The problem of overly persistent collectors of overdue debts on the territory of the Russian Federation is growing. Despite recent amendments to legislation and the creation of new regulations designed to legitimize the situation in the field, the situation is far from civilized. The new regulators of 2017, although they work well, however, the population simply has not yet figured out how to use them to the fullest. Where and to whom to complain about debt collectors for calls to relatives, friends, home visits, disclosure of personal information, and so on. It turns out to be a funny situation, it seems that legal norms already exist, sanctions and prohibitions have been published, but tax collectors continue to commit outrages. This happens because the average person simply does not know how this mechanism is applied in principle. Who is involved in solving the problem, in which cases should you turn to bailiffs, in which to general law enforcement agencies, when to communicate personally with the district prosecutor. In this review, we will clarify this situation with all the associated details, and also figure out how to fill out the papers and draw up specific applications.

Law on the activities of debt collectors

The times when almost every citizen had the image of such an employee in his head with an invariable iron in one hand and a bat in the other are long gone. Legitimate regulators were now able to impose order on agency managers, forcing them to comply with regulations and treat people with respect. But there are still plenty of exceptions today. Many particularly persistent people who want to quickly get promoted ignore the requirements of the laws. And sometimes entire companies put this idea on stream, forcing workers to deal harshly with debtors.

But it is worth knowing that any organization in this area is now strictly limited in its capabilities. And there is a whole scattering of legal acts regulating the situation in the industry. Where to complain about the actions of debt collectors depends on how and what rights were violated. There are several basic documents that will become a reliable legal support:

- Civil Code of the Russian Federation. In principle, this law fully describes the actions of both the creditor and the debtor, and the collection departments, which can be recognized as legal. Regulates the entire procedure for relations in a lending transaction. This is a basic, fundamental aspect that applies to many cases. It is especially important when a bank or other organization allows itself to take actions that are not specified in the loan agreement. This may be an assignment of claims, transfer of collection privileges to an agency, and similar issues.

- Consumer protection. Few people know that this legal act also has a very direct relation to creditors. But in reality, the client remains a consumer at the time of the functioning of the credit relationship. And he can use the full amount of help. True, where to file a complaint against debt collectors for such violations is a more complicated question. Usually this means Rospotrebnadzor.

- This also includes the well-known law on “Enforcement Proceedings”. It partially connects the FSSP and the heroes of our today's review. Sometimes the two authorities even work together, but these offices are still accountable to the bailiffs. This means that if a problematic situation arises regarding debt collection, you can always contact the department with a question about company managers. And the bailiffs will be obliged to restore order. Of course, you will need a complaint against the actions of debt collectors, a sample of which can be obtained on the open virtual resource of the FSSP. Applications are not accepted by phone, but a completed application form can be sent remotely.

- Criminal Code of the Russian Federation. An unexpected member of our list, but quite legitimate. After all, a serious number of various offenses in the field are connected precisely with this branch of legislation. Insulted - Criminal Code, threatened with violence or harm to health - here. We are already silent about the physical intervention that could have taken place. And in this case the sanctions will be much tougher. These are no longer various restrictions and financial sanctions, nor bans with the deprivation of a license to operate. Here, guilty citizens, employees and company executives can go to places not so remote. But in this option, the main link becomes another body, which acts as an accuser in court and initiates criminal cases. If you are interested, the answer to the question of where to write a complaint against debt collectors and where to find a sample application to the prosecutor’s office is available online or on the structure’s official website. The form can also be obtained directly from the office. But this is not necessary, because the application is accepted in free form. A citizen is not required to have legal knowledge to protect his rights. The main thing is to indicate the date and essence of the complaint.

- 230 Federal Law. So we got to the main thing. This law consists entirely of articles regulating work in the collection of overdue debts. And all major offenses that arise during the performance of their duties by managers usually relate to him.

Prosecutor's office

This authority has more expanded powers. That is why, by contacting the prosecutor’s office, a person will file a complaint not only against the debt collectors, but also against the activities of the organization itself in collecting problem debts. Such requests are more extensive, because they must reflect the following information:

- violation by the lender of its obligations to ensure the safety of the client’s personal data;

- information about the client’s previous appeals to regulatory authorities and responses from them;

- information about violations by representatives of the collection service of the law regulating their activities No. 230-FZ;

- history of relationship with the collection agency.

- appealing to its management with a request to stop unlawful actions against the debtor.

Employees of the prosecutor's office have the right to conduct inspections regarding the legality of the agency's activities for the collection of problem debts . Based on the results of the inspection, prosecutors initiate the initiation of a criminal or administrative case against employees of the collection agency. When filing a complaint, a person must reflect in it a request to protect his rights and interests. Both legal entities and individuals can be held liable.

