Submit an appeal to SRO NP "Mir"

You should contact the organization provided that your MFO has entered into an agreement with it. For example, NP MIR includes 80 MFOs. SRO "Mir" accepts complaints about violations by microfinance organizations on its website and, after reviewing the application, offers options for eliminating them. You need to fill out a special form by clicking on the “Hotline for Consumers” link on the official website. In your application, be sure to indicate the reason for your request and briefly state the problem.

In 90% of cases, the issue is resolved without litigation by restructuring the loan (the term is increased, the commission or fine is reduced).

- You can submit an appeal via the link: https://www.npmir.ru/feedback/

- Hotline: 8 (800) 775–27–55

- You can check microfinance organizations in the register of members of SRO "MiR" at the link https://npmir.ru/about/sro-mir/members_sro.php

Submit an appeal to SRO NP Mir

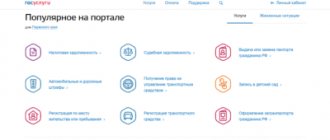

How to file a collective complaint

In addition to the individual, a collective appeal to the authorized bodies is possible, in which the person to whom the letter is sent based on the results of the inspection and his contacts: telephone number, postal address and zip code are separately indicated.

Advantages of filing a collective complaint:

- the likelihood that the Prosecutor's Office will leave the complaint without consideration or refuse to satisfy it, citing lack of evidence or groundlessness of the claims, is reduced. If a group of people applies for protection of rights, an inspection is mandatory, and it is more difficult for the violator to deny the facts of committing illegal actions or inaction in relation to several citizens;

- consideration of episodes of rights violations individually and in aggregate. Using this approach, the prosecutor compares and identifies common features of offenses, and also evaluates the situation carefully and from several angles;

- The effectiveness of a collective complaint is related to the diversity and breadth of the evidence base.

Look at the completed sample of a collective complaint to the Prosecutor's Office:

Complain to the financial ombudsman

The financial ombudsman is a special authority whose competence includes resolving disputes arising between creditors and borrowers. He acts as an intermediary between the MFO and the client during pre-trial proceedings.

You can send an appeal only in cases where the property claims do not exceed 500,000 rubles and you previously sent a request to the microfinance organization, but did not receive a response or you were not satisfied with it.

- Written requests are accepted at the address: 119017, Moscow, Staromonetny lane, 3.

- Toll-free contact center number: 8 (800) 200–00–10 (working hours: Mon-Fri, from 09:00 to 21:00 Moscow time).

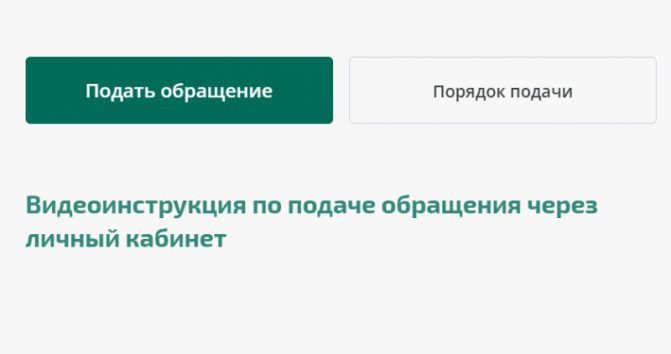

- Form for filing electronic complaints – https://finombudsman.ru/lk/login

Complain to the financial ombudsman

In what cases can consideration be refused?

Not every application or complaint is considered by the Prosecutor's Office.

It is enough to fulfill at least one of the conditions listed for the supervisory authority to ignore the appeal:

- lack of information about the applicant - anonymous letter;

- the applicant duplicates the appeal that he sent earlier and on which a decision was made;

- the meaninglessness of the statement and the lack of logic in the text;

- use of threats, insults and obscene language in the text;

- it is impossible to read the text.

