General conditions and restrictions for tax deductions for treatment for non-working pensioners

To receive the necessary compensation for money spent on treatment, you need to pay a tax to the state budget, and non-working pensioners do not make payments from the pension they receive. Carrying out a deduction is social, and it can be carried out by citizens of the Russian Federation who have earnings and pay income taxes to the budget. Accordingly, only a working pensioner will be able to receive such a deduction for medical procedures performed.

In 2014, amendments were made to the Tax Code of the Russian Federation (Article 219) regarding the receipt of tax deductions by non-working pensioners who have payments from a non-state pension fund, who have entered into an agreement with an insurance company for a period of at least 5 years.

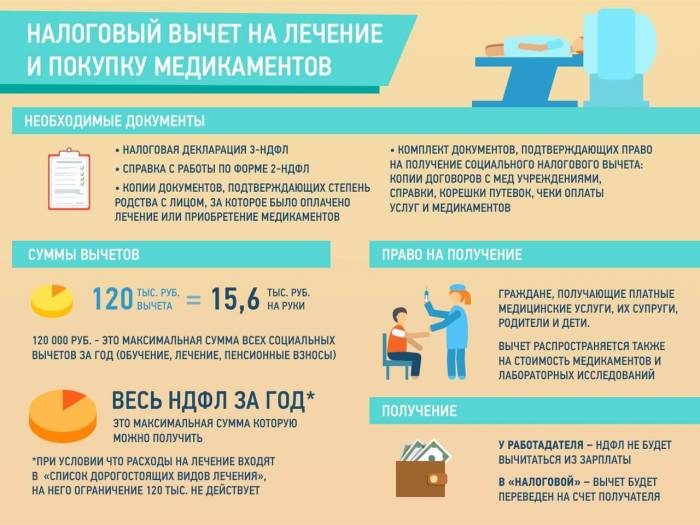

Important: The maximum amount for receiving social deductions is 120 thousand rubles; accordingly, a citizen will be able to receive 13% of this amount, namely 15.6 thousand rubles.

The maximum ceiling on the cost of services provided during treatment is not taken into account when returning tax after receiving expensive medical services according to the list approved by Decree of the Government of the Russian Federation.

Method 1. Additional income

One of the ways to return part of the money spent on treatment to an unemployed pensioner will be additional income, from which tax is paid. The main condition in order to receive a deduction will be the presence of taxable income over a period of three years.

To add. income subject to taxation for a person who has retired may include:

- pension payments coming from non-state pension funds in accordance with the concluded agreement;

- sale of real estate or car;

- winning the lottery;

- rental of real estate (house, apartment, room or non-residential premises).

Method 2. Tax refund for previous years

The deduction can be calculated no later than three years from the date of treatment, if at that time deductions of personal income tax were made. Let’s say a citizen received a pension in September 2020, and in December of the same year he paid for medications or underwent treatment. Accordingly, the person receiving the deduction can submit a declaration in Form 3 of the National Personal Income Tax Fund within 3 years, that is, in the period from 2020 to 2020 inclusive. The amount for calculating the deduction will be considered for the tax paid in the period from January to September 2017.

Method 3. Through relatives and family

If the person applying for the deduction does not make tax deductions and is officially married, then an application for social benefits can be submitted by a second family member (husband or wife, respectively), who officially works and makes tax deductions to the budget. In addition, children of an elderly person can also receive a deduction.

Many people wonder: how to apply for a personal income tax refund for the treatment of pensioner parents, what documents are needed so that the tax office does not refuse payment.

In order to process the payment, it is necessary to attach certificates confirming the fact of relationship to the documents submitted to the tax authorities. Also, a document from the medical institution confirming the expenses incurred by the pensioner must be issued in the name of the citizen receiving the benefit.

Please note: If payment is made by card, it is advisable that it be registered to the person making the payment. Documents confirming payment for treatment must indicate the TIN of the children (son or daughter) making the payment, as well as the details of the retired parent who received the treatment.

Features when receiving tax deductions for pensioners

It is worth listing other tax benefits that the state is ready to give to pensioners.

- Traditional deduction. The amount of funds will depend on the number of minor children and students. This benefit is valid until the end of the month in which the pensioner’s profit is more than 280 thousand rubles. (the calculation is carried out in an increasing degree from the beginning of the period).

- With donations. The deduction is equal to the amount of salary spent on donations. Its size cannot be more than 25% of the amount of income that was determined in the tax period.