Lawful actions of collectors

And there are such things. True, the list turns out to be quite narrow. And if you think about it, any employee of an organization specializing in financial collection remains an ordinary citizen. He has almost no special rights when performing his duties in his position. The only way it differs from millions of others is access to confidential data. Yes, he has information about the debt, but he is prohibited from disclosing it. Therefore, his list of acceptable actions is very small. And as soon as he takes a step aside, the borrower receives a legal opportunity to protect his interests. All that remains is to understand where to complain about the collection agency, because you can file a complaint with many different authorities. But in essence, the powers of managers include:

Bankruptcy of individuals

from 5000 rub/month

Read more

Services of a credit lawyer

from 3000 rubles

Read more

Legal assistance to debtors

from 3000 rubles

more

Write-off of loan debts

from 5000 rub/month

More details

- Informing about the presence of arrears and the specific amount due for payment. Moreover, with a detailed analysis of what part of the debt is relevant, what are sanctions and penalties, and what appeared due to the annual rate.

- Repayment requirements. Yes, the employee often says this - I demand. But this is where his powers come close to the border. He cannot force the borrower to pay. Visit or phone call. For polite, but only conversation.

Moreover, there are limitations to the described possibilities. Calls are allowed no more than once a day, no more than three times a week, with a total number of less than nine per month. Contacts during non-working hours, after 22.00 or before 8.00, are excluded. On weekends and holidays this range becomes even smaller. As a result, employees have few opportunities left.

Specific actions when debt collectors call about someone else's loan

Calls can come late in the evening, at night, and early in the morning. Therefore, during this time, put your phone on silent mode. In addition, record the fact of such actions, it is illegal.

- Do not return missed calls from unknown numbers. Look for information on this contact on the Internet.

- Record all conversations with debt collectors, but do not forget to warn about it.

- Be prepared for the fact that they will not listen to you. They will try to get money out of you in any way. To do this, they will ask the same questions several times in a strict and harsh tone. There may be attacks and intimidation. Under no circumstances should you show “weakness,” as they will put even more pressure on you. Don't be afraid and don't be annoyed. You yourself can ask several questions, thereby provoking the debtor to violate the law.

- Don't deal with debt collectors.

- Change your mobile phone number - this is perhaps the simplest and most logical solution. However, this will not help if they call you on a landline.

- Do not provide any personal information.

Submit a loan application online ⇒

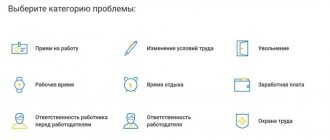

Where to file a complaint against debt collectors and in what cases is this permissible?

Any deviation from the prescribed standards is the basis for working with the competent authorities. Everything that does not fall under the three points described above. Any threat, insults, calls after hours, home visits, attempts to enter the apartment. As well as the anxiety of people not related to debt, relatives, colleagues, friends, acquaintances. Or the use of violence, damage to property, an attempt to intimidate. Disclosure of personal data, including the existence of a debt, its amount, and the period of overdue. And it doesn’t matter whether the manager did it personally or hung a photocopy of a document in the entrance with a full description of what happened.

We have listed a lot of regulations governing the work of offices. And in each of them there is a number of different deviations, in connection with which the borrower is able to begin active protection of his interests and rights. To be honest, every such collector at least once in his life violated the rights of people, going beyond the scope of his powers.

Where to file a complaint against debt collectors

We've already indicated that there is an impressive selection to choose from. There are 5 different authorities available to provide assistance. But you need to clearly understand what offenses a particular body deals with before you start writing a claim.

Distinctive features of an application to the FSSP

The agency actually constantly conducts competency and compliance checks in claim firms. And his tasks include analyzing any complaints from borrowers. It is noteworthy that convenient sending of papers is available. This is a fax, or a remote form through an official resource.

In principle, most of the violations that are directly related to the claim are dealt with here. You can submit any claims you wish. This is a general body that examines key aspects of the companies' work. It is especially important if the agency itself is outsourcing. That is, it does not purchase debt through an assignment transaction. Then their rights are even more limited, and the bailiffs will definitely be interested in deviations from the letter of the law.

A little about NAPKA

This is the only member of our list who does not have power. So why can we go there for protection? The fact is that it is a commercial organization created to regulate the work of all firms seeking money on the territory of the Russian Federation. Concerned about the damage to their image and the growing distrust on the part of the population, they created their own society, which impartially monitors all accountable objects in this area of business. These are the big brothers of small companies that have gone out of control, often operating in the provinces. Not direct management, but departments that have the right not only to reprimand, but even to revoke a license through an application to the Central Bank of Russia.

