Grounds for refund of state duty

It is possible to return funds transferred to the state budget only by submitting an appropriate application. However, you can only submit an application in the following cases:

- The citizen who paid the fee for filing a lawsuit abandoned his claim before the lawsuit was initiated;

- The court granted a justified refusal to consider the claim;

- The state duty was paid in an amount exceeding the established one, etc.

The grounds for returning funds must not contradict the law. The money will be returned only if the public service was not provided to the citizen for justified reasons.

Procedure for individuals and legal entities

The application is written to the Federal Tax Service at the location of the applicant. In the header of the document, you must indicate not only your data, but also in whose name it was drawn up (full name of the head of the inspection). The application is not handed to the management itself, but is submitted to the office.

Attention! Do not forget to indicate the correct account details for a refund in your application.

Application form to the tax office for tax refund under 3-NDFL 2018

Do you need to pay tax when donating an apartment? Read here.

How to fill out an application for a refund from the tax office, read the link:

If you plan to return the state fee paid in connection with the trial, then an application for a refund must be submitted to the Federal Tax Service, to which the court where the case is being heard is located.

When submitting an application for a refund of mandatory payments on behalf of individuals, there are a number of features:

- the application is drawn up in your own hand, indicating passport data, reasons for return, account details, contact phone number;

- The application is accompanied by the original receipt, if a full refund is planned, a photocopy, if a partial one, a photocopy of the passport or birth certificate (if the fee is paid by minors).

Consideration of an application for refund of state duty

An application for the return of the state fee paid to file a claim in court is submitted to the same court where the citizen filed the claim. The age can be made within three years after payment of the state fee. The application is considered taking into account the following legal aspects:

- A receipt for payment of the fee must also be provided when submitting the application;

- The tax service returns the money only after receiving a court decision on this issue;

- The decision to return money for the paid fee is made without the presence of the applicant only on the basis of the documents provided;

- The funds must be returned within a month after the judge’s decision is submitted to the tax service.

Letter for refund of state duty to the tax office: where are the applications and its sample

To correctly fill out an application for a refund of state duty to the tax office, you can download a sample on our portal. You have access to a document that fully complies with legal requirements.

In addition to the application itself, additional documents should be sent to the Federal Tax Service to confirm the expenses incurred. If the courts or magistrates made decisions or determinations on the return of state duty, then payment documents must be attached.

Regarding payment orders or bank receipts, there is one feature that should be taken into account when preparing the package: if the applicant intends to return the full amount of the state duty, then the originals of the payments are sent; if in partial amounts, it is allowed to send copies of the orders, since the originals will be required to claim the rest of the state duty.

Is it possible to return state duty from the tax service?

Taking into account the legal basis, a citizen has the right to return funds for previously paid state fees, either in full or in part. In this case, the basis for a refund should be the following:

- The amount of duty paid for a public service is more than established by law. In this case, the citizen has the right to return the difference.

- If a court or an authorized notary refuses to review documents. A citizen has the right to return money for services not received.

- Conclusion of a settlement agreement between the parties to the case before the procedural consideration of the application and the issuance of any court decision.

- Upon receipt of a notice from the court to terminate the consideration of the case.

- The citizen did not apply for a government service for which he had previously paid.

Deadlines

Expert opinion

Kurtov Mikhail Sergeevich

Practitioner lawyer with 15 years of experience. Specializes in civil and family law. Author of dozens of articles on legal topics.

The law establishes that any citizen has the right to return money for a government service not received within three years from the date of payment of the duty. At the same time, the legislation defines the right to extend this period if a citizen is unable to apply for a refund on time.

How to return previously paid state duty from the tax office

In order to return funds for the state fee, a citizen must provide the necessary documents to government authorities within three years. The application and all accompanying documents must be submitted to the government service that was supposed to provide the paid service. To receive a refund, you must provide additionally with the application:

- A copy of the receipt for payment of the state fee for a full refund;

- In order to return part of the money overpaid for the state fee, the citizen must provide a receipt for payment and a form for payment of the state fee, on the basis of which the payment is made.