- If you have paid for your studies at an educational institution. An elderly person has this right when he pays for his own or someone else’s (child, grandchild) education. The amount of the deduction is calculated based on payments made. However, there is still a limit: 120 thousand when paying for your own education and 50 thousand rubles for a child.

It is worth concluding that to provide honey. For tax deductions, it is necessary that the pensioner has earnings that will be taxed at the standard rate. These may include transfers from primary work and from other sources (for example, from renting out property).

Compensation for a pensioner who does not work can be issued by his close relatives. It is quite possible for a pensioner to earn an amount that he can spend on his own health in a medical institution. This is an excellent opportunity, although the government should still increase the percentage of money back. It is all the more important to review the legislation in relation to non-working pensioners, since this refunded tax will be especially useful for them. In general, obtaining medical services for the elderly is accessible, since the relevant authorities regulate the provision of funds for the elderly.

Regulatory acts regulating the issue

The regulatory document in accordance with which the tax on treatment is refunded is Decree of the Government of the Russian Federation No. 201 of March 19, 2001. This document, among other things, contains lists of medications and expensive services that are subject to compensation. The amount of the refundable benefit is mentioned in Article 219 of the Tax Code of the Russian Federation.

Another regulatory document is the Letters of the Ministry of Finance of the Russian Federation. These documents explain the procedure for returning 13% for treatment services received.

In what cases does the law provide for a tax deduction in the field of medicine?

The list of services subject to partial compensation with tax deductions is approved by Decree of the Government of the Russian Federation No. 201.

It includes the following categories:

- receiving emergency medical care on an outpatient and inpatient basis;

- treatment and rehabilitation in sanatoriums of the Russian Federation according to indications;

- diagnostic and therapeutic procedures in healthcare institutions;

- preventive and health education measures.

As we know, starting from 2020, the exact list of drugs subject to tax deduction has been excluded from the Resolution. Now this right extends to any drug prescribed by a doctor.

Calculation of the refund amount with examples

The maximum amount received as a deduction will depend on the treatment and the tax previously paid.

For example, a veteran received an income of 400 thousand rubles and paid tax on it. In the same year, he performed dental prosthetics at a dental clinic in the amount of 50 thousand rubles. This type of treatment, in accordance with the approved list, is not expensive, so the maximum payment amount is 120 thousand rubles. The amount spent on treatment does not exceed the maximum ceiling, and the tax paid is quite enough to receive a social deduction. As a result, the pensioner will receive: 50,000 * 13% = 6,500 rubles.

When receiving expensive treatment, there is no maximum amount spent; everything will depend on the tax paid. For example, a pensioner worked at an enterprise and retired in November. For 11 months of the year, she earned 600 thousand rubles for her work and paid a tax on it in the amount of 78 thousand rubles. In December of the same year, she went to the doctor and received services for installing dental implants. She paid 130 thousand rubles for the treatment received. This procedure is an expensive treatment; therefore, there is no maximum cost for the services provided. As a result, the pensioner will receive: 130,000*13%=16,900 rubles. She will receive the payment in full, since for the period from January to November she paid an amount of income tax greater than 16,900 rubles.

Legislative nuances

Compensation for the provision of healthcare services has a number of important features:

- the amount of payments should not exceed 13% of the amount spent;

- deductions are made for expenses not exceeding 120 thousand rubles (except for types of treatment separately indicated in the List);

- the maximum amount of compensation is 15,600 rubles;

- the amount of compensation cannot be greater than the annual amount of tax remitted by the applicant.

According to our information, payments for treatment can be received within 3 years from the date of treatment. That is, in the current 2020, submitting an application to the Federal Tax Service for the period 2017-18 is still relevant.

Income tax refund for dental treatment for non-working pensioners

Dental treatment usually costs a lot of money, especially since most of the services provided by dentists are paid.

Not all citizens know that the tax benefit for treatment also applies to dental services.

You can get 13% back from services such as:

- Installation of braces.

- Dental prosthetics.

- Installation of implants.

- Other dental services related to dental treatment.

The same indicators regarding the statute of limitations and amount of payments apply to receiving benefits as in other cases. Accordingly, the package of documents is also standard, as when submitting an application for payment of benefits for treatment.

The amount of payment received will depend on the determination of the dental services provided (expensive or routine treatment).

If the treatment is considered expensive (documented with code No. 2), a deduction of 13% is returned from the entire amount spent on dental services, but within the limits of the previously paid tax.

If the services received are marked with code No. 1, then dental treatment is normal; accordingly, a deduction of 13% is returned from the amount of 120 thousand rubles and does not exceed 15.6 thousand rubles.

