Sometimes the tax inspectorate does not fully fulfill its functions and responsibilities towards citizens. For example, she did not respond to a citizen’s written request, did not provide the information he requested, or provided a tax deduction and delayed the tax refund.

Thus, you can complain both about the actions of the tax inspectorates and about their inaction.

This article describes where and how you can file a complaint against the tax office.

Where to send a complaint to the tax office?

Filing a complaint against the work of the tax inspectorate occurs in several stages:

- Initially, a complaint is filed with the tax office at the applicant’s place of residence;

- Then you need to send a complaint to the tax office of the applicant’s region;

- And only as a last resort should the application be sent to the central office - the Federal Tax Service.

Attention

Please note that you must send your appeal to a higher tax authority through the tax authority to which the complaint is written.

If the inspection is inactive and the conflict situation is not resolved, you should contact the following authorities:

- Prosecutor's Office;

- Court.

When can you complain?

Both citizens and legal entities have a huge number of reasons to file a complaint against the tax office with the prosecutor's office. These include:

- Dissemination of personal information;

- Transfer of documents to third parties without the written consent of the owner;

- Wrongful or erroneous tax decisions;

- Significant errors in work that cause damage to citizens and violate their interests;

- Illegal actions by tax authorities;

- Fraud or other similar activities;

- Refusal of the tax administration to agree to a peaceful resolution of the conflict.

Info

As you can see, every person has the opportunity to file a complaint against the tax prosecutor’s office, but only if the conflict arose due to a violation of the applicant’s civil rights. This means that you can only complain about crimes - the prosecutor’s office will not accept complaints about poor service and similar minor shortcomings.

How to file a complaint with the tax office?

Where can I complain if my rent is charged incorrectly?

How to complain about Euroset?

How to complain about poor heating in an apartment?

Where to complain about doctors?

How to write a complaint against a bus driver in Moscow?

Where to complain about Tele2?

A complaint to the tax authority can be submitted as follows:

- By online contact;

- By submitting your application in person. It is important here that the applicant has 2 copies of the application. The first copy remains with the tax office, and on the second copy the inspector must put his signature and date of acceptance;

- By sending a registered letter. Before sending a letter, you must ask the postal employee to draw up an inventory of the attachment in 2 copies. The first is sent to the inspection along with the letter, and the second is certified by the postal worker and remains with the applicant. It is also necessary to order the delivery notification service.

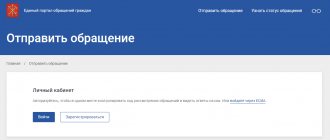

How to file a complaint with the tax office online?

The tax service has an official website through which a registered user can submit an online application.

Attention

To register on the Federal Tax Service website, you need to contact the nearest tax office with your passport, after which the applicant will be given a registration card with information to log into the site.

After the user has registered on the Federal Tax Service website, he can send a complaint. To do this you need:

- On the main page of the site, go to the “Individuals” tab;

- Next, the system transfers the user to a page with a list of services provided, among which you need to select “Filing a complaint to the tax authorities”;

- On the next page the user must select one of four proposed situations. In order to file a complaint, you must select “I want to file a complaint against the actions/inaction of the tax authorities”;

- On the newly opened page, the user can familiarize himself with the information provided. For example, about how a complaint is filed. After studying the information, the user is asked to act according to further instructions.

Complaint form

An electronic complaint against the Federal Tax Service (a sample form can be found below) can be submitted:

- according to TKS;

- through the taxpayer’s “Personal Account”.

The document must be drawn up in a form approved by the Federal Tax Service of Russia. Based on this, the higher authority must make an appropriate decision. Certification of the document with an enhanced electronic signature is required.

A complaint against the actions of the Federal Tax Service is drawn up according to the unified form given in Appendix No. 1 to the Order of the Federal Tax Service of Russia No. ММВ-7-9 / [email protected] , and Appendix No. 5 shows the procedure for filling it out.

The document consists of two pages, it states:

- the name of the superior department in relation to the Federal Tax Service, against which the complaint is being written;

- information about the organization or individual entrepreneur whose rights were violated (TIN/KPP, full name/full name, address);

- subject of appeal (indicate one of the codes given in the form);

- details of the document being appealed (number and date of the document being appealed by the Federal Tax Service);

- the name and code of the department of the Federal Tax Service whose employees violated the applicant’s rights;

- the grounds on which the applicant believes that his rights have been violated (the taxpayer’s arguments and the circumstances on which they are based);

- requirements for the tax authority (you must indicate what decision, in the applicant’s opinion, should be made by a higher authority);

- method of obtaining a decision on the complaint (by mail on paper, electronically through your personal account, via TKS);

- complaint code (simple or appeal);

- details of the power of attorney (if the complaint to the Federal Tax Service is submitted by an authorized representative);

- FULL NAME. head of the organization;

- date of registration and signature of the complainant.

The complaint must be certified by the taxpayer's enhanced, qualified signature. The fields reserved for the taxpayer’s grounds and requirements can contain up to 2000 characters, therefore, if the amount of information is larger, it is presented briefly in these fields, and the full text of the circumstances and requirements can be submitted as an attachment to the complaint, by scanning the text and attaching it as a separate file.

