A writ of execution allows you to enforce a court decision, as well as monitor its implementation. The presence of a writ of execution in hand does not mean that the court decision has been executed, the obligations of the parties in committing actions have already been fulfilled, the property of the defendant has been transferred, and funds have been recovered. Once received, many plaintiffs do not know what to do with the writ of execution from the court.

In accordance with Art. 21 of the Federal Law “On Enforcement Proceedings”, writs of execution issued on the basis of judicial acts can be presented for execution within three years from the date the judicial act enters into force or the end of the period established when granting a deferment or installment plan for its execution.

There are several scenarios for what to do after receiving a writ of execution:

Interesting article

You can read about a sample letter to bailiffs regarding a writ of execution here.

1. The most popular option. Hand over the writ of execution in person or send by mail to the bailiff service office at the location of the debtor, if it is a legal entity, and at the place of registration, if it is an individual. To apply, you need to find which department of bailiffs serves the administrative-territorial unit within whose borders the dispute took place.

2. If the plaintiff knows in which financial organization the debtor has a current account, then he has the opportunity to completely legally send there a writ of execution with a statement of collection. After the application is reviewed by the bank, the funds will be redirected from the debtor’s personal account to the details specified by the collector within three days.

When the plaintiff’s side has received a writ of execution and is still deciding what to do next, but plans to contact the bank as one of the options, you need to be sure whether the defendant has the required amount in his account.

3. If at the last trial you had a conversation with a debtor who is potentially ready to fulfill his obligations according to the writ of execution, or you are confident in the integrity of the debtor, then quickly send the writ of execution to the defendant so that the latter independently fulfills the prescribed obligations. There is a risk that the debtor will not repay his debt or the writ of execution will be lost.

4. If you have a writ of execution in your hands and what to do next you imagine only in theory and there is no desire or time to deal with the paperwork yourself, you can hire professional lawyers who, for a fee, will collect funds from the defendant for you.

Let us consider in more detail in what cases and what to do with the writ of execution after receiving it.

What is a writ of execution?

According to the law, this is the name of the document on the basis of which the bailiff service carries out collection from the debtor, and also carries out other actions required by the court.

Most often, such documents are issued by arbitration courts and courts of general jurisdiction (district or magistrate) on the basis of their decisions. However, the law allows other options:

- the sheet can also be issued based on an unfulfilled settlement agreement that was approved by the court;

- Extradition is also permitted on the basis of an arbitration court decision.

To obtain it, the plaintiff in whose favor the decision was made must apply to the court that made the decision. The period for receiving a writ of execution is usually from ten to fourteen days. It can be handed over to the person who wins the case, or it can be sent directly by the court to the bailiff department. This is allowed both in certain categories of cases directly provided for by law (in particular, in cases of recovery of damage caused by a crime, or compensation associated with the loss of a breadwinner), and at the request of the citizen himself. The court does not have the right to refuse a citizen to send documents immediately to the bailiffs.

Concept and purposes of obtaining a document

A writ of execution is a document giving a citizen the right to turn to bailiffs to enforce a court decision.

Requirements that can be fulfilled using this sheet:

- payment of fines,

- alimony payments,

- compensation for damage

- collection of benefits, debts,

- other situations of a material nature.

Attention! The writ of execution reflects information about the case, the amount of funds collected or the fulfillment of other obligations. The document refers to the court that made the decision and also identifies the parties to the resolved dispute. That is, the writ of execution imposes an obligation on the defendant and gives the right to demand its execution.

What to do with a writ of execution?

According to the law, enforcement proceedings are initiated if the sheet reaches the bailiffs. However, in some cases, a citizen can collect debt independently. For example, if it is known for sure that the debtor has an account in a particular bank, the claimant can come there himself and demand, by presenting documents issued by the court, to write off money from the debtor’s account in his favor. In addition, if the amount of the debt is less than twenty-five thousand rubles, or according to a court decision, payments must be made periodically (for example, in cases of alimony), you can contact directly the organization where the debtor receives a salary or pension. In this case, the claimant does not have the right to refuse.

