

- Real estate and property with declared value, for example, objects of art;

- Liability of owners of movable property in case of an accident;

- Liability of the insured for causing any harm to other persons or their property;

- Medical insurance, etc.

Despite the legislative establishment of a voluntary registration procedure, most banking institutions force their clients to sign an agreement with insurance companies.

To waive insurance and receive your funds, you just need to contact the bank where the loan was issued and submit an application for waiving insurance.

- Example

Let's consider a practical example:

Citizen Agapov O.V. took out a consumer loan from a bank in the amount of 500,000 rubles. Additionally, he purchased life insurance for 1 year, the cost is 25,000 rubles.

The borrower, the next day after receiving the loan, contacted the insurer for a refund of the premium. After 10 days, the money in full (RUB 25,000) was transferred to the bank card.

If the creditor is another financial organization, the application for refusal should be sent directly to.

Refunds must be made no later than 10 business days from the date of the client’s request or receipt of a written application.

Bank account details for transferring funds are indicated when filling out the application. This period includes the acceptance of an application for refusal of insurance, its consideration and the transfer of funds (if a positive decision on the application is made).

Is it possible to return Sovcombank Insurance if the Loan is Closed on Time?

In accordance with clause 5.5 of Section 5 and clause 7.4 of Section 7 of Conditions No. 2, when drawing up an Offer Policy, payment of loan obligations on time without the occurrence of an insured event is not the basis for returning the amount of the insurance premium to the policyholder.

The agreement between an individual and the insurer terminates on the basis of clause 7.1 of Section 7 of Conditions No. 2, and contractual obligations are recognized as fully fulfilled. Refunds of insurance premiums are not permitted.

Similar provisions are established by federal legislation, so court proceedings regarding such disputes can only end with a decision refusing to satisfy the applicant’s claims.

Cash is the income of the insurer.

Thus, the refusal of the insurance company to return money after timely repayment of the loan is legal.

Is it possible to return Sovcombank Insurance after the Cooling Period?

According to the law, the insurance company has the right to independently provide for the conditions and possibility for insured persons to receive compensation under contracts after 14 days from the date of conclusion. At Sovcombank this is possible with full early repayment of the loan.

The payment is calculated in proportion to the number of days during which the policy was in force. The days on which it was supposed to be valid, but due to the early closure of the debt, were canceled are also taken into account.

You can get your money back for your insurance policy after the cooling-off period ends. The only negative is that the company will withhold the costs of conducting the case (CBC), which can reach up to 40%.

It turns out that the client automatically loses almost half of the deposited value, which is extremely unprofitable. The longer the policy is valid, the lower the amount to be returned.

Before making an insurance return following the cooling-off period, you should weigh the risks and calculate the amount. It is often more profitable to leave insurance, which will pay out if an accident occurs.

To calculate the return, you should check the size of the RVD by calling the toll-free customer support service. After:

- Divide the contract amount by the number of days in a year to obtain information about the daily cost of protection.

- Calculate how many days are left until the expiration date.

- Multiply the number of remaining days by the daily price of the protection form.

- Subtract the RVD from the resulting cost.

After receiving the result, make a choice whether to issue a refund of the policy or leave it. In practice, the form is left if at least several months have passed since the date of its registration.

