How to find out where pension contributions are transferred

Every employee has the right to information about the amount of his insurance savings. Knowing this data, a person can calculate the amount of investment income when using the services of non-state pension funds (NPFs) when contributing to the funded part of a pension or check how disciplined the employer is in making mandatory transfers to the Pension Fund.

| Verification method | Peculiarities |

| Using the Internet | The most convenient way is to access the websites gosuslugi.ru and pfrf.ru. Registration on the resource is required to receive information. |

| Through the customer service of the territorial bodies of the Pension Fund, Non-State Pension Fund and MFC | Occurs when contacting these structures in person. Requires the presence of the insured person's passport and SNILS. |

| Find out from the employer | When making an official request (by filling out an application with a request), the employer is obliged to provide a written response. |

| Check with the credit institution | This service can be used by clients of banks that have entered into an agreement with the Pension Fund of Russia (the list is given below). Information can be provided by contacting a credit institution in person or through online services. |

Is the employer honest?

We figured out how to calculate a pension, we find out how to find out whether the employer pays contributions to the pension fund.

For fans of Russian Roulette, there is one quick but dangerous way: ask the accounting department for this information. If the employer is honest with the tax office and pays all contributions, you will be provided with all the information you need without any problems.

The game will begin if, so to speak, the organization has “its head in the cannon.” Nosy people are not welcome in this business. At best, you will be loaded with work so that you don’t think about “trifles.” At worst, you will go through the cold in search of an open relationship between the employer and the tax office. Do you need it?

It is clear that the above method does not work. Let's move on to safe methods. We check it ourselves and quickly. There are several options:

Public services

www.gosuslugi.ru/

To check your deductions through the state portal, log into your personal account. Please note that this can only be done from a verified account. You can confirm through mail, customer service, electronic signature, or during a visit to any government agency.

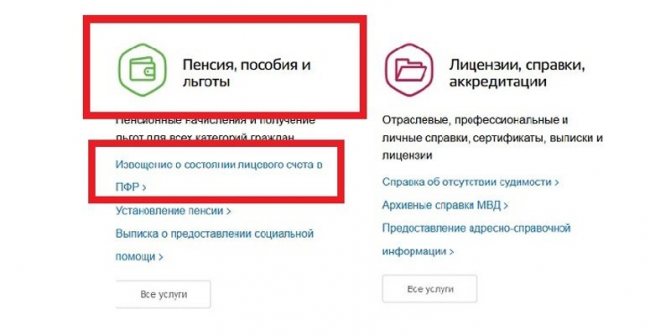

Select the category “Pension, benefits and benefits”, click on the line “Notice of account status”. In a few minutes all data will be provided.

PFR website

www.pfrf.ru/

You can also view your savings here. Log in to your personal account, which is located on the website of the Russian Pension Fund. You automatically gain access to it when registering for State Services. Find the section “ Ministry of Health and Social Development ” and select “ Information on the status of individual accounts ”. This way you will receive a detailed breakdown of deductions by year.

Customer service

If you are not in a hurry, and even communicate with computer technology on a first-name basis, contact the pension fund at your place of registration. Take your passport and SNILS with you. You need to fill out an application at the branch. In the form, indicate the desired method of receiving information: personal visit or letter. And in 10 days maximum you will receive the desired data.

MFC

You can make a similar request in the multifunctional center. Single Window service . You must have your passport and SNILS with you.

Bank

The Pension Fund of Russia has agreements with large banks. Therefore, credit institutions store information about the employer’s transfers. Provide the bank employee with your passport and SNILS and he will give you access to your personal account, with which you can view all transactions with pension contributions.

Federal Tax Service

lkfl2.nalog.ru/

Information about the status of your personal account can be found by leaving a request on the tax service website in your personal account. Login is carried out using the Taxpayer Identification Number (TIN) or through the government services portal. This is where you can order an extract.

If we are talking about a non-state pension fund, it is better to contact the fund itself directly.

At a time when spaceships roam the expanses of the universe, requests (even via the Internet) do not always come. This happens for one simple reason: your ignorance is beneficial not only to the employer, but also to the pension fund. After showing interest, it often turns out that some length of service was not taken into account and the fund owes you.

