Home / Complaints, courts, consumer rights

Back

Published: 10/03/2018

Reading time: 5 min

0

196

Illegal business activity is an activity carried out by an individual or legal entity to obtain financial gain on a periodic or continuous (not one-time) basis. Such activities are not licensed, do not have all the permits, and taxes on the funds received are not paid or are not paid in full.

- Where to report illegal business activities Federal Tax Service

- Department of Economic Security and Anti-Corruption

- Prosecutor's Office of the Russian Federation

- Other authorities

- What evidence and documents are needed

Every concerned citizen who is of legal age and has legal capacity can complain about violations in this area.

Grounds for writing a complaint against an individual entrepreneur

There are a large number of reasons for writing a complaint against an individual entrepreneur. Most complaints against individual entrepreneurs are related to violations of consumer rights. If such a situation arises, then it is necessary to first contact the individual entrepreneur himself orally or in writing. If an individual entrepreneur decides not to respond to a complaint or deliberately delays responding, then it is necessary to contact a third-party authority to resolve this issue.

The grounds that may also serve to write a complaint against an individual entrepreneur may be the following:

- Doubts about running a legal business;

- An individual entrepreneur violates the labor code in relation to his employees;

- Failure to comply with regional laws regarding rest periods;

- Loss of personal data provided to an individual entrepreneur in the course of his activities;

- The activities of an individual entrepreneur do not comply with sanitary standards;

This list can be supplemented with many reasons for complaints. One of the important aspects is to prove that the entrepreneur is violating the law both in relation to the consumer and in relation to the state.

BOOK OF NOTES

A universal means of complaining about poor-quality services provided or incorrect operation of a particular object is a book of comments and suggestions. According to the law, organizations and all their branches and representative offices, as well as individual entrepreneurs, must have a “complaint book”. This list includes most retail facilities, public catering facilities, with the exception of seasonal cafes, consumer services, reception centers, various stations, depots, ticket offices, educational institutions, healthcare institutions, dormitories, banks, etc. The organization must have a person who is responsible for maintaining and storing the book.

News on the topic Mogilev resident sued the store for 8 kopecks for buns in paid packages

According to clause 2 of the Resolution of the Council of Ministers “On some issues of organizing work with the book of comments and suggestions,” the book of comments and suggestions must be provided upon request. In this case, the administration of the facility is prohibited from requiring the citizen to present identification documents or explain the reasons that necessitated the need to make a comment and (or) suggestion.

Any entry in it is equivalent to a written request. This means that there must be a documented reaction to it. Applications are reviewed within 15 days. If the case requires additional verification, the period for its consideration may be extended to one month.

In this case, the citizen must be sent a written response to the complaint and the results of the work carried out on this matter. At the same time, in the case of an anonymous complaint, a response is not sent to the complainant. The response may not be sent in cases where the issue was resolved in the presence of the applicant, there was no complaint, proposal or information about a violation of the law in the appeal, or the applicant simply wrote a thank you.

What are you complaining about? What Belarusians are most often dissatisfied with Read more

Where to go to file a complaint against an individual entrepreneur

You can file a complaint against an individual entrepreneur at the place of actual business activity. Depending on the nature of the violation and what the consequences are, you can contact such authorities as:

- Rospotrebnadzor.

- Roskomnadzor.

- Federal Service for Labor and Employment.

- The Federal Tax Service.

- State housing inspection.

- OEBiPK (Ministry of Internal Affairs of the Russian Federation).

- Prosecutor's office and court.

Important!!! If an individual entrepreneur works without documents confirming his activities, that is, he is not registered as an individual entrepreneur, then he must immediately contact the Economic Safety and Internal Affairs Committee (Ministry of Internal Affairs of the Russian Federation) or the prosecutor's office.