Ways to return money for an insurance policy

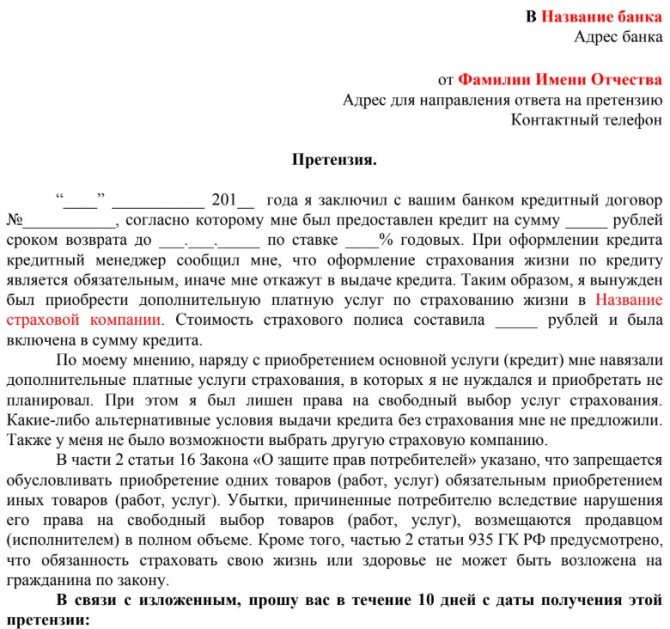

It is possible to return insurance when receiving a loan from Sovcombank in several ways, depending on the situation. First, you need to write an application addressed to the manager of the credit institution for the return of the illegally imposed service. It must describe the current situation in detail, explain the existing complaints and demand a refund. Review may take up to 10 business days.

Write a competent claim against refusal to receive loan insurance.

Important! The claim must be drawn up in two copies - one for each party. It can be sent by registered mail with notification via mail. When submitting in person, you should hand over the application to the secretary and make sure that your copy is stamped with the incoming correspondence stamp.

If the bank rejects the claim (a written refusal must be received), the client has the right to go to court. It is recommended that you carefully study the agreement with Sovcombank, which may contain nuances.

Call Sovcombank's hotline to ask about waiving insurance before receiving a loan. If the bank stipulates that insurance is voluntary and refusal of it is not a reason for not providing funds, it will be almost impossible to prove its case. Therefore, you should carefully read the contract before concluding it, otherwise even an experienced lawyer will have a hard time winning the case.

The main document that should be used is the consumer protection law, in which Article 16 states that no organization has the right to offer one service subject to the purchase of another. If the manager says that it is impossible to get a loan without taking out insurance, call the administrator.

In addition to the court, you can contact:

- Rospotrebnadzor;

- local law enforcement agencies;

- local consumer protection organization.

Litigation will require costs, so before starting it, you should decide how profitable it is to sue the bank even if the premium is returned.

The proceedings can take a long time, especially if the issue is resolved through Rospotrebnadzor and the Consumer Protection Society. The bank is trying to the last to defend its case, but there have been cases when Sovcombank returned the premium to avoid a fine. If you challenge an application through arbitration, you will also have to wait a long time for a decision.

If the contract with Sovcombank is terminated early, the money will not be returned. This is clearly stated in every agreement. The organization can agree to a meeting if the repayment occurs within 30 days after signing the agreement. You can get back up to 75% of the premium paid.

If you repay the loan early, later than 30 days after the conclusion, obtain a certificate of no debt from the bank and contact the insurance company with it. The full amount will not be returned, but the insurers will calculate what part of the remuneration paid was not used and the company will return the proportional balance.

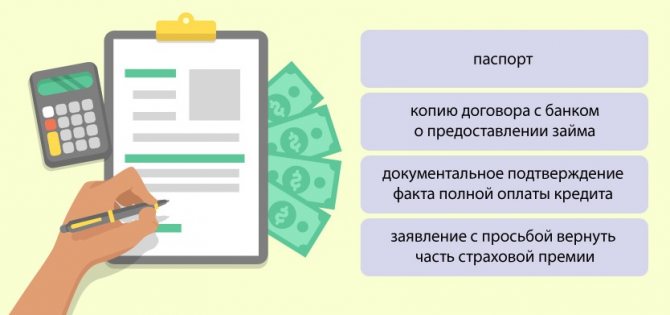

"Sovcombank" - Return of Insurance upon Early Loan Repayment

Early repayment of the debt is the basis for a partial refund of 57.5% of the amount paid at the conclusion of the contract. The remainder of the insurance period and the previous period are taken into account.

If a refund application is submitted after the contract has been executed, the final amount payable is subject to personal income tax. For residents of the Russian Federation the rate is 13%, non-residents – 30%.

