Home / Complaints, courts, consumer rights / Services and consumer protection

Back

Published: 09/07/2018

Reading time: 7 min

0

176

Since banking activities are carried out in accordance with the Constitution of the Russian Federation, the Federal Law “On Banks and Banking Activities”, the Federal Law “On the Central Bank of the Russian Federation” and other regulations, their violation implies the client’s ability to complain about the bank on various grounds.

- How to write a complaint correctly?

- Where to contact? FAS

- TSB RF

- Roskomnadzor

- Rospotrebnadzor

Among the main complaints are when the bank:

- violated Federal Law No. 395-1 “On banks and banking activities” dated December 2, 1990;

- did not observe bank secrecy;

- provided services unprofessionally;

- made hidden payments;

- imposed illegal fines;

- refused to return insurance or commission;

- limited early repayment;

- changed the terms of the contract unilaterally;

- transferred the debt to third parties;

- wrongfully wrote off funds;

- blocked the card without reason;

- imposed additional services;

- hid information about services;

- transferred money to another recipient, etc.

In what cases can you complain to the Central Bank of the Russian Federation?

Content

The Central Bank of the Russian Federation exercises control over the implementation of legislation by credit institutions and the normal functioning of the financial system as a whole. In addition to commercial banks, the Central Bank controls the following organizations:

- microfinance organizations;

- Insurance companies;

- pawnshops;

- non-state pension funds;

- credit cooperatives and other financial communities.

The Central Bank of the Russian Federation is authorized to consider all complaints about violations of legislation by banks and other dishonest actions of credit institutions. However, the most common cases of contacting the Central Bank of the Russian Federation are:

- an increase in the loan rate not provided for in the agreement and other attempts to change the terms of the loan agreement unilaterally;

- unlawful accrual of fines and penalties;

- writing off money from the client's account without his consent;

- disclosure of customer information to third parties;

- ignoring customer requests;

- imposition of services;

- incorrect work of bank employees;

- assignment of the right to claim a debt without the written consent of the borrower.

Complaints that do not fall within the competence of the Central Bank of the Russian Federation will not be considered.

Powers of the Central Bank when considering appeals

The Central Bank of the Russian Federation issues licenses for banking activities and monitors compliance by credit institutions with banking legislation. At the request of citizens, the Central Bank has the right to initiate an inspection and, if violations are detected, take preventive measures. Thus, the Bank of Russia can block an account from which funds are unlawfully debited, issue a warning to the bank, deprive it of its license, and influence services if an error occurs in recording banking system data.

However, if a bank client needs to return money that was unlawfully withheld, the Central Bank is unlikely to help with this:

he does not have the appropriate powers. In this case, you need to contact the prosecutor's office or court.

The practice of considering citizens' appeals by the Central Bank shows that this organization most effectively solves the problems of inadequate banking services. In case of legal problems, the appeal is usually redirected to other, more competent structures: FAS, Rospotrebnadzor or the prosecutor's office.

Why is a complaint filed?

Drawing up such a statement usually aims to protect the rights of a citizen, but preliminary inspection authorities will check the validity of this complaint.

This video will tell you how to correctly write a complaint against a bank:

Applications submitted to various organizations usually lead to the bank being held liable, but it is impossible to force it to take any actions in relation to the citizen. If you need to achieve any practical result, then you need to file a lawsuit.

What actions are appropriate to complain about?

It is optimal to make this statement in situations:

- there is evidence that the bank has committed an economic crime;

- the organization is declared bankrupt;

- the actions of an employee of the institution violate the law or the rights of a citizen.

In this case, you can hold the bank liable or seek compensation.

The procedure for sending and considering appeals

Although the Central Bank of the Russian Federation is not a government body, it is obliged to consider citizens’ appeals in accordance with Federal Law No. 59-FZ of May 2, 2006 “On the procedure for considering appeals from citizens of the Russian Federation.” Therefore, the period for consideration of a complaint by the Central Bank of the Russian Federation is 30 days from the date of receipt, and if additional verification of the information specified in the appeal is required - 60 days.

There are several ways to file a complaint with the Central Bank of Russia.

Important! No matter how a complaint is submitted to the Bank of Russia against the actions of a commercial bank, the result of its consideration largely depends on how exactly it is compiled: the reason for the appeal is formulated, evidence is provided, and references to regulations are provided. Otherwise, you can receive a formal reply from the Central Bank, which will not help in solving the problem.

By phone

By phone you can find out the address and operating hours of the regional bank branch, find out the status of consideration of the application, and get advice.

Contacts:

- 300 – free short number for mobile phones;

- +7 – for residents of Moscow and the Moscow region;

- 8 – single hotline.

Through the Internet

This method is the simplest and fastest. Complaints submitted through the Internet reception of the Central Bank of the Russian Federation have the status of written appeals and are subject to mandatory consideration.

In order to submit a complaint to the Internet reception of the Bank of Russia, you need to open the official website of the Central Bank of Russia. In the form that opens, the request is filled out in 4 stages:

- Selecting the topic of the complaint. If the complaint concerns the relationship between the bank and its clients, you must select “Banking products/services”

- Description of the problem. It is necessary to fill in the fields “Product” (with which service the problem occurred), “Type of problem” and “Name of organization” (bank). Next comes the “Text of the complaint” field, where you need to state the essence of the complaint in free form. The problem should be described sequentially, in chronological order, with details of relevant documents and other evidence. Here you can attach files related to the complaint: a scan of the loan agreement, history of debits from the account, etc.

- Contacts. You can use auto-fill through government services or fill out the fields yourself. It is important to provide only reliable information about yourself, otherwise you may not receive a response to your complaint. You should definitely leave your email, which will receive a response.

