Low-income families are a category of citizens whose total income per family per month should be less than the minimum subsistence level fixed in the district of residence.

These groups of people may qualify for state and municipal support in the form of material benefits and preferential benefits.

The main goal of this assistance is to ensure a decent standard of living for citizens in need. State support is provided after submitting an application to the Social Security Administration at your place of residence.

The legislative framework

All questions regarding the criteria by which citizens recognize themselves as low-income, the procedure for registration and calculation of benefits are determined in the current regulatory federal documents.

These are:

- Federal Law No. 134 of October 24, 1997 “On the living wage in the Russian Federation”;

- Federal Law No. 178 of July 17, 1999 “On State Social Assistance”;

- Federal Law No. 44 of March 5, 2003 “On the procedure for recording income and calculating the average per capita income of a family for recognizing it as low-income and providing state social assistance”;

- State regulatory orders;

- Local legislative documents established at the level of individual regions of the Russian Federation.

Subsidies for low-income families

Low-income families are entitled to receive subsidies:

- for payment of living quarters;

- for housing and communal services payments.

They are provided if a family (or a single citizen living alone) is forced to spend more than 22% of the total family income for these purposes. Regions are allowed to set a lower bar. For example, in St. Petersburg, according to the standards established in the city, the right to a subsidy arises as early as 14 percent of a family’s expenses on housing and utilities, and in the wealthy capital it is provided at 10 percent of rent expenses.

For low-income families, the maximum permissible value is reduced even more - by the ratio of the average per capita income to the regional subsistence level (subsistence level).

Those who expect to receive a subsidy must submit an appropriate application and also confirm their right to it with an impressive set of documents. It includes:

- Russian passports of all household members - over 14 years of age;

- children's certificates - minor family members;

- PF insurance certificate - SNILS (subsidy applicant);

- marriage certificate, if the citizen is in an official relationship with one of the family members;

- divorce certificate if the marriage was terminated;

- registry office certificate of adoption of a child (if adopted children live in the family);

- Form No. 9 - indicating all family members living in the residential premises;

- certificates about the amount of income of family members - for the last six months (scholarships, salaries, unemployment benefits, pensions and other cash payments received by household members);

- documents confirming their special status (pension certificate - for old-age pensioners; “pink certificate” of disability - for disabled people, etc.);

- photocopies of work records for all non-working family members;

- documentary evidence that the family is low-income (if such status has been established for it);

- a social rental agreement for housing or a certificate that it is owned by the applicant;

- invoices - indicating the amount of rent for housing (usually asked for the last 6 months);

- a certificate confirming that the family has no rent arrears;

- details of a bank account or bank card - where to transfer the money (this information is also indicated in the submitted application).

This list, despite its scale, is not final. Many additional documents have to be provided if there are various situations in the family of the applicant for the subsidy. In particular, if one of the citizens registered in the apartment temporarily left, it is necessary to document the reason for such departure (placement in a hospice, military service, imprisonment, etc.).

For payment of “housing” subsidies, people usually turn to the local administration - the Housing Committee or another body with similar functions. The applicant also has the right to bring all documents to the nearest multifunctional center, whose employees themselves will transfer them to the government department.

Having examined the documents, officials are obliged to:

- within 10 days - give a positive response to the citizen’s application;

- within 5 days - notify the submitter of the refusal of his request (the notice states the reason for the refusal).

The subsidy is provided for six months; after this period, officials must again certify that the family has retained the right to it.

Which family is considered low-income?

To accurately determine the right to privileges, you will need to calculate the average profit for each family member. It is on the basis of this condition that a family is given the title “low-income.”

In addition, it is necessary to understand that the concept of “family” includes a group of citizens living in the same living space and leading a common life. In most cases, family ties are noted between such persons, but they may not be present.

According to current legislative documents, the following citizens can constitute a low-income family:

- Husband and wife;

- Child;

- Children who were adopted and their immediate adoptive parents;

- Grandmother and grandfather;

- Not relatives, but legitimate: sons, daughters, mothers and fathers;

- Trustees and their direct wards.