Complaint against the tax office to the prosecutor's office

A complaint against the tax service should be sent to the prosecutor's office only in cases where the rights of the taxpayer have been grossly violated.

You must contact the prosecutor's office at the location of the Federal Tax Service. You can draw up an application on paper and take it to the prosecutor’s office in person, or you can send an electronic appeal. For this:

- In the online reception of the Prosecutor General's Office, the applicant must select his region in the drop-down menu “Prosecutor's Offices in the constituent entities of the Russian Federation”;

- After this, the system transfers the user to the Internet reception of the prosecutor’s office of his region. There the user needs to study the information offered, after which he needs to click the “Agree” button;

- Then the applicant is asked to fill out a form where it is necessary to enter the requested data in the corresponding empty fields: Full name;

- Address;

- Email;

- Telephone;

- Area;

- To whom is the appeal addressed;

- Text of the appeal;

Procedure for filing a complaint

The appeal is considered accepted if the taxpayer receives an acceptance receipt within one business day. If a refusal to accept an electronic document is received, the sending procedure must be repeated after eliminating the errors specified in the notification. Within 3 working days, the complaint must be transferred by the inspectorate to a higher tax authority.

The verification of a complaint against the Federal Tax Service by a higher authority is carried out within 15 days or within one month from the date of its receipt (depending on the type of complaint - clause 6 of Article 140 of the Tax Code of the Russian Federation).

After receiving a decision from a higher body of the Federal Tax Service, the inspectorate to which the complaint was filed informs the taxpayer electronically within one business day of the decision made on the complaint. In response, the tax authorities must receive from the taxpayer a confirmation of acceptance, signed by the UKEP - 1 business day is allotted for this.

A taxpayer has the right to write a complaint if he believes that his rights have been violated, incl. in the following cases:

- receiving claims for payment of taxes or fines that are not true;

- suspension of transactions on the current account;

- refusal to offset tax overpayments;

- appealing decisions of tax audits (office and field);

- refusal of tax deduction;

- complaint about inaction of the Federal Tax Service, etc.

Going to court

Citizens can appeal to the arbitration court if they believe that the decisions or actions of the tax authorities:

- Their rights and interests in the field of entrepreneurship and other economic activities are not respected;

- It is illegal to impose obligations on them;

- They create other obstacles.

Info

The applicant may go to court no later than 3 months from the moment he became aware of the violation of his rights by the tax service. If the deadline for filing an application was missed for a good reason, the court has the right to reinstate it.

If the decision of the arbitration court does not satisfy the applicant, he has the right to appeal this decision in the court of appeal, and then in cassation proceedings carried out by the supreme (cassation) court.

Complaint consideration period

An appeal sent to the tax office is registered within 3 days, after which it is considered within 30 calendar days.

In some cases, the review time may be extended by another 30 days, but no more. The official notifies the applicant in advance of the extension.

The prosecutor's office reviews appeals and makes decisions on them within 30 days.

The judge alone considers cases challenging the illegal actions of the tax service and makes a decision within 3 months from the date of receipt of the application. This period can be extended by the judge on the basis of a reasoned statement up to 6 months.

Complaint to the Federal Tax Service against the organization

Expert opinion

Grigoriev Egor Kirillovich

Legal consultant with 7 years of experience. Specializes in criminal law. More than 3 years of experience in protecting legal interests.

Anyone who has identified violations has the opportunity to file a complaint against a specific organization with the tax authorities. True, the procedure for challenging differs from that provided for by the Tax Code (in Chapters 19, 20), since the claim was caused by the actions of the organization, and not the tax collectors.

The situation is regulated by Federal Law No. 59 dated May 2, 2006. Its Art. 7 establishes the requirements for such treatment, Art. 10 speaks of its consideration, and Art. 12 - about the timing of this procedure. The total period for consideration of such a petition is 30 days from the date of its registration. After consideration, the applicant will receive a written response.

According to Art. 1 and 2 of the Federal Law dated May 2, 2006 No. 59, anyone dissatisfied with the problem that has arisen in their organization can file a claim under the regime of this Federal Law. For example, reasons such as:

- the so-called salary in envelopes;

- tax evasion, etc.

When writing, the person complaining must be indicated (full name plus place of residence), the exact name of the Federal Tax Service where the document is being submitted. It is also possible to indicate a specific official. Then the postal address is noted where the response based on the results of the analysis will be sent. The next required element is an inventory of the essence of the situation: a description of the violation and the final request. The document ends with the date and signature of the applicant. The complaint must be accompanied by evidence of the violation described. If the employer has the evidence and the employee does not have access to it, this must be reflected in the text

The claim is drawn up in two copies, since after registration by the office of the department, the tax office will keep one, and the second will remain with the applicant. It must bear a mark from the inspectorate employee about acceptance of the document, his signature and date. All materials are submitted by appearing in person at the Federal Tax Service or by mail (by registered mail with notification). In the latter case, the application is registered within three days after receipt. A registered complaint is analyzed for 30 days; if necessary, this period is extended by another 30 days, after which the author of the document receives a response.

This is important to know: Appealing a decision to terminate enforcement proceedings