We all go to stores regularly, but sometimes it happens that an item doesn’t fit. my purchase and return the money for the purchase. You bring an item to the store, and for some reason the seller is in no hurry to accept it. Let's figure out in what cases such refusals are legal and how to protect your rights?

To protect buyers from unscrupulous sellers, there is a law “On the Protection of Consumer Rights”, which regulates all relations between individuals and organizations based, among other things, on a purchase and sale agreement.

This law states that buyers can return any non-food item, regardless of its quality. However, there is a group of goods that, if everything is in order with them, cannot be returned.

It is extremely important that the presentation of the purchase is not altered, and that the factory tags remain intact. There should also be no signs of use. When returning, you will need to explain the reason for it.

How to repay a debt pre-trial?

If the person who lent money wants to resolve the situation with debt repayment without going to court, he can try to do this in pre-trial procedure. Popularly, this method is called an “amicable” solution to the issue. As usual, the lender tries to talk to the debtor and explain that the funds must be returned and this moment is inevitable and overdue. It is worth mentioning that if the case goes to court, then payment of state duties, attorney fees and mandatory payment of interest on the loan will become the debtor’s responsibility. So, he will have to part with an amount significantly greater than what he borrowed. Often this argument works.

If an attempt to resolve a debt dispute out of court led to a conflict and it was not possible to reach an agreement, there is only one way out - to apply to the court to protect your rights. The only thing is, when sorting out relationships, you shouldn’t waste your nerves, much less be zealous. The Criminal Code of the Republic of Belarus has Article 384, according to which any conversation with a debtor in an unacceptable form can be regarded as coercion to fulfill obligations. Therefore, in case of unacceptable pressure, the person who gave the loan may be held criminally liable. You need to be careful with this and not go too far.

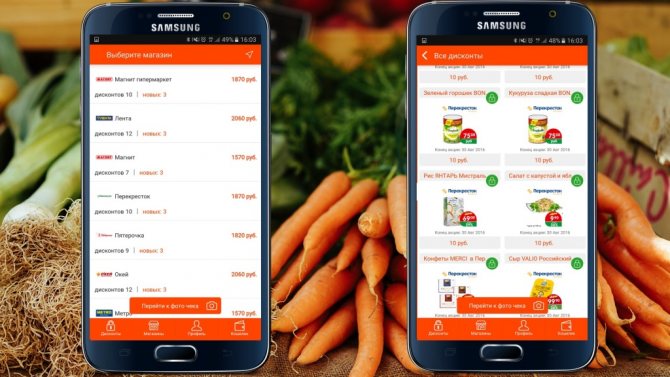

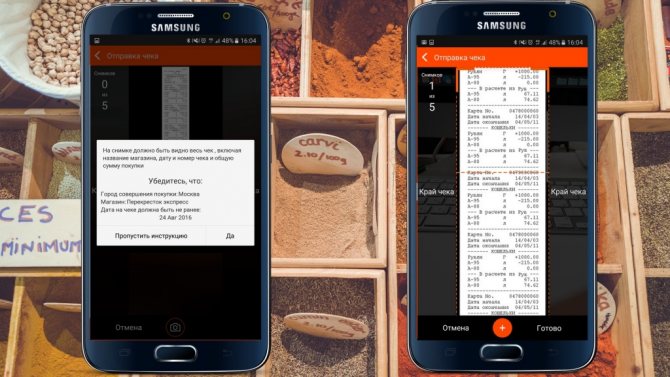

Discount - how to get money back for regular purchases in supermarkets

Once you've signed up for the app, you can start comparing discounted items to your shopping list. You can do this in two ways: either take into account all the promotional offers, or find out about available discounts in a certain chain of stores. Next, you need to unlock the offer, check the maximum allowed number of products for the promotion and go to the store. As soon as you have all your purchases, you need to take a photo of the entire receipt, regardless of the number of product items, and upload it for verification. After about a day, you will receive a reward to your account inside the Discount application.

You can use the saved money in two ways: pay for your mobile phone when you have accumulated 200 rubles or more, or wait until you receive 1000 rubles in your virtual account and transfer the money to a bank card or e-wallet. Personally, only the second option suits me, since Disconto supports withdrawal of money to the account of Megafon, Beeline, MTS and Tele2 subscribers, but such a service is not provided for Yota clients. However, I personally have always found it more pleasant, useful and interesting to save as much money as possible so that the savings are truly noticeable. Therefore, even if my operator was supported by Disconto, I would prefer to withdraw money to a bank card. By the way, with any method of cashing out you will have to pay a small commission.

What can I say about my impressions of using Disconto? In matters of keeping track of money and everyday purchases, I can hardly be called pedantic and disciplined, so at first it was difficult for me to control myself and remember to carefully take home receipts, then photograph them and wait for approval by the service moderators. At first, small amounts of 10, 50 or 100 rubles did not motivate me enough. But as soon as you go shopping ten times, at some point you notice that a decent amount has accumulated in the internal account of the application, and along with this, excitement appears and a desire to accumulate as much money as possible for subsequent withdrawal to the card. However, I think that among our readers there will be many buyers who, from the very beginning, will not carefully monitor the available offers at Disconto, compare them with the shopping list and will not forget to download each suitable receipt.

