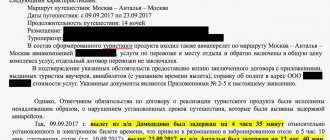

Refund of prepayment under contract sample letter

- partial payment of funds for the purchase of goods as a percentage or by agreement with the seller;

- conclusion of an agreement valid for a long period of time.

- payment of the full amount of the cost of the goods;

When returning an advance payment, it is important to understand the difference between a deposit and an advance, since the first concept has legal norms and is a guarantor of the signed agreement.

An advance does not require any paperwork. The buyer has the right to demand the advance payment back if he refuses the purchase or service provided.

How to write a letter for advance refund

Sample letter for funds Details of LLC “Name of Organization”: General Director ________________ Good afternoon!

There is no unified form, so we draw up a free application.

Be sure to include the following information: Attach copies of supporting documents: payment slips, bank statements about debits from the account.

In the inventory, indicate not only the quantity, but also the number of pages in each of them.

Sample letter for return of goods and funds Prepayment for goods that the supplier is just about to deliver is not uncommon.

Refund for undelivered goods - sample letter and procedure

In the contract for the delivery of products, a separate clause stipulates the transfer of an advance payment or the full cost of the products.

Otherwise, the supplier's risks increase. Prepayment guarantees the protection of the rights of both parties:

- Supplier in timely payment;

- Buyer in timely delivery.

In this case, compensation for the cost of undelivered products directly depends on the existence of the contract and its content.

You can request a refund for undelivered goods:

- By submitting a claim;

- Through negotiations with the supplier;

- By filing a claim in court.

When starting oral negotiations with an unscrupulous party, you should remember that they are not evidence.

Sample letter for refund of advance payment to buyer

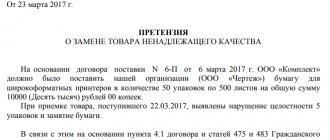

Request (claim) of the buyer for the return of the advance payment by the supplier under the supply agreement in connection with non-delivery of goods Requirement (claim) of the buyer for the return of the advance payment by the supplier under the supply agreement in connection with non-delivery of goods Clause _____ of the Supply Agreement dated “__”___________ ____

N _____ (if the request is signed by the applicant’s representative). Other documents confirming the circumstances on which the applicant bases his claims. Request (claim) of the buyer for the return of the advance payment by the supplier under the supply agreement due to non-delivery of goods.

Termination of contract with return of advance payment sample

The need to return a previously paid advance (money) under a contract, as a rule, arises when the contract (agreement) is terminated due to: • failure to fulfill obligations under the contract • refusal of the contract (agreement) due to the fact that the circumstances have changed somewhat and the need for the service or the product is no longer available. The procedure for returning the advance (money) in the event of termination of the contract directly depends on whether funds such as: • advance payment of the cost of the agreement have been paid. In addition, it is necessary to take into account what conditions the agreement (contract) provides in the event of its early termination.

Refund of advance upon termination of contract. What is provided by law? Depending on the grounds for termination of the contract and the type of contract, the law provides for the procedure for terminating the specified document and the fate of previously paid money.

Refund letter from supplier

The request must be formulated in writing.

The items should be arranged in the following order: Original document number in the company’s internal document flow; Date: day, month, year; Full information about the partner: name, address, TIN, checkpoint, etc.;

1. Consider the Agreement dated _______ 20__ ________ (hereinafter referred to as the Agreement) terminated by agreement of the Parties from the moment the Parties sign this Agreement.

3. From the moment the Parties sign this Agreement, the Parties do not have any financial or other claims against each other, with the exception of the Contractor’s obligation to return the advance payment under the Agreement in the manner established in clause 2 of this Agreement. 5. Details and signatures of the Parties. "____" ___________ 20__.

1. By agreement of the Supplier and the Buyer, Contract No. _________ dated “___” _____________ _____ for the supply of goods is terminated from ____________ 20__. 2. The Supplier is obliged to return to the Buyer, within the period of ____________ 20__, the advance payment transferred for the goods to be delivered by payment order N ____ dated “___” ____________ 20___ in the amount of ____________ (_________________). 3.

