Home / Complaints, courts, consumer rights / Consumer rights

Back

Published: September 30, 2018

Reading time: 7 min

0

485

Along with replacing an unsuitable product, eliminating defects, or reducing the price of a product, a full refund for the product is one of the forms of the seller fulfilling its obligations to the buyer.

- Refunds for purchases: legislative basis for the issue

- Grounds for returning money to the buyer

- The procedure for returning funds to the buyer How to process a return from the buyer: step-by-step algorithm

- What documents will be needed to process a return?

- Rules for making a return: cash and non-cash payments

In accordance with Russian legislation, a consumer can initiate a refund both in relation to goods with a defect found in them, and in relation to products of proper quality.

Rules for returning goods paid for by credit card

In accordance with Article 25 of Law No. 2300-1 dated 02/07/1992, the client has the right to return an unsuitable purchase. You must visit the store within 14 days after completing the transaction. A defective item can be returned within the warranty period.

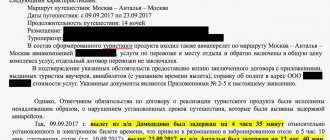

If the item was paid for by bank transfer, you must present a cash receipt, a plastic card and a photocopy of your passport. When contacted on the day of purchase, the transaction is immediately canceled and the funds are transferred back to the customer’s card. In other cases, the procedure is a little more complicated and longer.

In practice, the process looks like this:

- A citizen writes a statement to a shopping center;

- The store sends a copy of the application to the credit institution;

- The bank checks the application for authenticity within three days;

- The money is transferred to the client.

To carry out settlement transactions using bank cards, the seller enters into an acquiring agreement with a credit institution. Upon purchase, the citizen is given a slip confirming the fact of using the card and a cash register receipt. Refunds are carried out in the manner established by the acquiring conditions.

What must be provided to the buyer by law

Remember! Since refunds paid from a bank account or card can only be made by bank transfer, the buyer, when filing a claim, must present the following to the store:

- goods (if the product has no defects, then with mandatory preservation of its presentation);

- warranty card, if the product provides one;

- document identifying the buyer;

- a document confirming the fact of payment for the goods;

- application for refund.

The application can be drawn up in free form or according to the sample that the store offers. If additional costs arise during the implementation of the procedure, the costs are covered by the seller.

How to return money for goods paid for by credit card?

To receive a refund, the buyer will need to complete certain steps. Let's look at the procedure and nuances that arise in practice.

Where to contact?

The product is purchased in a store, so you must contact the seller for money. The citizen fills out an application and submits it along with the unsuitable item.

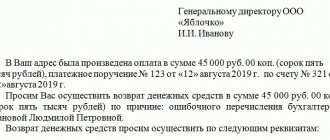

The text of the appeal must include the following required information:

- name of the supermarket, its location and contacts;

- client information (full name, address, telephone);

- information about the purchase agreement (name of the purchased item, cost and date);

- why the client was dissatisfied and why he wants to return the money;

- information about the bank card with which the transaction was made;

- requirement to credit the spent amount back to the account.

The application must be accompanied by a sales receipt, invoice, contract, and other documents issued upon purchase of the item.

The document is submitted in two copies. One is handed over to the store, on the second the employee marks receipt. If the buyer does not have the opportunity to visit the seller in person, the application is sent by registered mail with notification.

When making a return, the store issues the consumer an acceptance certificate of the item or an invoice confirming that the purchase has been received by him.

What to do if the check is lost?

It happens that a buyer pays for an item using a card and throws away the receipt. The advantage of non-cash payment is that the payment document can be restored. To do this, you need to request a statement from a credit institution.

If the buyer has Internet banking enabled and an SMS notification from the bank, then the information received through his personal account and copies of SMS messages about the transaction will be sufficient.

The consumer writes an application to the store to reinstate the receipt. In addition to information about the seller and buyer, the text must indicate:

- date of purchase;

- information about payment using a bank card;

- information about the witness (if he was present with the buyer).