As a result, Disconto is a really cool service that is easy to use, works in many Russian cities and allows you to save on purchasing the most common goods in regular supermarkets. By and large, I would advise many services of various types to pay attention to how to work using the example of the Discount application. And I advise all our readers to start saving on purchases and saving money for later return. As they say, a penny saves a ruble, and the Disconto virtual piggy bank can be a big help at some point.

Is it possible to contact debt collectors to repay a debt?

A person professionally engaged in debt collection is called a debt collector. They work in specialized collection agencies. Due to the fact that in Belarus the legislative framework in this industry has not been formed, such agencies are practically absent. However, some legal experts whose specialists help to repay the debt pre-trial. They operate within the framework of current legislation and do not violate the above article of the Criminal Code. They often explain in an accessible form the consequences of non-repayment of the debt, namely the payment of a significantly larger amount, taking into account interest, fees and attorney fees.

How to repay a debt through court if there is a receipt or a loan agreement?

If it was not possible to return the money pre-trial, you must contact the judicial authorities. An important point is the statute of limitations for debt repayment. It is defined at the legislative level and is 3 years from the date of transfer of funds.

In order for the judge to accept the claim for consideration, it is necessary to correctly prepare the documents and appeal. In order for the claim to be accepted, the following recommendations must be followed.

1. Before going to court, it is recommended to send a registered letter to the address of the debtor indicated in the receipt. In the text of the letter, you indicate the amount of the debt, the period when the funds should have been returned and inform that if the money is not returned within 1-2 weeks, you plan to go to court. This action is not legally binding, but during the trial it can serve as an additional and compelling argument that you tried in every possible way to establish a dialogue with the debtor pre-trial and did everything in your power.

2. Next, you need to make a photocopy of the receipt in triplicate. One is necessary for the court, the second will be sent to the borrower, and the third will remain a reserve. You will also need a photocopy of your passport.

3. The statement of claim will be considered by the court, which is territorially related to the place where the debtor is registered. In order for the court to accept the application for consideration, the claim must be drawn up taking into account all the requirements and rules.

4. Before filing a claim in court, you must pay the state fee.

5. Next, documents are generated: a copy of the receipt, a copy of the letter to the debtor, a copy of the passport and a receipt for payment of the state duty are attached to the statement of claim.

6. The documents are transferred to the court office, and the case is prepared for consideration. As a rule, the period for consideration of claims for debt collection is 1 month.

7. You will be summoned to court. It is best not to ignore the legal process as the judge may need more information about the case. If the debtor does not appear in court, the judge will be able to consider the case in his absence.

8. After the trial is completed and a decision is made in your favor, you will be given a writ of execution. You will also be given a copy of the court decision.

9. The writ of execution must be handed over to the bailiffs and the nuances associated with further actions to repay the debt must be discussed.

You can do all the steps yourself, but if you want to be sure that your claim is drawn up correctly or your interests are represented in court, you should contact professional lawyers.

How to return a purchase correctly

Don't want to face claims from a store employee? It is necessary to return the item correctly. To do this, check the presence of all tags and components that came with the product. Then carefully pack your purchase in the original box.

When you arrive at the store, briefly explain the problem to the seller. Probably everything will go smoothly, the item will be accepted, the money will be returned. The seller will tell you how to fill out an application for a refund. We recommend making two copies of the application, asking the seller to sign and affix one. If you still have the receipt, attach that too.

But what to do if the store employees refuse to return your hard-earned money.

If you return the goods without damage, it will be enough to fill out a free-form application and send it by registered mail with a list of the contents and notification of receipt.

If you are not accepted for a defective product, you need to file an official complaint, which must include:

- Date and time of purchase.

- Complete list of product characteristics.

- The malfunctions you discovered, as well as a description of how exactly you discovered them. For example, you purchased a smartphone and discovered that its battery is discharged in 30 minutes, but the instructions “say” about ten hours.

- The requirement that the examination be carried out at the expense of the seller.

- Attach a copy of the sales or cash receipt. If the receipts are lost, please indicate that, in accordance with clause 5 of Article 18 of the PZPP, you have the right to return substandard goods in the absence of a receipt.

- If the weight of the goods is more than 5 kilograms, feel free to ask the seller to pick it up yourself or pay the shipping costs.

We advise you to refer to the legislation when writing a complaint. This increases the chances that the claim will be satisfied.

Here are laws that can help you:

- Article 18 of the PZPP or its duplicate Article 503 of the Civil Code of the Russian Federation - note that buyers have the right to return goods of inadequate quality;

- Article 309 of the Civil Code of the Russian Federation - that the seller must comply with what the law says;

- Article 310 of the Civil Code of the Russian Federation - its essence is that it is not legal to unilaterally refuse a sales contract.

It is better to make a claim in two copies. One goes to the seller, the other you keep with a receipt mark. If you do not want to accept the claim, you should send it by mail (do not forget about the inventory and notification of receipt).