Responsibilities of an individual entrepreneur to the tax authorities

An individual entrepreneur is an individual who conducts business activities in accordance with the established procedure and is registered with the Federal Tax Service. From the moment of state registration with the tax office, the individual entrepreneur has obligations regarding the timely submission of reports, payment of insurance premiums and personal income tax.

An individual entrepreneur can work independently or with employees. In the latter case, on the basis of Art. 24 of the Tax Code of the Russian Federation, entrepreneurs are required to pay personal income tax and other contributions for employees, because they are tax agents.

The full list of rights and obligations of an individual entrepreneur before the Federal Tax Service is as follows:

| Rights | Liabilities |

| Receiving free clarifications from employees of the Federal Tax Service on issues related to the payment of contributions and taxes | Timely registration with the Federal Tax Service as an individual entrepreneur |

| Receiving blank declaration forms from the Federal Tax Service and requesting instructions on how to fill them out. Instructions are usually located on information boards | Payment of fees and taxes: personal income tax, insurance pension contributions, etc. |

| Keeping secret information obtained by Federal Tax Service employees as a result of inspections | Use of cash registers or strict reporting forms if required by law |

| Using the opportunity to refund overpaid taxes and fees | Providing upon first request documents on business activities to the Federal Tax Service, incl. and books of income and expenses |

| Failure to comply with illegal demands of employees of the Federal Tax Service | Storage of accounting and tax documentation for at least 5 years even after termination of business activity |

| Appealing illegal decisions and actions of the tax service in court | Timely submission of reporting documentation to the Federal Tax Service |

Important! The obligations of an individual entrepreneur largely depend on the availability of employees and the chosen taxation system. For example, if an entrepreneur uses a PSN, he only needs to pay the cost of the patent once and use it until the expiration date. If OSNO, UTII or simplified tax system is used, the features of the systems should be taken into account: they require a larger list of reports.

Complaint against individual entrepreneur to Rospotrebnadzor

You must contact Rospotrebnadzor to file a complaint in the following cases:

- Sales by individual entrepreneurs of low-quality goods or services;

- The individual entrepreneur cheated the buyer;

- The individual entrepreneur refuses to comply with the rules of guaranteed service, etc.

What needs to be done in order to contact Rospotrebnadzor;

- Send the complaint through the post office to the territorial division of Rospotrebnadzor with a notification, which will serve as confirmation of sending the complaint. It is advisable to attach additional materials to the complaint that will confirm the fact of the information presented in the complaint;

- Call the Rospotrebnadzor hotline and explain the essence of the current situation;

- Submit a complaint through the online form on the website ru/petition/, only to do this you need to log in through authorization in the ESIA. And this can serve as an unscheduled audit of the activities of an individual entrepreneur. When filing an online complaint, the consumer can also submit additional materials to Rospotrebnadzor that will serve as evidence of a violation, only for this it is necessary to attach the corresponding electronic files.

Complaint against individual entrepreneur to Roskomnadzor

If an individual entrepreneur has violated consumer rights in the field of personal data, then it is necessary to file a complaint with Roskomnadzor. Roskomnadzor is a state regulatory body that must conduct an appropriate inspection and take the necessary measures. This is meant when the individual entrepreneur leaked personal data or used it for other purposes. In this case, you can send a complaint to Roskomnadzor in one of the following ways:

- Send a complaint through the post office. The complaint must indicate which norms of the law were violated and in what form they were expressed;

- Through the “Generate an appeal” option on the official website of the Department rkn.gov.ru/treatments/ask-question/. You must select “Personal Data Processing” as the topic.

What to do if you find out about the illegal activities of an individual entrepreneur?

Any business in Russia must be conducted legally. Even now, some entrepreneurs manage to break the law:

- work without registration with the Federal Tax Service, for example, an application has been submitted to the tax authority, but a notification of registration has not been received;

- there are no licenses for work or services that are carried out only with permits, for example, for conducting educational or medical activities;

- concealing actual income, for example, receiving regular income from hairdressing services at home.

