Why does the Bank of Russia accept complaints?

The Bank of Russia, also known as the Central Bank or the Central Bank of the Russian Federation, is the main regulator of the state’s financial and banking system. All other banks and other credit organizations are subordinate to him. In addition, it is entrusted with supervisory and regulatory functions, issuing and revoking licenses.

The list of responsibilities of the financial regulator includes resolving controversial and conflict situations between market participants. In this case, between clients, servicing banks and other credit institutions. The Central Bank of the Russian Federation reports directly to the State Duma.

Procedure for filing a complaint

To avoid misunderstandings, you should prepare 2 copies of the claim. One of them remains with the applicant, which will allow him to monitor compliance with the deadlines for consideration, as well as the fairness of the decision made. The document submitted to the Central Bank must contain the following information:

- full name of the authority to which the complaint will be sent;

- personal data of the submitter;

- information about the insurance company;

- details and other information about the agreement concluded between the parties;

- the reason for the conflict;

- information to substantiate the position;

- demands of the injured party.

If necessary, other documents should be submitted for consideration by the Central Bank. These include the insurance company’s written refusal, audio and video materials, and witness testimony. All this will allow us to more accurately clarify the situation and achieve justice.

In what situations should you contact the Central Bank?

The reasons for filing a complaint with the Central Bank of the Russian Federation from individuals and companies may be:

- blocking a card or account;

- high interest rate for withdrawing funds from a card or account;

- high interest rates on the loan or large fines and penalties for violating the terms of the agreement;

- changing the interest rate under lending agreements unilaterally without notifying the borrower;

- illegal accrual of penalties and fines;

- problems related to the operation of the Internet bank or personal account that the servicing bank refuses to solve;

- placing a personal telephone number in a database for auto-dialing and SMS advertising without the client’s consent;

- forcing paid additional services without the need for them;

- violation of the deadlines for issuing a card or crediting funds to it;

- non-receipt or illegal debiting of money from a card or account at an ATM or payment terminal;

- inaccurate information provided by the bank to the Credit History Bureau, which affected the credit rating;

- prohibition or restriction on contacting another insurer and forcing one to work with only one insurance company;

- transfer of debt to collectors, if this is expressly prohibited in the loan agreement;

- refusal to return the paid insurance benefit during the “cooling off period”;

- illegal issuance of a loan, for example, on the basis of a lost or fake passport or to an incapacitated person;

- illegal actions of debt collectors when working with a debtor;

- refusal to issue a deposit, interest on it;

- questionable quality of banking services;

- refusal to issue documents related to the loan;

- dissemination of the client’s personal data or their insufficient protection, resulting in a data leak;

- refusal to open an account or deposit, to carry out transactions, to open or close a bank account;

- writing off money to repay a loan without notifying the client;

- violation of the law when registering collateral;

- disclosure of information related to banking secrecy.

In addition, other violations of legislation, including antimonopoly legislation, may be the reason.

What violations can you complain about?

The Central Bank and the SRO will consider any complaint that concerns non-compliance with the law and the rights of the borrower. Standard reasons for contacting:

- an inflated interest rate exceeding the maximum percentage specified by the regulator. We are talking about the rate at the time the loan is issued;

- The lender charges illegal fees. For example, for issuing a microloan, for early repayment;

- the creditor demands to return more than the law provides. We are talking about 1.5 times the amount of interest and late fees;

- The MFO disclosed the borrower’s personal data. This really happens. Additionally, you can file a complaint with Roskomnadzor;

- the organization increased the interest on the loan after its issuance, which is illegal;

- illegal issuance of microcredit. For example, the microfinance organization is illegal, the borrower is incompetent;

- fraudulent activities related to the microcredit market. For example, applying for a loan using someone else’s passport;

- abuse of authority by the credit institution's collection service.

If the reason for your appeal is some other reason, it will still be considered. Submit requests and wait for a decision.

What to consider when filing a complaint

To file a complaint with the Central Bank of the Russian Federation, adhere to certain rules of correspondence:

- The text style is formal business. Minimum emotions and maximum facts. This will help not only understand the current situation, but also give an objective answer that will help find a way out.

- The text is succinct but concise. Verbosity and deviation from the essence may harm the content, and the appeal will not be considered.

- The complaint is made by the applicant. The Central Bank does not provide answers without indicating the details of the person who is applying.