Sample letter to supplier about prepayment refund

- The letter is drawn up on a company document of the organization indicating its details. Usually for these purposes the company has specially prepared forms for correspondence with third-party companies.

N, p.

2 tbsp. 520 of the Civil Code of the Russian Federation, please return the advance payment in the amount of ( ) rubles under the Supply Agreement dated » » city.

N due to non-delivery of goods in the following order. Attachments: 1. Copy of the Supply Agreement dated » »

N. 2. Copies of documents confirming the advance payment. 3. Power of attorney of the representative dated » »

N (if the request is signed by the applicant’s representative).

Reflection of transactions in accounting Let's consider the procedure for reflecting transactions in accounting accounts on the part of all participants in the transaction: No. Situation Supplier Buyer 1 Advance transferred excessively Dt 51 Kt 62 - advance received; Dt 51 Kt 76/2 - excess amount received Dt 60 Kt 51 - prepayment transferred; Dt 76/2 Kt 51 - excessively transferred amount 2 Erroneous transfer Dt 51 Kt 76/2 - erroneously received amount Dt 76/2 Kt 51 - erroneously transferred amount 3 Termination or change of contract terms Dt 51 Kt 62 - prepayment received Dt 60 Kt 51 — advance payment is transferred When funds are returned, reverse accounting entries are made.

Letter of refund of advance payment for goods

Download an application for a refund for a product Application for a return of a product from the buyer In accordance with established custom in the consumer sphere, an application for a product and an application for a refund are identical documents in essence.

In both appeals there is a demand to take back the goods and, therefore, to terminate the purchase and sale agreement.

Source: https://152-zakon.ru/vozvrat-predoplaty-po-dogovoru-obrazec-pisma-12444/

Document structure

A letter (notice or notification) about excessively transferred funds is drawn up in any form. The legislation of the Russian Federation does not determine the structure of this document. However, in order for the unjustly enriched person to be provided with the most complete information, the text of the letter should indicate:

- business name of the company sending the letter;

- outgoing document number and date of its preparation;

- full name of the addressee (name of the enterprise, address, full name of the manager);

- address to the manager (for example, “Dear Pyotr Petrovich!”);

- actual data (date, time of transfer of funds, payment order number, amount, how much it exceeds the required payments);

- reasons for the overpayment (calculator error, late submission of information to a specialist, etc.);

- a request to return amounts paid in excess of the norm;

- the exact amount of funds to be refunded;

- bank details to make a refund;

- initials and position of the person signing the document.

The letter can indicate legislative acts that establish obligations to return unjustifiably received amounts, as well as notify the counterparty of the negative consequences that will result from ignoring the request for a return.

The return notice may be signed:

- the head of the organization or his deputy (subject to confirmation of his authority);

- chief accountant;

- by any employee of the enterprise, provided that the signature is affixed with the official seal of the company.

To return funds, some organizations (banks, government settlement authorities) ask you to fill out an application using a special form. In this case, the sample or form is issued by the organization itself.

This is interesting: Order on a salary increase sample

Documents confirming unjust enrichment can be attached to the letter requesting the return of funds, namely:

- money orders;

- bank account statements;

- acts of reconciliation of mutual settlements.

Application for refund of advance payment for goods sample

Features of drawing up an application for a refund for a product - a sample letter to a supplier The need to draw up a letter for a refund can arise for completely different reasons. For example, you returned a product of inadequate quality to the store, but did not receive money for it on time.

Or one legal entity paid for services or goods to another, but the paid obligations were not fulfilled. Or the payment for the services provided turned out to be more than necessary (for both legal entities and individuals). For example, you entered into a contract with a construction organization to perform certain work for a specific amount.

And after they were completed, it turned out that less work was completed than specified in the contract.

There is only one pre-trial solution to such situations. It is necessary to write an application in accordance with the standard form (for legal entities, it is necessary on company letterhead) with a request to return the funds to the account, for the following reasons:

- excess transfers;

- money transferred to the wrong account by mistake;

- payment for goods of inadequate quality;

- other situations.

The payer, naturally, is determined to get his finances back as soon as possible. The recipient, in turn, requires compliance with certain standard rules for the return of payment / payment. To ensure that everyone is satisfied in the end, that legal standards are complied with (and most importantly, that you get your money back), before filing a claim, consult with specialists.

