Home / Complaints, courts, consumer rights / Services and consumer protection

Back

Published: 09/03/2018

Reading time: 6 min

0

140

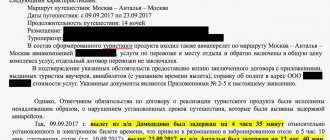

Selling an unnecessary financial product at a bank, disagreement with the accrual of a loan commission, refusal to provide information and other reasons can become a serious reason for a client to file a formal complaint with a financial institution. As a tool for pre-trial proceedings, a well-drafted and reasoned claim allows the consumer to defend their legitimate interests without the involvement of regulatory authorities.

- Legal regulation of the issue of filing claims

- Grounds for filing a claim with the bank

- Rules for filing a claim with the bank How to file a claim: step-by-step instructions

- Filing a claim and deadlines for its consideration

- What to do if the bank ignores the claim

Differences between a claim and a complaint

In legal practice, a letter of claim is considered to be the last step in the pre-trial settlement of disputes. In order for a document to be classified as a full-fledged claim to the bank, it must contain:

- reference to a concluded agreement or other situation, formalized in writing (number, date of conclusion and indication of the clauses of the agreement that were violated);

- clearly formulated requirements (payment or final settlements for previously supplied goods and services, payment of penalties under the terms of the contract, provision of services in the agreed volume, delivery of a consignment of goods or specified items);

- the amount of the claim (it is determined even if the counterparty is required to make deliveries, provide services, or eliminate the consequences of events that caused financial damage);

- the period allotted for correcting violations, after which you can start looking for a lawyer and drawing up a statement of claim;

- determination of further actions - the logical scenario for the development of the situation would be for the injured party to go to court, this must be mentioned in the complaint.

The complaint has a looser structure and can be drawn up in a completely arbitrary form. The client can raise not only money issues, but even cases where the behavior of employees affected his personality.

The complaint can set out abstract (including intangible) demands, for example, “punish the culprit”, “protect the employee from incompetence”, etc. The speed of response to this document is determined by the law on ZPP (No. 2300-1 of 1992), which means you will have to wait for a response from 10 to 30 calendar days.

In the complaint, the bank must clearly state the essence of the problem and its requirements.

Going to court

If negotiations with the bank did not lead to anything, and contacting the above organizations did not help restore violated rights and compensate for losses, you should file a claim in court.

The procedure for going to court is somewhat different from appealing a bank's actions to other organizations. It is not a complaint that is filed with the court, but a statement of claim, in which the circumstances of the violation must be clearly formulated, evidence must be provided, and the requirements must be outlined.

- the name of the court in which the claim will be filed. The claim can be filed at the plaintiff’s place of residence or at the location (legal address) of VTB. If the price of a claim for consumer protection (the sum of all declared claims) is less than 100,000 rubles, the claim is filed with a magistrate. If the amount of the claim is 100,001 rubles or more, and also if the claim contains claims of a non-property nature, the statement of claim is sent to the district court;

- Name and address of the defendant: PJSC VTB Bank, legal address - 190000, St. Petersburg, st. Bolshaya Morskaya, 29.

- Full name, passport details and address of the defendant, as well as contact telephone number of the plaintiff.

Important! In some cases, before filing a claim in court, the pre-trial dispute resolution procedure must be followed, i.e. A claim must be sent to the bank. If you file a claim for the protection of consumer rights, it is not necessary to follow this procedure, but if there is no claim, it is better to refer in the claim to the clarification of the Supreme Court of the Russian Federation.

Grounds for filing a claim with the bank

The grounds for sending a claim paper to the bank must be of a material nature. Requirements aimed at eliminating non-financial violations or changing the organization of work with bank visitors are presented in the form of a complaint or a simple written request.

The most common reasons for writing a letter of claim to a bank:

- illegal debiting of funds from a current or card account;

- imposed additional payments (for example, optional credit insurance or paid overdraft on an account);

- charging an inflated commission or payments about which the client was not previously informed;

- violation of the terms of operations or provision of services (for example, when payments to partners or to the state budget were credited late);

- unilateral change in the terms of an already signed agreement (credit, deposit or cash services for open accounts);

- other situations in which the client suffered material, financial or reputational damage due to the actions or inaction of bank employees.

The grounds for filing a claim with the bank are only financial

Pre-trial settlement

Analyzing the judicial practice in arbitration courts related to the activities of VTB 24, we can conclude that its employees commit offenses when working with clients, which are also typical for other credit institutions. Such violations include :

- Unjustifiably inflated amount of the penalty (tens of times);

- Inclusion of conditions in the loan agreement under which the bank received the right to write off the client’s money from his account without his consent to repay the loan debt;

- Failure to provide information about the cost of services, their conditions, when concluding a loan agreement;

- And others.

