Citizens cannot always repay a bank loan on time or repay a debt to a microfinance organization (MFO). If the debt becomes significant, it may be referred to a collection agency for collection.

Active activity of collectors may violate the civil rights of debtors if employees call relatives or managers of debtors, make frequent visits, threaten to damage property, etc. To restore their rights, the injured citizen has the right to write a statement against the collectors to the police, as well as contact a number of other law enforcement agencies.

How to properly file a complaint to Roskomnadzor against debt collectors

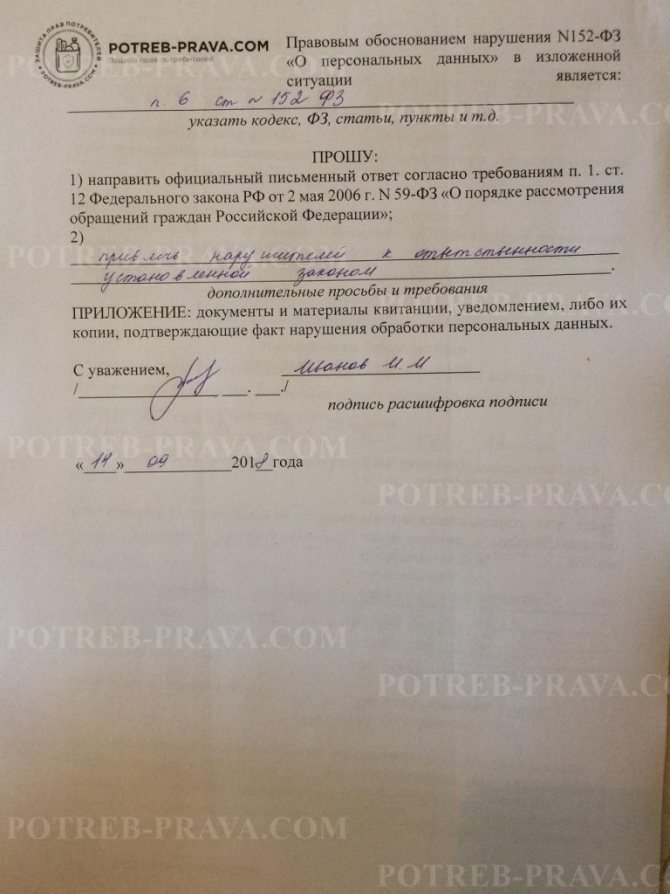

When drawing up an application, the header of the document indicates the place of residence and telephone number of the applicant, then describes the facts of debt collectors exceeding their responsibilities, which entail a violation of the rights of a citizen.

However, the statement itself will not be enough. Attached to it are copies of documents confirming the violation of the confidentiality of the applicant’s personal data by collectors when collecting debts.

Note! It is permitted to attach copies of transcripts of telephone correspondence and conversation recordings.

Evidence in the form of an audio recording of a conversation will be legal if, during the negotiations, an employee of the collection agency was informed about the recording being made.

The application to Roskomnadzor has a form similar to submission to other supervisory authorities. Thus, in the header of the document on the right, the branch of Roskomnadzor, the legal address of the organization, the official to whom the appeal is sent, and the index are indicated.

Next, in the middle of the sheet, the type of application is indicated - “complaint”. The narrative of the complaint must include detailed credit history information. The next part of the complaint is based on the evidence. It is necessary to indicate specific facts of excess by collector service officials of their powers, indicating the dates.

Next, the applicant indicates his requirements using the wording “I request.” Thus, it is necessary to initiate a check on the legality of the actions of the above persons. Based on the violations identified, indicate that the collectors have committed offenses that entail administrative liability by law enforcement agencies.

At the end, you must indicate which documents are attached, copies or originals, with reference to the number of sheets. The complaint is dated and signed in the applicant's own handwriting.

ATTENTION! Look at the completed sample complaint to Roskomnadzor against debt collectors:

Where else can the debtor turn?