The priority right to be awarded the title of low-income people is given to a family that has an incapacitated person, three or more children, or a child raised by a single parent.

Recognition of such social units by low-income citizens is carried out outside the general procedure.

State legislation does not provide for the right to grant the title of low-income family to citizens living in a civil marriage. Also, officially registered spouses living separately of their own free will will not be able to obtain preferential status.

In addition, the assignment of low-income family status is carried out exclusively for people who are in a difficult situation due to circumstances independent of their actions.

Able-bodied citizens will not be able to apply for social assistance in the following situations:

- Family members do not work of their own free will;

- Citizens have alcohol or drug addiction.

Details on each individual situation can be clarified with employees of the local Social Security Administration.

Payments for low-income families in 2020

Before moving on to the main topic of conversation, it is necessary to understand which families are considered to be low-income. There are several variations of low-income families. Now we will talk about those who were conditionally called poor.

Please note that there are quite a few such families in the Russian Federation. And this term does not mean at all that members of a given family cannot provide for themselves. The government decided to call them that only to make it more convenient to assign increased payments. That is, we can confidently say that low-income families in this case are statistically average. So what benefits will be given to such a large number of Russian families?

Everyone probably already knows that the government is currently concerned about the birth rate problem. As far as we know, in the last few years alone, the birth rate has fallen by almost ten percent.

This means that parents simply cannot support their children, so they do not dare to have them. And in order to eliminate this problem, the authorities decided to support the people by paying them small amounts of money. One of these laws is a document signed long ago obliging all employers to provide girls with maternity leave in case of pregnancy. Why did we note this particular law and not any other? Yes, all because on January 1, 2020, an amendment was made that allows not only the mother, but also the father to go on parental leave. But now we will not go deeper into this topic and will continue the conversation about how much the government worries about its people.

So, if we are talking about the payments that some families are entitled to, it is worth spending a little time talking about what the cost of living is and how it affects this whole situation. PM is an economic statistical indicator with the help of which analysts and statisticians can form regional and federal budgets. In other words, this is the amount that an individual citizen of the Russian Federation needs to provide himself with a minimum supply of food products and satisfy basic needs. Thanks to this indicator, you can understand whether you are entitled to increased payments for the birth of your first child or not. How to do it? First, you need to collect several particularly important documents:

- You must have a piece of paper in your hands indicating your official salary for the last two years.

- Your significant other should have the same piece of paper.

- You need to know the cost of living for children in your region.

Once you have all the necessary information, you need to find out the cost of living for the working population. And if the value of your wages together with the child’s monthly salary does not exceed 1.5 times the subsistence minimum, then your family will be conditionally considered poor.

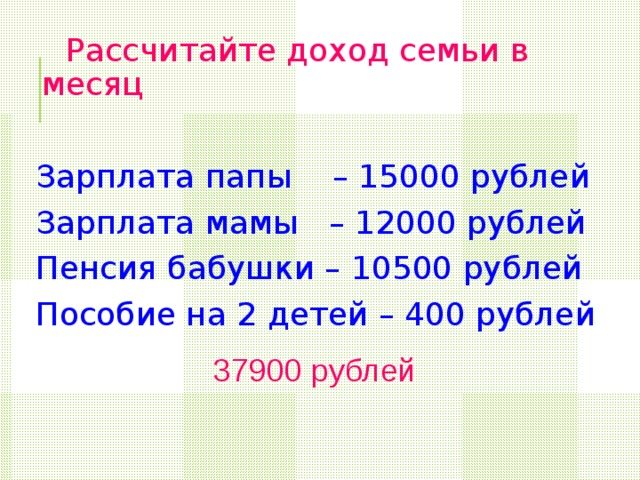

With what income can you be considered low-income?

This question worries every person who wants to apply for benefits under this status. This indicator is calculated on the basis of an official profit statement for the previous three months for each family member.

The total profit is divided by the number of all close relatives living together.

If the final value is less than the subsistence minimum established in the region, then the family is assigned low income and appropriate benefits are assigned.

When calculating the income indicators of candidates for state assistance, only officially registered sources of income are taken into account.