Application for refund of state duty to the tax office: how to draw up + sample

To return funds, a citizen must fill out an application in the form established by law.

Instructions - how to fill out an application for a refund of state duty

It is worth noting that filling out an application for individuals has some differences from legal entities.

Step No. 1 – fill out the form header

At the first stage of filling out, it is necessary to indicate information about the individual or legal entity who, in this case, is the applicant:

- It is mandatory to indicate the taxpayer identification number, but for legal entities it is also necessary to indicate the reason for registration code - KPP.

- Indicate the application number. The serial number of the taxpayer's appeal to the tax authorities is indicated here.

- Details of the tax authority where the applicant is applying.

Step No. 2 – fill out the first page of the application form

The following data is indicated point by point:

- The applicant is required to indicate either his full name or the name of the organization, depending on his taxpayer status.

- Article of the tax code on the basis on which a refund must be made.

- Reason for refund: refusal to provide a public service, overpayment, etc.

- It is necessary to note the type of obligation to be returned.

- The amount that must be returned.

Step No. 3 – fill out the second page of the form

The applicant will have to provide information about the bank account where the money should be transferred. Data must be submitted in full to avoid possible errors and delays. Such information includes:

- Name of the credit institution in which the taxpayer has a bank account;

- Type of bank account (current account, deposit account, etc.)

- Taxpayer's bank account number, etc.

- Information about the account holder is also indicated here for both individuals and legal entities.

- Applicant's passport details.

When a return is not possible

There are a number of circumstances under which a refund of state duty is not possible:

- any registration actions in the registry office;

- if, after filing the claim in court, the defendant fully accepted the applicant’s claims;

- refusal to register rights to real estate;

- when working with a mark on jewelry (analysis, testing, installation).

If more than 3 years have passed since the payment of this obligatory payment, then there is no point in filing an application, the application will be refused.

But one application for a refund is not enough. Attached are documents proving your case. For example, a check confirming excess payment, a court decision to terminate proceedings, etc.

By law, government bodies must respond to requests from citizens and legal entities within 30 days. The same applies to filing a duty refund application. The application will be considered for a month. Afterwards a decision will be made on whether to return or refuse.

Watch the video. How to get back overpaid taxes:

How to submit

The request will need to be sent to the inspectorate at the location of the government department to which the fee was transferred. The documentation must be submitted to the Federal Tax Service employee personally by the head or his official representative. You can also send your application to the tax office by mail. The letter must be registered with a list of enclosed documentation.

An LLC that has registered a personal account on the Federal Tax Service web resource can submit an online request for a duty refund. If the application is completed correctly, then after it is sent to the user’s personal account, a notification will be received about its acceptance.

The legislation provides the payer with the opportunity to return overpaid duties to the treasury. To receive money, a legal entity (individual) will need to draw up an application in the prescribed form and support it with the necessary evidence.

Home » Documents » Agreements » Application for refund of state duty to the tax office

Why do you need an application to the Federal Tax Service?

Article 333.40 of the Tax Code of the Russian Federation gives citizens and legal entities. persons have the right to a refund of previously paid state duty. If additional court hearings are planned, then this payment may not be returned, but can be counted against subsequent payments.

You can return a payment made to the state budget if:

- more was paid than required;

- actions for which the state duty was paid were not performed;

- the state fee was paid, but the person never applied to government agencies for a specific service;

- money was paid for obtaining a passport, but the applicant was refused to issue this document;

- the application for state registration of rights related to intellectual activity was withdrawn (clause 1 of Article 333.30 of the Tax Code of the Russian Federation);

- the administrative violation case was left without consideration or was terminated.

The application is subject to special requirements established by the Order of the Federal Tax Service under the number ММВ-7-8 / [email protected] dated February 14, 2020 (8th appendix). Until March 31, 2020, other rules were applied, enshrined in Order of the Federal Tax Service No. ММВ-7-8 / [email protected] dated August 23, 2016.