Additional information: The criterion for determining services will not be the final amount spent, but the classification of these services as expensive, in accordance with the approved list (Resolution of the Government of the Russian Federation No. 201 of March 19, 2001). For example, expensive treatment will include the installation of implants.

To receive payments for dental treatment, you need to prepare the following documents:

- obtain from a dental clinic or private dental office a document confirming payment for dentures or other dental services;

- draw up an agreement for the provision of treatment services and request a copy of the medical institution’s license;

- prepare copies of financial documents and agreements;

- fill out a tax return in form 3 personal income tax and write an application for a refund of 13%;

- attach tax return 2NDFL;

- if the return is issued by working close relatives, then documents confirming this relationship.

If the declaration is filled out correctly, then after a short period of time, the citizen filing a tax refund will receive the calculated amount.

Step-by-step instruction

In order to apply for a social deduction for an unemployed elderly person, the following conditions must be met:

- The pensioner has an additional source of income. This could be an agreement with a non-state pension fund, renting out your own apartment, or purchasing real estate.

- Relatives can pay for a pensioner. To do this, an application is submitted to the Federal Tax Service with supporting documents that the pensioner’s treatment was paid for by his relative, plus a document that confirms the fact of the family relationship.

Important! The law provides for a deferment period of three years. This implies that an individual dismissed from work or after retirement has the right to return the money spent over the next three years.

Documentation

- Pension certificate

- Application for a social deduction

- Completed declaration in form 3-NDFL

- Payment documents confirming payment for treatment

- Medical institution license (copy)

- Documentation confirming the pensioner’s income (agreement with a non-state pension fund, purchase and sale agreement for an apartment, other sources of income)

- Bank account details

In 2012, he bought medicines worth 40,000 rubles. In 2012, he received income from the plant in the amount of 400 thousand rubles. (33,000 rubles per month). The boss withheld tax from him in the amount of 52,000 rubles (400,000 * 13%), which gives him the right to issue a deduction. The amount is 40,000 rubles. less than 120,000 rubles. This means that Vasiliev will receive compensation within the limits of the funds spent: 40000 * 13% = 5200.

Having issued a refund for previous years

Citizens who have stopped working and do not receive additional income can receive a refund for previous years.

- When purchasing housing and simultaneous retirement, three years are counted from the year of dismissal.

- If a citizen did not work and bought an apartment, the countdown will start from the date on which they purchased the property.

Through relatives and family

A citizen is officially married and does not work, then his spouse can apply for a deduction if he has an official source of income.

Important! If a pensioner has previously applied for a property deduction for the purchase of a home, he will not be able to use this right again.

Tax deduction for medicines for pensioners

Based on Article 219 of the Tax Code of the Russian Federation, a citizen has the right to make a 13% refund for medications purchased as prescribed by a doctor. One of the main conditions for a refund for medications will be the presence of this drug in a special list, in accordance with Decree of the Russian Federation No. 201 of March 19, 2001. If a medicine is not on this list, you need to check its availability on the list based on the Federal Tax Service letter No. BS-4-11/111454 dated 07/01/2015. If medications are on the lists, then you can start collecting documents.

To apply for a 13% refund you will need:

- an original prescription from a doctor for medications in form 107-1/u with a mandatory stamp for the Federal Tax Service;

- financial documents confirming payment for medicines (if the cash register receipt does not contain the name of the purchased medicines, then you must ask for a sales receipt);

- completed tax return in form 3 personal income tax;

- signed original income tax certificate Form 2;

- when returning tax for a non-working pensioner through a spouse or children, copies of documents indicating a close relationship.

In addition to the specified documents, the tax inspector may additionally ask you to provide a copy of your passport, TIN certificate and original documents confirming payment for medicines. In addition, some of the drugs prescribed by the treating specialist do not require a prescription, but in order to receive a further refund from the tax office, it is necessary to fill out a prescription in the established form.

If medications are not on the approved lists, the pensioner or his relative will not be able to receive payment for the drug.

What is compensation for paid treatment?

Tax deduction is a type of social benefit that is provided to every resident of Russia, guaranteed by Art. 219 of the Tax Code of the Russian Federation. To receive it, you must have income that is taxed at 13%.

This percentage is refundable:

- From a tax base of 12 thousand rubles when using standard services.

- If the service falls into the expensive category. In this case, it is calculated from the full amount of treatment, and not from the tax base.

Expensive services:

- ECO;

- complex operations to correct congenital diseases;

- treatment of cancer tumors;

- surgical operations;

- nursing premature babies;

- dental prosthetics.