However, independent collection requires precise knowledge. Therefore, the best option is to contact the bailiff service before the writ of execution expires. This will be the shortest path to repaying the debt.

Contacting the organization where the debtor works

It is not legally prohibited to submit a writ of execution to the place where the debtor works. However, this option is not always available, unlike the previous ones.

In this regard, the law establishes a number of restrictions, which include the following:

- the amount of debt that will be subject to collection should not exceed twenty-five thousand rubles,

- The writ of execution should be sent only to an organization where there is an authorized body or entity that transfers periodic payments to the debtor in the form of wages, bonuses, and so on.

Important! Even when contacting the accounting department, you must fill out an application and attach to it the details necessary for transferring funds.

This option, if all the requirements have been met, is also considered one of the fastest in collecting funds, since transactions with money occur automatically without taking into account the opinion of the debtor. Moreover, the property, that is, money, is available in fact, and there is no need to look for objects of collection.

Validity of a writ of execution for alimony and other debts

In this case, you can find some discrepancies. The law establishes that the validity period of a writ of execution is three years from the moment the judicial act on the basis of which it was issued came into force.

It is important to remember this circumstance, because, unfortunately, many believe that this period is counted from the moment the sheet was received in hand. This is absolutely not true. The claimant can go to court and receive it at any time. However, if three years have already passed, there is no point in this anymore: the deadline for receiving the writ of execution has already expired, and the bailiff simply will not accept it for execution, but will issue a decision to refuse.

However, where, by a court decision, the debtor is obliged not to pay a specific amount, but to make periodic payments (as, for example, in alimony cases), the terms will be completely different. In this case, you can apply for enforcement during the entire period for which payments are assigned (for alimony - until the child becomes an adult), plus another three years beyond that.

Collection of funds from the insurance company

In addition to the methods of filing a writ of execution, to a bank or directly to bailiffs, there is an option when the writ is sent directly to the debtor. This method is most often used when a claim was filed against an insurance company.

The main advantage of this option is that the time it takes to receive the debt is significantly reduced. When the writ of execution is handed over to the bailiffs, and they collect funds from the insurance company, it takes about three months, and when the writ is directly transferred to the insurer, it takes no more than two weeks.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

The main condition for this order is a writ of execution. To receive it, you must wait until the court decision comes into force, and in a civil case this period is one month. After this, a sheet is issued, and only then the person has the opportunity to demand money from the insurance company.

If the person has a writ of execution in his hands, then compensation will be guaranteed. Often, insurance companies refuse to compensate for losses when their client presents only a court decision, even if it has already received legal force. In addition, the sooner the sheet is filed, the faster the losses will be reimbursed.

When can I submit?

Even with the document in hand, it is not necessary to immediately contact the bailiffs. Sometimes citizens who win a case in court negotiate with debtors peacefully. In this case, the sheet serves only as an additional guarantee that payments will be made on time. If the debtor stops fulfilling his duties, then until the writ of execution expires, you can go to the bailiffs at any time.

If the original was lost for some reason, the claimant can go to court again and receive a duplicate. However, you should remember: the same rules apply to the duplicate as for the original, so you need to make sure that the deadlines are not missed.

What to do in difficult cases

Practice shows that for some debtors the court decision does not matter. The defendants refuse to fulfill their obligations, which leads to controversial situations. How to proceed?

Remember! To decide on a solution to possible problems, you should consider options for difficult situations:

- when the insurance company refuses to pay the debt even though it has been presented with a writ of execution, you should contact the bank. Situations like this are not uncommon. It is enough to find out which credit organization holds the insurance company’s accounts and send the writ of execution with the application there. The bank will be obliged to make the transfer, and no consent from the insurance company will be required. It is necessary to mark the date when the application was submitted so that the defendant does not have time to empty his accounts,

- when a company goes completely bankrupt and the debt has not been paid, you should always contact the regulatory authorities. The choice of a suitable structure must take into account the nature of the defendant’s activities. For example, a car insurance company, therefore, needs to contact the Union of Motor Insurers,