Read more: How sick leave is paid for with a child in hospital

In the above cases, you can complain to:

You can send a message to the tax authority in one of the following ways:

- personally;

- by registered mail;

- on the official website of the Federal Tax Service.

The complaint is made in any form; there is no standard form.

Some citizens want to remain incognito and try to file a complaint anonymously. Such requests are not considered by tax authorities. If you want the entrepreneur to be punished, be sure to provide all the necessary information about yourself.

Complaint against an individual entrepreneur to the Federal Service for Labor and Employment

If an entrepreneur has violated labor safety standards, then there is every reason to contact the Federal Service for Labor and Employment. It could be:

- Hiring employees without official employment;

- does not comply with the norms of the Labor Code of the Russian Federation regarding the provision of sick leave, rest days, vacations, etc. to employees;

- the entrepreneur enters into a civil contract with the employee, instead of concluding an employment contract as required by the Labor Code of the Russian Federation, etc.

There are several ways to contact the Federal Service for Labor and Employment:

- come for a personal appointment with a specialist of this Service on the days when citizens are received. It can be viewed on the official website of the Service, without prior registration. In personal communication, a citizen can submit a complaint against an individual entrepreneur in writing, where it is necessary to indicate which norms of the Labor Code were violated;

- Send a complaint by e-mail to the Internet mailbox, where you can also attach additional materials that confirm the violation of the Labor Code;

- Send a letter via Russian Post;

- Via the online form rostrud.ru/room/obrashcheniya-grazhdan/kremlin/. It is also possible to attach additional materials electronically.

Complaint against individual entrepreneurs to the Federal Tax Service

If an employee’s rights in relation to the labor code are violated, then it is recommended to contact the Federal Tax Service. If an employee works illegally, this is accompanied by lower tax contributions to the budget.

Let's present how you can file a complaint against an individual entrepreneur with the Federal Tax Service in the form of a table:

| Ways to file a complaint | Description of actions |

| Send a letter by Russian post | The letter is drawn up in the appropriate format and must be accompanied by the necessary materials. |

| Sending a complaint by fax | It is necessary to check the telephone number of the local tax office and send the complaint by fax |

| Personal appeal | To communicate personally with a Service specialist, you must first make an appointment. This can be done either by phone or online. All contact information can be found on the Service website. |

| Online appeal on the website | When applying, it is mandatory to indicate the applicant’s personal data, state the essence of the problem and contact information for feedback. It is recommended to attach additional material. |

Where to file a claim for an individual entrepreneur

The application must be submitted in the region where the entrepreneur operates. Depending on the conditions, the type of damage caused and the type of activity of the company, it is worth choosing the most suitable authority. You are allowed to submit an application to several offices at once.

To Rospotrebnadzor

A claim to Rospotrebnadzor is filed in the case where an entrepreneur has violated consumer rights through his actions. These include:

- sale of poor quality product;

- financial fraud of the client;

- refusal of warranty service.

There are four main ways to file a claim:

- Personal appeal to the authorized body at the place of residence. Each region has a territorial unit of authority. It is also possible to contact the central office.

- Sending a letter by mail. In order for it to be accepted, it is important to follow the document writing template and indicate all the necessary circumstances of the case. The addressee will be the Moscow Department of Rospotrebnadzor. When specifying the destination, the following data is written: Vadkovsky Lane, building 18, buildings 5 and 7, Moscow.

- Phone call. When communicating with an employee, you will need to clearly and thoroughly describe the problem and be prepared to provide personal information. Anonymous requests are rarely considered. Contact phone: 8(495)7853741.

- Filing a complaint online. To do this, you need to use the portal rospotrebnadzor.ru. The advantage of the method is a quick response from employees and the ability to attach evidence.

- photos and videos;

- copies of checks or other documents.

To Roskomnadzor

Roskomnadzor considers situations where a person’s personal rights regarding the confidentiality of personal data have been violated. The most common cases include:

- illegal obtaining of a person’s personal data;

- leak of personal information;

- misuse of information about a citizen.