In this case, you need to personally visit the pension fund branch. If they refuse to provide you with information, go to the prosecutor's office. This is not classified information and an extract should be provided to citizens. Refusal is a violation of your rights and freedoms. This is regulated by Article 14, Federal Law-27 of the Russian Federation .

Above, we figured out how to find out whether the employer makes contributions. It's time to figure out what to do with this information.

If you are not satisfied with the state of your personal account (“it won’t be enough”), first of all, talk to your boss. Maybe he doesn't understand how important it is to think about retirement in advance. If such a situation is close to ideal, the employment contract will simply be revised and the deductions will increase.

The fun begins when constructive dialogue fails. There are the following authorities where you will be understood and the offender will be punished:

State Labor Inspectorate

You will be advised, an application will be taken and the verification will begin.

Tax office

You can inform the Federal Tax Service both openly and anonymously. Any statement will serve as a reason for verification. Failure to pay tax is a crime that carries serious liability for your employer.

Law enforcement agencies, prosecutor's office

Write a statement about violation of the labor code and the department will begin an investigation.

Courts

Such cases are considered by courts of general jurisdiction, which are located at the address geographically coinciding with the legal address of the organization.

Trade union

We are talking about the organization’s trade union (if there is one), and about the sectoral committee or the regional Federation of Trade Unions.

When contacting any of these departments, you must leave detailed information about the employer: official name, actual address, Taxpayer Identification Number, telephone number, detailed information about wages, etc. This way your problem will be solved faster.

After a citizen’s appeal, departments have the right to check the organization. If a violation is confirmed, the employer will be forced to pay all taxes. In addition, you will have to pay a bunch of fines. In certain cases, the employer faces criminal liability.

If you have become a victim of an employer cheating on pension contributions, you can add a review of any employer and company .

It's normal to be interested in your pension. Our future depends on us. In this question there is no “oh, okay, I won’t become poor,” “I won’t live to see retirement,” “I feel somehow embarrassed,” etc.

Pension contributions online on the State Services portal

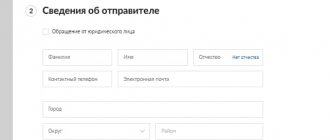

The convenience of this method lies in its accessibility. In order to check pension contributions online on the State Services website, you need:

- Register on this resource. To do this, you need to confirm your email address and mobile phone number. Then enter your passport details, SNILS number and create a password.

- The next step is to confirm your account. The most common way is through the Pension Fund client service. Other options are using an electronic signature (you must have one) or Russian Post (this option takes 3-4 weeks). It is important to note that if the account is not confirmed, the service for clarifying insurance deductions will not be provided.

- On the main page of the site, you need to go to the electronic services section, then select the “Ministry of Labor and Social Protection of the Russian Federation” tab.

- In the tab that opens, click on the “Pension” item, then click on the “Notification of personal account status” command.

- The submitted request is processed for several minutes, then the user is provided with a pdf file with the necessary information.

Checking pension contributions through the client service of territorial authorities

To do this, contact the customer service department of the territorial branch of the Russian Pension Fund that corresponds to your place of registration. When applying, please provide a document proving your identity, as well as SNILS.

Department employees will help you draw up an appropriate application. In it, indicate how you want to receive the requested information: in person or by mail.

Regardless of which method you choose, it will take the employees of the Russian Pension Fund 10 days to prepare the statement. After this period, the statement will be sent to your address in accordance with the method you previously selected.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

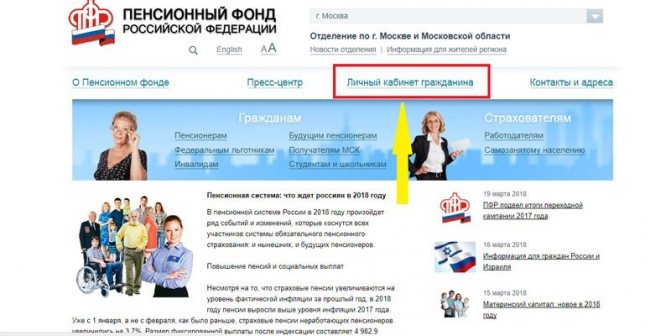

Checking your pension on the official website of the Pension Fund in your personal account

Another way to view contributions to the Pension Fund via the Internet is to do it on the network resource of this organization. The user needs:

- Type www.pfrf.ru in the address bar of your browser. Having registered on the State Services website, you can access the necessary data on the PFR Internet resource. An alternative option is to register in the Unified Identification System, which involves entering personal data, confirming your email address and cell phone number.