You can contact a lawyer-consultant free of charge through the feedback form on our website.

Return procedure procedure

The process of returning funds for legal entities and individuals is practically no different. There are small nuances, but they are not global. In any case, documents confirming the fact of payment or transfer of funds to the defendant’s account must be available. This is a payment receipt, or accounting payment documents, etc.

For legal entities, a letterhead will be required; for individuals, a white sheet of A4 paper is sufficient. In the upper right corner, fill in the details of the organization to which the claim is being sent, as well as all the detailed information of the applicant.

Such letters are written to the main person in the organization. Usually this is the director. It is necessary to know his last name and at least his initials. The main part of the letter should contain the essence of the complaint.

Who, when, to whom, how much transferred and on what grounds this money should be returned (legal norms and provisions).

Excess transferred funds or money that must be returned for goods of inadequate quality are much easier to obtain than an erroneous money transfer.

In this situation, you must first write to the person to whose account the money was received. This person will most likely refuse to return the money (even if it is an official company).

All that remains is to file an application with the court. And you can win the case if you prove that the error in transferring funds is not your fault.

There are many situations in which you need to return your money; there are even more nuances and subtleties for each situation.

In order to understand everything and achieve positive results, before starting any actions, you need to consult with experienced lawyers. Moreover, this can be done absolutely free on our website through the feedback form.

Application from the buyer for a refund of the prepayment

Application from the buyer for a refund of the prepayment

Is advance payment refundable or not: requirements, procedure and features

The latter should include a calculation of damages. This amount may include:

- the amount of the penalty in case of violation of deadlines;

- interest on the use of other people's funds;

- compensation for damage caused by violation of deadlines;

- amount for moral damage.

- the entire amount of advance payment;

If the court decides that the buyer is right, then, in addition to the payments listed above, he is entitled to a fine amounting to 50% of the total amount of damage, including moral damage, as well as payment of costs associated with participation in court. This is a common question.

Is the advance payment refundable or not?

We have answered this question.

Application for return of goods from the buyer (sample)

Update: June 14, 2020

Application for a refund for a product It should be noted that, due to the existing provisions of the rule-making acts of the Russian Federation, only citizens have the right to contact the seller of a product of proper quality with an application for its return. In this case, a necessary condition for recognizing such a claim as legitimate is the actual acquisition of property for personal or family needs.

In other cases, to return goods you need:

- inadequate quality of property;

- the opportunity provided by the contract to return inventory items.

When studying the issue of the legality of returning purchased property to the seller, you need to remember that even the buyer’s full compliance with the established requirements does not guarantee the return of money to such a person.

It should be borne in mind that an application for a refund for a product, a sample of which is available at the link below, will be satisfied only if: Download an application for a refund for the product In accordance with established custom in the consumer sphere, an application for the return of goods and an application for a refund are essentially identical documents.

In both appeals there is a demand to take back the goods and, therefore, to terminate the purchase and sale agreement.

The legal consequence of the described actions is the seller’s obligation to return to the consumer the money received for the unsuitable item. Regardless of the name of the relevant application, when drawing it up, it must be taken into account that it must: The application must necessarily contain the handwritten signature of the buyer returning the goods, as well as the date of its preparation.

It should be noted that if the money for the goods is not returned immediately, it is necessary to prepare two identical versions of the application, on one of which the seller must put a stamp on receipt of the application. Failure to comply with a consumer’s legitimate request may lead to legal disputes and negative consequences for the organization in the form of:

- a fine for refusing to voluntarily satisfy a citizen’s legal demand;

- compensation for moral damage;

- reimbursement of the buyer's legal costs.

Buyer's application for refund of advance payment for goods

The buyer has the right to demand the advance payment back if he refuses the purchase or service provided.

There must be a seal of the responsible organization (stamps are placed on all pages) and signatures of the contractor and the customer or their representatives. The date of compilation is also required. If the document is drawn up without inaccuracies, then a refund will be possible for services not provided.

To return money for services not provided, you must have the necessary documents. Is there something on them? What to refer to? It is no longer possible to purchase the product, since it was purchased in another store on April 29.