Under mandatory insurance contracts, the Savings Bank is designated as the beneficiary. This means that it is the bank that will receive the payment or decide who will receive it when an insured event occurs.

Since after repayment of the debt the property ceases to be the subject of collateral, the contract can be terminated. To do this you will need:

- after repaying the loan, request a certificate of no debt;

- fill out an application and attach documents;

- contact the insurance company office.

If, for structural elements, not an annual policy is issued, but an agreement with annual payment for the entire loan term, then you don’t have to make the next installment. In this case, the mandatory protection form is automatically terminated. However, this option is relevant for those clients for whom the annual payment is suitable after full repayment of the loan.

- There are also precedents (successful legal disputes)

- Continuation

Particularly interesting is the Determination of the Judicial Collegium for Civil Cases of the Armed Forces of the Russian Federation dated May 22, 2020 No. 78-KG18-18 in the case of one citizen who repaid her loan ahead of schedule.

The bottom line is this: the insurer did not return her premium in proportion to the “unused” days. The citizen appealed to the court of first instance - it refused to satisfy her demands, then to the court of appeal, which also refused.

And only the Supreme Court of the Russian Federation did not agree with the decisions made and ordered the insurer to pay the premium for “unused” days.

When rendering its verdict, the Supreme Court noted that, according to the terms of the insurance contract, the insured amount is equal to 100% of the amount of debt under the loan agreement.

Since at the time of early repayment this debt became zero, the insured amount also became zero. This means that there is no point in insurance, in which the payment of insurance compensation is impossible.

It is also interesting that the RF Armed Forces noted that the norm of Part 1 of Art. 958 of the Code is still dispositive, not imperative. That is, not only the destruction of property or termination of business activity is the basis for proportional compensation of the insurance premium.

In relation to this case, this norm should be interpreted as “disappearance of insurance risks” (since the insurer no longer has the obligation to provide insurance compensation).

How to Recover Loan Insurance at Sovcombank - Step-by-Step Instructions

The algorithm of actions depends on the reason for the return - early repayment or application within the first 14 days.

To return the insurance premium, the borrower must:

1. Analyze the loan agreement. In it you need to find information about whether the bank will increase the interest rate if the client refuses insurance. This information can be found in several sections. The first is “The borrower’s obligation to enter into other agreements.” If the column opposite says “Not applicable,” this means that the rate will not increase if the insurance contract is terminated.

You also need to look at the items “Interest rate” and Services provided to the lender for a fee. If the rate depends on the presence or absence of an insurance contract, this will be indicated in these sections.

2. Analyze the insurance policy. This way you can understand whether an individual insurance contract has been concluded or whether you are joining a group insurance policy.

3. Study the special conditions of the contract. This will allow you to understand what the conditions for terminating the contract are, whether it is possible to terminate it early, whether the insured amount is tied to the debt and other important points.

4. Obtain a statement of credit account from the bank. It will be proof that a certain amount was transferred from the credit account to the insurer.

5. Prepare an application for insurance.

6. Submit a package of documents along with the application to the insurance company, bank or both organizations. If the individual insurance contract is terminated, send the documents to the insurance company. If the collective insurance contract is terminated, then send one package of documents to the bank, and the second to the insurance company.

7. Track receipt of documents. If they were sent by post, then this can be done using a postal identifier, which is issued at the post office. As soon as you see that the letter has been received, you need to count down 10 days - during this time the insurance premium must be transferred to the bank account specified in the application.

If the insurance company does not transfer the money on time, then you need to write a pre-trial claim to the bank and insurer, as well as a complaint to the Central Bank. If this does not help, then the only thing left to do is go to court.

Why does the bank force you to take out insurance?

By issuing loans for large amounts without collateral, the bank bears risks. After all, if something happens to the payer, there will be no one to repay the debt and the organization will suffer losses. Insurance of life, health and disability of the borrower provides a guarantee of repayment of funds. Therefore, banks impose insurance on potential clients when applying for unsecured loans.