If your problem is not resolved, complain to Rospotrebnadzor for violation of the consumer’s legal rights. Or prepare a statement of claim in court.

Is it possible to go to court if there is no receipt or agreement?

The media quite often cover stories like: I lent money “on my word of honor” without a receipt or agreement, and now I can’t get my money back. If you lend to a person and do not properly formalize your debt relationship, remember that if the debt is not repaid, it will be almost impossible to get the money back through the court.

If you lent an amount exceeding 210 rubles and did not comply with the simple written form of the agreement, the court will not take into account the testimony of witnesses. This norm is reflected in Article 163 of the Civil Procedure Code of Belarus. Witness testimony in this case does not reveal the completeness of the information and the fact of debt obligations. In this case, available photo and video materials, SMS or email correspondence with the borrower, confirming the fact of transfer of money on loan, may be taken into account.

Having at least some of the above evidence, you can file a complaint with the police to initiate a criminal case for fraud. The police officers will decide whether to approve the application or refuse it. Having received a refusal, the lender has the right to appeal it in court. In practice, there are cases when the refusal is justified by the lack of complete information about the amount of the debt, but the fact of the borrower’s guilt has been established. This can serve as strong evidence in court confirming the fact of the transfer of money in debt.

To be more confident in a successful outcome of the case in such a situation, it is recommended to seek the help of lawyers.

What needs to be done after receiving a court decision and writ of execution?

After the trial has been completed in favor of the borrower, the person receives a copy of the court decision. The decision is not the basis for enforcement of debt repayment. It serves as the basis for obtaining a writ of execution.

After receiving the writ of execution, the stage of enforcement proceedings begins. It is necessary to write an application to initiate enforcement proceedings and, with the received sheet, contact the enforcement department. A bailiff will be assigned responsibility for fulfilling the court's requirements. It is recommended to find out his details and contact phone number for communication.

Actions of the bailiff for debt collection

After the court decision is made and it enters into legal force, the stage of enforcement proceedings begins. But what actions can the bailiff take to recover the debt?

- First of all, the bailiff sends a resolution to initiate enforcement proceedings to the debtor and invites him to voluntarily repay the debt. Sometimes this process is effective; some debtors are afraid of the actions of government officials. However, the percentage of such debtors is small, and if things have reached this stage, then you should no longer count on voluntary repayment of the debt.

- Sending requests to the tax service, Rosreestr, MREO traffic police and banks. These requests are sent to analyze the financial condition of the debtor. A request will also be sent to the Pension Fund to find out whether the debtor is a pensioner or is officially working. If the answer is positive, the debt will be collected from bank accounts and wages.

- Foreclosure of property. If the bailiff discovers that the debtor has property that can be foreclosed on, then such actions will be taken.

- If the actions do not bring positive results, the bailiff will begin work by visiting the debtor’s place of residence in order to locate the property.

- Property owned jointly with a spouse may also be subject to foreclosure. However, such actions are taken only if no other property is found. For this purpose, the bailiff initially submits an application to the court for the allocation of a share in jointly acquired property, and only then receives the right to foreclose on it.

- Foreclosing on a share in an organization. It is also carried out only if no other property is found. A separate judicial act is required, for the purpose of obtaining which the bailiff also goes to court.

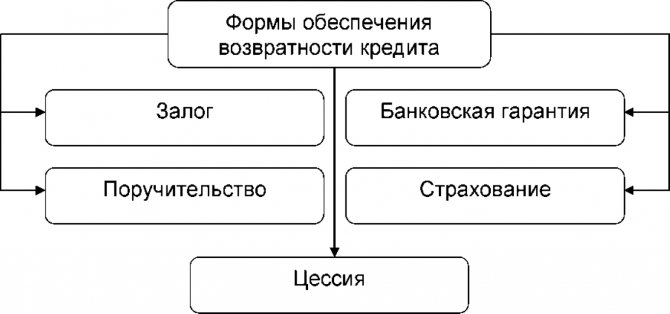

Ensuring loan repayment.

Ways to ensure debt repayment

To eliminate the possibility of non-repayment of debts, the lender should take some actions before applying for a loan.

- Analysis of the financial condition of the debtor and his property. It is worth carefully assessing the debtor’s ability to repay the loan.

- Registration of loan security. The legislator has provided many ways to ensure loan repayment, for example, introducing additional liability measures into the contract, such as penalties and fines, and registering guarantors. The most effective method is to issue a loan with the registration of collateral, which can be foreclosed on in the future.

- Checking the borrower's credit history. Organizations can be connected to the BKI system, so they have the ability to check their credit history.

- Include in the contract the possibility of selling the debt. If such an option is specified in the contract, then there will be no additional need to obtain the debtor’s consent in this case.

- Correctly draw up a loan agreement or receipt. Provide valid passport details of the debtor.

- Do not lend without concluding a loan agreement or receipt. Even acquaintances should under no circumstances have oral legal relations regarding loans.

Compliance with the minimum recommendations will, if not completely protect the lender, then at least reduce the risk of non-repayment of the loan to a minimum.