- Then you need to go to your personal account, find the “Individual Personal Account” block there, where you select the “Get information about generated pension rights” service.

- Having opened this page, you need to click on the link “Information about experience and earnings reflected in your personal account.” The screen will display information about all insurance premiums made.

What is the tax amount?

Contributions to the pension fund - how much is it?

Currently, the tax to the Pension Fund for all working citizens is 22% .

Moreover, the employer deducts it for each of his employees.

This deduction of 22% is divided into the following types:

- 16% constitutes the insurance part;

- 6% goes to create a savings portion, which everyone has the right to dispose of independently.

For some categories of employees, there is a reduction factor in accordance with Federal Law No. 212, Article 58. Thus, for organizations that are on a simplified taxation system, deductions are 20%.

Individual entrepreneurs also make the same transfers for each employee. For employees working in harmful and dangerous working conditions, there is an additional insurance premium rate (Federal Law No. 212, Article 58.3). The highest tariff is adopted for hazardous working conditions, it is 4%.

How to check contributions to the Pension Fund using SNILS

You can also control the status of your pension contributions using the Insurance Number of your individual personal account. This document contains an 11-digit unique combination of numbers, and it is issued to every working Russian. You can find out pension contributions according to SNILS using:

- credit organization (bank);

- Multifunctional center;

- Non-state pension fund.

- Inexpensive sanatoriums in the Moscow region for older people

- Sage medicinal properties

- Hormone analysis in women

A credit institution can provide the client with information on contributions to the social insurance fund if it is a partner of the Pension Fund. As of 2020, there are more than 30 similar banks in our country, including:

- Sberbank of Russia;

- VTB 24;

- Gazprombank;

- Raiffeisenbank;

- Sovcombank;

- Russian standard;

- UralSib.

Obtaining information about insurance deductions through a specific bank is most convenient using the website of this organization (it is also possible during a personal visit, but this takes more time). For example, here’s how this is done using the Sberbank online service:

- The user registers on this resource by filling out an application for information exchange with the Pension Fund. Then you need to approve the processing of personal information, indicate your passport details, SNILS and mobile phone number.

- After completing the registration process, the user needs to go to his personal account, re-entering the login and password provided to him. Next, select the “Pension Fund” tab and click on the “Get statement” link.

- A new page with an application for an extract will open in front of the user. He needs to check that his personal data is correct and click the submit button for this form.

- An indication of the request status (sending, execution, etc.) will be displayed on the main page. When the data is ready, the user will be notified about it. All he has to do is click on the “View statement” link and study the information prepared at his request.

Checking pension transfers through the MFC and NPFs involves personally contacting these structures. You should have your passport, SNILS and an application for information about the status of your personal pension account with you. At the choice of the applicant, the necessary data will be provided to him personally or by registered mail within a 10-day period after the application.

What to do if funds do not reach the Pension Fund

If you find that your employer is acting dishonestly towards you, and this dishonesty is manifested in improper transfers of funds to the Russian Pension Fund, go to court to protect your legal rights and interests.

According to the fifteenth article of the federal law of December 15, 2001 No. 167-FZ “On compulsory pension insurance in the Russian Federation,” every citizen has the right to receive reliable information about what funds are transferred to his personal account in the Pension Fund of Russia.

If you decide to go to court to protect your legal rights and interests, you will need to provide the court with your work record book, the employment contract concluded between you and the employer, as well as payslips for the wages accrued to you.

In order to ensure the income of its citizens in old age, our Motherland has obliged employers to make certain contributions to the individual accounts of the citizens working for them in the Pension Fund of Russia.

Despite the fact that the payment of these contributions is the direct responsibility of employers, not all of them treat it in good faith. Therefore, in order not to become a victim of such dishonesty, check yourself what amounts were transferred by your employer to your individual personal account.

There are many ways to check this information. For example, you can personally visit the territorial division of the Russian Pension Fund and formally request the information you are interested in there. Also, to receive it, you can use your personal account on the State Services portal or on the official website of the Russian Pension Fund.

Attention! If you discover that transfers are not being received to your individual personal account in full, immediately seek protection in court.