There is another side. By collaborating with insurance organizations, the bank earns money on each transaction. Therefore, managers convince of the need to purchase a policy and care only about their own benefit. Employees of credit institutions often do not inform borrowers that their loan has been insured, and clients sign documents “without looking.” Therefore, reading all clauses is a mandatory part of the contract.

Sovcombank is obliged to hand over an agreement with the insurance company along with the loan agreement.

Federal law says:

- credit institutions do not have the right to impose the services of insurers;

- refusal of insurance cannot be a reason for rejection of an application for the issuance of funds.

This allows you to legally cancel the policy at the stage of signing the documents. In practice, Sovcombank either refuses to issue a loan (violating the law) or legally increases the interest rate by 1-2 percent.

"Sovcombank" - Refusal of Insurance and Refund of Money Through Court

Based on Art. 958 of the Civil Code of the Russian Federation, insured citizens can return part of the premium upon early termination of the loan agreement, or provided that at the time of refusal there is no possibility of an insured event occurring.

Also, the basis may be a violation by the bank of Art. 16 of the Law of the Russian Federation dated 02/07/1992 No. 2300-1, according to which the sale of goods (conclusion of a loan) is prohibited, subject to the registration of another service (insurance).

The above is currently the most common. 95% of clients claim that when applying for consumer loans, bank employees impose insurance, explaining this by possible disapproval of the loan or an increase in the rate.

It is worth considering that the law reserves the right for banks to refuse lending without giving reasons. Thus, refusing insurance before drawing up a loan agreement is problematic, and there is a chance of being left without the necessary loan.

Despite legal restrictions, clients are at a disadvantage, and it is problematic to refuse a policy, even knowing their rights, if they are in dire need of money.

You can receive the funds and then immediately apply for a refund of the premium. However, even in this case, insurers may refuse payments without reason, indicating a variety of reasons in a written decision.

The exception is when applying during the “cooling-off period”: in this case, the insurance company must make all payments and return the money paid within the established time frame.

When faced with the problem of refusal, the borrower has the right to request a written decision from the insurance company indicating the reasons. If the requirement is not met, there is only one option left - going to court.

Often, borrowers are faced with such a problem as receiving a refusal to return the insurance premium. It is worth considering that this refusal is unlawful. If you receive a refusal, you should defend your rights.

pre-trial claim: drive.google.com/file/d/pretenzia .

Instructions on how to get your money back through court:

- Receive documentary evidence from the insurer that no refund will be made. You can go to court if you have received an official refusal from the financial company. It is important that the document is in the original.

- Prepare documents, namely a passport, a voluntary protection policy and a payment receipt.

- File a claim. In the form, indicate personal data, information on the loan and insurance agreement. If you go to court on your own, we suggest filing a statement of claim. You can fill out the document and make additions via a computer.

- Submit a complete package of documents to the court and wait for the outcome of the review.

Litigation with insurance companies in the absence of legal training and experience is a labor-intensive process, almost always doomed to failure for the plaintiff. Experienced lawyers of the insurance company participate in the proceedings, who probably know what to do and how to appeal so that the court takes their side.

The best option is to seek help from a lawyer or attorney specializing in lending. It is difficult to win a case on your own, because... During the proceedings, perfect knowledge of the Civil Code of the Russian Federation and other legislative acts will be required.

The procedure for returning insurance in court is carried out in accordance with the Civil Code and the Code of Civil Procedure of the Russian Federation:

- The plaintiff (insured person) files a statement of claim at the place of residence of the defendant (SC) in the district court, indicating in the document references to all legal norms that were violated by the refusal.

- The judge accepts the documents for consideration within 5 days, makes an appropriate decision on the start of proceedings and forwards them to the parties - the plaintiff and the defendant. The latter also receives a copy of the claim.

- A preliminary hearing is scheduled, during which the judge clarifies the details of the case and requests additional documentation.

- After the preliminary hearing, proceedings are scheduled.

- The decision is made no later than two months from the date of receipt of the claim. The period may be extended by systematically adjourning hearings in case of failure of the parties to appear, but in the absence of valid reasons, the court reserves the right to consider in absentia.