Therefore, any lender must be fully aware of the risk of possible consequences and be prepared for all kinds of actions, including pre-trial, judicial work and work on enforcement proceedings.

Issuing a loan is always unpredictable, so it is important to keep a cold calculation, while being ready for compromises and new agreements, and also be prepared that the debt may take a long time to repay.

If you haven't been repaid and you don't know what to do, you can find advice in this video:

What actions do bailiffs take to collect debt?

To collect a debt, a bailiff can act in various ways. As a rule, he receives information about the debtor’s property and funds and seizes these objects. In some cases, the bailiff may resort to more effective and radical measures and restrict the debtor’s rights to leave the country or deprive him of the right to drive a vehicle.

The bailiff has the right to apply several measures of influence on the borrower .

According to the current legislation of the Republic of Belarus, the bailiff has 2 months to put into effect the instructions on the writ of execution.

If the debtor has funds in a bank account, real estate or other property, the bailiff has the right to sell it to return the debt to the borrower. So, an auction may be scheduled, and items may be transferred to a consignment store. It is also allowed to sell one's own property by the debtor himself under the control of a bailiff. Please note that the claimant has the right to be present when the bailiff carries out a specific action to sell the debtor’s property.

What to do if bailiffs are inactive?

If the writ of execution was handed over to the bailiff, and no action was taken to collect the debt, or these actions were unproductive, it is worth knowing the procedure for influencing the bailiff.

The main measure of influence on the activities of an ineffective and ineffective bailiff is a complaint in the order of accountability. The complaint is submitted to the senior bailiff.

The complaint must indicate:

— Full name of the bailiff who ignores the fulfillment of his duties under the writ of execution;

— Full name of the person filing the complaint, address and contact telephone number;

- the essence of the complaint (what exactly the bailiff does not do);

- requirements of the person filing the complaint.

If the complaint has been considered, and the performance of the bailiff’s work leaves much to be desired, you can file a complaint with the court. The complaint can be submitted in person or through the office.

Important advice. Taking into account the emerging practice, in order for the bailiff to work effectively from the very beginning, the claimant must demonstrate the seriousness of his intentions. If the executor sees that you are not indifferent to the debt, you have an active position, the matter will be better to argue. Among other things, be in constant contact with the appointed bailiff, and do not bother him about trifles: inquire in a timely manner about the results of enforcement proceedings, collection of funds from the debtor and the sale of his property.

How to get money back from Google Play Store

The favorite category of all Android users is the Play Store. Here you can find a service for every taste, request and budget. You buy a new application in the Google Play store and are sure that you will definitely need it. But time passes and you forget about it. Or even worse: the purchased program is not supported by your smartphone model. Money spent, but to no avail.

But it’s too early to despair; Google has a money-back function, which is built right into the Play Store. Therefore, you need to take advantage of this opportunity as quickly as possible.

The easiest way to get a Google Play refund for a recently purchased app or game is to request a refund directly from the Play Store. The process is very simple, no one asks questions, but there is one catch. You must act quickly. In fact, you need to submit your refund request within two hours of purchasing the app or game. Two hours is a period of time that allows you to determine whether you will continue to use the application or game.

To get a quick refund from Google Play, first open the Google Play Store app, go to the page for the app or game in question, and then click the REFUND button. If this button is missing, it means you have already missed the two-hour window.

Contacting application or game developers or requesting a refund does not provide a 100% guarantee of success. You can write to the developers expressing your dissatisfaction with the app or game and demand that they refund your purchase. Their decision determines whether you will get your money back or not.

In case the developers do not respond to your emails or do not agree with your request, there is another option that you can try. Google's support page says that you can contact their support team and ask for help resolving your issue. But you will have to wait at least a week for an answer. Therefore, you can start the chargeback procedure through the CosmoVisa service even if your account is blocked.

Is it possible to collect a debt from a debtor if he has no property and is unemployed?

It is important to remember that if a debtor who lacks any property intends not to repay the debt, then it will be extremely difficult to collect the required amount. In fact, a person can borrow, dispose of the money, not return the amount borrowed and remain unpunished. For this simple scheme, the debtor should not have personal property. If there is no property, then there is nothing to recover from.

When the bailiff visits the debtor, he will only make sure that the person lives without anything, in poverty. Accordingly, nothing can be recovered from him. In this case, you should also not count on penalties. Whatever the amount, bailiffs are powerless in such a situation.

How I get some money back from almost all my purchases

Most of us buy something every day: groceries, clothes, furniture, appliances, and so on. But not everyone knows that today there are tools that allow you to legally get back some of the money from almost any purchase.

In this article, I will share my experience with you and tell you about the tools that allow me to get some money back from almost any of my purchases.

I’ll say right away that representatives of those organizations that will be discussed below never contacted me with requests to talk about them. This is just my experience that may be useful to you. My benefit from sharing this information with you is only that if you, like me, start using them, they will give me a bonus as part of their affiliate program. For me, this will be a pleasant plus for the time spent preparing this article.

So, let's begin.