Before sending complaints to the Bank of Russia, try to find out the situation with the servicing financial institution. At the same time, it is important not only to listen to what the specialist answers, but also to request references to the legal or internal documents that he is guided by. All specified documents, points and excerpts can then be used in the text of the complaint drawn up and sent to the Bank of Russia.

If there is any doubt that a personal meeting or telephone call to the hotline will provide complete information, it is better to submit your request in writing. Typically, a lawyer will work on drafting the written response. Therefore, the text will include all necessary references to clauses of the agreement, legislative acts, decisions of the Code of Administrative Offenses, internal regulations and other grounds.

Complaint to SRO

If there is a reason to file a complaint against a microfinance organization, the best option is to contact the self-regulatory organization (SRO) of which it is a member. By law, all microfinance organizations must be members of some SRO, which coordinates the “sponsored” company and controls its activities. We can say that MFOs are subordinate to the SRO.

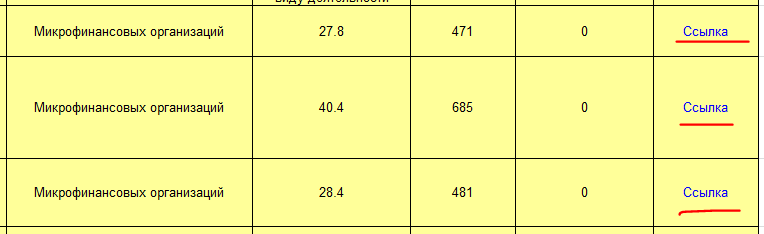

Today there are 3 main SROs operating on the market, across which microfinance organizations are scattered. If you want to file a complaint against an MFO, you must first find out which SRO it belongs to. It could be:

- Unity, the largest SRO on the market, number of members - 685;

- Microfinance Alliance is in second place, the number of members is 481;

- Microfinance and development, it includes 471 organizations.

The current register of SROs and microfinance companies that are members of them is published on the website of the Central Bank. Information is regularly updated on the website of the Central Bank of the Russian Federation.

When looking through the register, choose SROs that work with microfinance organizations. The last column of the table contains a link to the list of participants. Look for the organization you need there:

Having determined which self-regulatory organization the MFO is a member of, you can go to the SRO’s website in the contacts section and submit an appeal. You can first call the phone number provided by the structure and get advice.

How to complain about a servicing bank

You can take the completed claim to the public reception of the Central Bank. It is located in Moscow, per. Sandunovsky 3 building 1. Schedule:

- from 10:00 to 18:00 - on Monday;

- from 10:00 to 16:00 - Tuesday, Wednesday and Thursday;

- Friday, Saturday and Sunday are days off.

The public reception is closed on weekday holidays and public holidays.

During the coronavirus quarantine period, the reception office also does not receive citizens in person. The resumption of the work schedule will be announced additionally on the Central Bank website. During this time, you can use other options for filing a complaint.

What to complain about to the Central Bank

As mentioned earlier, the Bank of Russia is a supervisory authority among commercial banks; accordingly, it monitors all operations of financial institutions and monitors compliance with the legislation in force in our country. Despite the fact that many commercial banks try to comply with all the rules of the law, otherwise they may lose their license, there are cases when, for some reason, the client’s rights were violated. Let's look at some of the most common examples of what customers complain about:

- the bank did not comply with the client’s legal requirements when providing any financial services;

- imposing additional paid services in order to increase profits;

- conducting financial transactions on client accounts without his consent;

- unilateral change in the deposit or lending agreement;

- increase in interest rates during the lending period;

- incorrect work of bank employees;

- transfer of personal data to third parties without the client’s consent, violation of the Bank Secrecy Act;

- assignment of the right to claim a debt without the written consent of the borrower.

First of all, it should be noted that before you write a letter to the Central Bank of Russia and complain about the actions of the bank, you need to know the laws well, because some actions of financial institutions are well within the framework of the current legislation. Accordingly, if you decide to complain about a bank, then at least consult with a competent lawyer or independently study all the laws that control banking activities in our country.

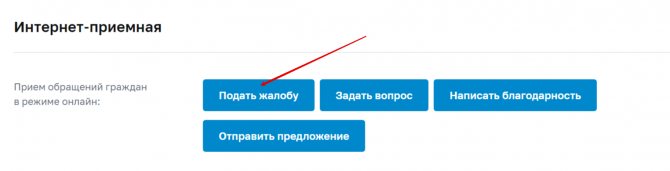

Intrent reception of the Central Bank

Other serving options

In addition to the public reception, they file a complaint with the Central Bank of the Russian Federation:

- through the Internet reception;

- by fax;

- by registered mail;

- by calling the Central Bank of the Russian Federation hotline.