Attached the agreement with several photos May 13, 2014, 17:49 Mikhail Pishchulin,

Application for refund of prepayment for goods sample

A claim for non-delivery can be made from the moment the agreement expires, in written or oral form. In relations between retail outlets and customers, contracts are not always concluded; sometimes terms are only agreed upon verbally.

It is important that the consumer has in hand documentary evidence of payment in the form of a check or other payment document.

When concluding a contractual relationship, these terms are usually specified in the supply agreement. There must be a seal of the responsible organization (stamps are placed on all pages) and signatures of the contractor and the customer or their representatives.

The date of compilation is also required.

In order not to waste time on drawing up these documents each time, use our form and sample application for the return of goods from the buyer.

Download and simply let the buyer fill out the required form from those presented below, depending on what he wants to do: exchange what he purchased or return the money for it.

How to return an advance payment for an item when canceling a purchase

If the transaction is canceled by the seller, he will have to give notice, stating the reasons and offering to return the advance.

This is where the nuances of returning when purchasing online are exhausted; everything else is subject to the same principles as when working with regular stores, as set out in the Law “On the Protection of Consumer Rights”.

It is best, of course, to resolve the issue immediately, by mutual agreement.

But it is not always possible to do this: the parties may disagree on nuances, set impossible conditions, and sometimes the seller refuses to return the advance at all. To return the prepayment, you need to file a statement of claim for the recovery of money (see sample), indicating in it all the important circumstances and demanding the return

Application for return of prepaid goods

Filling out is carried out in any form with the obligatory indication of all necessary details; Important!

Signing an agreement is a procedure that has legal confirmation when considering a case in court. Is advance payment for goods refundable? Having made an advance payment, the buyer can return it in the following cases:

- if the required quality of the product is not met;

- in case of violation of delivery deadlines;

- upon delivery of the wrong product that was ordered.

- Sample. Specification for goods to be supplied. Contract for the supply of goods, products. Sample.

A statement of claim to initiate proceedings for the return of an advance payment is no different from a complaint to Rospotrebnadzor. Once submitted, it must be reviewed within a week and, if everything is in order, proceedings initiated.

Timeframe for consideration of a claim by the seller

Typically, the period for consideration of a claim is indicated in the text of the document. If the applicant missed this point, then one must be guided by Article 22 of the Law on the Protection of Consumer Rights, according to which funds must be returned to the buyer within 10 days from the date of application.

In practice, sellers rarely immediately meet the consumer. After receiving a claim, the goods are sent for examination, which is carried out in order to determine the causes of malfunctions. If during the research it is established that the manufacturer or store is at fault, the money is returned to the client.

We must remember! If the claim is refused, the buyer has the right to defend his interests in court. The statement of claim is filed without paying a state fee, since tax benefits apply to disputes about the protection of consumer rights. The exception is cases when the amount of the claim exceeds RUB 1,000,000. In this case, the amount of the state duty is determined according to the rules of paragraph 1 of part 1 of Article 333.19 of the Tax Code of the Russian Federation.

Sample letter to supplier about refund of advance payment

For various reasons, you may need to get your money back from your partner. The sooner steps are taken to return them, the faster and with the least losses they will return. The first step in this process is to send a written offer to the counterparty to voluntarily return the amount

. The last one is going to court.

Depending on the circumstances that determine the requirement, a letter for a refund from the supplier may be:

- request;

- requirement (claim).

In the form of a request, the supplier is sent a message about the return of funds that were transferred to him by mistake; they are asked to return the overpaid amount of money (overpayment) in other situations when such a request is not due to the fault of the counterparty.

The claim form includes an offer to return money when it is based on the partner’s dishonest behavior.

There are no formal rules for drawing up such documents, but business customs have formed certain templates according to which they are drawn up.

We return what is ours: general recommendations

The appeal to the partner is made on company letterhead. It is usually signed by the head of the organization.

. If the company uses a round seal, it is used to certify the manager’s signature. The proposal is sent to the official address of the counterparty, addressed to its manager.

It is recommended to send the item with a description of the contents. The postal receipt is retained in order, if necessary, to confirm compliance with the claim procedure. Sending by courier, fax or e-mail is less preferable

. These methods do not allow us to reliably prove the fact of sending.

Important! It is not advisable to submit a claim only by fax or email.

