Conditions under which you can return money for unused MTPL insurance

All information about the conditions for refunding money for insurance is specified in the “Regulations on the rules...” No. 431-P dated 09.19.2014. It also states that compensation is provided only for the unexpired term of the compulsory insurance contract or seasonal use of the vehicle.

Is it possible to get money back for selling a car?

The money can be returned, since the sale of the car is included in the list of conditions suitable for the owner to receive a refund.

In this case, in order to receive a refund for unused insurance, in addition to the main documents, you will also need to provide a car purchase and sale agreement and a copy of the title to the insurance company to confirm the change of owner.

When selling a car, it is not necessary to terminate the MTPL agreement and demand a refund from the company. You can simply sell the car along with the existing insurance and, in order not to remain in the red, include the amount of unused insurance in the price of the vehicle.

Is it possible to return the money just because you won’t use the car?

If a citizen simply does not want to use the car for some time, then, according to the law, this is not a reason to return the money paid for compulsory motor liability insurance. After all, it is almost impossible to prove that the car was really idle during a specific period of time.

All other cases

There are several other conditions regarding refunds:

- loss of a car: theft, large-scale irreparable damage, disposal;

- death of the policyholder, in connection with which the insurer company is obliged to terminate the contract;

- death of the owner of the vehicle, entailing a change of owner, as in the case of sale;

- liquidation of a legal entity that is the owner of the insured vehicle;

- The insurance company lost its license, so the rest of the money must be returned.

If an insurer loses its license due to impending bankruptcy, you should hurry, otherwise you may not get your money back at all.

In what cases is it possible to return MTPL insurance?

MTPL insurance guarantees that victims of an accident will receive compensation for injury to health, damage to a car or other property. Therefore, it is necessary to have a policy for the entire period of operation of the car, and its absence will result in a fine. If you look at the MTPL Rules, you can see three grounds for early termination of an insurance contract and refund of money:

- if the ownership of the car for which insurance was taken out is terminated (after registration of the purchase and sale agreement or donation with the traffic police);

- if the owner has disposed of the car, or its restoration and operation after the accident is no longer possible (this fact is confirmed by certificates of disposal, opinions of experts and appraisers);

- if the owner of the car died, as a result of which the car was inherited by other persons.

The issuance of a general or ordinary power of attorney is not a basis for the return of compulsory motor liability insurance.

If the car is subsequently sold by proxy, you can apply for a return only after registration with the traffic police and cancellation of ownership.

Only the person who took out the policy and paid the insurance premiums can return part of the money under compulsory motor liability insurance. The only exception is succession during inheritance, if the car has become the property of other persons. This fact is confirmed by a death certificate and a certificate of inheritance rights.

Since uniform MTPL Rules apply in Russia, returns are carried out according to the same rules in all insurance companies. If the company's insurance policy or rules provide for conditions that contradict the law on compulsory motor liability insurance, they will be declared invalid when the dispute is considered.

When it will be impossible to return the money

In some cases, it will not be possible to return the insurance under any circumstances.

Insurance returns are not allowed:

- if the policy has expired (it is 12 calendar months);

- if during the policy period the insurance company paid compensation to the victims, as a result the limit of compulsory motor liability insurance payments has been completely exhausted;

- if the car owner has not paid the insurance premiums for issuing a policy (for example, if compulsory motor liability insurance was purchased in installments).

If payments were made to victims under the policy, but the compulsory motor liability insurance limit has not been exhausted, the insurer is obliged to satisfy the application in proportion to the balance of insurance premiums.

If the car owner has not paid the insurance premiums, the policy will not take effect. Many companies offer installment payments, so MTPL insurance will begin to apply after making the first payment. If the policyholder submits an application before the full payment of premiums, a refund will be calculated on a pro-rata basis. It is better to clarify these points in your company's insurance rules, as they may differ.

Refunds are made only for the period of time before the expiration of the policy. To do this, the insurance company will calculate a proportional part of the amount of insurance premiums. If there are grounds for receiving money, you need to contact the insurer as soon as possible. The fewer days left until the end of the policy, the less money the applicant will receive.

When the money is not returned: reasons

The policyholder will not receive money if:

- the contract is terminated at the initiative of the insurer due to incorrect data provided by the vehicle owner himself when completing the paperwork or incomplete payment for compulsory motor liability insurance;

- the car was transferred to another person by proxy, since in fact it was sold, but according to the law the owner remained the same;

- the owner terminates the contractual relationship with the insurer only because he does not plan to use the vehicle for some time;

- his driver's license was revoked;

- the insurer is declared bankrupt;

- 2 months have passed since the sale of the car, which means it is too late to submit documents for termination of the contract and refund;

- The insurance company may refuse to return funds due to previously paid indemnities, but this is unlawful, and such a decision must be challenged in court.

Step-by-step algorithm for terminating a contract

To terminate the MTPL agreement, you must adhere to the following procedure:

- Contact the insurance company with which you have a contractual relationship.

- Write a statement of desire to terminate the contract. It is written in free form, but you can also use a sample from the company’s stand. Be sure to indicate the bank details where the insurance company can return the money.

- Provide along with the application the following package of papers: the original insurance policy, a receipt for payment of the insurance premium, a purchase and sale agreement, pages of the owner’s passport, documents confirming the need to terminate the contract (on the liquidation of a legal entity - the owner of the vehicle, the death of the insured, etc. ).

- Wait for the insurance company's decision within 10 days.

- If the answer is yes, then take a certificate of the terminated MTPL policy for future insurance.

- In case of refusal to terminate the MTPL agreement and the corresponding payments, you can contact the judicial authorities or the Union of Auto Insurers.