The latter option is used when a conflict of interest arises on the part of Central Bank employees.

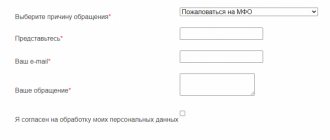

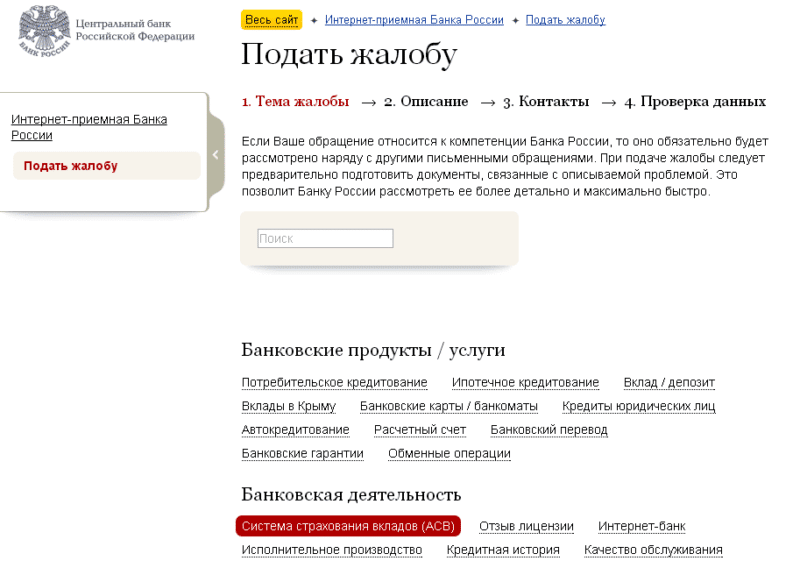

Online reception

Filing a complaint through the online reception is the most common way for most Russians to file a complaint. This option is suitable for anyone who cannot attend a public reception in person, but still wants to receive a detailed written answer.

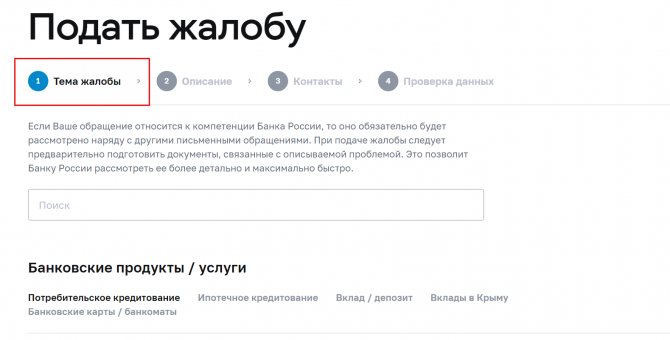

To register a complaint in the system:

- Go to the website of the Central Bank of the Russian Federation.

- Go to the "Complaint" section.

- Write the subject of the letter. For example, failure to meet the deadline for card production or imposition of paid services.

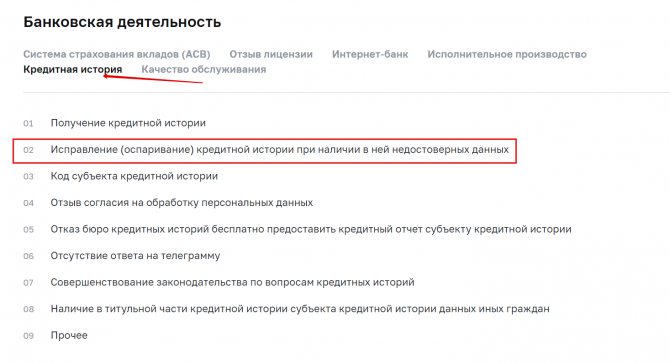

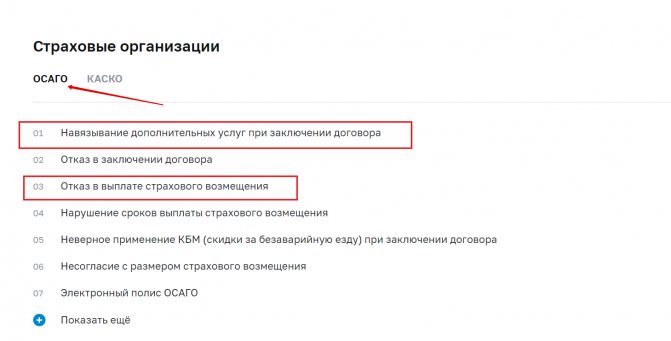

- Select whether the complaint relates to banking products, banking activities, insurance companies or other services.