1. “AllAirlines” credit card from Tinkoff Bank

I discovered this card at the beginning of 2014, and since then it has brought me approximately 105,000 rubles.

How?

The principle here is very simple. After receiving the card, you immediately have access to 30,000 rubles from the bank, which are already on the card. In essence, it is a loan. But if you use it wisely, then this loan will not take money, but rather bring it.

Here's how it works.

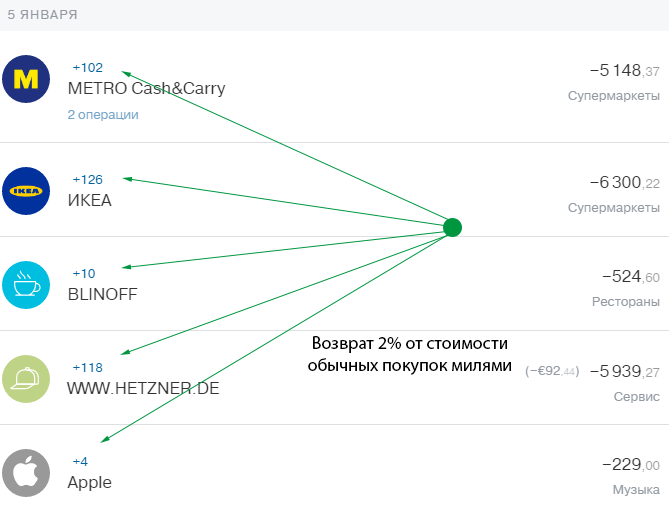

When I pay with this card in stores or on the Internet, the bank returns me 2% (up to 5% for the purchase of airline tickets, up to 10% for hotel reservations) of most purchases back to the card, but not in the form of regular money, but in the form of miles .

For example, if I bought furniture worth 40,000 rubles at the Ikea store, the bank will credit my account with approximately 800 miles. So, just by using the card to pay for all my regular expenses, I have about 35,000 miles in a year.

How to spend these miles?

Miles can be used to offset the cost of air tickets on any airlines that you purchased using this card.

For example, if I have 35,000 miles on my balance, and I recently bought air tickets for, say, 27,500 rubles, then I can compensate for this purchase with miles. Upon compensation (it is done in my personal account on the website), the bank will write off 27,500 miles from me, and in return will replenish my account with 27,500 rubles.

Thus, in three years I have already spent more than 100,000 miles.

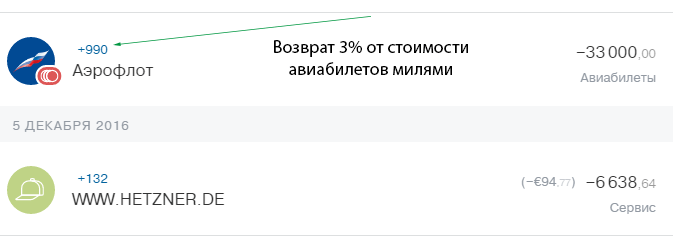

I'll give you a few screenshots of how it works. Here are screenshots from the card statement, where you can see that for regular purchases the bank returns 2% to the balance in the form of miles:

If you buy air tickets through the card, the return will usually be even greater. In this case 3%:

As you can see from the screenshots, I even pay for renting servers for my sites with this card and receive 132 miles from each payment. It turns out that I just spend this credit money on my regular purchases and at the same time accumulate miles in my account.

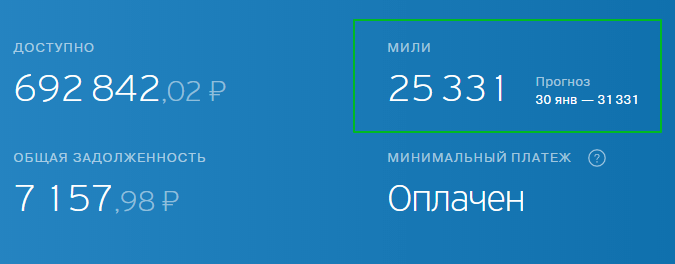

This screenshot from my bank account shows that I currently have 25,331 miles accumulated.

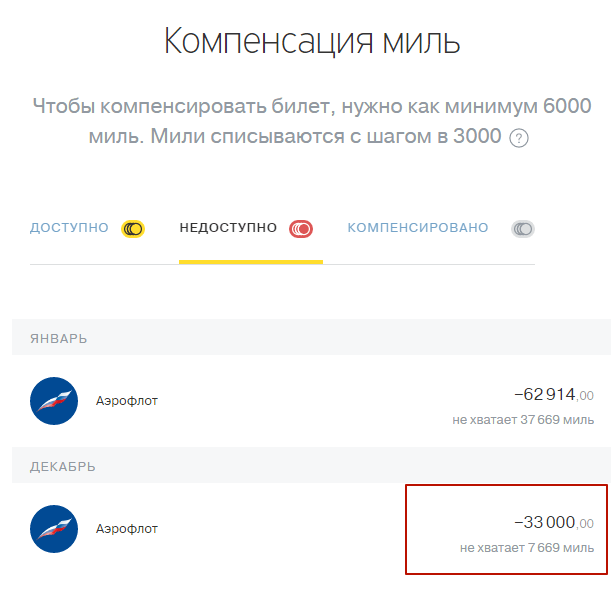

As I said above, miles can be used to offset purchases of any air tickets. For example, as soon as I accumulate 33,000 miles, I will be able to compensate for the purchase of air tickets that I made on the Aeroflot website in December.