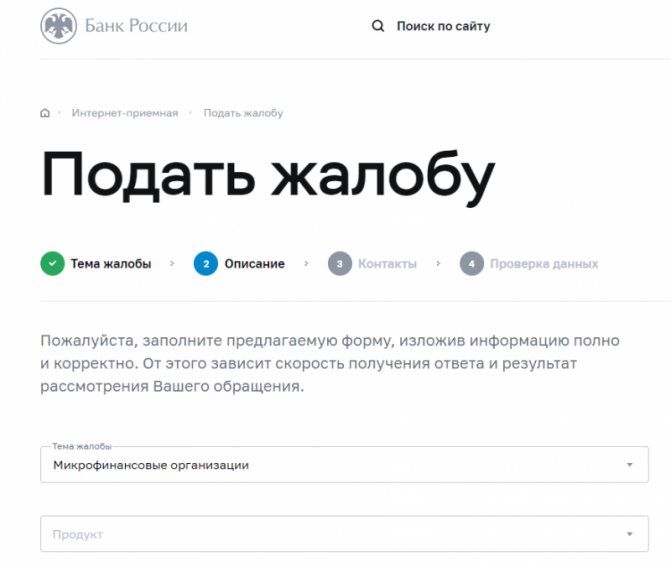

Complaint against microfinance organizations to the Central Bank of Russia

If an MFO has serious violations, the Central Bank of the Russian Federation has the right to revoke its license, after which the company will not be able to continue to engage in microfinance.

It is advisable to contact the Central Bank:

- If the microfinance organization does not have permission to operate, fines.

- The penalty or interest rate exceeds the maximum possible.

- When the terms of the contract change without warning and in a number of other cases.

The Bank of Russia recommends that borrowers first contact the MFO with a complaint and receive a response, so that the decision on the issue is as objective as possible.

- Toll free contact center number: 8 (800) 300–30–00

- Additional number (payment according to the tariffs of your operator) +7 (499) 300–30–00

- Free short number from mobile phones 300

- Form for electronic complaints: https://cbr.ru/Reception/Message/Register?messageType=Complaint

- Personal visit to the branch at the address: Moscow, lane. Sandunovsky, 3, building 1 (reception hours: Monday from 10:00 to 18:00, from Tuesday to Thursday - from 10:00 to 16:00).

Complaint against microfinance organizations to the Central Bank of Russia

What are MFOs afraid of?

Being an organization whose activities are designed to generate profit, they are afraid of the main sanctions provided for by law for violations:

- For example, failure to provide information about your credit history is fraught with a fine of up to 50,000 rubles.

- If he takes illegal actions aimed at returning money to the borrower, he may be fined up to 100,000 rubles.

- Failure to publicly disclose information about the conditions for obtaining a loan (loan agreement) on the Internet and in other ways up to 100,000 rubles.

- At the end of 2020, the Bank of Russia determined the amount of fines for violations of the law - 0.05% of the amount of debt of citizens and legal entities to microfinance organizations (for the principal debt) as of the last day of the quarter preceding the onset of liability.

A repeated violation committed within a year, if it led to a violation of consumer rights, will result in a fine of 0.1% of the principal debt.

The most terrible sanctions - closure of an organization - are applied by the Central Bank of the Russian Federation on the basis of violations of the law by such organizations, failure to provide the necessary information to the Central Bank, failure to submit reports to the supervisory authority.

The Central Bank of the Russian Federation excludes MFOs and registers for repeated violations of the requirements of the Federal Law “On consumer credit (loan)” N 353-FZ.

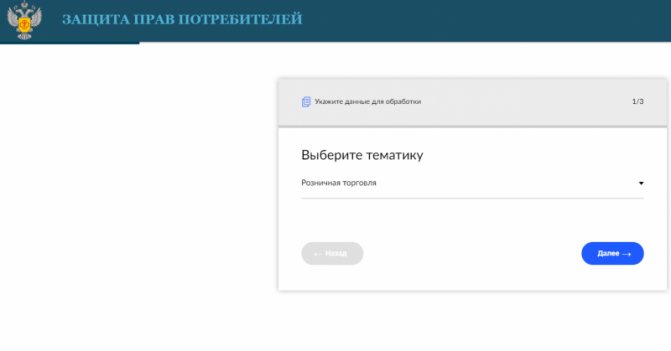

Contact Rospotrebnadzor

In case of illegal actions on the part of MFO employees, transfer of debt to collectors without your consent, disclosure of personal data, or charging of an unreasonable commission, you can contact the territorial department of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare (Rospotrebnadzor).

- Phone for information: 8 (499) 973–26–90

- Personal reception of citizens is carried out at the address: Moscow, Vadkovsky Lane, 18, building 5, 7.