After the expiration of the appeal period (1 month), the decision takes legal force. The plaintiff must apply to the court for a writ of execution, on the basis of which payments will be made upon satisfaction of the claim. The parties are also given certified copies of the decision.

Important! In practice, it is extremely difficult to prepare all the documents yourself. To get a positive result, it is better to use the help of an experienced lawyer. A qualified lawyer can competently draw up a statement of claim and send it to the court himself.

Refund of insurance based on the decision of the Central Bank

If 3-4 days have passed after signing the loan agreement, it is possible to return the contribution in full. This is provided for by the Central Bank decree of June 1, 2020 (link), which specifies a 5-day period during which you can refuse insurance. The submitted application will be reviewed and funds will be returned no later than 10 calendar days after submission.

When choosing Sovcombank as a lender, you need to be prepared to impose a service. You can always defend your rights and in the future learn how to refuse insurance from this article.

How to get back Sovcombank Insurance - Features of the Loan

Insurance companies use two ways to collect premiums: withholding the entire amount at once by increasing the loan, or including the premium in parts of the loan. The latter has the following features:

- The amount of mandatory payments is withheld. For example, if the cost of insurance is 20,000 rubles, the amount is divided into 12 months. The monthly payment will be 1,666.66 rubles.

- If the contract is terminated in the future, the amount of mandatory payments is simply reduced. Refunds are not made because... money is charged only for the current period during which the debt obligations are valid.

If the insurance is not included in the loan in parts, but is paid at a time when it is issued, compensation is made in accordance with the law: when applying during the “cooling period” or when repaying the loan early.

It is important to consider some features here:

- The cost of the policy automatically increases the size of the loan, therefore, the overpayment of interest also increases.

- If the “cooling period” is missed, but the loan is not repaid ahead of schedule, the money will not be returned.

- Sovcombank allows you to enter into agreements with other insurance companies that are not related to the institution, subject to accreditation. In this case, the refund is made in accordance with the requirements of the insurer.

Note! The full terms and conditions for payment of funds in case of cancellation of insurance are contained in the agreement with the insurance company. If 14 days have passed, the possibility of a return must be clarified in this document.

Often, credit managers include the cost of insurance protection in the body of the loan. In practice, the cost of the policy is divided proportionally over the entire term of the contract, included in the amount of the monthly payment and the total interest is calculated.

As a result, the cost of protection increases significantly. In this case, the form can be terminated, taking into account some features. Features of termination of the policy included in the loan:

| Statement | The application form must be drawn up in free form addressed to the head of the financial company. In addition to the required information, the application must indicate the duration of the protection and the amount of the insurance premium. You should also indicate that you want to exclude insurance and reconsider the payment schedule. Following the results of the application, you should have a copy of the application in your hands, with a mark of acceptance for work. |

| Agreement | After accepting the document, the Sberbank employee is obliged to draw up an additional agreement in which he indicates the changes, namely the exclusion of insurance protection. |

| Payment schedule | A payment schedule, minus the cost of insurance, is attached to the agreement. The schedule must be signed and attached to the loan agreement. |

If the loan includes a required form of insurance, but to save money, you can request an amendment to specify that payment will be made in cash. In this case, you can save money.

When is the Sovcombank Insurance Agreement considered terminated?

According to clause 7 of the Bank of Russia Directive, the policy is terminated on the date the insurance company receives the corresponding application from the refusing client.

It is important to consider that receiving a copy of the application for acceptance of return documents does not guarantee that the contract will be terminated. The voluntary protection form expires after the policyholder receives funds on the card or current account.

Additionally, experienced experts recommend requesting a certificate stating that the contract has been terminated. You can request a certificate for free, in any convenient way:

- in person at the office;

- by sending a free-form request by email;

- by calling a toll-free number and filling out an application for a certificate.

It is better to keep the received document until the loan debt is repaid in full.

"Sovcombank" - Refusal to Refund Money under the Agreement, What to Do?