Example of compensation:

This results in the following diagram:

We take the card on which the bank’s money is located. Over the course of a month, we pay for all our regular purchases with this card (with bank money) and accumulate miles. At the end of the month, we top up the card with our own money with exactly the same amount that we spent on purchases for the month. Replenishment from this bank is interest-free. The amount you give to the operator will be credited to your card account.

As a result, we spent the same amount as if we simply paid for everything in cash, but the difference is that with this approach we also accumulated miles.

“What’s the catch?” - you ask. After all, you have to pay interest for spending credit money! Banks always strive to make money from their clients, and not the other way around!

The whole trick here is the so-called interest-free period. For this card it is 55 days. This means that I can safely use credit money for almost two months without paying any interest. The main thing is to top up the card with the full amount of money spent on it faster than these 55 days have passed. Thus, I make purchases using the card, accumulate miles, and at the end of the month I simply top up the card without interest in the Svyaznoy store and do not pay any interest on the loan.

In three years of using the card, I have not found any tricks. The only thing I don’t understand is on what basis miles are not credited for some purchases at all, and for some (10 percent of all purchases) not 2% is credited, but less. I’ll try to write to their support today and clarify this point.

Updated

I chatted with them online. The reason turned out to be that a maximum of 6,000 miles . Sometimes I exceeded this limit, so further miles were not awarded.

To get the most out of this card, there are a few important things you need to know.

1. Card maintenance costs 1,890 rubles per year. In my case, this amount pays off many times over. 2. If you are traveling to another country and plan to pay with a card or withdraw cash there, then add the country of travel to the white list in the card settings in your personal account, otherwise the card will be blocked when you try to pay for goods or withdraw money from an ATM in another country. 3. Miles for purchases are not credited immediately, but after about 1-2 weeks. 4. When I received the card, I had the insurance service against non-payment of debt activated. The bank wrote off a small amount for it every month. If you do not need insurance, you need to disable it in your personal account in the card settings. 5. If you actively use the card and repay the spent amounts on time, the bank will gradually increase the credit limit of the card. For me it was like this. At first there was only 30,000 rubles on the card (upon receiving the card), after a while, with active use of the card, the limit increases to 70,000, then to 150,000, 400,000, 700,000 rubles. I don’t know further, because for me it is now frozen at this number. 6. You can top up your card without interest in Svyaznoy, Euroset stores, at any post office and many other places. 7. Do not withdraw money from ATMs from this card. Any bank charges a large commission for withdrawing credit money from an ATM, and Tinkoff Bank is no exception. Personally, in three years I have never withdrawn money from this card at an ATM. 8. The main thing to remember is that the money on the card is credit, but you shouldn’t worry about having to pay interest on this loan. This card has an interest-free period of 55 days. Just manage to return the spent amount back to the card during this period and you won’t have to pay any interest. 9. Not everyone is issued a card. If you have a bad credit history or have other credit cards from this bank, then the card may not be issued.

“Then how does the bank make money?” - you ask again.

In my opinion, the bank makes money on those people who spend money from the card, but do not have time to repay the debt in 55 days. Such people are forced to pay interest on the loan. And for some reason it seems to me that such card users are the majority, and therefore it is profitable for the bank. Your task is not to give in to temptation and return the spent amount to the card on time in order to use only its advantages in the form of bonus miles.

In general, if you use this card wisely, you can fly somewhere for free with your whole family once or several times a year, which is what I do and advise you to do.

You can apply for such a card here.

I know that now other banks offer similar cards, where part of the money spent is returned back to the card, so I will be grateful if you share your findings in the comments. Particularly interesting are such solutions that are available throughout Russia, and not just in large cities. There may already be better solutions than the AllAirlines card, and at your suggestion I will switch to a more profitable option.

Next, I’ll tell you about the so-called cashback services that allow you to return part of the money from purchases made in popular online stores, hotel booking sites, etc. These services originated in the West, but in recent years, worthy solutions have begun to appear in our country.

What is the main idea of such services and how do they generally work?

Their principle is very simple. Let's say there is such a popular platform as AliExpress.

The creators of the cashback service contact the administration of this site and tell them in a very simplified form something like this: “Guys, let us bring crowds of customers to your site, and you will pay us 10% of their purchases. How do you like it? . The guys from AliExpress thought and thought and agreed.

Next, technical specialists get to work and set up a special integration so that all people who come to this site from this cashback service are taken into account by the seller and 10% of their purchases are allocated to this cashback service.

Now the creators of the cashback service write to other popular stores, for example in MVideo, something like this: “Guys, let us bring you crowds of customers, and you will return 5% of their purchases to us. Yesterday we signed an agreement with Aliexpress according to the same scheme. How do you like it? . The guys from MVideo thought and thought and agreed.