These are:

- Official salary;

- Profit from property transactions;

- Social benefits;

- Alimony payments;

- Dividends;

- Profit from your own subsidiary plot;

- Author's awards;

- Vacation pay.

To recognize a family as low-income, each of its able-bodied citizens must be an adult and working under a concluded employment contract.

To calculate the possibility of receiving state benefits, you will need to find out the cost of living established in your district of residence. This information can be clarified with the local administrative authority.

As an example, below are these indicators for individual regions of Russia:

- Moscow – 15,477 rubles;

- St. Petersburg – 10,606 rubles;

- Perm region – 9,619 rubles;

- Samara region – 9,734 rubles;

- Bryansk district - 9,244 rubles;

- Kemerovo district - 9,019 rubles.

These indicators are different for each region and are calculated by local legislative bodies based on the cost of the minimum consumer basket.

To calculate the possibility of receiving a state benefit, you will need to find out the cost of living established in your district of residence.

A package of documents for a low-income family for submission to the SZN

To assign the name of the poor you will need:

- certificate of family composition (F9);

- identification papers of those listed in the family composition certificate and their family connections: passports, marriage, birth, divorce certificates, guardianship documents;

- cash receipts for the last three months: 2-NDFL from individuals, 3-NDFL from legal entities, certificates of maternity benefits, scholarships, and so on;

- copies of work books, and for the unemployed - a certificate either from the employment service or about incapacity;

- information from the Unified State Register for each person about what property is registered on it;

- the applicant’s TIN and bank account details;

- application for status.

Where can I get all the necessary certificates to register?

Information is received by:

- in the management company;

- in workplace accounting;

- lost and missing documents will be re-issued by the registry office and passport office;

- in the dean's office of a secondary school or university;

- from the head of the kindergarten;

- at the school clearinghouse;

- in Rosreestr.

Many papers, in addition to job information, can be requested through the MFC.

Calculation of average earnings

Citizens can become a family receiving government assistance only if the local cost of living is taken into account.

The family consists of four people: a spouse and two children (fourteen and two years old). Income calculations will be taken into account only for able-bodied citizens.

The total profit for the three-month period was:

- 43,000 rubles – mother’s salary;

- 51,000 rubles – father’s official salary;

- 2,000 rubles – child benefit.

The total amount of officially registered profits was:

Next, calculate the average monthly income level for this period:

After this, the average income for each family member is calculated.

To do this, the average monthly profit is divided by the number of family members:

This is the final count.

The cost of living in the capital is:

- For able-bodied citizens – 17,560 rubles;

- For children – 13,300 rubles.

This means that a family can rightfully apply for the status of a low-income family, with all benefits, material benefits and subsidies.

Fighting poverty and tips for the future

Having learned about what benefits the federal authorities are providing to low-income families in 2020, you can finish the article. But finally, I would like to remind every resident of the country that everything depends only on ourselves. Remember, our dear readers, if something doesn’t work out for you, don’t give up right away! To survive in the modern world you need to move and be stronger than many! And, of course, don’t forget about your children, because they are your future and only thanks to you can a baby turn into a person who will turn the world upside down. Good luck in all your endeavors!

How to get status?

A citizen can be considered in need only after he has gone through the official registration process at the nearest Social Security Administration.

To do this, you will need to provide a certain list of documentation.

The main list of papers requested by a government agency is:

- A completed application requesting the assignment of preferential status;

- A passport for each family member, and for children - a birth certificate;

- Certificate of income for a three-month period;

- Statement of family composition;

- A document from the Employment Center on registration - for citizens who have lost their jobs but are on the waiting list;

- For working persons – work book;

- Marriage certificate;

- Statement confirming the opening of the bank account into which the benefits will be received.

The application review period is fourteen days . During this period of time, employees of the government agency check the accuracy of the documents provided.

If all documents are true, the family receives benefits in a bank account, as well as the right to preferential benefits.

A negative response to a request can only be provided when inaccurate data is discovered during document verification. Also, a refusal will be issued if the family has more than one living space, or the value of all real estate exceeds the norm.

If the answer is positive, a certificate of low income is issued from social security.

It is this document that confirms the current status of a low-income family.