- when the insurance company has lost documents, that is, an application or writ of execution. There are several options for resolving this problem. You can provide a copy of the application marked as accepted and the court decision on the basis of which the debt will be accrued; you can also receive an explanation from the bank as to why the papers were lost and receive a duplicate of the writ of execution. It is also possible to simply wait if there is a chance that the documents will be found,

- when the insurer pays only part of the debt and refuses the remaining amount. As soon as at least part of the money is received as fulfillment of the obligation, this means that the company recognizes the court decision. Any denial of such an act will subsequently require an appropriate appeal procedure from the insurance company. To get money, you can also revoke the IL and send it to the bailiffs so that they can solve the problem. It is also possible to contact the bank to collect the remaining part of the debt. If the writ of execution is lost, you can also request a duplicate, and the procedure is carried out again.

In fact, there are a large number of difficult situations encountered in practice. Each case is individual, so the problem often has to be resolved through the involvement of lawyers.

Sample application for the issuance of a writ of execution to the arbitration court.

Application of writ of execution

From the moment the execution begins, the limitation period for the writ of execution is interrupted. A new phase of the process begins - collection. Those actions that bailiffs have the right to perform are described by the Federal Law “On Enforcement Proceedings”, as well as in the job descriptions of bailiffs.

The proceedings begin no later than three working days from the moment the claimant filed an application with the bailiff department and brought there the writ of execution. However, if the judge forgot to certify the document with a signature or seal, or there are typos and ambiguities in it, the bailiff has the right to refuse execution. In this case, together with the refusal order, the bailiff returns the sheet to the claimant, and he must go to court again and receive a properly certified document with corrected inaccuracies.

Submission of IL to the FSSP

What to do if the writ of execution was received in person? The procedure is reflected in detail in the legislation and involves the passage of several mandatory stages by the interested party, that is, the plaintiff, in whose favor the funds must be recovered or the corresponding obligations must be fulfilled.

The procedure involves several important points. The first of them is the choice of the bailiff service, where the writ of execution is sent.

The following options are possible here:

- when the debtor is an individual, the plaintiff is obliged to transfer the sheet to the unit of the bailiff service that is located according to the defendant’s registration address,

- when the debtor is an organization, the same principle applies, but the legal address of the company will be determined,

- when the writ of execution does not imply the collection of funds, but the commission of any actions by the defendant, then the proceedings are initiated by the bailiff service that relates to the place where the specified action was performed.

Application for the issuance of a duplicate writ of execution.

However, it is not enough to simply submit a writ of execution. It is always accompanied by a statement written in free form and containing a request to initiate enforcement proceedings, as well as details if it is necessary to transfer funds.

Federal Law “On Enforcement Proceedings” in Article 33 also allows the plaintiff to present an additional requirement to the bailiffs for implementation. It may concern the seizure of the debtor's property. It is even allowed to indicate the location of this property to speed up the process.

Moreover, this article contains many more opportunities for the creditor. Speaking about the procedure for filing an application, it is worth remembering the need to draw up two copies of the document, because one of them remains in the applicant’s hands with a note that the writ of execution has been accepted, which means that a decision to initiate enforcement proceedings must be received within three days.

In addition, the presence of such a statement with a note in case of controversial situations will confirm that the plaintiff has used all means of protecting his interests.

Actions of the bailiff

Having received the writ of execution, the bailiff first gives the debtor 5 days to voluntarily pay the amounts due. If this does not happen, enforcement actions begin: seizing the debtor’s bank accounts, sending documents to his work to collect the debt from his salary, and, as a last resort, seizing the property and selling it at auction.

For alimony

In this case, the decision of the judicial authority comes into force immediately. After all, here we are talking about protecting the interests of minors who have the right to receive financial assistance from both parents until they reach the age of 18. On the same or the next day, the child’s legal representative (most often the mother) receives a writ of execution. In some cases, the child’s parent also does not know what to do next. If the child’s second parent works, then the claimant can take this document directly to the accounting department at the debtor’s place of work. In cases where people do not live together for a long time, and the child’s mother does not know where her ex-husband is, it would be best to send a writ of execution to the bailiffs. Of course, this will take more time, but, nevertheless, it will be much more effective than searching for the defendant on your own.