How to write a letter

The request for a refund from the supplier is expressed in a business style. They don’t overload with information, but they also don’t forget to indicate the important things:

- the amount requested to be returned;

- reason;

- bank account to which the refund is required.

The money is asked to be returned within a reasonable time. As a rule, this is 7 working days after receipt of the message by the counterparty.

Sample letter for refund of overpayment:

Sample letter for refund

Making a claim

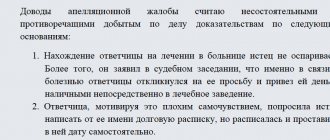

Before drawing up a message about the supplier’s violation of obligations, you must carefully study the contract. Determine the limits of the requirements.

The buyer can demand money back from the seller in the following situations:

- the paid goods were not delivered on time;

- the quality of the goods deviates significantly from what was agreed upon.

Important! Submitting a claim to the supplier is the buyer’s obligation, which he must fulfill before going to court.

In addition to general information, the claim must indicate:

- which contract has not been fulfilled;

- what is broken;

- deadline for refund.

An act of reconciliation of calculations, copies of documents confirming the claims, and an expert opinion are attached.

If a partner is required to compensate for losses or pay a penalty, their calculation must be provided.

The proposal must contain all the requirements that the buyer states. It is not necessary to specify them, but they need to be identified. For example, in the form of a warning about the consequences of non-compliance.

The letter should not contradict the agreements of the parties, enshrined in the contract.

Example of a request for an advance payment:

Statement of claim for recovery of advance payment

Conclusion

Compose your letter in a business style, write briefly, and do not overload with information. Keep proof of shipment and track receipt by your partner.

If the supplier supplied the buyer with a smaller quantity of goods than provided for in the agreement, or did not deliver anything at all, then the buyer should write a claim to the supplier for non-delivery of goods.

All claims must be sent by registered mail with notification and, preferably, with a list of attachments

. If possible, you can hand over the claim personally to the supplier’s representative against signature.

Having received a claim, the supplier can either supply the goods with the next batch or not fulfill the requirement

.

In both cases, the buyer's rights will be violated by the fact that the goods were not delivered on time, and the buyer has the opportunity to demand restoration of his violated rights in one way or another. In some cases, the buyer also has the right to refuse the delivered goods or terminate the contract unilaterally.

Letters to supplier for refund

Tax Code of the Russian Federation). Term for the return of funds Erroneously or excessively transferred funds must be returned within seven days from the date the creditor submits a demand for its fulfillment (p

. 2 tbsp. 314 of the Civil Code of the Russian Federation). In cases of unlawful withholding of funds and evasion of their return, interest is charged on the amount of the debt in accordance with the rules set out in clause 1 of Art.

395 of the Civil Code of the Russian Federation and clause 5 of the Review of the practice of resolving disputes related to the application of rules on unjust enrichment (Inf.

.

letter of the Supreme Arbitration Court of the Russian Federation dated January 11, 2000 No. 49)

.

Similar requirements for calculating interest apply upon termination of a contract for the supply of goods (clauses 3–4 of Art.

. 487 of the Civil Code of the Russian Federation).

To avoid paying interest for using someone else’s money, pay attention to the date of the letter and fulfill your obligations no later than seven days (see sample letter for refund of overpayment to supplier).

In practice, the following types of cash refunds are common:

- overpayment for goods or services provided;

- advance payment from the counterparty;

- acquisition of inventory items.

Each return document is drawn up in pairs: one for the initiator, the other for the counterparty. The parties file their copies in the relevant correspondence and store them for 5 years.

https://www.youtube.com/watch?v=a7c-t1VBomw

Advance payments are not provided for under the contract. Compose a letter

. Download Responsibility and storage periods Return letters, like other business correspondence, must be stored for at least 5 years.

For claims correspondence, you can create a separate registration log; its form and procedure should be approved in the accounting policy. Familiarize the responsible official with this procedure against signature.

We strongly recommend that you try to resolve all disputes amicably out of court. Firstly, because there is always a chance to reach an agreement with the other party on mutually beneficial terms

.