- request to reinstate the check.

Based on these documents, the seller is obliged to refund money for goods paid for by credit card.

How long will it take for the money to arrive on the card?

The process of transferring funds takes on average 10 days (Article 22 of Law No. 2300-1).

If the store and the buyer are serviced by different banks, then the seller’s credit institution transfers the money to the buyer’s credit institution. She, in turn, credits the received funds to the consumer’s bank card.

The repayment period depends on the efficiency of the bank. Often credit institutions delay the procedure up to 30-40 days . In this case, the responsibility for delay falls on the store. The consumer has the right to contact the seller for payment of penalties due to delay. The store may, by way of recourse, demand compensation for losses from the bank.

Is it possible to return in cash funds transferred to the seller by bank transfer?

When paying for a purchase using a bank card, a refund is made to the same account via bank transfer. The Federal Tax Service prohibits transactions in cash, regarding them as misappropriation of funds. For violation, the store may be fined under Article 15.1 of the Code of Administrative Offenses of the Russian Federation in the amount of 50,000 rubles. (Letter of the Federal Tax Service of the Russian Federation for Moscow dated September 15, 2008 No. 22-12/087134).

If a client has lost his card, he can ask to transfer money to another one. To do this, you must indicate new details for crediting funds in the refund application.

Terms for returning money to the card

The Law of the Russian Federation “On ZPP” provides for different terms for returning money to the card. They mainly depend on the reason for making such a requirement.

So, the store is obliged to transfer funds within the following periods of time:

- no later than 10 days from the date of receipt of the application from the buyer - for goods in which a deficiency has been identified, as well as those purchased remotely ( Article 22, paragraph 5, paragraph 4, Article 26.1 );

- no later than 3 days from the date of return of the product - this period is valid for goods of proper quality ( clause 2 of Article 25 ).

IMPORTANT . The seller should keep in mind that for delaying the deadlines allotted for returning money for a low-quality product, he may be charged a penalty in the amount of 1% of the total cost of the product (Clause 1 of Article 23 of the Law of the Russian Federation “On ZPP”).

In what cases can a refund be refused?

By law, not all goods can be returned (see the list of goods that are not subject to exchange or return). The store has the right to refuse on the following grounds:

- the buyer returns a quality product after a two-week period;

- high-quality food products are presented for return;

- the item being returned is included in the list of non-food products that cannot be returned or exchanged (Resolution of the Government of the Russian Federation of January 19, 1998 No. 55);

- defects in the goods arose due to the fault of the consumer, third parties or force majeure circumstances.

In other cases, the seller’s refusal is illegal and can be appealed.

When the need arises

Payment by non-cash means for goods and services is not prohibited by law. Accordingly, the provisions of the Law “On Protection of Consumer Rights” will equally apply to cases where the buyer pays with funds directly from a bank account.

What can a buyer do if he discovers defects in the purchased product?

Important! The Law on PPP in Article 18 provides for the following requirements:

- replacing a bad product with the same one, but without flaws (there must be full compliance with the brand, model and other characteristics);

- provision of goods of a different brand, but the same model with recalculation of the price;

- reduction in the cost of products in proportion to the detected deficiencies;

- repair of goods by the store or reimbursement of expenses incurred by the buyer when correcting product defects;

- refuse the transaction, terminate the contract and return the money paid, regardless of whether the payment method was non-cash or cash.

Returning goods to the online store.

Whether the seller can refuse to issue a check to the buyer, read here.

Who pays for an independent examination of the product, read the link:

Transferring the goods to the store to complete the refund procedure will not be a mandatory requirement.

If the buyer simply does not like the product in terms of size, color, model and other characteristics, he can also implement the non-cash refund procedure.

Please note! It is enough to keep within two weeks when sending refund requests. However, to do this, you should remember the list of goods approved by the Government of the Russian Federation (Resolution No. 55), which includes products that cannot be returned.