Documentation

To submit an application, you need to know what documents are needed to recognize a low-income family. A complete list of documents can always be found on the website of the local municipality, or by calling social security or the MFC.

Social security telephone numbers are different in each region, but the MFC has a general telephone number 8800 for inquiries. By calling it, you can get the necessary information from specialists, specifying your region.

To apply for registration of low-income family status, you must fill out an application and attach the established list of documents to it.

These include:

- All passports of family members, and in their absence, certificates confirming birth. In addition to the originals, you must make photocopies of all pages.

- If a marriage was concluded, then it is necessary to submit documents confirming this civil status record. Copies of these documents are also required.

- If the marriage was subsequently dissolved, documentary evidence of this fact is also required with a copy of the document.

- If the spouse has died or is considered missing, then a corresponding certificate or court decision must be provided. Also be sure to make a copy.

- Certificates confirming income for the last 3 months. Served in original.

- Documents confirming the size of the family. This can be an extract from the house register if the family lives in an apartment building, or a certified copy of the house register for residents of private houses. A certificate from the housing cooperative or their migration department of the Ministry of Internal Affairs about the registration of citizens at one address can also be attached. These papers are submitted in original.

- A photocopy of the work book confirming the fact of employment, or a certificate from the employment center stating that the citizen is or is not registered with this government agency. The certificate must be submitted in the original, and a copy of the work book must be certified by the signature and seal of the employer with a record that the citizen is currently employed.

- Copies of documents confirming the right of this family to reside at the address indicated by them. These may be title documents for real estate, or a lease agreement, or other circumstances that allow the family to live in a given territory legally.

- An extract from the Unified State Register confirming the presence of taxable property, indicating its value and quantity. This document must be submitted in original. You can get it from Rosreestr, MFC, or using the State Services website.

- If there are disabled people in the family, then it is necessary to submit a medical report from a special commission, which indicates the established disability group. A copy of this report will be required.

- Details of the bank account to which funds will be transferred.

- In some cases, a TIN and SNILS may be required, although these documents are not required in the federal list.

It is important to make copies of all originals, and having the documents themselves with you is also mandatory. The employee receiving the application and the entire list of documents is obliged to verify the data and verify its authenticity.

It is also important to know what documents may be required to verify family income. First of all, they should all reflect information for the last 3 months.

You will need the following list of documents:

- if the income is wages, then the certificate must be issued by the accounting department for the specified period in form 2-NDFL;

- if a citizen is not officially employed, but works under an unregistered employment contract, then he must be issued a certificate from the employer in free form indicating his income for the specified period;

- if a citizen is a recipient of pension payments, then he must issue this certificate to the Pension Fund of Russia;

- if the student is a recipient of a scholarship, then he must issue such a certificate at the place of study in the accounting department;

- if a citizen receives certain social payments and benefits, then a certificate is issued by the social authorities where they were issued;

- if a citizen is an individual entrepreneur or a person engaged in private practice, then he must provide a completed declaration form 3-NDFL;

- if someone is a recipient of alimony payments, then he can take this certificate from the person who actually makes such deductions (this could be a bailiff, the payer’s employer);

- if alimony payments are made on the basis of a signed agreement, then a copy and the original are presented (and such an agreement must be notarized).

The established package of documents along with the application can be submitted in person or through a representative.

In this case, he will need to issue a notarized power of attorney, granting the right to represent the interests of the entire family in specific authorities.

One person can also be considered as a low-income family if he is single and his income is less than the subsistence level.

To submit an application, he must provide the same package of documents, with the exception of those that do not concern him.

Statement

One of the most difficult stages after collecting documents is drawing up an application. It is filled out according to the usual rules of a business letter.

But not all citizens know them. To complete the application, a ready-made form is issued, which facilitates the procedure for filling it out.

The writing algorithm will be as follows:

- The name of the local social security authority to which this petition is sent is indicated.

- Next, enter personal information about yourself, including full name, passport and registration information; you also need to indicate your actual residential address and contact telephone number.

- The name of the application is usually printed on the completed form.

- After this, the essence of the statement is indicated that this family in a certain composition has an average income of a certain amount for the last 3 months, which is below the subsistence level. All family members and their income are listed.