Important

Secondly, because the court is always an unpleasant, time-consuming and financially expensive task, which does not end with a decision, but flows into enforcement proceedings. Thirdly, because many agreements provide for a mandatory pre-trial dispute resolution procedure and without compliance with it, the statement of claim will be left without progress

.

Even if such an order is not provided, the courts always lean on the side of the one who made the effort to resolve the issue peacefully. It is very important to correctly file a claim for non-delivery of goods

. The claim must be drawn up extremely politely, addressed to the head of the supplier company, signed by the head of the purchasing company.

Letter for refund (sample)

In order to return the money, the entrepreneur must send a letter to the counterparty requesting a refund from the supplier. Letters for refund of money Reasons for returning funds already transferred may include the following circumstances:

- violation of the terms of delivery of goods, which are established by the contract concluded by the parties;

- inadequate quality of products discovered after acceptance by the buyer;

- termination of the contract in cases provided for by agreement of the parties, as well as in the manner established by the current civil legislation;

- the presence of an overpayment, if this circumstance was established as a result of drawing up a reconciliation report;

- error in payment order details and others.

The letter is an application for the return of transferred funds.

The fact is that every action is reflected in the accounting and document flow of the counterparty. Therefore, all transactions are accompanied by a certain number of accounting and legal documents.

A simple letter to return a product is no exception. A reconciliation report must be attached to it, regardless of the reasons for the return.

.

This document allows parties to easily identify billing discrepancies and errors.

.

You can return goods purchased from contractors in the same manner.

.

The procedure for completing documents is identical

.

Only instead of the document in question, a request to return the goods is issued

.

A sample letter for returning goods can be found on our website. It is available to a wide range of users and for use in the document flow of any company

.

Production activities are not immune to the human factor; you should know that any erroneous operation can be corrected by returning assets.

Sample letter for refund of prepayment for goods

The reasons may be not only an error in the details of the payment order, but also a violation of the terms of delivery of goods or performance of work, inconsistency in the quality of goods or services, termination of the contract, overpayment revealed by the reconciliation report, and so on. To return the money, a claim document according to the sample is drawn up. General requirements The document is an application (request) for the return of transferred money

.

There is no unified form, so we draw up a free application. Important There is no form approved by law, so the document is drawn up in free form

.

The letter for a refund from the supplier, a sample of which is given below, contains the following provisions: details of the legal entity (the letter can be drawn up on company letterhead, then this is not required), as well as the bank details of the organization; FULL NAME

.

How can a seller issue a refund of an advance payment upon termination of a contract in order to deduct advance VAT?

Carrying it out before terminating the contract is in your interests! If, before the buyer expressed a desire to terminate the contract, you only managed to receive an advance payment and the amount he asks to return corresponds to what was received, you can easily do without reconciliation of mutual settlements.

If, within the framework of the contract being terminated, you have already shipped goods against the received advance payment and you only need to return the advance payment that was not covered by delivery, then a reconciliation report will not be superfluous.

It will not hurt in situations where the advance payment was received into your account in several payments or the advance was transferred not by the buyer himself, but by a third party at his request.

And, of course, you should not neglect the reconciliation if the initiative to terminate the contract comes from you.

Source: https://tinyton.ru/obrazets-pisma-postavshhiku-o-vozvrate-avansa

Letter to return advance payment

Termination of the contract with the return of the advance payment at the initiative of the seller also requires written documentation and mandatory justification. Regardless of the initiator, the advance payment is returned to the buyer in full. Therefore, the question of whether the advance is returned or not should not arise.

This norm is provided for by the provisions of business turnover and the Civil Code of the Russian Federation. Refund of the prepayment upon termination of the contract involves the following steps:

- Reception from the client of an application for termination of the contract indicating in it a request for the return of the advance payment. When canceling a transaction at the initiative of the seller, the latter sends a notification to the client indicating the reasons and an offer to return the advance.

- Settlement of previously paid advance payment. The return is carried out in the same form as receipt - cash or non-cash payment (return to a card or current account depending on the client’s status - individual or legal entity).

In practice, returning an advance payment is not so easy.

How to write a letter to a supplier for a refund

There may be various circumstances due to which it is necessary to return the money, for example:

- termination or modification of the terms of the contract.

- erroneous transfer;

- excessive transfer of prepayment;

To get your money back, you must send a refund letter from the supplier.