Also, the basis for receiving funds paid on the card is the seller’s failure to fulfill the terms of the agreement for the supply of goods. If the buyer has already made payment, and the goods were not received due to the fault of the store, then a return procedure is also acceptable. However, here the rules apply only to individual entrepreneurs and organizations.

What to do if you were refused illegally?

In the event of an illegal refusal to return money to another bank card, the buyer has the right to protect his interests in Rospotrebnadzor or through the court.

How to file a complaint with Rospotrebnadzor?

In case of a conflict with the seller, the consumer can send an appeal to Rospotrebnadzor. Based on the application, an investigation is initiated for violation of Law No. 2300-1.

The complaint is drawn up taking into account the requirements of the Law of May 2, 2006 No. 59-FZ. The text should indicate:

- name of the territorial division of Rospotrebnadzor;

- information about the buyer (full name, contacts, telephone);

- store information;

- circumstances of purchase of the goods;

- information about contacting the seller for a refund;

- information about the seller’s refusal;

- references to legal norms that are violated;

- request for verification.

The request is accompanied by a purchase receipt, a copy of the complaint to the seller, and evidence of refusal.

If you have any questions while filing a complaint, we recommend that you contact an experienced lawyer. He will help prepare the necessary documents and protect the interests of the consumer in Rospotrebnadzor.

The appeal is submitted in person through the department office. If the consumer does not have time to visit Rospotrebnadzor, the documents should be sent by registered mail with notification. It is also possible to file a complaint through the official website of the government agency.

The review period is 30 days. If the issue is resolved positively, an order is sent to the store to eliminate the violations.

How to file a claim in court?

The second way to protect consumer rights is to go to court. The buyer prepares a statement of claim and supporting documentation.

The claim is drawn up taking into account the requirements of the Code of Civil Procedure of the Russian Federation and must contain:

- name of the judicial authority;

- information about the plaintiff and defendant (name of the store, full name of the buyer, addresses of the parties, telephone numbers, email);

- description of the circumstances of the purchase;

- information about sending a claim to the seller and receiving a refusal;

- references to legal norms that are violated;

- demand to return the money, compensate for moral damages and pay a fine for refusal;

- list of documentation;

- date and signature.

The claim must be accompanied by payment documents, a copy of the claim and the response to it, and other evidence.

Disputes with a claim amount of up to RUB 50,000. are considered by magistrates' courts within one month. All other cases – by district and city courts within two months.

Example. Emelyanov I.A. filed a lawsuit against ALBA-Corporation LLC. He asked to oblige the defendant to return the money paid for the goods, pay a fine and compensation for moral damage. He indicated that he had purchased men's shoes in the store for a third party and paid for the purchase using a bank card. When trying it on, it turned out that the low shoes did not fit. The plaintiff applied to the store to return the goods and was refused. Disagreeing with the defendant’s decision, Emelyanov I.A. sent a claim to him, which he refused due to the lack of a box for the product. The court found the plaintiff’s demands justified and satisfied the claim (Appeal ruling of the Moscow City Court dated December 11, 2014 in case No. 4g/8-9738).

What you need to know

Refunds to the buyer by bank transfer by letter, as well as by other options, are carried out in strict accordance with the established norms of Russian legislation.

Distinctive features include the fact that a certain percentage is deducted from any amount when funds are credited to the bank account of an entrepreneur or company in particular.

During a refund, the corresponding commission is not refundable to the seller of goods or services.

This is also important to know:

What is the expiration date: how to determine and check it

In addition, there are other important features that require detailed study.

Required terms

Return of goods via non-cash payment by legal entities is carried out in strict accordance with special regulations.

In order to correctly interpret all existing Regulations, it becomes necessary to understand the existing terminology in advance.