- Based on the specified data, a request is made for granting the status of a low-income family.

- A list of attached papers is listed.

- The date and signature of the applicant are placed.

This document is completed in this order.

If you encounter any difficulties in compiling it, you can always contact the employees of the MFC or social protection with your question.

Therefore, it is better to fill out this application in their presence.

Errors and corrections should not be allowed. If they were admitted randomly, you will need to request a new form.

What assistance is provided?

According to current legislation, needy citizens with low incomes receive material benefits, social benefits and assistance in kind. The final list of privileges is determined at the level of individual regions.

However, some types of assistance are determined at the federal level. These will be discussed in the sections below.

Cash benefits

The widest range of assistance for low-income families is the provision of financial assistance from the state free of charge.

These are:

- Up to seven hundred rubles – when registering with the state before the twelfth week of pregnancy;

- About 2,500 rubles (depending on the region) - a one-time payment for the birth of a child;

- Up to three hundred rubles – monthly child benefit, which depends on the composition of the family;

- Six thousand rubles under the “Mom’s Choice” program - money is paid to mothers if there is a shortage of places in kindergarten, which requires raising a child at home;

- Five thousand rubles is a one-time payment to first-graders to purchase school supplies.

Individual regions may establish their own additional types of financial assistance by decision of municipal authorities.

Preferential benefits

The main part of government assistance consists of benefits that low-income families can use.

These are:

- Free food for children in school canteens;

- Free travel on public transport;

- Payments necessary for the purchase of essential goods;

- One-time cash payments for the targeted needs of the child;

- Preferential provision of medications with a doctor’s prescription;

- Reimbursement of funds for vouchers to sanatorium-resort institutions for the purpose of treatment or recovery.

Subsidization

With this type of government assistance, the main benefit for low-income families is a partial reduction in tariff rates for utility bills. This subsidy is provided if the amount for housing and communal services exceeds more than twenty-two percent of the total family income.

To do this, you will need to submit a certain list of documents to social security. Employees of the government agency check the accuracy of the documents provided, and if they correspond to reality, a positive answer is given.

All of the above benefits are not exhaustive and may be supplemented or reduced, depending on the county of residence.

Types of assistance to low-income families

What types of assistance can a low-income family receive?

The state purposefully allocates funds to support citizens in need to fulfill the following conditions:

- reducing the degree of social differentiation of population strata;

- use of state budget funds at the address, that is, for a specific purpose;

- increasing the income of the population in need, and thereby increasing their level of security and life in general;

- ensuring accessibility and high quality of social services provided by the state.

The monetary expression of state assistance to low-income families is various benefits and subsidies. These include:

- Subsidy for the child’s attendance at kindergarten (for the first child - 20% of the parent’s average salary, for the second - 50%, for the third and all subsequent ones - 70%).

- State financial assistance provided on a one-time basis in order to provide support to families who have suffered property and other losses.

- Social supplements to pensions (assigned to low-income pensioners).

- State social scholarship for students who are members of needy families.

- Subsidy for payment of housing and communal services (if the expenses of a low-income family to pay for these services are greater than the amount of expenses for these purposes, which is the maximum share in the total family income - 22%). Payments are made within 6 months. Possible applicants for receiving these payments are both homeowners and tenants under a social or commercial tenancy agreement.

- Educational allowance for the maintenance of a child, the third in the family, until he reaches the age of three. Monthly payments are made at the regional level from local budgets and differ in amount in different regions of the Russian Federation.

Also, members of a low-income family are entitled to a number of social benefits:

- exemption from paying tax on the amount of social benefits received;

- receiving free housing from the municipal housing stock, under a social rental agreement, while being in line for the provision of this service;

- priority in the queue for a child to enter kindergarten;

- free legal consultations;

- free representation in litigation.

When does government assistance stop?

Article ten of Federal Law No. 178 provides a list of factors influencing the provision of such support for low-income people.