The main ways to contact the authority are:

- a claim sent by mail;

- online application on the department’s website - in both options it is required to indicate not only the essence of the complaint, but also the standard under which the offense was committed.

Read more: Do pensioners have to pay property taxes?

Methods of contact:

- The letter is sent to the address: Moscow, Kitaigorodsky proezd, building 7, building 2.

- To generate an electronic appeal, you need to go to the website and select the category related to personal data.

To the Federal Service for Labor and Employment

The Federal Service for Labor and Employment regulates issues related to the employment of employees, as well as working conditions and compliance with the Labor Code of the Russian Federation. Contacting this authority is permissible in cases where:

- the entrepreneur does not provide official employment;

- instead of employment contracts with employees, civil law ones are concluded;

- working conditions and safety precautions at the enterprise do not meet standards and norms.

There are several options for contacting the labor inspectorate:

- Personal visit to a specialist. This can only be done in Moscow, at Myasnitskaya street, building 40, building 16. Visiting hours are limited and appointments are by appointment only five days prior to your visit.

- Sending an application by mail. The letter is sent to the same address where the personal reception takes place.

- Email. When forming such an appeal, it is important to indicate the circumstances of the violation and attach documents confirming it. Email address: [email protected] .

- Using an online platform. This method will not only allow you to attach materials, but also provoke an inspection of the enterprise.

To the tax office

In case of violation of the labor code, an additional application to the Federal Tax Service is recommended. If a person works illegally, this is accompanied by smaller contributions to the state budget.

Read the article about the procedure for filing a complaint against a judge.

In order to write a complaint against an individual entrepreneur to the tax service, you can use the following methods:

- By Russian Post. The letter must be of the established format and accompanied by materials. It is permissible to send an application both to the central office and to the territorial units of the department.

- By fax. Although this method is becoming a thing of the past, it can still be used by checking your local branch number.

- Personal reception. Since these issues are considered by management, a recording is required. This can be done either online or by phone. Contacts in this case can be found on the page of the territorial authority.

- Online appeal on the website. When forming, it is necessary to indicate the applicant’s personal data, the essence of the complaint and contact information for feedback. It is permitted and recommended to supplement the application with materials.

The website nalog.ru clarifies information regarding the contacts of inspections, the schedule for receiving citizens, as well as the timing of consideration of the application.

To the housing inspection

The city housing inspection will consider a citizen’s complaint against an individual entrepreneur if:

- his actions cause inconvenience to people living near the enterprise;

- evades paying utility bills.

You can write a claim only to the territorial unit of the department, whose jurisdiction includes control over the area where the business is located. When filing a complaint you can use:

- Russian Post;

- website of the regional executive power;

- physical branch of the service.

In order to obtain specific contact information, you need to go to the official website of the subject and select the required section with information.

If there is evidence, the entrepreneur is brought to administrative responsibility. If he violated the rights of a particular citizen, then it is worth filing a claim in court demanding compensation for damage.

In the Ministry of Internal Affairs

The Department of Economic Security and Anti-Corruption under the Ministry of Internal Affairs of the Russian Federation considers applications from citizens if there are suspicions of illegal activities on the part of an individual entrepreneur.

The main types of crimes include:

- illegal activities;

- committing an economic offense;

- obtaining income from crime.

Due to the fact that these offenses are serious in nature, the appeal should be submitted to the Main Directorate. The application methods are as follows:

- Written appeal by mail. The application must be accompanied by evidence and a description of it. Address: Moscow, Novoryazanskaya street, building 8a, building 3.

- Online request on the website with the choice of department. In addition to formulating the violation and circumstances, it is important to describe in detail the location of the IP and the ways of its detection.

Depending on the situation, the applicant may be invited to a personal meeting with a staff member to clarify the details. In this regard, it is necessary to indicate personal contacts for feedback.