- If the complaint relates to insurance, please go to the section below.

- Describe the problem, leave cantata data and indicate which method of obtaining an answer is most suitable.

- Check the data and wait for a response.

All requests that fall within the competence of the Bank of Russia are considered and responded to.

Fax

A claim to the Central Bank can be sent by fax to the following numbers in Moscow:

- 621-64-65;

- 621-62-88.

The extension code for calls from other cities and regions is +7 (495) before the phone number.

By calling 771-48-30 you can check whether your request has been received or not. If you plan to go to court, it is better to use other methods of appeal - registered mail or online reception. Fax requests may not be taken into account in court.

Ordered letter

Written requests by registered delivery to the Bank of Russia are sent to the address: 107016, Moscow, st. Neglinnaya, 12.

You can send the envelope via mail or courier. When sending by courier, it is advisable to ask to put the date of receipt of the request on the second copy, but if the question does not fall within the jurisdiction of the Central Bank of the Russian Federation, then it is not obliged to provide an answer.

Helpline

The “Helpline” of the Central Bank of the Russian Federation can be reached at 8 800 250 48 83 . Calls are accepted 24 hours a day, 7 days a week. Individuals and companies can contact this service with information:

- on the identification or suspicion of corruption in the actions of bank employees of the Central Bank of the Russian Federation;

- if a conflict of interest arises in the work of employees of the Central Bank of the Russian Federation;

- non-compliance by employees of the Central Bank of the Russian Federation with prohibitions, restrictions, obligations, and legislation of the Russian Federation.

It is not recommended to use the service for other purposes. They will not respond to calls or requests that do not relate to the listed facts.

How to write a complaint against a microfinance organization?

To write a complaint about your loans, you must accurately formulate the essence of the violation. As a rule, all complaints against the organization of quick loans are as follows:

- Violation of the terms of the microloan agreement

- Commissions prohibited by the consumer lending law

- Illegal terms of the contract

- The terms of the agreement indicate that there is no possibility of early repayment

- Disclosure of personal data of a microfinance company borrower

- Threats to the borrower

- Appearance of debt after loan repayment

- Services are imposed that are not required by the borrower: insurance, subscription service packages, magazine subscriptions

- Other violations requiring verification by regulatory authorities

Procedure for filing a complaint: basic instructions for the borrower

The complaint must describe without emotion the fact of the violation, what it is, when it was noticed by the borrower, when it actually occurred, and how the borrower’s rights are violated in connection with the violation.

- It is worth indicating what the borrower is asking to do and what the outcome of the consideration of the complaint should be. When drawing up this part of the complaint, it is necessary to proceed from the competence of the body to which the complaint is filed. Most often, it is enough to confine yourself to a request to conduct a check on the stated facts. The body that controls microfinance activities will conduct an inspection within the time limits established by law. In this case, the applicant may be asked for additional information. The outcome of the complaint depends on the competence of the authority - a fine, a notice to eliminate the violation, etc.

- The complaint must contain your full name. applicant, company name. It is better to attach a copy of the contract and other documents.

- In some cases, when filing a complaint through the website, you must be registered in the Unified Identification and Logical Information System of State Services.

USEFUL : watch the video with additional tips on filing a complaint, and also read the recommendations on the link on how to win a lawsuit with an MFI if the complaints do not produce results

What to include in a complaint: document samples

There is no universal form for a complaint to the Central Bank that is suitable in all cases. But the text of the claim submitted to the Bank of Russia must contain:

- The full name of the applicant, even if the company is applying, the personal information of the director or manager on whose behalf the complaint is made must be indicated;

- TIN and OGRN for legal entities;

- telephone for communication;

- address for sending the response - email or postal;

- the name of the company against which the claim is being made, bank, microfinance organization or other reporting organization;

- a description of the situation that served as the reason for contacting the Central Bank of the Russian Federation;

- the essence of the claim, as well as demands or proposals that will satisfy the applicant;

- a list of supporting documents that certify the claim;

- links to legislative acts;

- date of filing the complaint and signature of the applicant.