- Submission of appeals on the official website in the subsection “Appeals from citizens”: https://www.rospotrebnadzor.ru/feedback/hotline2.php

Contact Rospotrebnadzor

It is worth acting according to the circumstances

Of course, it is worth understanding the problem itself, and only then trying to convey its essence to the regulatory authorities. So, in some cases, it will be enough to simply contact the directorate of a specific MFO with a complaint. This applies to situations in which, for example, you are denied a loan without explanation, or they call you, convincing you that you are a guarantor, because someone indicated your phone number when drawing up the contract.

The activities of microfinance organizations in the Russian Federation are controlled by several legislative acts:

- “On microfinance activities and microfinance organizations”;

- “On consumer lending”;

- “On the protection of consumer rights.”

Info

It is worth familiarizing yourself with these documents, not only in the event that a claim is made against you, but also before taking out a loan. In particular, the legislation of the same name well conveys the essence and powers of MFOs in relation to the consumer of credit services. When defending your rights before regulatory authorities, you will need to provide all possible arguments, which should be based on legislative acts.

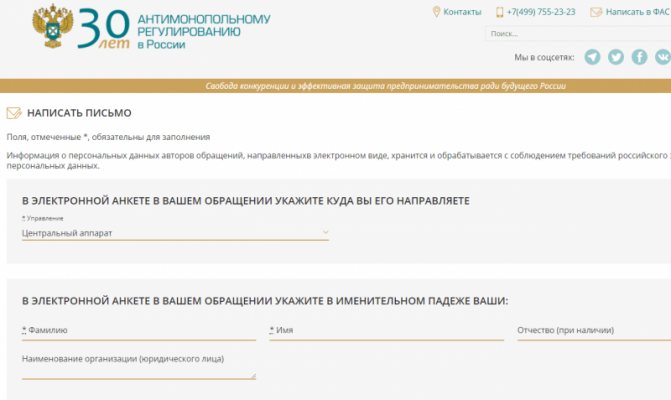

Complaint to the Federal Antimonopoly Service

FAS provides assistance in cases of misleading borrowers through advertising that does not correspond to reality. For example, an MFO advertises some conditions, but specifies others in the loan agreement. Another reason for applying may be that the company has not received registration from the Central Bank of the Russian Federation, but is engaged in advertising and offers to issue a microloan.

- Multi-channel telephone line: +7 (499) 755–23–23

- Address: Moscow, st. Sadovaya-Kudrinskaya, 11

- Email:

- Contacts of territorial offices: https://fas.gov.ru/pages/kontakty_territorialnye_organy

- Write a letter: https://fas.gov.ru/approaches/new

- Applications are also accepted through State Services

Complaints are written in any form or in accordance with the electronic form indicated on the website of a specific service. You must provide your details (full name, registration address, passport series and number), the essence of the problem, date, signature. Experts recommend attaching a copy of the agreement with the microfinance organization and copies of payment documents to the complaint.

Complaint to the Federal Antimonopoly Service

Who else should I complain to?

These are not the only options. If a consumer took out a loan and found himself in an unpleasant situation due to the fault of the MCC, he can solve the debt problem with the help of:

- Roskomnadzor;

- prosecutor;

- police.

You need to use all possibilities - send a complaint to Roskomnadzor, rely on prosecutorial leverage, and you can also contact law enforcement agencies. Write letters to different authorities, but be sure to notify the ICC of your decision in advance.

Remember that the company can also contact the FSSP bailiff service. MFOs complain about negligent debtors, and thereby express a claim on their part to the borrower. Do “microloans” go to court? Easily, if the borrower is so inclined. Soberly assess the situation and your strengths, but it is even better not to let the matter go beyond the borrower and the MCC.

