An integral part of the financial activities of any commercial enterprise are cash transactions, which can be associated both with direct profit and with the internal work of the enterprise (payment of salaries, bonuses, vacation pay, etc.). Accordingly, the financial activities of companies depend not only on the accountant or financial director, but also on such a seemingly inconspicuous, but very important specialist as the cashier.

An integral part of the financial activities of any commercial enterprise are cash transactions, which can be associated both with direct profit and with the internal work of the enterprise (payment of salaries, bonuses, vacation pay, etc.). Accordingly, the financial activities of companies depend not only on the accountant or financial director, but also on such a seemingly inconspicuous, but very important specialist as a cashier .

Let us note that the modern cashier has long not only accepted and issued money, but also performed a number of job responsibilities that require representatives of this profession to have certain knowledge, skills and personal qualities, which we will talk about today. We will also tell you about the most significant advantages and disadvantages of working as a cashier, which will help you decide on the choice of your future profession.

A little history

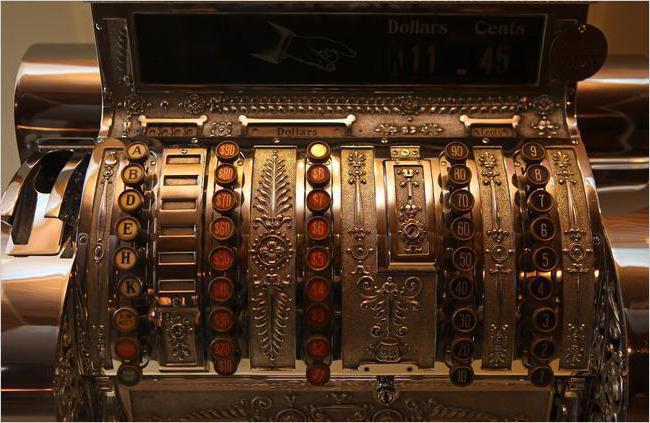

The cashier profession began with treasurers and clerks, who described and distributed property captured by the troops. Cashiers as we imagine them now appeared in the 19th century, when the Ritti brothers, Americans, invented the prototype of the modern cash register.

Since then, of course, a lot has changed, and now the job of a cashier rarely consists only of accepting and issuing money. Most often, in modern companies, the position of a cashier is combined with the position of an accountant, operator, controller, or bank employee. The requirements for such financial specialists are different. The general requirement is increased attentiveness, because their work involves money.

Is the use of a cash book and orders relevant?

The traditional category of documents that are maintained when working with cash register systems includes the cash book, receipts and debit orders. In order to understand the issue of the relevance of their application, you can refer to the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U.

In this approved regulatory document, all enterprises that carry out cash transactions are required to use two types of orders and enter all information about cash flows into the cash book. This must be done for any operations involving the circulation of cash through the cash desk of a business entity. The rule must be observed even if the cashier’s workplace is equipped with modern equipment, which automatically transmits all transaction data to the tax office through a fiscal data operator.

Organizations must use unified forms of PKO, RKO and cash book, which were approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Unlike large companies, individual entrepreneurs are exempt from this obligation and do not have to fill out a cash book and related orders. However, they are still required to keep a ledger of income and expenses. This is an analogue of a cash book, which reflects all transactions for issuing and receiving cash. If an individual entrepreneur uses an online cash register to conduct his business, then he needs to fill out the book daily, otherwise - as funds arrive.

Most often, in practice, PKO and RKO are filled out by entrepreneurs at the end of the working day. After closing the shift, the cashier fills out incoming and outgoing cash orders, as well as the cash book according to the printed Z-report.

A cashier who works with an online cash register needs to remember that when filling out a receipt order:

- Execute as many PKOs as there are types of cash transactions reflected in the report generated at the end of the shift. In this case, you should pay attention to the details “payment method attribute” and “account attribute” . Thus, for transactions that reflect payment of the full cost of goods, you need to fill out one order, and for advances, another.

- If a return of goods was issued during the shift and the “return of receipt” , the expense note is not filled out. However, the refund to the client must be reflected in the cash documents. To do this, a receipt order is drawn up, reduced by the return amount.