It follows from this that VTB 24 imposes loans on consumers on terms that infringe on their rights . To counteract this, it is necessary to take a clear civic position, arm yourself with legal knowledge and the help of practicing lawyers.

Statistics show that VTB 24 commits many violations. Thus, in 2014, Rospotrebnadzor carried out about 370 inspections of financial organizations, more than 210 of them resulted in the issuance of a violation report. The main reason is the imposition of third-party services on borrowers.

Procedure

The dispute with the bank must begin pre-trial. The main reason is the legal requirement. In accordance with it, before applying to arbitration, you must try to resolve the conflict through a claim procedure. Despite the abolition of such a requirement from July 1, 2020, for disputes surrounding civil disputes over monetary claims it remains unchanged. These include conflicts with banks.

You need to start by contacting the operator (manager) or head of the bank branch where the agreement was drawn up. It’s even better if you first consult with a financial lawyer who :

- Analyze the provisions of the agreement concluded with a credit institution.

- Will give a legal assessment, including any violations committed.

- He will describe the further algorithm of actions.

- Will provide a template for drawing up applications to the bank and its controlling organizations, and will help write them.

After communicating with the bank staff, if the dispute is not resolved, you can call the helpline . It is indicated in the contract, as well as in advertising and other documents of the institution. At the same time, a written complaint is drawn up and sent to the bank itself.

A written complaint in this case is considered as a claim. You can also send different documents - first a complaint, then a claim. But this does not change the meaning; the applicant will receive the same answer.

A complaint is sent and the bank’s response to it completes the first stage of the dispute. If the requirements set out in the claim are not met, it remains to proceed to the next stage of pre-trial proceedings. All data received up to this point is used to file complaints with regulatory organizations . Based on them, requests are compiled quickly, within 10-20 minutes. Therefore, you need to approach claims work competently, coordinate actions with practicing lawyers, and sign up for a consultation with them.

Methods for filing a claim with the bank

The fastest way to convey your point of view to the bank and explain the reason for your dissatisfaction is to call the support service or use an online chat, especially if these feedback channels operate 24/7. The effect will be almost immediate if the bank’s wrongdoing is obvious and there is a violation by employees of their official duties. If the problem is deeper, then calling will not solve it.

In this case, the deceived consumer will have to use other methods of informing the management of the financial institution:

- postal mail (registered, and even better if it comes with a list of the contents and a receipt receipt);

- personal delivery through the receptionist or one of the operator (but this should not be an oral statement, but a paper drawn up in two copies with a note of receipt, entry number and date);

- an email sent through your personal account (if the online service provides for this type of communication, and you log in using your personal login and password);

- to the email specified in the contract details as a contact (it is better if the application is sealed with an electronic signature).

When submitting a claim to the bank in person, you must obtain a confirmation of delivery on the second copy of the document

Rules for filing a claim with the bank

A client who suspects that the bank has deceived him or caused damage through his actions can contact the management of the credit institution, basing his claims on:

- norms of the Civil Code of Russia;

- provisions of the law on consumer protection (Law on Protection of Consumers No. 2300-1);

- the requirements of Chapter IV of Law No. 395-1;

- clauses of an agreement or public offer concluded between the parties.

At the same time, you need to understand that the provisions of the contract signed with the client cannot tighten the requirements put forward by the Civil Code of the Russian Federation or fundamentally contradict the legislation on the protection of consumer rights. If the contract contains such clauses, the court may invalidate them, even if the client previously agreed to them and signed the agreement.

Important! If a banking agreement or the text of a public offer contains provisions that contradict civil law, then they can be challenged by referring to the Civil Code and the Civil Code.

How to write a complaint to the bank?

To resolve the issue as quickly as possible, you should write a claim to a credit institution, guided by the Civil Code of the Russian Federation, the Federal Law “On the Protection of Consumer Rights” and the Federal Law “On Banks and Banking Activities”.

This approach will allow you to quickly find out the bank’s position on the problem that has arisen, and will also speed up its solution. In most cases, preparing a claim is a mandatory step in resolving disagreements between the parties before going to court.