The letter clarifies the reasons for the request, as well as the transaction details: agreement, payment order, amount.

Below is a sample letter for the return of an advance payment from a supplier (you can download the file at the end of the article). Let's consider the procedure for recording transactions in accounting accounts on the part of all participants in the transaction:

Refund of advance payment for goods sample letter

Particular attention is paid only to the individual terms of the transaction, which cannot be attributed to typical situations.

Attention When concluding a transaction between organizations, it is advisable to draw up an agreement that will reflect the main points of the transaction, on which conflicts are possible:

- The subject of the contract is information about what product the supplier undertakes to deliver, its characteristics and volume, price. Product data can be provided in a separate application;

- The cost of a batch of goods or raw materials. The total cost and price per unit of goods are indicated, so that in the event of incomplete delivery or a change in its volume, it is easier for the parties to pay;

- The time frame within which the goods must be shipped after receiving the money.

- Date: day, month, year;

- Full information about the partner: name, address, TIN, checkpoint, etc.;

Advance: when it is returned and when it is not

Therefore, if the prepaid obligation is not fulfilled, the advance must be returned (Article 1102 of the Civil Code of the Russian Federation). For example, if the advance payment is an advance payment against the future delivery of goods, then in the event of non-delivery, the supplier is obliged to return the money to the buyer (clause 3 of Article 487 of the Civil Code of the Russian Federation). Deposit A deposit is both an advance payment and security for the fulfillment of the contract.

Therefore, if the party that gave the deposit is responsible for the failure to fulfill the contract, then it remains with the other party.

For such situations, there is a special rule: in case of doubt, the deposited amount is considered an advance (clause

3 tbsp. 380 Civil Code of the Russian Federation)

When to draw up the KM-3 act

Since this document is completed only in certain cases, the form does not need to be submitted daily. However, if several returns occurred during the day, then only one KM-3 is issued. This happens at the end of the shift after the Z-report is taken. Data from KM-3 is used for forms KM-4 and KM-7.

The limitation period for a document is 2 calendar months . After this time, the inspection cannot make a claim against the incorrectly executed act. KM-3 is stored in the accounting archive .

Filling out the fields of the KM-3 form

In the header of the form, fill in the company details. If it is not a structural unit and does not have them, we leave this field empty. However, in cases where several stores are united into a network, it is advisable to indicate the name and address of a specific outlet.

Be sure to indicate the name of the cash register.

The application program and type of operation need not be specified. The cashier responsible for the return can be indicated by full name or personnel number.

The clarification “including on erroneously punched checks” should be understood as follows: the basis for filling out KM-3 is an error made by the cashier when the amount is greater than the actual cost of the goods and the company returns the “difference” that arose as a result of this.

Using an example: let’s say that the cashier Svetlova, when making a purchase of a book, did not take into account the promotion for which the new price is 159 rubles. As a result, a check for 1,749 rubles was punched. The buyer discovered the error and pointed it out, as a result of which 1,590 rubles were returned to him. According to the regulations, the buyer submitted an application for a refund. Senior cashier Efremov O.A. requested an explanatory note from the cashier, which was also attached to KM-3 dated August 26. 2020.

If several checks have been knocked out incorrectly, the form provides details for each of them. However, the report on the return of funds in KM-4 will only show the final figure.

Filling out the table in KM-3

The KM-3 act, as a rule, is filled out by hand, but there is no reference to the fact that it cannot be completed using a computer. In any case, the document must be certified by the signatures of the commission, otherwise the audit may determine it as incorrectly drawn up.

Data can be reduced - this is especially true for positions in column 6.

How to write a letter to a supplier for a refund

A letter for a refund from a supplier is a written request to a partner. It is sent by counterparties who have discovered errors when transferring funds and want to get the money back.

ConsultantPlus FREE for 3 days

Get access

In the life of a business entity, situations arise in which it is necessary to return funds previously transferred to the supplier. Let's consider the reflection of transactions in accounting and legal nuances when returning funds.

How to get money back

There may be various reasons why you need to return the money, for example:

- excessive transfer of prepayment;

- erroneous transfer;

- termination or modification of the terms of the contract.

To receive a refund if you have overpaid, you must send a letter.