Then everything follows the same pattern. So, step by step, the cashback service negotiates with a huge number of online stores and sets up technical integration.

Now all that remains is to start attracting crowds of customers to all these stores and sites. What's the easiest way to do this? That's right - by offering to return part of the money from their purchases to customers if they go to these sites through a cashback service.

On the cashback service website there is a message: “Buy on Aliexpress through us and we will return you 6.5% for any purchases”! 6.5% is not lying around, so any normal person, knowing that there is no catch here (and there is none), will of course take advantage of this offer.

The win-win-win model works here, so everyone benefits.

Advantages of the seller: The same AliExpress or any other store receives a crowd of customers, while losing 10%, but he does not have to spend money on advertising. Advantages of the buyer: An ordinary user, like you and me, receives a refund of 6.5% of the value of the purchases he makes. Advantages of a cashback service: The creators of the service earn from the difference that they receive from the store and return to the client. In this example, it is 3.5% of the purchase amount.

Everyone is happy.

Now a few words about the cashback services that I myself use.

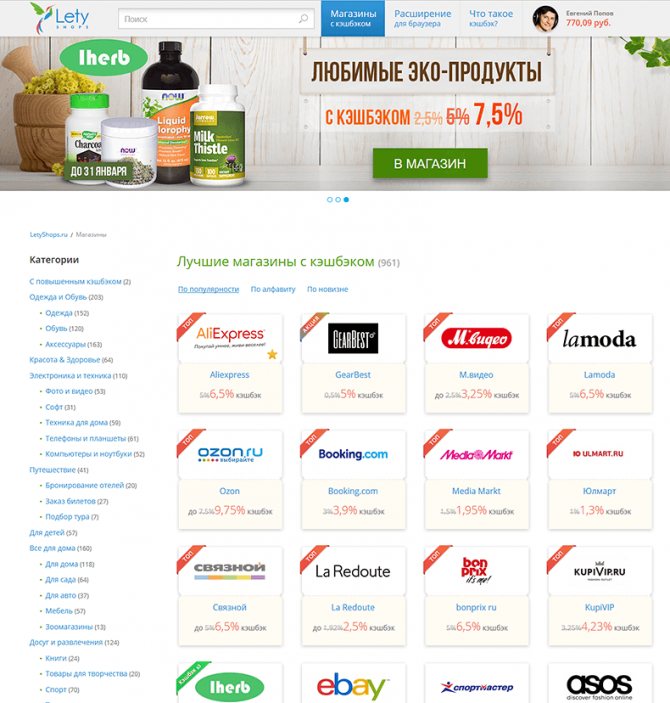

1. LetyShops service

I switched to this service recently, but every day I like it more and more. They currently have agreements with 960 stores. They return from 1 to 10% on purchases.

The service has a user-friendly interface, nice design, an online support service, and many positive reviews.

You can withdraw money to a bank card (cards of the Russian Federation and Ukraine), Webmoney, Yandex.Money or Paypal. The minimum withdrawal amount is 500 rubles.

How to make purchases through this service?

The first thing you need to do is register in the service and log in with your username and password.

Then there are two options.

1. On the main page of the service, select the desired store and simply click on it. The service will redirect you to the website of this store, and there they will already be aware that you are entitled to a refund of part of the amount from any of your purchases.

2. You can install a browser extension (Chrome or Firefox). Click on it, find the desired store there and go to it from there. Or you can just go straight to the store’s website, and then open the extension and click “Activate cashback” for this site. But this option does not work with all stores, so to be on the safe side, it is better to use the first method.

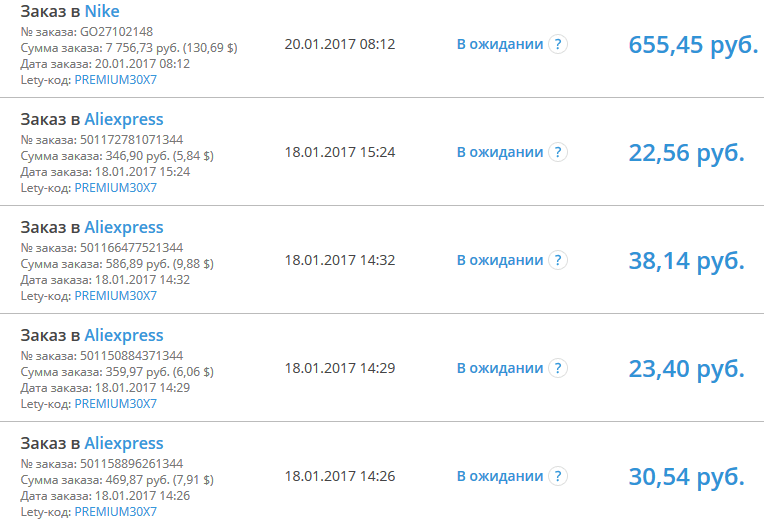

Over the past few days, I have made several small orders on AliExpress through this service, and this morning I bought some fitness equipment from the Nike store. All cashbacks immediately appeared in my account.