You can submit an appeal yourself if you have done thorough preparatory work. But if the applicant plans to go to court, and the complaint becomes a stage of pre-trial or judicial settlement, then it is better to contact a lawyer or advocate. He will competently compose the text of the appeal and will be able to point out all violations from the point of view of the legislation of the Russian Federation.

The sample complaint to the Bank of Russia is different for an individual and a legal entity. To give you a general idea of what this document looks like, download links have been provided.

→

→

For a specific appeal, you will need to refer to those federal laws and violations that apply to your case.

Where to begin?

In order to begin correspondence with the Central Bank of the Russian Federation, you first need to prepare an application to the bank, which is your lender, with a request to withdraw your personal data, after which the bank can contact the borrower only by mail, sending regular letters to your registered address.

There should be no calls from collectors at home, to work phones or to neighbors after the revocation of personal data. Are the calls continuing? Now we can write an application to the Central Bank.

The application to the Central Bank of the Russian Federation must contain a requirement to send an order to your creditor, a ban on disclosing bank secrets and a requirement to withdraw your personal data from third parties.

One of the central TV channels showed an interview with a debt collector who tried his best to look civilized (it was about a case in Ulyanovsk, when a collector, having thrown a Molotov cocktail through the debtor’s window, hit the crib where the child was sleeping). He said: “Yes, these are animals, these are non-humans who abandon...” To the question: “How can you collect a debt?” The collector replied: “Well, you can call, you can talk, well, write advertisements...” It is worth mentioning the story in Kaliningrad. The collection agency bought advertising stands and placed there photographs of debtors indicating the last name, first name and amount of debt.

Remember, disclosing bank secrets is a violation of the law.

Art. 26 Federal Law No. 395-1 dated December 2, 1990 “On Banks and Banking Activities” states that credit, audit and other organizations, as well as their officials and their employees, are liable for disclosure of banking secrets, including compensation for damage caused, including in accordance with the procedure established by federal law.

So, the grounds for filing a complaint with the Central Bank of the Russian Federation may be:

- Illegal transfer of debt to collectors when such a condition is not provided for in the loan agreement;

- Disclosure of banking secrecy.

Banks try to include in the loan agreement a clause on the possibility of assigning the right of claim. Therefore, the first reason is rarely a reason for the Central Bank of the Russian Federation to appeal.

But the second reason is very common. Collectors call not only the debtor, they call everyone who knows the debtor and whose phone numbers they can find. And in a conversation, they often voice the amount of debt, which is prohibited by law.

- Sample complaint to the Central Bank of the Russian Federation about the illegal assignment of the right of claim (Word 2003.doc)

- Sample complaint to the Central Bank of the Russian Federation for disclosure of bank secrets (Word 2003.doc)

There are several ways to complain to the Bank of Russia. Let's tell you a little more about some of them.

Who else can you complain to the Central Bank about?

Complaints are written to the Central Bank about the work and specific actions of not only banks, but also other organizations:

- credit cooperatives;

- housing savings cooperatives;

- pawnshops;

- insurance companies;

- microfinance organizations;

- non-state pension funds;

- investment fund managers.

In addition, the Bank of Russia is approached to resolve disputes with statistical authorities, the foreign exchange market, and between participants in the commodity market and the securities market. A complete list of reasons and organizations is posted on the Internet reception page of the Central Bank of the Pension Fund.

Other methods of communication

An Internet reception has been launched on the official website of the Central Bank of the Russian Federation to quickly respond to citizens’ requests. Here you can contact a Central Bank employee to clarify the information you are interested in.

In addition, to publish news from the activities of the Bank of Russia, a Facebook page was created, where you can also ask the operator a question and receive a quick answer. Social networks Twitter also contains the latest news collections.

You can watch a series of videos about the activities of the Bank of Russia on a special Youtube channel. Moreover, by subscribing to the channel, the user will be able to view the story among the first and always be aware of the latest events.

How long does it take to process an application?

A regular complaint that does not require the involvement of other supervisory authorities and inspections will be considered within 7-30 business days. If a credit institution has committed serious violations, the investigation period can last up to 2 months. But most often, a response or an interim letter about additional verification is received by the applicant within 30 days.