Assistance may be terminated in the following cases:

- The composition of the family was changed, or the income level of beneficiaries increased. In such situations, the poor person undertakes to notify the Social Security Administration within up to two weeks;

- If false information is found in the applicant’s documents after repeated verification;

- In case of violation of the rules of the state social rehabilitation program.

Citizens who violate the established rules will be held accountable in accordance with current legislation.

Last news

If we consider Moscow, then for single-parent families, benefits are issued for children up to 1.5 years old and from 3 to 18 years old every month. Their size is 2,500 rubles. For children from 1.5 years to 3 – 4,500 rubles. For children raised by military personnel or whose parents are wanted, a payment of 1,900 rubles is provided (children under 1.5 years old and from 3 to 18 years old).

Monthly cash payments in St. Petersburg for each child aged 1.5 to 7 years are 735 rubles, and from 7 to 16 years – 695 rubles.

In Ufa, benefits are provided for utility bills. Free hot meals at school are provided for children from low-income families. Parents of children who have entered first grade can apply for a subsidy to purchase stationery and school uniforms.

Compensation for utilities for the poor

As before, subsidies will be provided to low-income families in 2018 to pay for utility bills. Owners and tenants of housing have the right to receive such material assistance from the state, provided that they:

- there are no arrears in paying for housing and communal services;

- the total cost of paying for all types of utility services exceeds the figure established by law.

At the federal level, it represents 22% of total family income. Local authorities determine their threshold for providing compensation for the cost of housing and communal services. Mostly it is below this indicator, so you can count on an increase in subsidies. For example, in Moscow it makes up 10% of the family budget, the rest of the expenses are compensated from the municipal budget.

Types of subsidies for housing and communal services

When calculating consumption rates by type of utility services, the number of residents and the size of living space are taken into account. Low-income citizens have the right to choose how to receive a subsidy:

- payment of the full cost of housing and communal services with subsequent compensation of part of the amount paid and crediting of funds to a bank account;

- payment of utility services at reduced rates - taking into account the assigned subsidy.

Who is eligible to receive

Subsidies for low-income people to pay for utilities are assigned to home owners and tenants. The right to receive state assistance to pay for apartments and utilities is granted to the following categories of residents:

- who use state or municipal housing stock;

- renting housing under a rental agreement;

- housing construction cooperatives;

- homeowners - apartments, houses or parts thereof.

There are cases of refusal to issue subsidies for utility bills. According to the law, financial assistance for partial compensation of housing and communal services expenses is not assigned:

- when, upon concluding a rental agreement, citizens live in the same living space with the owner of the real estate;

- annuity recipients.

Submission deadline

Subsidies for the poor to pay for utility services are assigned by the social protection body for a period of 6 months. Funds are allocated monthly. After 6 months, it is necessary to reissue compensation for utility bills. Please note that when applying for a subsidy:

- until the 15th, the allocation of funds begins from the month the application is written;

- after the 15th – compensation is allocated starting from the next month.

How to apply

To receive a subsidy for housing and communal services, you must complete the following actions:

- Find out the list of documents required to receive compensation for the cost of housing and communal services.

- Collect documents.

- To write an application.

- Submit an application along with documents to assign compensation for expenses for housing and communal services.

Where to contact

You can find out the necessary information on providing this type of state support from the department of social protection of the population, housing maintenance organization or multifunctional center. The collected documents and the completed application are provided to the above authorities. The decision on the assignment of subsidies is made within 10 days.

List of required documents

To receive compensation for the cost of housing and communal services, you must provide the following documents:

- passport or birth certificate of all residents;

- tax certificates;

- Marriage certificate;

- certificate of family composition;

- certificate of ownership of housing or rental agreement;

- income certificate;

- certificate of no debt;

- documents on the basis of which residents receive utility benefits (certificate of a pensioner, single mother, mother of many children, etc.).

Other features of status assignment

Since it is believed that the reason for low family income is precisely the reluctance of one such family member to work.

In addition, you can receive benefits for low-income people under additional conditions:

- A family member is disabled.

- The family member is an elderly person over 65 years of age.

- There are minor family members and students under the age of 23.

- If children under guardianship are under 3 years of age.

- The family is large.

- If a mother or father raises children alone.

- If children are raised by grandparents.