Is it possible to terminate an insurance contract? Can any contract be terminated? We have had to deal with this problem more than once in practice. The insurance contract provides for the possibility of early termination.

ATTENTION: our insurance lawyer will begin with a claim to your insurance company for termination of the insurance contract and return of the insurance premium, and if the settlement does not go through peacefully, he will defend you in court.

Grounds for termination of an insurance contract

When can a contract of life insurance or other insurance object be terminated? In practice, it has been proven that any insurance agreements can be terminated for the following reasons:

- the policyholder evades payment of mandatory contributions in the agreed amount and due date

- the participants have fulfilled the terms of the agreement in full and they have no claims against each other

- end of the period of legal validity of the document

- the insurance contract was declared invalid in court

- the parties have found a common denominator and agree to terminate the contract without dispute

- during the conclusion of the agreement, the policyholder provided false information or concealed important facts

All grounds for termination of agreements are described in Art. 958 of the Civil Code of the Russian Federation. In some cases, the document is terminated due to force majeure. This includes the reorganization of the agency that provided the insurance, as well as the liquidation or bankruptcy of the latter.

When is it permissible to terminate a contract?

By law, the policyholder has the right to demand termination of the insurance contract at any time during the entire validity period of the policy he purchased. However, in this case, the refund of the money paid by him for insurance will be returned only when this is provided for in the contract with the insurance company or its internal insurance rules, which is enshrined. 958 Civil Code. One of those who provides such exclusive policy cancellation conditions is VSK JSC.

Note!

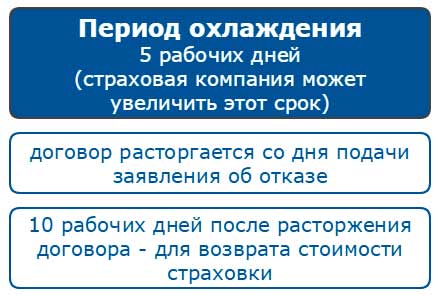

For others, only a “cooling off period” applies. In accordance with clause 1 of the Central Bank Instructions, the policyholder is guaranteed a 14-day period from the date of purchase of the insurance policy, during which he has the right to submit an application to the insurance company and thereby cancel the agreement he has concluded. If the policyholder misses the specified period, she will be able to terminate the contract as before, but it is unlikely that she will receive back the money paid for the policy.

In addition to the indicated case of unilateral refusal on the part of the insured, it is also possible to terminate the policy due to the disappearance of risk risks and the possibility of an insured event occurring. Such a reason may be the death of the insured person, which is not considered an insured event, or early repayment of the loan if the policy was purchased within the framework of a credit relationship. In these cases, policyholders may qualify for a partial refund of the amount paid for the policy.

In addition to these cases, additional grounds for termination of the insurance contract may be established by the contract itself or an additional agreement to it.

The procedure for terminating the insurance contract

So, first you need to submit an application to the insurance company to terminate the insurance contract, demanding the return of the paid insurance premium.

You can submit an application by Russian Post, necessarily by registered mail with notification and a list of the contents. You can also submit an application directly at the insurer’s office, and be sure to include a receipt stamp on your copy of the application.

The insurance company must respond to your application within 10 days from the date of receipt of the application. Please note that the insurance company must send you an application within 10 days, so when the answer comes to you depends on Russian Post.

However, at present there is a tendency in which the insurer refuses to return the insurance premium to the policyholder, or returns only a small part of it, without providing the corresponding calculations.

At this point you have two options:

- Continue the “discussion” with the insurer, submitting a claim, demanding the return of the proper amount of money

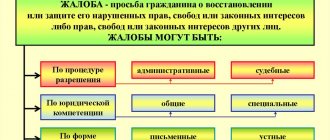

- Submit a claim

Financial risk protection

Life insurance can be offered when applying for a loan only as an additional service. The client must make the decision to purchase it voluntarily.

The loan application is considered by the bank regardless of whether the borrower has agreed to insure himself against accidents. The only consequence of refusing to take out insurance may be an increase in the interest rate, if such a provision is provided for in the contract. By carefully calculating the amount that will need to be repaid to the credit institution, you can understand the feasibility of insurance. Sometimes an increase in the interest rate will have little effect on monthly payments, but if the total payments on a loan without risk protection increase disproportionately to the amount of insurance, then it is better to agree to pay for the policy.