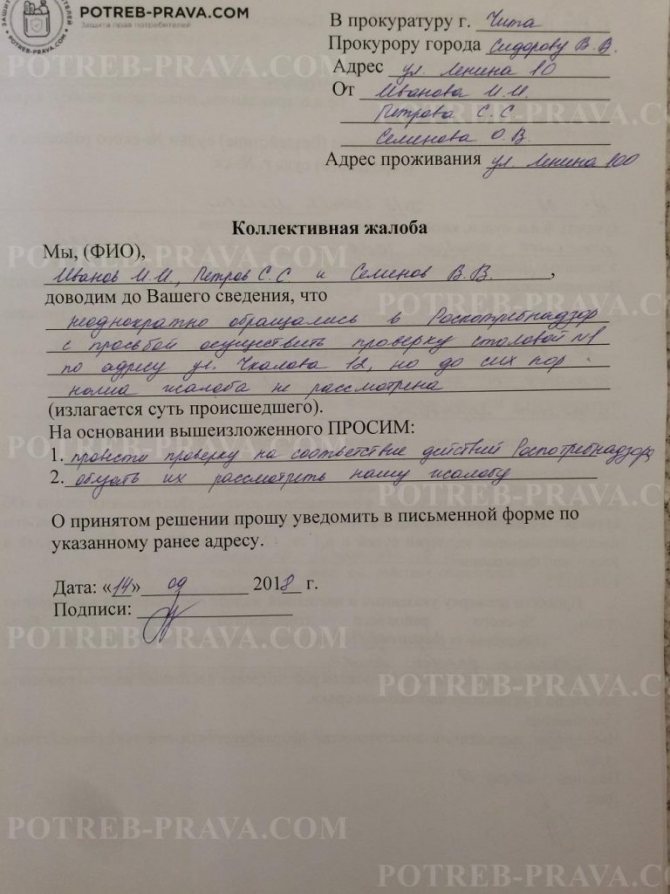

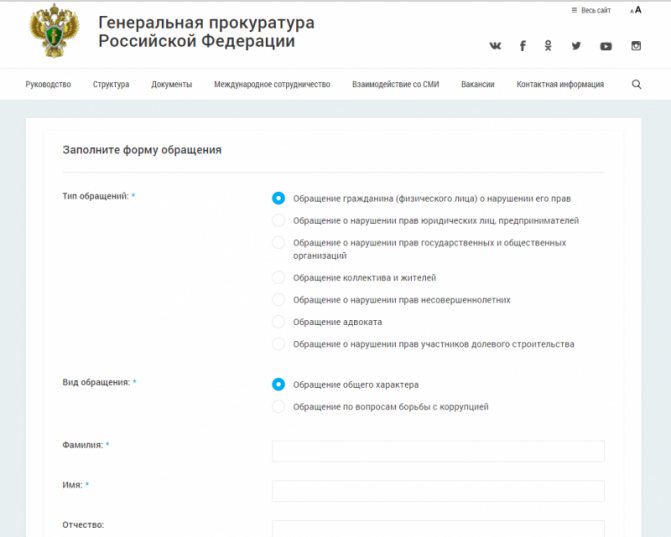

Complaint to the prosecutor's office

The employees of the MFO Security Service began to threaten, blackmail you, bother you with calls in the evening and at night, put moral pressure on you and constantly look for a personal meeting? In this case, you can immediately go to the territorial body of the Prosecutor's Office and write a statement. Clearly state the essence of the problem, if possible, confirm the facts of violations with audio files, photo or video materials, and testimony of witnesses. Applications are accepted during a personal visit, through the online reception or by registered mail.

Official website of the General Prosecutor's Office of the Russian Federation: https://genproc.gov.ru/

Internet reception where you can submit an application electronically: https://ipriem.genproc.gov.ru/contacts/ipriem/

Phone number for inquiries: 8 (495) 987–56–56

Complaint to the prosecutor's office

Ways to file a complaint

The solution to the problem that has arisen is possible by filing a complaint with the Central Bank. This is done by means of a written statement or by submitting a complaint online on the institution's website. To do this you need:

- Make a written statement.

- Attach evidence.

- Send a request through the online reception or by registered mail.

Before sending a request, you should call the free hotline to get advice at 8 800 250 40 72.

You can compose it yourself in any form using the following algorithm:

- The header is filled out indicating the organization to which the complaint was sent.

- The citizen's full name, passport details and registration address are indicated.

- The essence of the problem is described.

- The date is indicated and the citizen’s signature is placed.

- Attached are photocopies of all documentation and papers that confirm the unlawful actions of the MFO.

The complaint must be drawn up in detail and contain information about the facts of violation of the law and the rights of the citizen. It is necessary to write strictly to the point, discarding emotions. Obscene language and unfounded accusations are unacceptable, only business style of address.

The application must contain all information about the applicant and the microfinance organization. Otherwise, the complaint will not be considered.