For some stores, cashback amounts do not appear immediately after purchase, but a day later.

The money accumulated on the balance in this way can be withdrawn in about two months. This is done to protect against unscrupulous customers who, having received cashback, can cancel their purchase in the store and thus be able to return the money for the purchase and receive cashback.

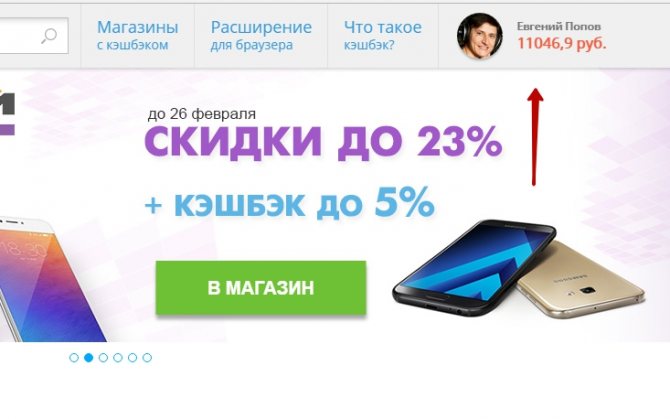

Updated

For a month of using the service, I managed to return more than 11,000 rubles

Overall, the service is decent and definitely worth a try.

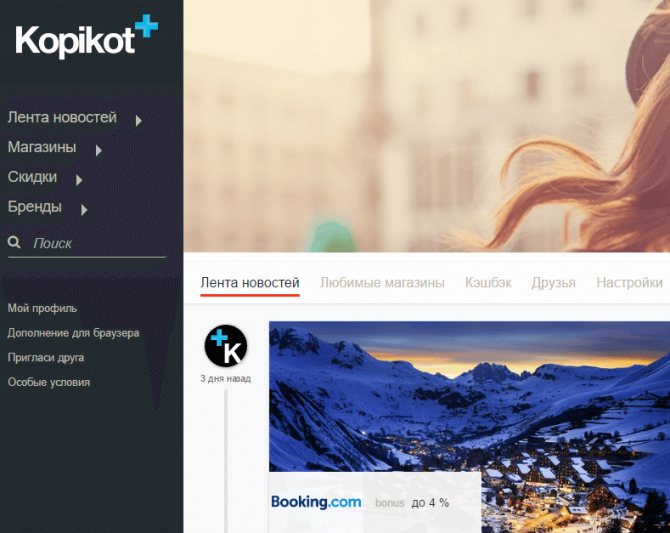

2. Kopikot service

This service was one of the first to appear on our market, and previously I used it mainly. There is also a huge number of shops, hotel booking sites, airlines, etc.

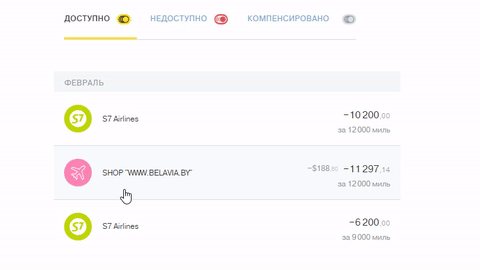

I received my biggest cashback through Kopikot, having purchased air tickets through them on the Etihad Airlanes website. Screenshot of what the list of cashbacks looks like in your personal account:

The operating principle of this service is exactly the same as the previous one. Go to the service website, log in with your username and password, select the desired store and go to its website. When you make purchases, you will receive a portion of the money in your Kopikot account. These two services may have different percentages of the amounts that the service returns to your account in certain stores.

Money can also be withdrawn to a card, Webmoney, Yandex.Money and other options. The service also has extensions for browsers.

You can register for the service here.

These services operate on a win-win basis, so I personally think that this is a very good solution that should definitely be used.

By the way, another non-obvious advantage of using these services is that by choosing a store from their catalog, you can be sure that this is a serious store and you will not be deceived there.

Combining cashback services and a bank card with a miles return function

I think you have already guessed that no one forbids you to use both methods described in this article at once. For example, I pay for all purchases I make through cashback services with my AllAirlines card.

Thus, part of the funds is returned to me by the cashback service, and 2% is returned in miles back to the card.

A little math.

This morning I bought myself some fitness equipment from the Nike online store. It cost me 7,757 rubles. Thanks to the fact that I switched to the store’s website through Letyshop, the store returned 655 rubles from my purchase. I paid for my order with my AllAirlines card, which will allow me to get about 155 more miles (count rubles).

In total, thanks to these two tools, today I was able to save 655 + 155 = 810 rubles .

And in a year, thanks to these two instruments, it is possible to return a decent amount, which can be spent, for example, on vacation or invested somewhere. Now you have the opportunity to return part of the money from any purchases. I hope this material was useful to you. I would be grateful if you share the link to this article with your friends and colleagues.

And if you know other solutions in this area, please share them in the comments.

Well, according to tradition, a small inclusion from life so that you do not forget that on the other side of the screen there is a person just like you)