When starting to work with an online cash register in a large trading organization, the cashier must remember that the cash balance in the cash register should not exceed the limit established by the management of the organization. Any amount of cash can remain at the cash registers of small retail outlets and individual entrepreneurs.

Job responsibilities of a cashier-operator

For example, there is such a position as cashier-operator. This is an employee who, in fact, is the face of the bank, because he is the first one that clients see.

The cashier-operator conducts transactions with customer deposits. The list of what a bank teller should do is quite extensive:

- carrying out operations for receiving and issuing cash to the client;

- conducting operations and issuing bank plastic cards (both debit and credit);

- checking the authenticity of banknotes;

- cash control;

- preparation and maintenance of cash reports;

- transfer of money for collection.

In addition, some banks may introduce additional requirements. The job responsibilities of a cashier in a bank may include knowledge of foreign languages, specialized education, and knowledge of orders from the Bank of Russia. Much depends on the specifics of the bank’s work. The cashier can maintain, open and close deposits of both individuals and legal entities, process money transfers, check the authenticity of signatures and the correctness of documents, and maintain daily documentation. If the cashier conducts transactions with foreign currency, the employer will require the employee to have a foreign currency cashier certificate.

Operating mode

The employee complies with Internal Labor Regulations , which should not contradict labor legislation in the part that determines working time standards.

In trade, different forms of work - daily (6, 8, 10 hours), around the clock, in shifts.

When in shifts , a working time schedule is drawn up indicating the names of the sellers.

If an employee works overtime , or working conditions, in accordance with the classifier, are recognized as harmful to health, he is entitled to an additional payment, which is calculated according to legislative standards and is issued as an increase to the basic salary.

Bank teller. Pros and cons of work

Of course, being a bank teller is quite prestigious. For some, the very fact of working in a bank gives them a feeling of confidence. For others, such work is just the first step to starting a fast-paced, ambitious career. After all, history knows a huge number of examples when the most famous bankers and financiers began climbing the career ladder from the position of cashier. But despite the fact that it is an honor to be a bank teller, such work also has a number of disadvantages. Cashiers bear great responsibility for the safety of funds, including material ones. In the workplace there are constant rush jobs, a tight schedule, a large amount of work, high workload, and a negative psychological background. There is also a risk of robberies, which should not be forgotten.

What is a calculation sign

A settlement attribute is a detail that can reflect the following information:

- If the attribute “receipt” , then it reflects the fact of receiving money for a product or service from the buyer. This operation is most often carried out when the buyer interacts with the cashier. She confirms the fact of payment.

- When the “receipt return” , funds are returned to the client for the returned goods. Returns are most often made if the product does not fit in size or is of poor quality.

- “expense” attribute should be selected by the cashier when the store buys something from individuals, for example, farm products.

- The sign “return of expenses” means that the visitor returned the previously received cash to the store. Such details can be seen on a fiscal receipt when a store returns a product purchased from an individual.

It should be noted that the attribute “settlement attribute” is mandatory for reflection in the fiscal receipt, both in paper and electronic form. Ensuring this requirement is not always within the competence of the cashier, since a programmer or other specialist with the appropriate specification is most often responsible for the algorithms for entering details.

The main responsibilities of a cashier in a store

In other organizations, cashier job descriptions look a little different. For example, a cashier in a store combines the functions of a cashier and a salesperson. Maximum attention is also required from him. But, in addition to this, the employer will require knowledge of a computer, office programs, 1C, cash discipline, and the procedure for preparing cash documents. Although work experience is often not required, skills in working with a cash register will only be a plus. In general, the main job responsibilities of a cashier in a store look like this:

- accepting money (cash and non-cash) from buyers for goods;

- ensuring accounting and safety of money in the cash register;

- checking the authenticity of banknotes, including using special equipment;

- maintaining a cash book;

- handing over money for collection to a senior cashier or collector;

- preparation of cash reports.

To get a job as a cashier in a trading company, it is enough to take specialized courses to obtain the necessary skills. It is not necessary to graduate from a specialized university. But if the employee has the following specialties: “Economics and Accounting”, “Finance and Credit”, “Banking”, “Commodity Research and Quality Examination of Consumer Goods”, he can apply for the position of cashier.