It is also not uncommon for a child’s parent, who has information that the ex-spouse has accounts with a banking organization, to contact the bank after receiving a writ of execution for alimony in hand. What to do next if there is no positive response from the employees here? It is best to contact the bailiffs. They will make inquiries at all levels and themselves will find all the debtor’s accounts and property, if he has any.

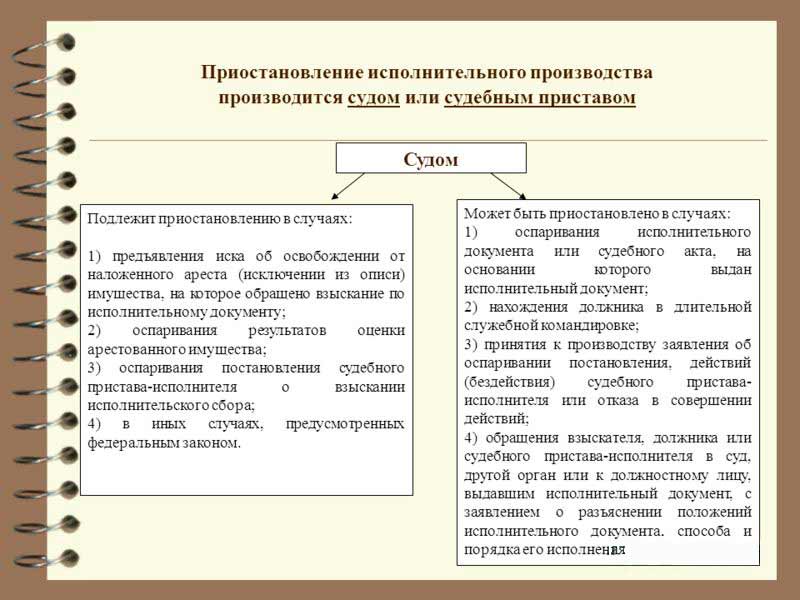

Is it possible to suspend production?

The law allows for the suspension of a writ of execution. This is possible, for example, in the following cases:

- if the debtor disputes the legality of issuing a writ of execution;

- if the debtor has become incapacitated;

- if the act itself on the basis of which the sheet was issued is appealed;

- if the debtor or claimant is in the active army or on a business trip of long duration.

In addition, the bailiff himself may decide to suspend if, after accepting the sheet, he discovered that the contents needed clarification from the court. In this case, the validity of the writ of execution is suspended on the basis of the bailiff's decision.

Actions of the plaintiff after receiving the court decision

Home Others Having failed to find a compromise in any case, the disputing parties resort to court with the hope of finding a solution to their problem. Defending your own interests in the courts is half the battle; the most important thing is to ensure that the ruling is executed by the losing party. For this purpose, a special document is issued, called a writ of execution, where, on the basis of the decision made, the debtor is given a time limit for execution of the decision. In the photo you can see what the IL sample looks like. What is a writ of execution Documents that are based on a decision of a court, and sometimes another competent authority, are writs of execution. They are issued in civil cases or administrative offenses. They contain details of the authority that issued the IL. In addition, it reflects information about the opposing parties (obligated and authorized person).

For how long is a suspension permissible?

The period depends on the specific circumstances of the case. In particular:

- in the event of the death of the debtor - until the moment when the procedure for entering into the inheritance of his relatives is completed;

- when the debtor undergoes military service, long-term treatment, a long business trip - before the end of the service, treatment or business trip;

- in the event that the actions of the bailiff or the grounds for issuing the sheet are disputed - until the court makes a decision in this dispute.

In general, the rule applies: suspension lasts according to law until the grounds for it cease.

Receipt procedure

A writ of execution (ID) is a document on the forced execution of a court order, drawn up on a form, with a stamp and containing all the necessary information about the creditor, debtor, the nature of the debt and, if such an obligation, its amount. In fact, the name of the document partially reflects its content, because in fact it consists of several sheets and in volume is a small brochure, bound and numbered.