To properly file a claim you must:

- decide on the subject of the appeal

- think over the structure of the document being prepared

- create a document of the correct form and content

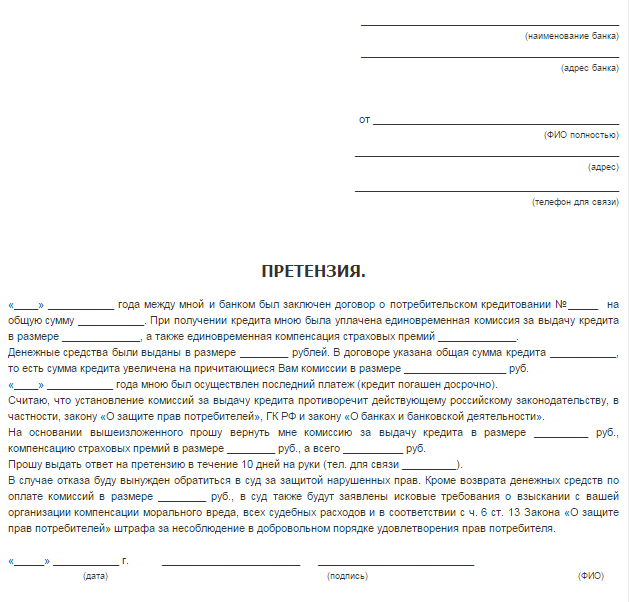

The claim to the bank must contain:

- full name of the credit institution, its legal address, as well as the address of the branch, names and surnames of bank employees, if necessary

- essence of the problem

- name and details of the contract

- applicant's name, surname, contact details

- references to legal norms

- date of claim

- personal signature of the applicant

Copies of supporting documents must be attached to the claim.

USEFUL: watch the video on how to file a claim, write your question in the comments of the video to receive free legal advice

Contents and structure of the claim

Although none of the legal acts of the Russian Federation regulates the form and procedure for presenting information in a claim, certain rules will still have to be followed when drawing it up.

The document must contain:

- details, or header - data of the recipient of the claim, address and full name of the responsible employee, if necessary;

- applicant’s data – in addition to the standard decoding of full name and address, you can indicate the number of the concluded agreement;

- name of the document - if it contains the word “claim”, then there will be one less step on the path to filing a claim in court;

- statement of the essence of the problem and calculation of material requirements;

- the time frame within which the client proposes to the bank to correct the violations (this point is also mandatory if the consumer intends to go to court);

- date of compilation and personal signature of the applicant.

Important! When applying, it is better to refer to the norms of local regulations, a signed agreement or legislation. But their absence cannot become a reason for refusing to consider the issue or fulfilling obligations. The bank’s negative response, on the contrary, must be reasoned and based on the “letter of the law.”

In case of violation of consumer rights

The main types of violations of consumer rights when interacting with banking organizations relate to:

- imposing additional services, optional services or insurance;

- providing false information about rates and tariffs;

- hidden commissions and payments;

- violation of terms for the provision of services (transfer of payments, issuance of funds or return of deposit).

In accordance with Art. 29 of the PZPP, a defrauded consumer has the right to demand from the bank:

- compensation for losses incurred (including penalties and penalties for obligations to third parties or the state budget), if they were caused by a delay in the provision of services;

- refusal by the client to fulfill the terms of the contract and its termination without applying the sanctions prescribed in it;

- reducing the cost of services by excluding from the contract clauses containing requirements that contradict the law.

In the paper sent to the bank, all material requirements must be immediately stated, otherwise the financial institution will limit itself to minimal measures. Then, to recover the full damage, you will have to start the claim process all over again.

Claims of this kind must be considered within 10 calendar days, Art. 31 ZPPP.

Lending terms inconsistent with the borrower are a common cause of complaints and claims.

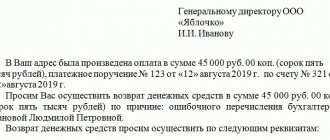

In case of repayment of the loan

In situations where the bank illegally debited funds from the current account to repay a loan payment, doubled or “lost” the payment, improperly charged a commission for early repayment, or increased the rate contrary to legal requirements, the period for consideration of the claim will be longer. Usually this period is established by an agreement with a credit institution, but cannot exceed those specified in Art. 12 of Law 59-FZ (no longer than 30 days from the date of receipt of the application from the citizen).

In addition to the legal basis for the client’s position, the claim letter must contain information about the dates and amount of transfers made, as well as the necessary calculations. If this section seems too lengthy, it can be prepared as a separate annex.

Important! It is useless to challenge the transfer of funds to repay a loan if it was made on the basis of a court decision that has entered into force or the client’s written consent to direct debit from a debit account.

