Is it possible to get a tax deduction for a driving school?

Social deduction provides for reimbursement of part of the expenses incurred during the training process. At the same time, according to Art. 219 of the Tax Code of the Russian Federation, this type of expense may be due to the studies of both the applicant himself and his children/wards, as well as brothers/sisters. To benefit from reimbursement for expenses other than your own education, you must meet a number of conditions:

- the child/ward, brother/sister must not be more than 24 years old;

- the form of training must be full-time;

- The educational institution must have a license to provide educational services.

If all these conditions are met, then the father/mother (guardians) or brother/sister of the student can return the tax, including expenses for driving school services. But the refund amount cannot exceed RUB 6,500. (RUB 50,000 deductible for personal income tax x 13%).

Important! An individual can claim a deduction for the education of a child/brother/sister for the year in which they turned 24 (letter of the Ministry of Finance of Russia dated August 28, 2012 No. 03-04-05/8-1010).

For information on the specifics of obtaining a deduction for a student studying on a paid basis, see the article “Personal income tax deduction can also be obtained for a “paying” student.”

As for the right to a personal income tax refund when an individual receives a deduction for training for himself, in this case a number of restrictions are lifted. If you have income on which tax was withheld at a rate of 13%, it is enough to confirm that the educational institution has a license. So an individual can make a tax refund regardless of how old he is and what form of training he takes - full-time or part-time, including driving courses. The maximum refund amount in this case is RUB 15,600. (RUB 120,000 x 13%).

For information on which income cannot be withheld personal income tax, see the article “Income not subject to personal income tax taxation (2014–2015).”

How much can I get back?

The tax deduction is 13% of the amount spent. Expenses for which money is returned should not exceed 120,000 rubles per year.

Let’s say that within a year you are going to pay for training at a driving school for 40,000 rubles and undergo a medical examination for 140,000 rubles. In fact, you will spend 180,000 rubles, but the deduction will be issued only for 120,000 rubles.

The maximum possible amount with which you will receive compensation for your child’s education is 50,000 rubles. As a rule, tuition at a driving school does not exceed this amount.

After completing the calculation, we will find out what amount of return you will get. As a rule, training in a driving school costs 30,000 rubles. Let's find 13% of this amount. The refund amount will be 3,900 rubles.

Also read: How to choose a driving school

What documents are needed for deduction?

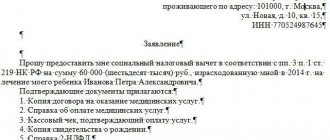

If a taxpayer receives a deduction for children/brother/sister, he fills out form 3-NDFL and attaches the following package of documents to it:

- certificate 2-NDFL;

- agreement with a driving school;

- proof of payment;

- certificate of study form;

- birth certificates of children (for a deduction for a child), brothers/sisters and your own (for a deduction for a brother/sister).

Important! In order to avoid disputes with the tax authorities, the contract and payment orders must include the full name of the applicant for the deduction (letters of the Ministry of Finance of Russia dated September 13, 2013 No. 03-04-05/3788, dated October 28, 2013 No. 03-04-05/ 45702).

When applying for a deduction for their own training, an individual also fills out 3-NDFL and submits to the Federal Tax Service:

- certificate 2-NDFL;

- driving course agreement;

- payment slips confirming payment for training.

Size

The tax deduction cannot be more than the personal income tax paid to the budget during the period of study at the institute. Maximum values:

- 120,000 rub. per year for your education and the education of your brothers and sisters . It is possible to return a maximum of 13% of the money spent on the educational process. Calculation: 120,000 rub. * 13% = 15,600 rubles;

- 50,000 rub. per year for each child: for the education of a son, daughter, ward or ward. A refund of 50,000 rubles is possible. * 13% = 6500 rub.

The refunded amount cannot exceed the amount of income tax paid.

Procedure for reimbursement of personal income tax from driving school training expenses

The specified package of documents is submitted to the tax authorities after the end of the year in which these expenses were incurred. Moreover, if the 3-NDFL declaration is submitted only for the purpose of filing a deduction, the deadline for its submission, limited to April 30, does not apply. Documents can be submitted throughout the year.