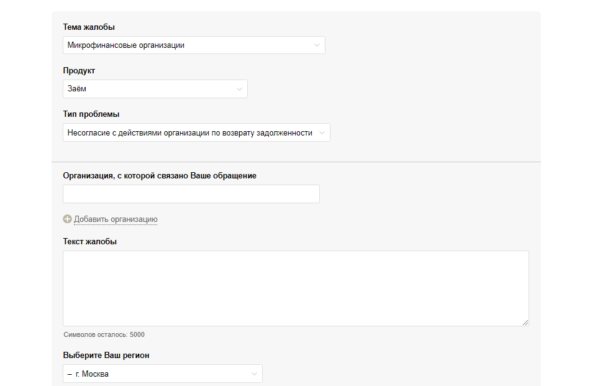

The easiest way to submit an appeal to the Central Bank of the Russian Federation is through the appropriate section of its website. Possible application topics are presented here in a conveniently structured catalog; you can also use the search bar. To file a complaint, in the “Other” section, click on the “Microfinance organizations” link. Next, on the page that opens, select the product that your request relates to and the type of problem.

Next, you need to indicate the details of the company you are complaining about, region, date and contract number (in case of a problem with the loan), as well as enter the text of the complaint and attach the necessary documents.

As an application through the online reception, you can send not only scans of documents, but also photos, video and audio evidence. The main thing is that the total file size should not exceed 12 megabytes.

This opportunity is an undoubted advantage of sending a complaint via the Internet compared to regular mail. Your request will be assigned a registration number, which will be sent to the specified email. It is necessary to indicate contact information for feedback and full name, otherwise there will be no response to the request. The Central Bank does not consider anonymous complaints.

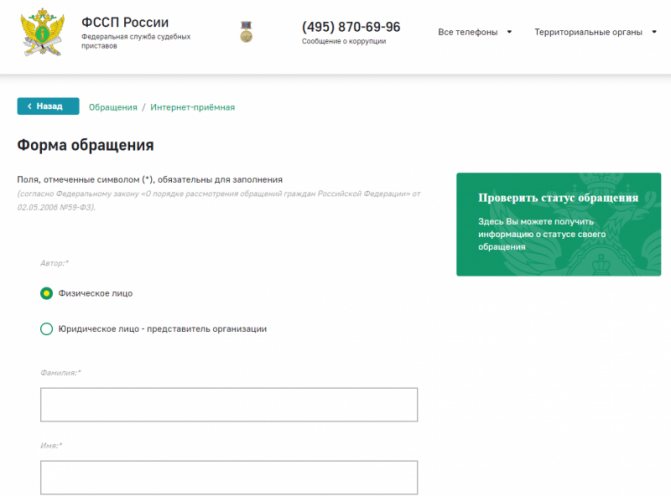

Complaint against microfinance organizations to the FSSP

If illegal methods of debt collection are used, you can contact the Federal Bailiff Service (FSSP). Submit your complaint in person, when visiting the regional office of the FSSP, send it by registered mail or through the online reception. In your appeal, indicate the essence of the complaints against the work of the MFO, and, if possible, attach evidence. 30 days are allotted for consideration of the complaint.

Internet reception: https://fssp.gov.ru/form/

Helpline: 8 (495) 870–69–96

Call center: 8 (800) 250–39–32

View the address and telephone number of the territorial authority on the map: https://fssp.gov.ru/form/

Complaint against microfinance organizations to the FSSP

How to complain correctly

If, however, the situation is not conducive to a peaceful resolution of the conflict, you need to put pressure on the creditor with the help of government agencies. How to write a complaint correctly? The document must formulate in extreme detail and clearly the essence of the claim against the MFO. Templates and contacts are listed above - each organization has its own requirements. But the general points are:

- you need to indicate lane. inf. – full name, address;

- it is necessary to describe what the problem is - in simple language;

- it is required to indicate the date of application and sign the submitted document;

- Photocopies of all required documents must be attached.

Legitimate reasons for complaints against microfinance organizations

It is not always the case that the microfinance organization is wrong. Below are possible situations where violations on the part of an MFO are obvious.

- Unilateral increase in interest rate (without notifying the borrower).

- Refusal to repay the loan early.

- Incompetence of MFO employees.

- Refusal of the microfinance organization to issue a certificate of full fulfillment of debt obligations by the borrower.

- Refusal to reimburse commissions and insurance.

- Non-compliance with bank secrecy, disclosure of personal data.

- Connecting additional paid services without notifying the client.