Not all types of insurance agreements are offered additionally. When purchasing a car on credit, purchasing a car insurance policy becomes mandatory, and when purchasing a mortgage, it is necessary to insure the purchased property.

Termination of a life insurance contract can be made at any time, like any other agreement entered into voluntarily. However, you may not indicate the reasons why it is terminated. If you decide to refuse financial risk protection, you should pay attention to the composition of the agreement and the terms within which a full refund of the money paid is provided.

The return of the insurance premium upon termination of the contract is provided for by law if certain conditions are met. Insurance companies can soften the conditions for their clients, but do not contradict legal norms.

Documents for insurance termination

The law does not establish a list of documents that must be attached to the application for termination of the insurance contract. However, such a list may be established by the insurance contract itself; in such a case, documents provided for by the contract itself must be attached to the application for termination of the insurance contract.

If the contract does not provide for the specified list, then attach:

- Copy of passport

- A copy of the insurance contract

- A copy of the insurance policy, if you were issued one

- A copy of the agreement through which the insurance was imposed (for example, a loan agreement)

The same documents will need to be attached to the claim, or to the statement of claim, if the issue could not be resolved within the framework of the submitted application for termination of the insurance contract.

However, despite the small list, we are often approached by principals who did not attach all documents to the specified application, or did not attach anything at all, and are refused, which is an illegal action of the insurance company and is subject to appeal.

After the cooling period ends

Is it possible to return the insurance after this period has expired? Only the contents of the contract can clearly answer this question.

Some insurers extend the validity period of the conditions described above to 30 calendar days. Others allow you to get money back only if you repay the loan early. The law does not establish uniform mandatory requirements for insurers.

Carefully read all clauses of the agreement and rules. You are unlikely to be able to find information in the submitted documents on how to return money for life insurance, but the general terms for terminating the contract should be indicated. The area of financial risk protection legislation is quite confusing, so it is better to contact a qualified lawyer to make sure that you can get your money back.

Any citizen has the right to refuse life insurance when applying for a loan. When concluding a loan agreement, you should always carefully read all signed documents so as not to pay unagreed amounts in the future. If you agreed to life insurance, but changed your mind, you should immediately contact the insurer, until 5 business days have passed from the date of purchase of the policy. Only in this case will the company terminate the agreement and be guaranteed to return the money.

Unfortunately, in most cases it is not possible to recover the amounts paid for insurance on your own. But if you missed the legal deadline for filing a complaint, then a competent specialist may well find suitable ways to resolve the issue if the agreement with the insurer allows you to issue a refund after the cooling-off period.

How to write an application for termination of an insurance contract?

Any document must be drawn up correctly and error-free, which requires your full attention to detail.

Thus, the application must reflect:

- name, legal address, OGRN, TIN of the insurer;

- Full name, registration address and preferably telephone number of the applicant;

- Link to the insurance contract itself (contract number (if any) and date of conclusion);

- How to make a refund, namely in cash or non-cash. In this case, if you choose a non-cash refund, you should indicate your account number and details of the bank in which the account you specified is registered.

In addition, in the application itself you need to indicate all the documents that you are going to attach to it. Such documents are indicated in the previous chapter.

USEFUL : watch the video with additional tips on waiving credit insurance, and also read more at the link, our offer of help on this issue

Step-by-step instructions on how to terminate an insurance contract and get your money back

Don't know how to terminate the contract and get your money back? Use these instructions:

- Please note the period from the date of conclusion of the agreement. If less than 14 days have passed since then, contact the bank/insurance company with a statement requesting termination of the contract. The document also reflects the following information: the account number where the insured person wishes to receive the premium, the number of the main agreement. The papers are brought to the branch in person or sent to the counterparty by registered mail. In the latter case, keep the receipt from the mail until the money is credited to the specified account. If the funds were not transferred (or they were not transferred in full), the counterfoil is supported by the case being considered in court. It is initiated by the borrower.