How to file a complaint on VTB 24 and where to file it

I, Dogadaeva Olesya Gennadievna (my number is 7-910-211-94-75), am a client of VTB 24, Kursk, I received an SMS on Viber at 17:55 04/19/18 that they wrote off the account from my card and the phone number was The bank's telephone line is 8800... I called back, the VTB 24 auto-informer worked and the manager Alexey answered me, who of course asked me everything about my card + he also told me my latest transactions over the last week. As a conscientious client, she answered all his questions in the same way, 2-3 minutes passed and I understand that these are scammers and immediately called the bank on the line that was indicated on my credit card, to which the VTB 24 operator told me that the application was being processed to cancel She CANNOT have the operation, although I called urgently to cancel the operation and I quote my words: cancel the operation, I didn’t withdraw the d/s, I received an SMS about the withdrawal of 70,700 rubles, these are scammers. When I realized that the d/s was written off and they didn’t help me on the VTB 24 hotline, I immediately wrote a statement to the police about fraudulent activities. After the police, I of course flew to the bank located in Kursk, st. Radishcheva, 28, managers at the decision sent me to the security officer Korolev V.V. Kursk, Radishcheva Street, 24, after listening to me he simply smiled and said I had nothing to do with this bank, then we went up the elevator and then it was just a manager , who for some reason simply decided to listen to me and also smiled and said that I should return the d/s from my pocket, to which she received an answer from me in response to her rudeness: I don’t mind! The girl, Kursk, Radishcheva Street, 24, refused to introduce herself. I again asked the question to whom exactly can I contact with this problem and they simply answered me, call the telephone line; no one will help you here! I returned Kursk, st. Radishcheva, 28 manager Minina Maria took me to the manager T.A. Kargaeva and I once again explained the situation, to which she told me it was their own fault that they did not call back to the bank line and in general you are not the first with such a complaint THIS continues HOW A WEEK EXACTLY, so I clarify to her, I’m not complaining, I demand justice and a refund of the items I didn’t use. She also said that if this is NOT the first complaint and you all understand that you were hacked or your employees are leaking information, why didn’t you send an SMS to all the bank’s clients, that be careful, scammers, why do you know that you have problems and big problems and you’re not doing anything? , why does the security guy who just kicked me out and didn’t help me get paid at all? Why didn’t they CANCEL the OPERATION on the telephone line within 3-5 minutes, but CARRY IT OUT? There were no answers to these questions! Employee Kargaeva T.A simply calmly explained to me, we will now write a statement and it is possible, but not a fact, to return the d/s to you. She was also told that you understand that someone is using your database, that they even told me all my operations for the last week, this is HOW? Why did the VTB Bank operator hear from a bank client that canceling the operation is a fraudulent activity? Even the next day no one from the security team called me back, why the operator did not react to my words at all and did not write a possibly official note. HOW can you trust a bank when everything happens like this!? Now I ask this bank to check for fraudulent actions by employees + return the credit card to the card within 3-5 days + restore my credit history and figure out why my transaction was NOT blocked. Were the bank's actions LEGAL?

On 04/21/18 I transferred 40,000 rubles to the blocked card through the VTB24 bank cash desk, which all my relatives collected for me, so I don’t work and then I received an SMS from VTB24 that 3,800 rubles were written off to me as a commission for that transfer of 70,700 rubles, well I can’t wrap my head around what kind of security guards are there who don’t react to anything at all! Why does everyone get away with this (I am outraged by the work of this BANK!

I also want to emphasize that I am a disabled person of the 3rd group, I am currently on maternity leave and have a 10-month-old child in my arms, I am raising one, I am ready to provide all the necessary documents, I also now need surgery due to heart problems.

I ASK you to consider my appeal for further appeal to the court. Thank you in advance 04/22/18 CENTRAL BANK + ONLINE VIA THE INTERNET RECEPTION + FINANCIAL OMBUDSMAN + FEDERAL ANTI-MONOPOLY SERVICE + ROSPOTREBNADZOR + PROSECUTOR'S OFFICE - the complaint has been sent.

Package of documents for filing a claim

The claim will look more convincing if the requirements set out in it are supported by documents. It is important to remember two basic rules:

- All available written evidence of the client’s words must be attached to the letter (copies of payment receipts for disputed payments, correspondence, certificates of work performed, documents from third parties);

- there is no need to attach to the appeal documents that the other party clearly has (copies of a signed agreement, excerpts from legislation, undisputed acts or invoices).

Photo and video evidence can be attached to the letter if this will help the bank management understand the details and circumstances. In addition, it is permissible to mention that during the development of events there were witnesses present who are ready to confirm their testimony in court.