Competence of Rospotrebnadzor

This is an accountable structure of the Public Chamber. By the way, if you want to know where and how you can complain about debt collectors for calls, the OPRF hotline can provide all the specific information. Phone number – 8-800-737-77-66.

In most cases, this organization resolves problems associated with incorrectly drawn up contracts. And also obvious violations when a banking structure or agency commits actions not prescribed by the initial loan agreement. A simple example is the purchase of debt, if there were no terms of the transaction in the first edition of the document. Also, other minor aspects lie in the level of analysis of the authority. But they usually come here when filing an application to court. To correctly draw up the evidence base associated with the documents for an incorrectly executed transaction. If you do not have conditions in your loan agreement regarding the full cost of the loan, go to Rospotrebnadzor.

Police

A huge number of violations committed by managers fall within the competence of law enforcement agencies. Usually these are threats and insults; most often it is for such reasons that people go to the nearest branch. But physical contacts are also possible. If an employee allows himself to use force, then you should immediately contact the police. The same goes for trying to break into your private property. Or if your guest, who came for a conversation, allows himself too much and does not want to leave voluntarily.

Bankruptcy of individuals

from 5000 rub/month

Read more

Services of a credit lawyer

from 3000 rubles

Read more

Legal assistance to debtors

from 3000 rubles

more

Write-off of loan debts

from 5000 rub/month

More details

Where to send your request for protection of rights

So, let's briefly summarize which authorities can help us deal with particularly intrusive debt collectors. We’ll also add a few more options that are not as common as the previous ones. But they also have the opportunity to provide us with all possible assistance. And sometimes they will be more effective.

FSSP

In fact, this is where you should first direct your steps. After all, 80% of all agency violations lie in the area of review by bailiffs. What’s noteworthy is that the main website of the project allows you to remotely check any of your charges. Find out whether they really exist legally, whether they have a license, whether they have been prosecuted for misconduct before, or whether they have become involved in a lawsuit.

Roskomnadzor

Rare case. Usually, to protect personal information from dissemination and disclosure, citizens immediately go to court. But nothing prevents you from asking this body for help. In fact, not only copyrights on websites are subject to protection, but also the personal information of each borrower. And in full. Even his first and last name cannot be disclosed unless he personally consents to it.

Rospotrebnadzor

A complaint to Rospotrebnadzor against collectors, a sample of which is also available on the official website of the project, is a very effective solution if you doubt the correctness of the drawn up contract. Of course, this does not imply an oversight by bank employees, but a suspicion of criminal intent, that illegal clauses were deliberately introduced into the contract. Or if the victim himself revealed violations in the papers.

Police

All violations of companies that fall under the definition of criminal acts are recorded here. No evidence is required to submit an application. Yes, it can help the investigation and will be useful in court. But no one will demand it right at the moment of submission. And the borrower is not obliged to run around and collect evidence on his own. As for the form of presentation, everything is even more interesting. According to the law of the Russian Federation, police officers are required to accept your application even orally. You can simply go to any department and voice your request, report a violation of your rights. But it’s better, of course, to write a statement.

Prosecutor's office

People often come here if the police do not respond to an appeal. The prosecutorial authority acts as a kind of analogue of the previous paragraph. Resolves issues less quickly, but much more reliably. In principle, it is easy to understand how to write a statement to the prosecutor’s office against debt collectors, because a sample complaint is always available to the applicant right on the spot. It is also available in remote format on the website. But a completely free form of information transfer is allowed. The prosecutor's office does not have the right to refuse if they are not satisfied with the format.

Central bank

After a court decision on this issue, the Central Bank will still deal with the offending office. And he will make his contribution, mainly by excluding the organization from the register and depriving it of its license. But it’s worth complaining on your own if the reason is really compelling. For example, an office forces you to pay using its details, although it is not the creditor.

The application has been written, but the calls don’t stop?

- On the Central Bank website in the Consumer Loans section there is. Describe your situation there.

- Write a complaint to the bailiff service. They must monitor the implementation of Federal Law No. 230 of July 3, 2016. Violating collectors can be punished in rubles from 20 to 200 thousand rubles, in case of repeated violation from 50 to 500 thousand rubles or their license will be suspended for up to 90 days (Article 14.57 of the Code of Administrative Offenses of the Russian Federation ).

- The National Association of Collection Agencies is also interested in ensuring that there are no violators among their ranks.