In addition, the state has established a list of medical services and medications that are included in the register of the Decree.

- Anti-inflammatory suppositories in gynecology

- How can I return an item without a receipt?

- How to make a married man fall in love with you

By paying them, a person will be able to receive a tax deduction in the future:

- Call an ambulance.

- Outpatient-inpatient treatment.

- Recuperation in a sanatorium. Only the costs of treatment and the purchase of necessary medications are taken into account. The cost of the train, accommodation, food, and personal expenses are not taken into account.

- Public health education.

- Own health insurance.

- Purchase of medicines included in the state register. A prescription from a doctor and receipts confirming the purchase must be present.

Deduction for expensive operations for pensioners

The main difference between expensive and conventional treatment is the absence of a maximum ceiling on funds spent on treatment (the limit for conventional treatment is 120 thousand rubles). The threshold for receiving payment will be the amount of tax paid for the year taken for calculation.

When filling out the documents, the appropriate column indicates expensive treatment or, otherwise, the column indicating the amount paid for conventional treatment.

When filling out a certificate of payment for medical services in a medical institution, the specialist finds in the relevant list and indicates either service code 1 or service code 2, which corresponds to expensive treatment. The list for 3 personal income taxes was approved by Government Decree No. 201 of March 19, 2001 and amendments and additions approved. Government of the Russian Federation No. 411 dated June 26, 2007. This list includes 27 different medical services, for example, surgical treatment and organ transplantation.

Therefore, before filling out the documents, you can check whether the treatment of the disease is included in the list of expensive medical services.

What treatment can be deducted for?

The list of medical services, medicines and types of treatment for which a citizen has the right to return 13% of personal income tax is contained in the Decree of the Government of the Russian Federation “On approval of lists of medical services and expensive types of treatment in medical institutions of the Russian Federation, medicines, the payment amounts for which from the taxpayer’s own funds are taken into account when determining the amount of social tax deduction" No. 201.

According to this legal act, a citizen can return part of the funds for the following medical procedures:

- diagnosis and treatment during emergency medical care;

- placement in a hospital - day or round-the-clock. This includes diagnosis, prevention, treatment, rehabilitation and medical examinations;

- provision of outpatient medical services;

- paid medical services that a citizen received while staying in a sanatorium-resort institution;

- health education services.

Important!

The list of drugs and other medicines for which a tax refund is due is impressive. It includes 19 blocks, which differ in scope and therapeutic purpose of drugs. This:

- Anesthetics and muscle relaxants.

- Analgesics and anti-inflammatory drugs.

- Allergy medications.

- Drugs that affect the functioning of the central nervous system, gastrointestinal tract, visual organs, etc.

- Anti-infective drugs.

- Medicines for tumors.

- Special medical nutrition.

- Vitamins.

- Antiseptics.

- Other medications.

Important!

If the medicine is not on the List, this does not mean a refusal to refund. The document does not contain the names of the drugs, but the main active ingredients. If they are included in medications prescribed by a doctor, filing a deduction is absolutely legal.

The following treatments fall into the expensive category:

- Correction of congenital abnormalities by surgery.

- Operations to eliminate serious diseases of the circulatory system, respiratory system, vision, digestive system and nervous system.

- Medical reconstruction of joints, implantation of prostheses.

- Reconstructive plastic surgery.

- Infertility treatment using IVF;

- Surgical interventions associated with difficult pregnancy and childbirth - for example, caesarean section.

- Other types of expensive treatment described in Decree No. 201.

Important!

A non-working pensioner can apply for a deduction at the territorial division of the tax office. The list of required documents can be clarified at an appointment with a specialist.

Why the tax office may refuse

The Federal Tax Service does not always accept documents and in some cases has the right to refuse to issue benefits. There are no refunds in the following cases:

- The document for issuing prescriptions for the purchase of medicines is not drawn up on forms 107-1у or 14-1/у-88, and there is also no stamp on the form for the tax office.

- The financial document confirming the payment was completed with errors.

- The citizen was not provided with an agreement to receive paid medical services.

- Lack of the necessary license to provide treatment from a medical institution.

- Absence of a service or medicine in a special list approved by the Government of the Russian Federation.

- If the applicant for the benefit has not paid income tax for a certain period of time.

- Exceeding the total cost of treatment (if it is not expensive) or the purchase of medicines is 120 thousand rubles.

In the latter case, it is necessary to redo the declaration for a smaller amount to be paid.