Started working with a cash register

A new employee who has received permission to work with an online cash register must perform his job duties in accordance with established rules from the very beginning of the operation of the device. Before starting to accept funds, the cashier must receive the cash register for official use.

To do this, you need to perform a number of actions:

- get the keys to the cash drawer;

- accept change money;

- check the presence of all the elements that the cashier needs to fully work with the online cash register.

In order to start working, the cashier must open a shift. The procedure must be reflected in the cash register. To do this, the employee will need to print the first shift opening report. This document will be automatically transferred in electronic form to the OFD. It will reflect data about the cash register equipment and the cashier who opened the shift.

Accounting for the change money that an employee received before starting work is kept outside the online cash register. For this purpose, special accounting forms are provided (cash books, incoming and outgoing cash orders).

Senior cashier. His job responsibilities

There are a lot of cashiers in large grocery stores or hardware stores. In shopping centers there is such a position as a senior cashier. His job responsibilities include organizing the work of other cashiers. He carries out the following work:

- if necessary, changes the cashiers' work schedule;

- promptly notifies them of new regulations;

- brings to the attention of the manager information about the appearance of an employee in a state of intoxication;

- Ensures proper operation of all cash registers;

- if cash registers malfunction, makes a request for their repair;

- issues the required amount of consumables (cash tape);

- conducts training for new cash desk employees;

- provides cashiers with the necessary small change;

- at the end of the shift, takes the Z-report from the cash registers;

- provides a report to the chief accountant.

How can a cashier close a shift?

When working with an online cash register, the cashier needs to remember that the shift can be closed no later than 24 hours after opening. If you violate this condition, the cash register will automatically be blocked and will not issue receipts.

To close the cash register, you need to generate a special document, which is a report that will be transferred to the OFD. It should contain the following information:

- the number of checks that were generated during the entire shift;

- the number of fiscal documents generated by the cashier, but not transferred to the fiscal data operator;

- cashier information.

After the report is generated, the cashier must hand over the proceeds to the collector or other responsible employee. After this, you must turn off the cash register and hand over the remaining property that was received to perform your official duties.

Clean water cashier

In the understanding of most, the “classic” position of a cashier is a cashier-controller. He deals with cash payments to customers, sells and issues subscriptions and tickets. The work of such a specialist is not always carried out in a certain place; controllers with a portable cash register can accept payments for services from the population, for example, for electricity and other utility bills.

The job responsibilities of the cashier controller are to determine or calculate the appropriate fee, accept funds, and issue a check. Cashiers are financially responsible people, so they will be liable for every mistake with a fine from their salary.

Relationships with other employees

The cashier-seller reports to the head of the enterprise (entrepreneur), maintains working relationships with other specialists in accordance with the rules of the job description.

He does not have the right to give orders and instructions to the sellers of his or another shift, unless a special order from management is provided for this case, but he can report to the director about cases of violations of labor discipline.

Is cashier a female profession?

The cashier profession is considered quite common, and it is believed that it is most suitable for women. Maybe because the profession is quite monotonous and monotonous? Cashiers are often the face of the company, because they are the ones who meet and see off guests, and women are better at being friendly. Be that as it may, both men and women, with their pleasant appearance and friendliness, are able to create a favorable impression of the company. Therefore, when choosing for this position, employers will give preference to a sociable person.

Short description

Conventionally, the cashier profession can be divided into several groups, which are determined by the field of activity:

- ordinary cashiers-controllers. Such specialists work in stores, cinema and theater box offices. They punch the goods manually or using a barcode scanner, add up the total, accept money from the client, give change, as well as a receipt;

- cashiers-operators. They work in the banking system, carrying out relevant operations. They are responsible for maintaining the banking database, making data and changes to it.

The first type of profession does not imply career growth, but in the future, operations officers can take the position of department head. Cashiers working in the field of sales can combine their main field of activity with additional responsibilities, for example, performing the functions of consultants, salespeople, sales floor employees (display of products, price tags, etc.).