- If more than 14 days have passed since the agreement was signed, please refer to the text of the document. If it contains a clause providing for the possibility of terminating the contract with subsequent payment of the insurance premium, contact the bank with a corresponding request, supported by a statement. It is better to use the sample provided by a specific company. If it is not approved, we draw up an application in a free format, indicating in it the insurance number and passport details. Formulate a demand to the counterparty, expressing a desire to terminate the agreement and receive back the money paid. Place your signature and date at the bottom (the date must coincide with the date you contacted the organization). If it is not possible to contact the bank in person, the application is sent by registered mail. It is recommended to keep the receipt of its receipt by mail, all responses from the insurer. They may be needed in court if the borrower's claim is not satisfied. The bank undertakes to return the insurance amount to the client, taking into account unused days and taking into account the deduction of income tax, payment for services within the framework of agency support.

- If the insurance company refuses to return the money, citing a violation of the federal law “Protection of Consumer Rights,” the citizen has the right to complain about the counterparty to Rospotrebnazor. If the regulatory authority refuses the complaint, go to court.

Important! According to the law, the bank does not have the right to refuse the client to terminate the concluded agreement, but this does not apply to the payment of funds.

Termination period for the contract between the policyholder and the insurer

The period for terminating the insurance contract, as a general rule, is fourteen days from the date of conclusion of the insurance contract. At the same time, you need to understand that the sooner you submit an application for termination of the insurance contract, the more money you will save.

So, if the insurance itself has begun, then the insurer must withhold an amount proportional to the time during which you were insured.

However, it is worth considering that the specified fourteen-day period is a minimum, so this period may be increased by the insurance contract itself.

How do I get my mortgage insurance back?

Returning mortgage insurance has its own peculiarities. It is necessary to distinguish between insurance of the subject of the mortgage loan (house, apartment, etc.) and insurance of the life and health of the borrower. In any case, you need to study the terms of the mortgage agreement to understand whether the borrower has the right to terminate or not renew the insurance agreement or whether the bank has the right to insist on extending the insurance agreement.

When repaying your loan early, remember that no financial institution will return more than forty percent of the total amount of your insurance. The client must repay the loan before the payment deadline, then he must contact the bank with an application for early repayment and provide it to representatives of the insurance company. An additional mortgage agreement and payment schedule are attached to it. The total return period can be one calendar month. If you were refused, then you can go to court with a claim.

Early termination of an insurance contract through court

As stated above, insurers do not always meet policyholders halfway to terminate the insurance contract and return the insurance premium. Insurers have a great many explanations for such decisions, but, fortunately, there are no legal grounds. So what should you do then? We know that you already know, and we say - “Yes, that’s right, you need to go to court!”

Wait, wait, wait, wait. There is no need to rush headlong to court right now. First you need to draw up a statement of claim. Collect all documents. Finally, consult our specialists. In general, let's go in order:

- The basis for filing a claim in court for early termination of an insurance contract is a written refusal of early termination by the insurer.

- In order to win the case, we need to correctly draw up a claim, presenting the circumstances and the regulatory framework in the light we need, attaching all the necessary evidence for this.

- Evidence required . Evidence can include business correspondence between the policyholder and the insurer, a recording of a telephone conversation with an operator, and other evidence; fortunately, no one limits us in our imagination, as well as in the methods of proof.

- In addition, during the trial itself, you need to convince the court itself that you are right , which is also not an easy task, especially not for a lawyer.

USEFUL : watch the video with additional recommendations on how to behave in court as a plaintiff or defendant

In what cases can loan insurance be returned?

How to return money under existing loan insurance? This can be done on the basis of the instructions of the Central Bank of the Russian Federation under Central Bank number No. 4500-U, which replaced order No. 3854-U and increased the cooling period from 5 to 14 calendar days for contracts concluded after January 1, 2020. The cooling-off period applies to individual clients and applies only to direct insurance contracts. Refund of the insurance is possible both in case of early or full repayment of the loan.

On January 1, 2020, Central Bank Order No. 4500-U came into force, according to which a consumer can refuse an insurance product within 14 calendar days (cooling-off period).

In practice, some banks use tricks so that a person does not have the opportunity to return the insurance money. The main way to avoid returning money to banks is to join a collective insurance agreement. In this case, the consumer is not a party to the contract and is not subject to a cooling-off period. However, in some cases, it is possible to return money under such contracts, as in the case when the 14-day period is missed.

If you have questions, our lawyers will advise you on how to act correctly in your situation, draw up a complete set of documents for the return of bank insurance, including an application for termination of the insurance contract and a claim, and can also represent your interests in court on your behalf.

How to return money under a contract of direct life and health insurance of the borrower.