How to compose a letter

There is no standardized form for such a statement. The application, which is drawn up on company letterhead, indicates:

- bank details to which the refund will be made;

- the reasons why funds were transferred incorrectly or an overpayment occurred;

- transaction details: agreement, payment order, amount to be returned;

- expected date of receipt of funds;

- signature and transcript of the full name of the responsible person - the head of the organization.

Application for return of advance payment

In order to resolve disagreements with the supplier, we recommend attaching a settlement reconciliation report to the letter.

Sample reconciliation report

When drawing up a letter and a reconciliation report, be sure to make a reference to the contract.

Reflection of transactions in accounting

Let's consider the procedure for recording transactions in accounting accounts on the part of all participants in the transaction:

| № | Situation | Provider | Buyer |

| 1 | Excessive advance payment | Dt 51 Kt 62 - advance payment received; Dt 51 Kt 76/2 - excess amount received | Dt 60 Kt 51 - prepayment transferred; Dt 76/2 Kt 51 - excessively transferred amount |

| 2 | Incorrect enumeration | Dt 51 Kt 76/2 - erroneously received amount | Dt 76/2 Kt 51 - erroneously transferred amount |

| 3 | Termination or change of contract terms | Dt 51 Kt 62 — prepayment received | Dt 60 Kt 51 - advance payment transferred |

When refunding money, reverse accounting entries are made.

Nuances of accounting under the simplified tax system

Often, the supplier has disagreements with the tax authorities about the taxation of excess revenue. The fact is that the tax base is formed upon payment, i.e., at the time the money is received, income arises.

In the event of an erroneous or excessive transfer of funds, the amounts received are not taken into account when generating taxable income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). Until the circumstances are clarified, these funds do not fall under the definition of income from sales or non-operating income (Articles 249, 250 of the Tax Code of the Russian Federation).

The above does not apply to advances returned due to termination or change in the terms of the contract. At the time of receipt of the prepayment, the taxpayer has an obligation to increase income. When advances received from customers are returned for the refunded amount, the income of the period in which the funds were returned is reduced (clause 1 of Article 346.17 of the Tax Code of the Russian Federation).

Refund period

Erroneously or excessively transferred funds must be returned within seven days from the date the creditor submits a demand for its fulfillment (clause 2 of Article 314 of the Civil Code of the Russian Federation).

In cases of unlawful withholding of funds and evasion of their return, interest is charged on the amount of the debt in accordance with the rules set out in clause 1 of Art. 395 of the Civil Code of the Russian Federation and clause 5 of the Review of the practice of considering disputes related to the application of rules on unjust enrichment (Information letter of the Supreme Arbitration Court of the Russian Federation dated January 11, 2000 No. 49).

Similar appeals for calculating interest are applied upon termination of a contract for the supply of goods (clauses 3–4 of Article 487 of the Civil Code of the Russian Federation).

To avoid paying interest for using someone else’s money, pay attention to the date of the letter and fulfill your obligations no later than seven days.

A different legal situation arises in the case of the return of the advance upon termination or modification of the work contract.

The organization that received the advance payment began to carry out the work. In this case, the contractor must prove that at the time of receipt of the notice of termination of the contract, part of it has already been completed.

If this condition is met, the contractor retains part of the established price in proportion to the part of the work performed before receiving notice of the customer’s refusal to fulfill the contract, and compensates for losses caused by termination of the contract (Article 717 of the Civil Code of the Russian Federation).

Where to begin

So, there was an error. Excessive funds transferred. It is noted that the more people are involved in the production chain, the higher the likelihood of committing incorrect actions. Someone said something to someone, he misunderstood, conveyed the wrong message - and the other hurried, and so on... Any amount paid incorrectly will be considered as excessively transferred funds, regardless of the type of error and the reasons for its origin.

So what should we do? In fright, clutch your heart and write a letter of resignation? Or even run away to a desert island? Of course not. Correct the mistake calmly and quickly. It is required to return the excessively transferred funds. But we will try to tell you in our article how to do this without losing self-respect.

First, don’t start looking for the culprit at the moment. Leave this for later so that you can figure out the reason in a calm atmosphere and avoid such a repetition in the future.

You might be interested in: How much do prosecutors earn in Russia?