The law also establishes a period during which the applicant must apply to the Federal Tax Service with a request for a refund of the state duty - 36 months from the date the money is credited to the budget.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Refund of state duty

You should write a letter to the tax office to which the payment was sent addressed to the manager. The letter must be submitted to the inspection office and a receipt must be issued.

If a refund of the entire payment amount is required, you must provide the original receipt. A copy of the receipt is sufficient for a partial return. The money is transferred after a few months to the current account specified in the application.

An application for a refund of state fees in court cases should be submitted to the tax authorities at the legal location of the court that is considering the case.

The application for a case being considered in an arbitration court, a court of general jurisdiction, the Constitutional Court of Russia or constituent entities of the Russian Federation, as well as magistrates, must be accompanied by a decision, certificates and a determination that serves as the basis for the return of the state duty of the overpaid amount. For a full refund, original payment documents or, in case of partial refund, copies of documents must also be attached.

You can apply for a refund of the state duty amount from the date of payment within 3 years.

To return an overpaid or erroneously paid amount of state duty, you must have with you when contacting the tax authorities:

For individuals

- A written statement addressed to the boss. The application must indicate:

- surname, name, patronymic of the duty payer;

- actual residential address;

- contact phone number;

- reason for return;

- refund amount (in words and numbers);

- details of the return recipient's bank account (BIC, INN, account number, bank checkpoint).

- A copy and original of the paid receipt (depending on the type of return), a certified original in the proper order.

- A photocopy of the applicant's passport and passbook.

- If the receipt was paid on behalf of a minor, a copy of the birth certificate.

All documentation must be completed for one person. If the applicant dies, a certificate of succession is attached. The right to claim this payment is necessarily included in the inherited property. Funds from the budget are returned to the bank account; cash is not issued.

For legal entities

- A written application, where you need to indicate:

- official full and abbreviated name of the organization;

- TIN and checkpoint;

- BIC, account, l/s (bank details);

- OKTMO and budget classification code;

- reasons for the refund;

- cost in numbers and words.

- Original with the bank's mark of the payment order.

- If a representative of the organization applies, a power of attorney is required.

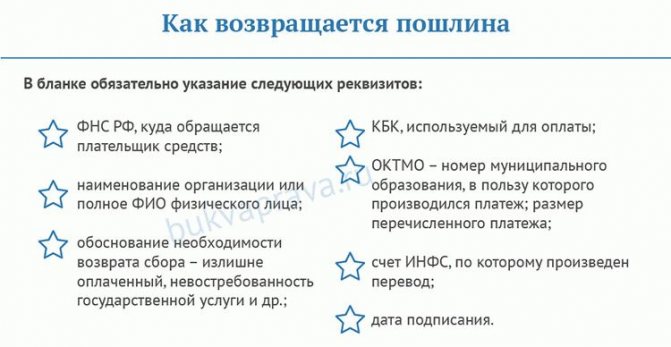

How is the duty refunded?

An application for payment transfer is submitted using a unified form. The document was approved by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-8/ [email protected] dated 02.14.2017, Appendix No. 8. It is possible to return the funds within at least 3 years from the date of their transfer to the budget.

In the application for refund of state duty to the tax office (sample), the following details must be indicated:

- Federal Tax Service of the Russian Federation, where the payer of funds applies;

- name of the organization or full name of an individual;

- justification for the need to return the fee - overpaid, lack of demand for public services, etc.;

- BCC used for payment;

- OKTMO – number of the municipality in favor of which the payment was made;

- the amount of the transferred payment;

- the INFS account to which the transfer was made;

- date of signing.

The taxpayer’s signature must be affixed to the document, just like in a passport. For individuals who do not have individual entrepreneur status, it is necessary to sign a document indicating the TIN and confirmation of the address of residence in Russia.

If the refund of the fee is justified by a court decision or the issuance of an act by a state or municipal body, such copies of title documents must be attached to the application.

It is necessary to take into account the peculiarity of duty refund. When requesting the full amount of payment, the original payment receipt is provided to the INFS; if partial, a duplicate is provided.