Who, besides the police, has the right to help a citizen:

- The bank is the one where he initially took out the loan. It is worth remembering that by transferring the debtor’s personal data to collectors, the bank itself is breaking the law. Therefore, after visiting a financial institution, the debtor should leave a special statement there in which he will ask to withdraw his data. Then discuss the situation with the loan. It may be possible to restructure it or extend the payment terms. A lawyer can help here.

- The collection organization is definitely worth going there. Discuss the situation, consider options.

- Roskomnadzor is an organization that regulates the activities of collection organizations. You can leave a detailed review by visiting the website or going in person.

- Rospotrebnadzor is an organization whose task is to protect the interests and safety of consumers. Here, the citizen will first of all complain about the bank itself, which has not fulfilled its obligation to maintain secrecy, because it handed over the data of the indebted client to collectors.

- FSSP (Federal Bailiff Service) will consider the complainant’s request and assess the illegality of the actions of the collection organization.

- Prosecutor's office - if the actions of the collectors were not stopped by the police in any way, the citizen has the right to use the last option. The sample application to the prosecutor's office against collectors is no different from the application submitted to the police. Only in the “header” the applicant indicates a different addressee and supplements the text of the complaint with a description of his actions.

The prosecutor's office can help when all other lower-level organizations have refused. Therefore, the applicant needs to attach written statements from Roskomnadzor, the bank, and the police department. After examining the application, specialists will send a prosecutor's request to each of the places indicated by the complainant, asking them to explain their refusal.

Reasons for contacting Roskomnadzor

The basis for the applicant’s appeal is the fact of refusal to give consent to the processing of personal data by the bank. Personal information found in external organizations is the basis for holding individuals accountable.

This case is regarded as a violation of the law by the bank, and a claim must be filed against the bank’s management.

However, if there is agreement on the use of personal data for good purposes between the applicant and the bank, the transfer of personal data will also be a violation of the law.

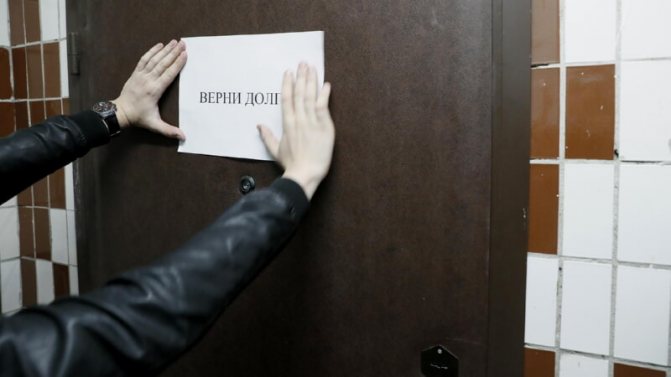

The fact of disclosure of personal data, even expressed in the posting of leaflets, gives the person the full right to contact the supervisory authority to file a complaint.

Roskomnadzor actively considers complaints filed against collection organizations.

Can a bank sell debt to collectors?

Can collectors come to the debtor’s home without a court decision? Read here.

How to get rid of debt collectors once and for all, read the link:

Where to apply?

The application can be submitted:

- to the police department at your place of residence;

- to the police department at the legal address of the collectors.

The applicant must personally contact law enforcement authorities. You must have your ID with you.

After submitting the application, the citizen is provided with a coupon. It is recommended to contact the department with this paper in two or three days to find out which investigator is handling the case.

Document submission procedure

The deadline for filing a complaint with Roskomnadzor is 1 year from the date the parties sign the loan agreement.

The supervisory authority has an online system for receiving visitors. So, having found the desired electronic page, you can file a complaint by filling out the fields and information about yourself. To specify the problem, you must select the field with the text “protection of the rights of personal data subjects.”

Important! Scanned images or photographs confirming the disclosure of information must be attached to the electronic complaint.

Next, the system will require a verification code, after which the complaint can be sent for review. There are other ways to send a package of documents to Roskomnadzor, for example, by fax or through a mailbox (submission through a personal visit).