It is issued only after the judicial act has entered into force. After the judge announces his decision at the hearing, he is given one working week to prepare a written form containing the arguments that guided him. The period during which a complaint can be filed begins to count from the moment the full text of the decision is drawn up, and not the last meeting. This period is very important for determining the moment the act comes into force and, accordingly, issuing the executive document. Because the right moment comes after the expiration of the period provided for reviewing the decision on appeal.

Thus, if the time for filing a complaint has expired, then the act takes full force and must be executed by the parties. If this does not happen, then the creditor (plaintiff) draws up an application for the issuance of a writ of execution. It is prepared within one to two working weeks.

Return of the writ of execution

In some cases, the bailiff may return the writ of execution to the claimant without completing the proceedings. As a rule, this happens when the debtor has nothing to collect, and the bailiff, despite all his efforts, was unable to find anything that could be sold at auction. In this case, the enforcement proceedings are completed, and the bailiff returns the sheet to the claimant.

The deadline for returning the writ of execution in this case is three working days. If the sheet is returned without execution, it can be resubmitted no earlier than six months later. However, do not be afraid that this will lead to the expiration of the sheet: the period automatically expires during execution. Thus, if the sheet is returned, the period for presentation begins to count again.

A little about the main thing

The entry into force of a judicial decision always ends with the plaintiff, who wins the process, receiving a writ of execution in his hands. Most often, the claimant simply does not know what to do next in such a situation. After all, the struggle to obtain money or property does not end here, but only just begins.

It is good if the defendant is a working and very wealthy person, has an apartment, a car, a dacha and other real estate. But what to do in the case when the debtor is not officially employed anywhere and there is simply nothing to recover from him? In this situation, you simply cannot do without the help of the bailiff service, but even these officials cannot always influence a person and force him to repay the debt.

Repeated execution

The rules described above regarding resubmission may be applied multiple times. Thus, even if the debtor does not have property, the document for execution can be submitted more than once. In this case, the three-year period will be restored each time if the claimant receives it back.

However, there is nothing to be happy about here. In practice, multiple submissions mean that the decision is not enforced and collection is not made. Consequently, although the sheet can be sent to the bailiffs over and over again, the chances of getting at least something from it do not increase each time.

Acts subject to immediate implementation

Such documents are listed in full by Art. 211 of the Civil Code of the Russian Federation.

The following decisions will be implemented immediately:

- for the collection of alimony payments,

- on the inclusion of a citizen of the Russian Federation in the list of referendum participants, the list of voters,

- on payment of wages to the employee within a three-month period.

Also, decisions to reinstate the employee to the company’s staff must be implemented immediately.

The judicial authority, relying on Art. 212 of this Code, at the request of the plaintiff, he has the legal right to assign the decision made to immediate execution in cases where the delay may lead to significant damage, or the debt has a risk of being unpaid.

At the same time, Article 182 of the Administrative Code of the Russian Federation requires the immediate implementation of decisions of arbitration courts in processes on appealing non-normative acts, improper actions of government agencies, local governments and other federal institutions.

Additionally

The court order must be executed no later than 10 days from the date of its issuance. This fact is indicated by Art. 130 Civil Code of the Russian Federation. As for court decisions, as well as decisions on administrative cases of other authorized bodies, they come into force only after the period for appealing them has expired.

According to Article 31.1 of the Administrative Code, the issued resolution acquires its legal force after:

- the end of the period of time provided for appeal, when the latter was not carried out,

- determination of a decision that cannot be appealed. The implementation process must begin immediately, except in cases where the decision annuls a previously made decision and makes a new one,

- the end of the period for challenging the decision on a protest/complaint, if it has not been appealed. An exception will be when a newly adopted resolution cancels the previous one.

All other documents requiring execution must begin to be implemented on the day that follows the date of the decision, unless this fact contradicts the current legislation.

What to do if deadlines are missed?

A claimant who filed a writ of execution after its validity period has expired has the right to go to court. There he can submit an application for restoration of the missed deadline. If the court considers the reasons for absence to be valid, the period may be restored in full. However, in relation to writs of execution in arbitration cases, the period can only be restored for six months.