In particular:

| According to the norms of the legislation of the Russian Federation, non-cash payments | This is one of the types of payment for goods or services using an electronic payment card. This may mean payment by credit card or electronic wallet, etc. |

| KMM | Device for reading information from bank cards |

| Correspondent account | An account that can be opened with a credit institution for the purpose of performing various financial transactions. The main purpose is considered to be the display of information about numerous types of calculations. Lender - a bank that provides services for opening current accounts and acts as intermediaries |

| Generated electronic documentation in paper form | Printout |

| Payment order | An order from the owner of a current bank account, thanks to which it is possible to carry out transactions between accounts |

| Personal account | An account through which it is possible to carry out transactions between the parties to a transaction and get acquainted with numerous information on such issues |

| Electronic payment documentation | A special document that serves as the basis for carrying out numerous financial transactions on accounts. Such documentation has the same legal significance as standard |

| Unpaid payment documentation | Special documentation on the basis of which the bank has the right to carry out numerous operations |

In the latter case, such documents mean:

- checks;

- letters of credit;

- collection orders.

The specified documentation can be used for the purpose of making payments between legal entities. When making payments to individuals, this documentation is optional.

Acceptable grounds

This year, the “rules of trade” approved a list of situations in which the buyer has the right to expect to return funds paid by bank transfer on the same day.

Today, these main reasons include:

| The product is of inadequate quality for various reasons. | At the same time, the client was not informed of this fact |

| The purchased product did not fit | For example, by color shade, style or for other reasons |

In the first case, difficulties may arise for the consumer when returning the purchased product itself.

Often there is a need to conduct an examination at your own expense to prove an existing defect that existed before the purchase.

If a defect is detected (the presentation is not taken into account), the seller must return the money in full, including for the paid independent examination.

According to Russian legislation, the buyer reserves the right to return the products within 14 days and demand a refund of the money paid.

Please note that the day of purchase of the goods during the countdown is not taken into account in this case.

Additionally, it is worth paying attention to the fact that there is a specific list of goods that, as required by the Federal Law “On the Protection of Consumer Rights,” cannot be returned.

Legal grounds

The main regulatory document that regulates the rules for the return of funds paid during non-cash payments is considered to be Federal Law No. 161 of June 2011.

For how many days is the minimum amount of sick leave issued in 2020, see the article: how many days is sick leave issued for.

How to correctly issue pay slips in 2020, read here.

It is this that must be referred to in order to eliminate the possibility of various misunderstandings and refusals when trying to return the money.

Is it possible to return money in cash from the cash register?

The seller can return funds from the cash register only if the purchase was paid for in cash. When paying with a bank card, a refund from the cash register is not possible, since such a procedure is contrary to legal requirements. The seller simply will not be able to return the money under such conditions, since if such actions are detected by the tax service, the store will be fined.

Breach of obligations

If for some reason the store does not fulfill its obligations to return funds to the card, the consumer has the right to demand payment of a penalty. According to Art. 26 of the Civil Code of the Russian Federation, the amount of the penalty is 1% of the amount of debt for each calendar day that the sellers are overdue. The only disadvantage for the consumer is the fact that in order to recover the refund amount and penalties, the consumer will have to go to court.

Conditions and grounds

only the holder of a plastic card can contact the store .

Therefore, when purchasing any new product, do not immediately put it aside, but carefully consider, test and check it in action. And, if you are not satisfied with something, do not hesitate to return this product back.

When going to the store you should have with you:

- passport;

- two receipts for the purchase: a cash receipt from a fiscal device and a receipt for withdrawing money from a bank device;

- payment bank card.

What to do if the check is lost?

According to Russian law, you have the right to return the goods even without a receipt, but for this you will definitely need witnesses who can confirm the accomplished fact of the transaction (if necessary, in court).

It's best if they are not your close relatives .

Required documents

In addition to the purchased product, you must also bring the following documents to the seller or the specialist responsible for the return:

- passport

- sales receipt and receipt from the trading terminal for withdrawal of funds from the payment instrument

- bank card