You must provide original documents along with their copies.

Termination of contractual relations is regulated by Federal Law No. 40 “On Compulsory Insurance” and Regulation No. 431-P.

In what case is it possible to get a full refund?

Moreover, when the question arises of terminating the contract and returning the amount remaining for unused months, the insurance company takes 23%. Is it possible to take away this 23% from the insurance company and thus receive a full refund?

Until 2014, it was possible through the court to regain 23% retained by the insurer. Car owners won the case without any problems and received their money. This court decision was based on the fact that this contradicts the rules of OSAGO, the Federal Law “On OSAGO”, as well as the Civil Code of the Russian Federation.

Since 2014, the rules of OSAGO and the Federal Law “On OSAGO” have stipulated that only 77% of the amount is refundable. At the same time, a record was left in the Civil Code stating that the entire amount is due for payment. But during legal proceedings in this matter, preference is given to the Federal Law “On Compulsory Motor Liability Insurance”, so recently, even through the court, it will not be possible to take away the remaining 23% from the insurance company.

How much money can you expect?

D = (P – 23%) x (N/12),

where: D is the amount you will be paid,

P – cost of a car insurance policy,

N – number of months until the expiration of the insurance period,

23% – special deductions from each policy.

23% includes: 3% - mandatory deduction to the RSA, and 20% costs of running an insurance business (paperwork, wages of insurance company employees and other expenses).

It is important to know that the law on compulsory motor liability insurance and the Rules of Compulsory Insurance do not stipulate mandatory contributions, especially in the amount of 23%. There are many precedents for policy owners going to court with claims to declare such deductions illegal. Most court decisions were positive for motorists.

As you can see, there is nothing complicated in calculating the expected amount of money for the unused policy period. It is advisable to always calculate in advance in order to know how much money will be returned to you. When there are three weeks left before the end of the policy period, then there will be little money, but if more than three months, then the amount is rather large.

In what case will the funds be partially returned? How is the payment amount calculated and what does it depend on?

According to clause 1.16 of the Rules of Compulsory Insurance and Art. 958 of the Civil Code of the Russian Federation, the owner has the right to return the unused portion of the policy amount. To do this, you just need to provide the company with documentation confirming the legal reason: a purchase and sale agreement, a death certificate of the policyholder, papers on the liquidation of a legal entity, loss of a car.

Formula for calculating the return of insurance premiums under compulsory motor liability insurance

The final amount that the policyholder can receive back depends on:

- number of remaining months;

- the initial cost of the insurance policy.

To determine specifically how many unspent months are left, you should clearly define the date of termination of the contract, which may coincide with the date of death of the owner, the date of theft, or deprivation of the license.

The calculation formula is as follows:

SV = (PSP – 23%) x (n/12), where:

- SV – refund amount;

- PSP – full cost of the policy;

- n – the number of months remaining until the end of the insurance period.

23% are:

- 3% are transferred to RSA;

- 20% goes to pay various expenses for conducting the process of termination of the contract.

Calculation example

Let's say the vehicle was insured in December and sold in mid-June, and the original policy cost RUB 4,200.

The calculation based on this data will look like this:

CB = (4200-23%) x (5/12) = 3234 x 0.42 = 1358.

The total refund amount will be 1,358 rubles.

Procedure for contacting an insurance company

In order to terminate an insurance contract early, you must go to the insurer’s office and write a statement.

The text of the appeal must contain the following information:

- the reason for termination of the contract;

- requirement to return money for the unused policy period;

- details of the bank account to which the money should be transferred.

The date of termination of obligations between the motorist and the insurance company also depends on the specific case provided for by the MTPL Rules. If the car owner sold the car, then the date the application was written is considered the moment of termination of the contract. If the owner or policyholder of the car has died, the date of termination of the contract is considered to be the day of death indicated on the death certificate.

The closest relatives will apply for money when they have a document on the right of inheritance in their hands. They will be able to receive it no earlier than six months after the person’s death.

When, after an accident, a car turns from a means of transportation into a pile of scrap metal that cannot be restored, the date of termination of the contract will be the day noted in the technical passport. When disposing of a vehicle under a state program, the date on the act will be considered the day of early termination of the contract.

If the insurance company’s license has been revoked, then, in accordance with clause 33 of the OSAGO Rules, the motorist must provide confirmation of the fact that the insurer’s license has been revoked by publication in an official publication.

The National Bank of the Russian Federation revokes the licenses. Therefore, you need to go to its official website and in the search box about revoking the license of a particular insurance company. You will receive an answer: the date and number of the Bank of Russia order, as well as the date it entered into legal force. On the same website, find the desired issue of the journal “Bulletin of the Bank of Russia” and print the order.

Not only the policyholder personally, but also another person for whom he has notarized a power of attorney can apply to insurers for early termination of contractual obligations. Please note that there must be a power of attorney that allows you to accept funds from organizations.

What to do if money is not transferred on time

If more than 14 days have passed and the money has still not been paid, you need to do the following:

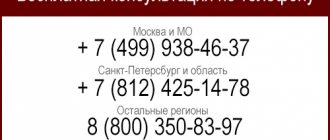

- Contact the insurance company and find out the reason.

- If they claim that they have transferred everything, then you need to take the transfer number and go to the bank, where they can easily check the availability of money.

- If the insurer violates the terms, transferred the wrong amount or refuses compensation altogether, it is worth going to the company management and the RSA, providing a copy of the policy and a statement of termination.

- If the issue is not resolved, go to court.

For each day of delay, a 1% penalty is added to the refund amount.