To the prosecutor's office and court

If the offense provides for administrative or criminal liability, it is recommended to contact the prosecutor's office. When drawing up a statement, it is important to be guided only by facts and reflect information without emotion.

The appeal is submitted to the territorial department of the prosecutor's office at the place of activity of the individual entrepreneur. Contact details of all structural units are presented on the website.

Contacting the Housing Inspectorate

The city housing inspection considers complaints from citizens against individual entrepreneurs in such cases as:

- Business activity causes inconvenience to people who live near the activity;

- The individual entrepreneur does not pay utilities.

There are several ways to submit an appeal to the housing inspectorate, namely:

- Send a letter via Russian Post;

- Write a letter to the housing inspection e-mail;

- Submit a complaint in person to the housing inspectorate;

- Send a complaint through the website of the regional executive authority.

If there is evidence, then the entrepreneur is brought to administrative responsibility. If the rights of a particular citizen are violated, then it is necessary to file a claim in court to compensate for the damage.

Appeal to the Ministry of Internal Affairs of the Russian Federation

If it becomes known that an individual entrepreneur is operating illegally, then you need to contact the Ministry of Internal Affairs of the Russian Federation.

The main types of crime include:

- Illegal conduct of activities;

- committing an economic offense;

- obtaining income from crime.

Since this violation is serious, you must contact the Main Directorate. The standard method for filing a complaint is:

- Sending a letter by Russian post. Evidence and an inventory must be attached to the letter;

- Online request on the website with the choice of department. In this appeal, it is important to describe the location of the IP and the ways of its detection;

Depending on the situation, employees of the Ministry of Internal Affairs may invite you for a personal conversation. Therefore, it is necessary to indicate contact information for feedback in your application.

Important!!! There are criminal penalties for submitting false or falsified information

Filing a complaint against an individual entrepreneur to the prosecutor's office and court

If fraudulent actions, theft or misappropriation of funds are detected on the part of an individual entrepreneur, then it is necessary to file a complaint immediately with the prosecutor’s office, since such actions lead to administrative and criminal liability.

The appeal must be sent to the territorial department of the prosecutor's office at the place of activity of the individual entrepreneur.

If the prosecutor's office refuses to initiate a criminal case, then it is necessary to file a statement of claim in the magistrate's court. The procedure for considering such a case becomes lengthy and difficult. In this case, it is recommended to hire a lawyer who will help you draw up a correct application and represent your interests in court.

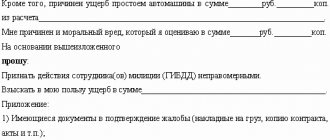

How to correctly write a complaint against an individual entrepreneur

When drawing up a complaint about the activities of an individual entrepreneur, it is necessary to proceed from violations of the legislative framework, and not from emotions. If violations are detected, it is necessary to first check the legislative framework, and only after the check can you begin to act.

What you need to consider when writing a complaint against an individual entrepreneur:

- It is first necessary to study the activities of an individual entrepreneur and compare them with the legislative framework;

- Collect documents that will act as evidence. Such documents can be: copies of checks, copies of contracts, photos, videos and other facts, it all depends on the situation;

- Select an authority to file a complaint, determine who specifically is involved in these cases, and what rights were violated;

- Get support from other victims. If several similar statements are provided, then the case will be considered faster;

- Documents must be drawn up with the requirements, especially if the complaint is filed in court or with the tax office;

Most common mistakes

Mistake #1. The employer is not required to provide salary slips.

No, salary certificates must be issued to all employees against signature on a monthly basis. They reflect the amount of money transferred, the amount of personal income tax paid and other contributions.

Mistake #2. How to prove employment to the Federal Tax Service if the complaint is filed due to refusal to draw up an employment contract, therefore the employer does not pay taxes for employees?

Any individual entrepreneur receipts that contain the signatures of the applicant can be used as evidence. Inspectors may also interview other employees to establish employment status during the inspection.