After receiving the specified documents from the applicant, the Federal Tax Service Inspectorate conducts a tax audit within up to 3 months, after which, within 1 month, a decision is made on the refund / impossibility of a tax refund. If the decision is positive, the amount of deduction declared by him is transferred to the individual’s current account.

Obtaining a deduction from the tax office

There are two ways to get a tax deduction for training in a driving school:

- by contacting the Federal Tax Service;

- through the employer.

The first of them involves a citizen’s appeal at the end of the billing period. He must draw up a declaration himself and attach to it the rest of the required papers along with the completed application. You can send it in one of the following ways:

- through personal contact;

- via post offices;

- using the services of multifunctional centers;

- online on the official Internet resource of the Federal Tax Service;

- through a proxy (a notarized power of attorney will be required confirming the authority to represent the applicant’s interests).

When using this method, the citizen receives a refund in a one-time payment. The period within which the tax service will transfer funds to the bank details specified in the application is three calendar months. The countdown begins from the moment the inspection accepts the application for registration.

Results

By paying for driving courses, the personal income tax payer can compensate for part of the amounts paid for training.

You can also get a tax refund on the costs of training close relatives under 24 years of age. However, for such compensation it is necessary to follow the procedure for documenting and justifying these expenses. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Who cannot receive a deduction?

The following are not eligible to receive a tax deduction for education:

- unemployed people;

- spouse;

- non-immediate relatives: grandchildren, grandmothers, aunts, grandfathers, uncles, nephews;

- individual entrepreneurs who do not pay personal income tax;

- non-residents of the Russian Federation.

When paying for education at an institute using maternity capital, you cannot receive a tax deduction (paragraph 5, subparagraph 2, paragraph 1, article 219 of the Tax Code of the Russian Federation).

Child education tax refund

As already noted, the taxpayer has the right to deduction both when he studies himself and when he pays for children, brothers and sisters, or persons under his care.

You can get back part of the tax paid if your child is studying if:

- son, daughter, brothers or sisters are not yet 24 years old;

- the ward or former ward is not yet 24;

- training – full-time;

- the party to the contract is a parent or guardian;

- At the same time, the person paying for the training also pays income tax.

Thus, it is extremely important that not only the age complies with legal restrictions, but also that the payer in the training agreement is specified correctly. Otherwise, if it turns out to be the child himself, then the parent will not have the right to receive a deduction.

How to get a deduction - 2 ways

Before 2020, there was only one way to refund tuition taxes - through the tax office and only after the end of the year. Now you can receive money almost immediately, directly from your employer, without waiting for the beginning of the year. Let's look at both methods and compare which is better.

Through the tax office

To get a refund of 13% of your training expenses, you need to provide a package of documents to the tax office. After a desk audit, the maximum period of which is 3 months from the date of submission of documents, the overpaid tax will be transferred to your bank account within a month.

You can submit documents at any time of the year. The tax office does not impose any restrictions here.

List of documents to receive a deduction:

- certificate in form 2-NDFL;

- an agreement with an educational institution on the provision of paid services;

- documents confirming your expenses;

- declaration in form 3-NDFL;

- application for the transfer of money to your current account.

Through the employer directly

The procedure itself is as follows. After the expenses have been incurred, without waiting for the end of the year, you need to take the documents to the tax office to confirm your right to a tax deduction. Within 30 days, a verification will take place and you will be given a confirmation that you need to take to your employer.

Further, from the current month, income tax will not be withheld from you until you exhaust the right to a tax deduction completely.

The difference between training tax refunds through an employer is that you do not need to fill out a 3-NDFL declaration and do not need a certificate of your income.

Example. In February of this year, Ivanov incurred training costs in the amount of 100 thousand rubles.

He provided the tax office with documents confirming the expenses he incurred. A month later, the inspectorate issued a confirmation giving Ivanov the right to a tax deduction in the amount of 13 thousand, which he handed over to the accounting department at his place of work in March.

Starting from this month, no income tax will be withheld from him and his salary will be paid in full.

It is important to understand that the employer does not have the right to return tax withheld for earlier months. That is, if you brought a notice from the tax office in November, then you will not receive anything for January - October of the current year.

The money that the employer does not have time to pay you before the end of the year is not carried over to the next period. To receive the rest of the lost amount, you will need to contact the tax office.

Which is better and more profitable?