- Data checking. After checking that all fields are filled in correctly, you can send a complaint to the Central Bank of the Russian Federation.

Come for a personal appointment

Personal reception of citizens at the central branch of the Bank of Russia is carried out at the address:

Moscow, Sandunovsky per., 3, building 1. Personal reception is carried out according to the schedule: Monday from 10:00 to 18:00, Tuesday-Thursday from 10:00 to 16:00, except non-working holidays.

You can also come to the regional branch of the Central Bank of the Russian Federation. A list of territorial branches of the Bank of Russia and their contacts can be found here.

At the reception, you can get advice on the legality of the banks’ actions, as well as submit a written complaint, which will be immediately registered. To do this, you need to make 2 copies of the complaint to the Central Bank, so that you can give one to a bank employee, and put a mark of delivery on the second.

Send a request by mail

In order for a written complaint not only to be accepted, but also to be answered on its merits and action taken, it must be correctly drafted. In particular, the style of presentation in the letter should be businesslike, the circumstances should be presented concisely and without emotional overtones.

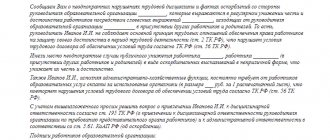

To write an appeal to the Central Bank, you must follow the following rules. The complaint begins with a header that indicates the sender's contacts and the name of the recipient: Bank of Russia. In order to receive an accurate answer, it is important to provide your correct information: full name, return address, telephone number and email address.

Next, you need to describe the essence of the complaint, indicating the following data:

- all relevant events in chronological order: date of application to the bank, name of the bank and address of the branch;

- Full name of the bank employees who performed the service;

- what rights, in the opinion of the applicant, were violated;

- links to regulations;

- requirement to conduct an investigation into the fact of violation and restore rights, provide explanations, etc.;

- attach all documents related to the complaint: account servicing agreement, payment documents, correspondence with the bank, etc.;

- date and signature.

Important! It is necessary to indicate exactly how the response to the appeal should be sent: by registered mail via mail to your home address or by e-mail.

Copies of all relevant documents are attached to the complaint.

Sample complaint

The letter should be sent by registered mail with return receipt requested to the address: 107016, Moscow, st. Neglinnaya, 12, Bank of Russia. Next, you need to wait for the return receipt, which will indicate the date of receipt of the complaint. It is from this date that the deadline for the Central Bank’s response to the appeal is considered.

How to correctly formulate a complaint against a bank

In order for the document to be effective, you must correctly understand how to correctly formulate the application. For this, the following requirements are taken into account:

- formed in writing;

- you don’t have to use any strict form;

- all information must be provided in a logical sequence;

- the document is drawn up in an official and respectful manner;

- It is not allowed to submit an anonymous report;

- information about the bank, its specific employee and the applicant is indicated.

The complaint can be brought in person or sent by mail and courier. A sample application can be downloaded below.

It is advisable to make two copies, since one remains with the applicant, but the recipient must put the appropriate acceptance mark on it.

Is evidence needed?

It is advisable to attach various materials to the complaint that confirm the applicant’s correctness. Also, if you need to receive a refund, a calculation is attached. If there are many documents, then an inventory is first drawn up. Various applications are usually considered within 30 days.

How to send a complaint against a bank to the FAS? Photo: znatokdeneg.ru

Where else to turn if the Central Bank did not help with the problem?

Rospotrebnadzor

Rospotrebnadzor is authorized to consider issues related to violation of consumer rights. He checks the circumstances set out in the complaint, and if violations are detected, within his competence, he issues an order to the bank to eliminate the violations.

Contacts: The complaint will be processed faster if you contact the branch of your region, but you can also contact the main branch directly.

- Call: unified consultation center - 8 (800) 555-49-43.

- Write to the Virtual Reception.

- Send a claim by mail or come to an appointment at the address: 127994, Moscow, Vadkovsky Lane, building 18, buildings 5 and 7.

The telephone number and address of the regional office of Rospotrebnadzor can be found on the website ХХ.rospotrebnadzor.ru, where ХХ is the region number, for example, 22.rospotrebnadzor.ru. You can call the department, come to a personal appointment, or send a complaint by mail.

FAS

Regarding credit organizations, the Federal Antimonopoly Service monitors the implementation of legislation on advertising and competition. Accordingly, you can complain to the FAS:

- for the presence of information in advertising of banking services that does not correspond to reality;

- to advertising spam;

- other violations related to bank advertising.

Contacts:

- Send a request electronically.

- Telephone.

- Personal reception: Moscow, st. Sadovaya-Kudrinskaya, house 11.

- Personal reception at the regional office.

- Postal address: Central office of the Federal Antimonopoly Service of Russia: 125993, Moscow, st. Sadovaya-Kudrinskaya, 11, D-242, GSP-3.

Financial Ombudsman

In what cases should I contact

The financial ombudsman (ombudsman) carries out pre-trial settlement of disputes between financial organizations and consumers of their services. In other words, if the bank does not respond to requests, you can write to the financial ombudsman, who will give qualified advice on issues of interest in the field of banking services, and also offer terms for resolving the dispute.

Contacts:

- Leave an email request.

- Call the Contact Center.

- Send an appeal by mail or come in person: 119017, Moscow, Staromonetny lane, building 3.

Prosecutor's office

In what cases should I contact

If a client suspects signs of fraud or other crimes (for example, disclosure of personal data) in the actions of the bank or its employees, it makes sense to contact the prosecutor’s office.

Contacts: You should write a written appeal to the prosecutor's office and send it by mail or take it personally to the prosecutor at your place of residence. You can find the nearest prosecutor's office using the Prosecutor General's Office website.

If the offense is not criminal in nature, you can write to the online reception of the prosecutor's office.