When faced with a refusal, the first step is to obtain a written explanation of the reasons from the insurance company. To do this, the insurer is sent a corresponding application to issue a reasoned decision on the return.

After receiving a written decision, the client needs to study the reasons stated in it. They must be supported by legislative norms.

In case of an unlawful refusal, you can go to court or file a complaint with Rospotrebnadzor if the actions of the insurer violate the rights of the consumer.

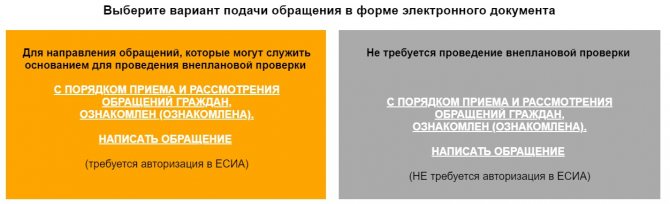

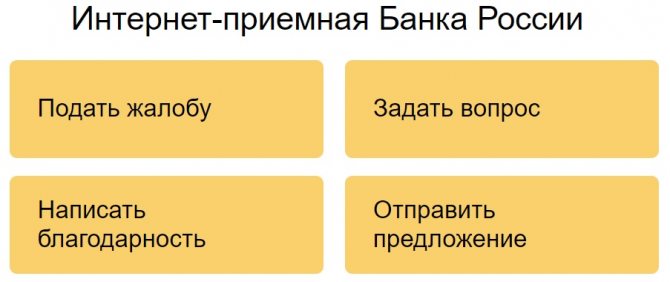

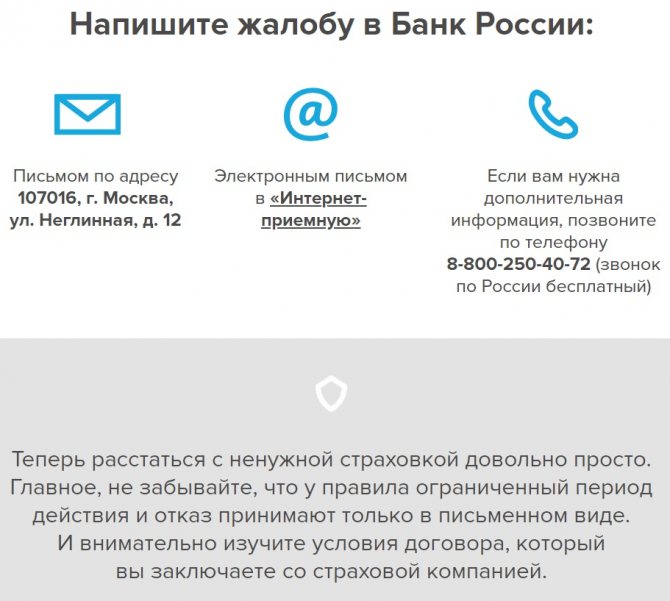

There is another option - sending a complaint electronically on the official website of the Central Bank . Here you need to select the reason for your application, then fill out the application form and attach supporting documentation.

If the insurance company sent a reasoned refusal to pay, a scanned copy of the letter will be required for consideration by the Central Bank of the Russian Federation. The period for consideration of complaints against insurers is 30 calendar days.

In practice, all refusals are unlawful. As a result, you should go to court. To save personal time, you can leave a request on the official website of the Central Bank. Attach high-quality photographs of all documents to the electronic application and wait for the decision.

The Central Bank considers requests as quickly as possible, usually no more than 3 working days. Based on the results of the review, a response will be sent. In 99% of cases, the client receives a refund, since an authorized employee of the Central Bank himself is involved in resolving the issue with a specialist from the insurance organization.

You can send your appeal by regular letter to the address: 107016, Moscow, st. Neglinnaya, house 12.

You can leave a request by calling the toll-free customer support line. However, in this case it will be extremely difficult to help. Without seeing the documents, Central Bank specialists provide only general information with which the problem can be solved.