Expert opinion

Orlov Denis Ignatievich

Lawyer with 6 years of experience. Specialization: family law. Has experience in drafting contracts.

Each method has its pros and cons. And there is no way to give a definitive answer. Each taxpayer chooses a more convenient or profitable option for himself.

- You can start receiving deductions through your employer almost immediately, without waiting for the end of the calendar year. But if the refund amount is large and submitted in the second half of the year, then the employer may not have time to pay everything in full due to the fact that the year will end. In this case, to obtain the unpaid balance, you will need to contact the tax office again.

- If you have several payments planned for education during the year, then it is still more advisable to contact the tax office once next year and receive a deduction for the whole year at once, rather than several times during the year.

- To receive money through your employer, you do not need to fill out a 3-NDFL declaration. You only need to include documents confirming expenses. But on the other hand, you will spend more time on registration: you need to contact the tax office twice, then to your accounting department. If you receive money through the tax office, you only need to provide them with a package of documents ONCE and wait for the money to be transferred.

- If after a year you still need to file a declaration, for example, to receive a property deduction, then it is more logical to include the education deduction in it and receive all the money at one time.

You can now follow updates in this and other articles on the Telegram channel: @vsedengy .

According to the Federal Tax Service, almost 200 billion rubles have been claimed by Russians for refunds from the budget in 2020. If you are officially employed and pay 13% income tax to the state, you can also get part of the taxes paid back. This is called a tax deduction.

How to get a tax deduction for education, what to consider when preparing documents and how not to fall for the bait of unscrupulous intermediaries.

List of documents for personal income tax return for studies

You can file and return your training tax from your employer or the tax office by submitting the required documents. The return procedure in these cases and the lists of required documents are slightly different. Let's look at this in more detail.

When applying for a personal income tax refund from an employer, you need to provide him with two documents:

- an application from you in any form for a personal income tax refund

, which you write yourself; - notification from the tax authority confirming the possibility of a tax refund for you in connection with training expenses

.

But in order to receive a notification from the tax authority about the possibility of a tax refund, you need to submit the following documents to the tax authority at your place of residence:

- application to confirm the taxpayer’s right to receive social tax deductions and a refund of overpaid tax

; - a copy of the training agreement with the educational institution;

- a copy of the license of the educational institution where the training is taking place;

- a certificate from the educational institution confirming full-time study (if there is no provision for full-time study in the contract);

- copies of payment documents confirming the fact of payment for training (cash receipts, receipts, etc.);

- copies of documents confirming your relationship with the students and their age. Such documents are submitted only if you claim a deduction not for yourself, but for the education of children (wards), brother, sister;

- a copy of the document confirming your guardianship or trusteeship of the child (in case of paying for the education of the ward).

Depending on the specific situation, other documents may be required.

You must submit all of the above documents to the tax authority, which within 30 calendar days will issue you a notification (link to the file in the twin article) confirming your right to a tax refund. You must submit this notification from the tax authority to your employer.

The employer, based on the documents received from you, will organize a refund of income tax to you starting from the month in which you submitted the documents.

If you decide to file a personal income tax refund with the tax authority, then you do not need to contact your employer. Prepare the necessary documents and submit them to the tax authority at your place of residence. You can do this after the end of the calendar year in which you paid for your education.

In this case, submit the following documents to the tax authority:

- application for a refund of overpaid income tax;

- tax return in form 3-NDFL. To fill out the declaration, you can use the services of the website of the Federal Tax Service of Russia;

- a certificate from your employer about your income;

- a copy of the training agreement;

- a copy of the license of the educational institution where the training is taking place;

- a certificate from the educational institution confirming full-time study (if there is no such condition in the contract);

- copies of documents confirming payment for training (payments, cash receipts, receipts, etc.);

- copies of documents confirming your relationship with the students and their age (copies of birth certificates, etc.). Such documents are submitted only if you are filing a personal income tax refund in connection with paying for the education of children (wards), brother, sister;

- a copy of the document confirming your guardianship or trusteeship of the child (if you paid for the education of your ward).

You can submit the listed documents required for a refund of income tax for training to the tax authority at any time within three years after the end of the year in which you paid for training.

The tax authority will notify you of its decision to refund your tax on training expenses after checking the documents you submitted.