The law does not specify in detail which reasons should be considered valid. The only main thing is that they should interfere with the presentation of the sheet for execution.

In addition, in cases where the court sends the document directly to the bailiffs, it is impossible to talk about missing the deadline: the bailiff, having received the document, is obliged to begin proceedings. Consequently, in cases where we are talking about compensation for damage caused by a crime, about compensation in connection with the loss of a breadwinner, the deadline will not be missed in any case.

Where to send

The judicial authority issued a writ of execution to the plaintiff. What to do next if the claimant does not know where the debtor works, in which bank the latter’s accounts are located, and whether he has them at all? In this case, lawyers advise not to hesitate and contact the bailiffs immediately. But there is one nuance here. The writ of execution must be sent only to the branch of the bailiff service that operates in the territory where the defendant lives. As a rule, the address of the debtor can be found out from the statement of claim; it is also always indicated on the sheet itself.

If the claimant does not have time to visit the bailiffs department, then it is best to seek help from a competent lawyer. Another option is to send the writ of execution to the bailiff service by mail. In this case you need:

— write a statement (in free form);

— attach a copy of bank details for transferring amounts;

— attach a writ of execution to the package of documents.

The letter must be sent with a description of the attachment. Then, most likely, none of the attached documents will be lost.

Deadlines for decisions of foreign courts

It is important to remember that everything said above applies only to Russia. If you want to recover money by decision of a Ukrainian court, then in this country there is a different validity period for the writ of execution. Since 2011, Ukraine has introduced a law according to which the period during which the sheet is valid is only one year.

The standards are also different in Belarus. There, according to decisions of courts of general jurisdiction, the period for presenting a sheet is also three years, as in Russia, but according to decisions of arbitration courts, it is only six months.

If the decision is made by a Kazakh court, and the writ of execution is presented for execution in Kazakhstan, then the rules regarding the timing of execution there are the same as in Russia: the writ can be submitted to the executors within three years from the moment the court made the decision.

Submitting IL to the bank

Remember! The Central Bank of the Russian Federation, in its regulation No. 285, provides for the possibility of sending writs of execution directly to the bank where the debtor has an account. The main condition is that the balance on this account is not zero.

The bank also draws up a statement attached to the writ of execution. In this case, you should make sure that the document was accepted and registered in the incoming documentation book. A citizen cannot be denied this action.

After the application has been accepted, it is sent for consideration to an authorized employee of the credit institution. Next, a collection order is generated, and funds are transferred according to it in favor of the plaintiff. At the same time, banks are limited by the deadline for executing such a decision. The plaintiff must receive his money within three days.

What to do if the bank has not fulfilled its obligation? Since the responsibility for carrying out a financial transaction to collect a debt is transferred to the bank after the application and writ of execution have been registered, if the credit institution fails to fulfill its obligations, it will be charged a fine in the amount of fifty percent of the amount of the debt written off from the defendant.

Please note! An important point is that the procedure for collecting debt through a bank is several times faster than the process controlled by bailiffs. However, it is not always possible to realize this possibility, since the court may not have information about the defendant’s accounts, and often, even if they are established, there are no funds to recover.

Period for fulfillment of requirements

The validity period of the ID differs from the period provided to the bailiffs for the enforcement of an obligation, for example, the collection of funds. If the first is equal to three years, then the second has a different length. It is established by law, but in fact it is rarely possible to “squeeze” into a certain framework: the rules are either not followed or are stretched by performing various actions, for example, returning a sheet to the applicant. He, in turn, can present the document for execution until the statute of limitations of the court decision expires.

Formally, the period for debt collection under a writ of execution by bailiffs is set at two months. During this short period, the employee must achieve full repayment of the debt. But in fact, these deadlines are impossible to meet: the examination alone to determine the value of the property can last a month.

The cumbersome design of procedures, the observance of which is mandatory, makes execution within the established framework extremely difficult. In this connection, the sheet may remain with the bailiff until the debt is actually repaid. The second option is that the document and application are returned to the creditor, and the debt collection proceedings are closed.

The order to return documents, like any other decision of the bailiff, can be challenged in court. The second option is to submit a new application after some time.