Procedure for filing a claim with the bank

The procedure for handling claims does not provide for strict restrictions on the form of application or compliance with time frames. In this case, it is worth focusing on the general statute of limitations (no more than 3 years from the moment the situation arose or from the date when the client should have learned about the adverse event). In order for the claim to be considered filed correctly, you can follow a simple algorithm:

- Compose a written appeal and attach a package of additions to it (in two copies).

- If the client does not want to send a request remotely (by mail or email), then he will have to visit the head office or one of the branches in person. You can give one copy after receiving it from the manager or through the secretary in the reception area.

- A mandatory step is to mark receipt. Ideally, on the copy of the claim, the bank employee should put his personal signature, position, full name, date of receipt and incoming number according to the correspondence log. In practice, the date, signature and name of the secretary are sufficient.

If the request is sent remotely, you need to make sure that the client has evidence that he sent it at all. These can be:

- postal notification of delivery and inventory;

- receipt of delivery by courier service;

- printout of email;

- online chat correspondence file;

- saved number of the electronic appeal in the feedback form (for example, Sberbank provides the opportunity to present your complaints in this way and track their fate using the code).

Features of document preparation

A claim, complaint or simple written request is a legal document, so when drafting it it is better to adhere to a business style of communication. This means that there is no room for lengthy stories or listing personal circumstances. Although mentioning belonging to one of the preferential or unprotected categories still does not hurt (you can, for example, write about the presence of a disability, the status of a large family or a combat veteran).

To better understand the situation, information should be presented in chronological order and at the same time try to maintain a balance between brevity and content.

If you separately indicate in the text the desired address where you want to send the response, the bank will be obliged to forward it using the new details.

How and where to complain about the bank?

If the response to the appeal does not satisfy the applicant or is not received at all, then action can be taken not only through the court. The following will come to the aid of a deceived client:

- Central Bank (if the provisions of the Banking Law No. 395-1 of 1990 are violated);

- the prosecutor's office (if the financial institution puts pressure on the client, intrusive calls or threats, violates human civil rights);

- Rospotrebnadzor (if a banking organization violates the consumer rights and interests of depositors, borrowers or other categories of clients);

- FAS (if there are systemic abuses in the field of antimonopoly legislation).

Where else to complain?

If appeals to the VTB 24 branch, its hotline or the main office are not successful, you can only contact other organizations. In response to a claim, formal responses often come with reference to the terms of the contract or provisions, instructions, orders of the institution, which often contradict civil law.

The explanations only look reasonable: here is a legal document, employees follow its provisions. It is recommended that you contact a lawyer with your response for a legal assessment. Having received a consultation detailing exactly what and how the bank employees violated, all that remains is to draw up and send a complaint to Rospotrebnadzor, the Central Bank, and the Federal Antimonopoly Service (FAS).

However, there are some peculiarities in considering appeals. So, the Central Bank reacts based on the facts :

- Improper operation of a commercial financial institution;

- Lack of response to citizens’ requests for poor quality financial services;

- Theft of money;

- And other similar violations.

For a commercial bank, consideration of citizens' complaints by the Central Bank may result in the revocation of its license.

Rospotrebnadzor monitors violations of consumer rights, namely:

- Illegal reduction of interest on deposits or increase in interest on loans;

- A ban on early closure of a deposit, the introduction of penalties for such consumer actions;

- And other similar violations.

FAS considers issues related to violations of antimonopoly legislation. In particular, according to department officials, illegal reductions in interest rates on deposits or increases in interest rates on loans are a manifestation of unfair competition.

For example, if a depositor entered into an agreement taking into account an interest rate of 17% per annum, and then the bank unilaterally reduced it to 12%, it is recommended to contact the FAS. The courts take the side of the financial organization and consider it acceptable to reduce the interest rate to the national average level. Therefore, if in the case under consideration the average rate in the Russian Federation was 12%, the claim of the injured person will most likely be dissatisfied.

The FAS made a similar conclusion as a result of considering complaints against the following banks: Uniastrum, SKB, Investtorgbanka, Tinkoff and others.

Alternatively, complaints can be made to the Financial Ombudsman. This is relevant in the following cases :

- There is no response from the credit institution to the submitted claim;

- Illegal imposition of fines;

- Changing the interest rate unilaterally;

- Theft of money from an account;

- Transfer of data to collectors;

- And others.

It makes sense to contact the prosecutor's office regarding issues of illegal actions of the bank that do not relate to violations of consumer protection laws.