After completing the verification, the Central Bank sends a response to the communication channel that was indicated as preferred. If the request is sent through the online reception, then the response will be sent electronically to the specified e-mail. In other cases, a registered letter is often sent to the sender's specified postal address.

Where to file a complaint against Sberbank?

If the problem cannot be resolved at the management level, you can contact the regulatory authorities:

- Central Bank. The organization controls the work of institutions involved in banking activities. She is also authorized to consider complaints received from clients of institutions. It is important that the appeal is related only to the work of the organization: transfers, invoices, contracts, loans. You cannot complain about poor quality service or economic crimes to the Central Bank of the Russian Federation. The claim is reviewed by the regional office within 30 days.

- Rospotrebnadzor. The authority oversees compliance with consumer rights. You can contact it if you identify violations in customer service: ignoring contract clauses, poor-quality service, imposing additional services. After considering the complaint, the bank branch is inspected within 30 days and the result is provided to the complainant.

- Prosecutor's office. It makes sense to contact the prosecutor’s office in case of serious offenses, when specialists and management ignore legal norms. After considering the complaint, an inspection is carried out, and bank employees may be held accountable.

- Federal Antimonopoly Service. It is necessary to suppress economic crimes and fraud. A complaint is filed if the bank deliberately violates the agreement or carries out illegal transactions with the client’s funds.

- Court. The authority considers requests for which no response has been given from the bank's management. The grounds for filing an application are any offense. Typically, citizens file a claim to recover compensation, terminate a contract, or force the bank to comply with the requirements of the contract. The document is reviewed within 5 days, after which a hearing is scheduled. The court decision is enforced by force with the involvement of the FSSP.

Where else can you file a complaint?

If it was not possible to solve the problem through the Bank of Russia, then you can contact other authorities:

- Rospotrebnadzor - in case of violation of the rights of the client as a consumer of a service or banking product. And also in the case when the client did not have enough information to make a decision or it was unreliable.

- The prosecutor's office - in case of violation of the civil rights of clients.

- Federal Antimonopoly Service (FAS) - in case of a unilateral change in conditions, for example, an increase in the interest rate on a loan or a decrease in the deposit. The content of the complaint should indicate, not the conditions, but the fact that in this way the bank obtained a competitive advantage in an illegal way. Here you can also complain about SMS spam, which endlessly rains down on the client.

- Association of Russian Banks , which not only protects the interests of banks, but also strives to improve their work. This organization's website also accepts complaints from customers.

- Financial Ombudsman's office . This impartial institution for resolving disputes appeared in the Russian Federation 12 years ago. The Financial Ombudsman does not look for someone to blame. It helps to find a compromise between the bank and the client on mutually beneficial terms.

You can write an appeal to any of the above organizations if the violations are related to:

- dissemination of personal information;

- carrying out transactions on client accounts without his order and consent;

- transfer of securities owned by the client to third parties;

- changing the terms of the contract, which led to a violation of consumer rights and civil rights.

Complaints can be submitted to all these authorities simultaneously. It is especially important to do this if a lawsuit is brewing between the client and the credit institution. In this case, it is better to enlist the support of an experienced lawyer. He will help you correctly draw up all documents with reference to current legislation and in compliance with established procedures.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Sample complaint against a microfinance organization to Rospotrebnadzor

| To the Federal Service Department for supervision in the field of consumer rights protection and human well-being in the Sverdlovsk region from full name, location Complaint On September 23, I used the services of obtaining a quick loan. I signed an agreement for the amount of 50,000 rubles, after which BystroDengi LLC _________. Taking into account the above and on the basis of Decree of the Government of the Russian Federation dated June 30, 2004 No. 322 ASK:

DATE SIGNATURE |

Comments: 3

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Zina

05/11/2020 at 10:55 Hello, my name is Zina, I found myself in a tezholm situation, I left for Kyrgyzstan on March 13, back tickets, I have to be at home on March 20 and the borders were closed due to carnavirus and I am in a foreign country these two months that I am in Kyrgyzstan Kyrgyzstan asked debts from Rostvinikv to pay off the loan with the hope that the lady will return soon, please ask for preferential or reduced interest

Reply ↓ Klavdiya Treskova

05/11/2020 at 12:03 Post authorDear Zina, you should contact the bank where you received the loan. When communicating with a bank representative, explain your current situation and listen to the proposal of the bank employees. Perhaps you will be approved for a credit holiday or offered restructuring. Read what is needed to approve a credit holiday in this article. Don’t delay contacting the bank and then it will be easier for you to find a compromise and not increase the overdue period.