Separately, I would like to say about calls and threats from collection agencies. Any bank and microfinance organization has the legal right to transfer debt to third parties. This is stated in the Civil Code and mentioned in the loan agreement. However, with the entry into force of Law No. 230 “On the protection of the legitimate interests of individuals when carrying out activities to repay overdue debts,” the activities of such organizations are clearly regulated. If you start receiving night calls, threatening calls, or you don’t like the persistence with which the debt collection organization’s employees act, contact the police. In this case, the law is completely on your side.

Appealing is not always the right decision

It is worth understanding that the microfinance organization pursues completely legitimate goals when contacting the borrower to claim a debt, or charging additional interest. In this case, it is worth understanding that going to an MFC meeting is sometimes much more profitable than trying to escape obligations.

Today, there are many ways to reduce the credit burden, for example, debt restructuring or refinancing. If we are talking about increasing the interest rate due to violations of the payment schedule, and this right arises from your own carelessness, then the complaint can only complicate the situation. The same applies to the transfer of your debt to collectors under the terms of the agreement. A complaint against an MFO is relevant only if there are actual violations.

What can be considered a reason for filing a complaint? Calls at night, threats from representatives of a microfinance organization or a collection agency cannot be legitimized, and this may be a legal reason for an appeal. Let's take a closer look at where exactly you should contact depending on the situation.

When not to complain about a microfinance organization

You shouldn’t always immediately run to complain about the company - it may turn out that it is the client who is wrong in the current situation. There is a high probability that a misunderstanding has arisen and it is much easier to resolve the problem directly with the MFO peacefully.

There is no point in filing complaints with higher authorities if the microfinance organization has not violated anything. Keep in mind that it will take approximately 1 month to wait for a response to your complaint. As a result, the issue will not be resolved in your favor, and the amount of the penalty will only increase.

We also do not recommend immediately writing appeals to the prosecutor’s office or the Central Bank of the Russian Federation. A full inspection of a microfinance organization clearly will not contribute to a peaceful solution to the problem, if you were counting on it.

Below you can familiarize yourself with reliable microfinance organizations that have certificates from the Central Bank of the Russian Federation, and choose the most favorable loan offer for you.

Causes of conflict with banks and microfinance organizations

Several government bodies monitor the control of banking activities. Among them are the Central Bank of the Russian Federation and Rospotrebnadzor. There are several common reasons for filing a complaint against a financial institution:

- Violations of client rights and legal standards when lending;

- Failure of the bank to comply with the terms of provision of services and fulfillment of its obligations;

- Fraudulent actions on the part of a bank or microfinance organization.

The first type of complaints is related to lending issues. The bank may charge the client an unreasonable commission or an inflated interest rate. It is not uncommon for a financial institution to refuse to close a loan early and issue a certificate of repayment.

According to Article 421 of the Civil Code of the Russian Federation, when applying for a loan, the borrower is not required to draw up an additional insurance agreement. However, in practice, banks try in every way to include insurance in the loan agreement.

The borrower can file a complaint against the actions of the financial institution to impose additional services . You can write an application to Rospotrebnadzor against the bank, a sample of which will be presented below, and be sure that the complaint will not be ignored and will bring a positive effect.

What other reasons are the most common?:

- Distortion of credit information, silence about the real state of the account;

- Connecting additional services without the client’s consent;

- Unreasonable write-off of funds, account blocking;

- Transfer of a credit file to collectors without drawing up an assignment agreement.

In addition to credit relations with banks, borrowers often complain about the actions of collectors who actually represent the interests of the bank.

Legal advice

The federal and regional governments and the Central Bank should promote information openness on the work of microfinance organizations and offer citizens information about the legality and illegality of activities carried out in the microfinance market. For this purpose, legislative acts are also being developed that are worth paying attention to.

However, responsibility is not relieved from the citizen himself, who applies for easily issued credits and loans with conditions that are simplified at first glance. The ease of issuing money in person without an expected period or the absence of the need to secure debt obligations with collateral and guarantees should become markers for the population about the need to carefully study the agreement with the MFO.

Often, these privileges hide huge interest rates, calculated not in monthly, but in daily terms (unlike other supporters of the Central Bank system). Therefore, after clarifying the presence of MFOs in the register of the Federal Service for Financial Markets - FFMS, distributed by the Central Bank, additional calculator calculations should be carried out according to the tariffs in force here.