To do this, you need to prepare an application for termination of the loan agreement and return of funds to the policyholder’s current account (details must be attached to the application) within 14 calendar days after the conclusion of the insurance agreement. If the funds have not been received within 10 working days, you must send a pre-trial claim to the bank and, if there is no result, then go to court. Judicial practice in such cases is in most cases on the side of the consumer.

How to get your insurance money back if you repay your loan early.

If the borrower repaid the loan early and terminated the loan agreement, then the funds can be returned for the unused insurance period, because the insurance company actually ceases to bear risks under the borrower's insurance contract.

The borrower can expect to receive an insurance premium for the remaining period. The following types of policies fall under the provisions of the Central Bank of Russia:

- Basic and additional medical insurance;

- In case of death of the insured person or loss of ability to work;

- If there is damage or loss of property;

- In case of damage to vehicles;

- MTPL policies;

- Policies that protect against financial losses.

Under such circumstances, insurance companies rarely agree to voluntarily return money, so you need to go to court.

How to return insurance under a group insurance agreement.

Some banks use collective insurance agreements to evade the Central Bank's decree on the return of insurance within 14 days. In this situation, the bank enters into an agreement with the insurance company, and the borrower only instructs the bank to connect him to the collective insurance agreement. In such a situation, the bank is actually the policyholder and the return of the insurance here depends only on the will of the bank and the prescribed return conditions.

Some banks, for example, Sberbank, agree to a meeting and return the funds, while VTB24 draws up an agreement in such a way that even if the agreement is terminated, all the money remains with the bank and the insurance company.

In this situation, getting the money back is quite difficult, but possible. Ideally, you need to contact our lawyers before concluding a loan agreement. We will draw up a detailed action plan, which, if strictly followed, will leave the bank with no legal options for not returning the money.

If the contract has already been concluded, then the only way to act is through the court, and in our practice there are positive court decisions on the termination of collective insurance contracts. In this case, you need to immediately contact a lawyer without wasting time. We will prepare the entire package of documents for the bank and insurance company, and will also represent the interests of the borrower in court.

Refund of insurance premium upon termination of the insurance contract

Early termination of an insurance contract often involves the return of the insurance premium, or part thereof. We have already hinted about this to you more than once. Now let's discuss this in more detail.

According to current legislation, if you terminated your insurance contract before the execution of the insurance contract itself began, you claim ALL the insurance premium you paid, without a remainder.

However, if the insurance coverage has begun, in this case, the insurer has the right to withhold the insurance premium in a portion proportional to the insurance period itself.

The above rules apply only if your insurance is voluntary, with the exception of:

- voluntary medical insurance for foreign citizens working in the Russian Federation

- voluntary medical insurance for citizens of the Russian Federation, if the insured event occurs outside the territory of the Russian Federation

- voluntary insurance of vehicle owners

- voluntary insurance, which is a prerequisite for the implementation of certain types of professional activities provided for by the current legislation of the Russian Federation

Deadlines for contacting an insurance company

Insurance contracts may be terminated early for reasons specified in Article 958 of the Civil Code of the Russian Federation. In addition, legal events may play a role, for example, the reorganization of the company that issued the insurance, its liquidation or bankruptcy.

As a rule, early termination of insurance contracts will lead to various legal consequences and the need to take actions to return insurance premiums or contributions. This will depend on which party initiates the termination of the contract.

Questions/Answers

What to do if you receive a refusal from both the insurance company and the regulatory authority

In this case, it will not be possible to avoid litigation. You will have to cancel the voluntary insurance contract, providing the judge with evidence that it was concluded under duress. Lawyers recommend referring to the fact that information about the service provided was veiled, or was not transmitted to the consumer at all (in writing, orally). What decision the court will make depends on the judicial practice in the region, district, and on the arguments provided by the plaintiff in favor of the claim.

Is it possible to terminate a preliminary agreement without losing money?

Not everyone knows how to terminate a life insurance contract and get the money back. A consumer cannot be refused payment of a premium if the corresponding request was sent to him during the cooling-off period. If a violation by a citizen has been recorded, his demand will be satisfied by Rospotrebnadzor, and the court will also be on his side, if it comes to that. In the latter case, in addition to insurance funds, it is possible to request compensation for moral damages and punishment for the counterparty/defendant.