Reply ↓

09.17.2020 at 15:54

I, Sikorskaya I.V. a pensioner since 2010, on 01/28/2020 she contacted the Yuzhny branch of Uralsib Bank PJSC in the Adler district of Sochi for re-registration of the deposit. The bank employee immediately began to persuade me to apply for the purchase of investment shares in the same bank. I repeatedly asked (3 times) whether my money (principal amount) would be saved in any case on the market, to which the bank operator (signature on application No. 238701-U602 dated 01/28/2020 - Amelina Kristina Vladimirovna) categorically stated, that of course it will be preserved, and I can’t even doubt it! The most important thing is that after filling out the application and agreement, the bank employee did not let me read it, but immediately gave it to me to sign. On February 5 or 6, 2020, I came to the bank again to pick up my money, because... I read the terms of the contract and realized that my money was not insured, to which the same bank operator again assured me that I would trust her and that I would receive my principal amount at any time and in any case!!! When I finally found out that I was simply deceived at the Adler Uralsib Bank, I wrote a complaint dated March 26, 2020 to the manager against the bank’s actions, to which I received an “answer-unsubscribe” on April 15, 2020, signed by the General Director of Uralsib Management Company JSC A. F. Galimnurov that they allegedly conducted an investigation, which consisted in the fact that the Criminal Code did not investigate on its own (for example: after hearing an audio recording, etc.), but sent a request to the same bank that I am complaining about!!!! Will the bank really not cover up its employee and why was the most powerful argument, the audio recording of our conversation with the bank employee, not listened to!!! After all, this is an obvious, blatant fraud, and for this, this employee and her manager should at least be held accountable. I ask the Central Bank of Russia to look into my complaint (finally listen to the audio recordings of January 28, 2020 and February 5 or February 6, 2020 of our negotiations) and return my initial amount in the amount of 209,772 rubles, and also hold accountable the employees of the Adler Uralsib Bank who are involved in in my opinion illegal actions. In accordance with Russian legislation, I ask you to provide an answer within a month. If the answer is unsatisfactory, I reserve the right to appeal to the prosecutor's office of the Adler district, the prosecutor's office of Sochi, the Prosecutor General's Office, and finally to the courts of higher instances.

Reply ↓

Filing a complaint against an insurance company under MTPL to the Central Bank

The Central Bank of the Russian Federation is the main bank of the country, which supervises and controls not only credit institutions, but also non-credit financial institutions. According to Article 76.1 of the federal law dated July 10, 2002 N86-FZ (as amended on July 29, 2018) “On the Central Bank of the Russian Federation (Bank of Russia),” the list of such organizations also includes insurance companies.

A special branch of the Central Bank, the insurance market department, is responsible for the supervisory function over the activities of insurance organizations. Its main functions:

- improvement of legislation in the field of insurance;

- control over compliance with legislation by parties to the insurance business;

- control and regulation of insurance rates;

- regulation of associations of insurance companies.

The department’s competence also includes conflict resolution and dispute resolution, and bringing those responsible to justice.

For gross violations, the Central Bank of the Russian Federation may forcibly revoke the license and terminate the activities of the insurance organization.

Where to go

If problems arise with a microcredit company, the question arises where to complain . The claim is sent to the agency that has the right to resolve the problem.

Depending on the causes of the conflict, the application is submitted to such government agencies as:

- Rospotrebnadzor;

- FSSP;

- Central Bank;

- Antimonopoly Service;

- Prosecutor's Office;

- Financial Ombudsman.

Reference! Before filing a complaint with a government agency, you should try to resolve the issue peacefully by submitting a written statement directly to the MFO.

Most often, consumers file a complaint for the following reasons:

- imposition of additional services;

- refusal to conclude a contract;

- calls from employees;

- refusal to repay the loan early;

- transfer of personal data to third parties;

- violation of the terms of the agreement, etc.

In accordance with regulations, an MFO must register in the register of the Central Bank of the Russian Federation. But not all organizations comply with this condition, so their activities are difficult to control.

Before applying for a loan from an MFO, you should check whether the company is included in the register on the official website of the Central Bank of Russia.