The current fax number and branch addresses can be found on the Internet by first calling the reception or office.

Watch the video. Complaint against debt collectors:

Time limits for consideration of a complaint

The supervisory authority reviews the application within the time limit. Supervisory proceedings are initiated and an inspection is organized. After inspection activities, violations are identified, and the perpetrators are brought to administrative responsibility.

Note! Roskomnadzor responds to complaints quite quickly. In practice, an on-site inspection is organized on the same or the next day after receipt of the application. However, the legislator has established a one-month period for consideration of the application, therefore they have the right to notify the applicant within a month after submitting a package of documents to the organization.

The clerk will send a response by mail or use the electronic system if the applicant indicated his address.

Submitting a complaint to the prosecutor

When complaining about debt collectors to the prosecutor's office, the debtor has the right to ask for a prosecutor's investigation of the agency harassing him. The application is drawn up in the same form as an application to the police, but in the header, instead of the police department, the name of the district prosecutor's office is indicated. Having outlined the facts of illegal actions of debt collectors, the complainant asks for a prosecutor's inspection of the organization of which they are representatives. Also, applicants often ask to be protected from unlawful attacks and to hold the perpetrators accountable.

The prosecutor is given 30 days - during this period he is obliged to respond to the received application and send an official response to the citizen. If the application does not have the desired impact on overzealous collectors, the borrower can make an appointment with the prosecutor and once again, orally, draw attention to his problem.

What actions of debt collectors are considered legal?

According to Russian legislation, collectors, in accordance with their job descriptions, are obliged to bring to the attention of the debtor information about the existence of a debt.

They have the right to re-inform about missed deadlines and offer a convenient payment method. However, such visits, even by telephone, should not be constant.

The actions of collectors are legal in cases where an authorized collector meets with the debtor on the territory of his real estate or in a public place no more than once every 7 days.

Know! The collector has the right to make a telephone call no more than once a day and twice a week, for a total of eight calls per month.

It is not a violation to send SMS notifications, as well as sending letters: both postal and electronic, several times a day, but no more than four times a week, for a total of no more than 16 times per month.

The working hours of collection services have been established. Thus, from eight in the morning to ten in the evening on weekdays and from nine in the morning until eight in the evening on weekends, it is allowed to inform the debtor, but it is prohibited to do this at night and early in the morning.

When to complain

There are a number of prohibitions for employees of collection services. Thus, a collector cannot bring moral discomfort to a debtor, especially a minor (moratorium), exert pressure, insult, contact the debtor at night, damage his property, share information with the debtor’s neighbors and relatives, as well as his employees.

Prohibitions also include posting informative posters and publications in the immediate vicinity of the borrower’s home. Employees of collection services cannot threaten the use of preventive measures in the form of arrest and others, as well as act in relation to disabled people of the first group located in medical institutions.

Every citizen has the right to appeal the actions of debt collectors. Everyone can send complaints to various authorities.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Laws regulating collection activities

The illegality of the actions of collectors in Russia is explained not by the lack of a legislative framework, but by its ignorance by financial institutions and collectors. Banks are also responsible for unlawful actions of collection agencies, as they enter into cooperation agreements with these legal entities.

Back in 2020, the government apparatus adopted Federal Law No. 230, aimed at protecting the interests of debtors. It is here that the basics of carrying out the activities of collectors within acceptable limits are considered. Unfortunately, in reality it is not always possible to prove the illegality of the actions of collectors on the basis of this standard.

Collectors are often presented as ordinary bandits, whose activities are of an official nature and based on legislative acts. Nevertheless, citizens should be attentive to all articles of this law and, if they do not comply with the rules for the activities of collectors, insist to law enforcement agencies about the need for protection.

To implement the law, not only representatives of law enforcement government agencies must act, but also the debtors themselves, who have come under the adverse influence of the criminal activities of the collector. In this case, it is essential to collect evidence in the form of audio and video recordings, as well as documents on conducting activities contrary to the laws (licensing, presence in the state register, etc.)