What is a court order

According to the Civil Procedure Code of the Russian Federation, this is a resolution based on an application for the recovery of finances or property from the debtor, made without hearing the arguments of the parties. This is an executive document, the basis for the commencement of actions by bailiffs. The law establishes that the maximum amount of recovery cannot exceed 500,000 rubles.

Issued by

The document is prepared by a judge who makes a decision on the submitted application after familiarizing himself with the circumstances of the case. A court order for debt collection is intended to resolve disputes only in situations where one of the parties is clearly right. In other cases, debt issues are considered only through a lawsuit.

Differences between a court order and a decision on a claim

In the first case, the result will be clearly in favor of the creditor, because the decision is made on the basis of indisputable documents (mortgage agreement with the bank, etc.), and the debtor is not summoned to the court hearing. For this reason, the procedure for preparing and issuing a writ of execution is much faster.

In a lawsuit, the circumstances of the case are considered and the opinions of the parties are heard, so it is initially unknown whether the demand for debt repayment will be satisfied or rejected.

Pros and cons of writ proceedings

For the applicant:

- Pros : a quick, guaranteed decision in his favor, when the debtor’s excuses are not taken into account.

- Disadvantages - return only the debt itself without fines and penalties, which can constitute a significant share of the total amount.

For the debtor:

- Pros : saving time due to the fact that you do not need to participate in court hearings. It is also important that the amount of the recovery will not increase during the consideration, as happens with a traditional claim.

- Disadvantages - the inability to influence the course of the process, the outcome of which will obviously not be in his favor.

What is an application for a court order, and what are the requirements for it?

You cannot simply come to court and demand a court order because your rights have been violated. You need to contact the judge based on the rules of jurisdiction, submitting an application where you indicate the essence of your problem, and with the help of which you can repay the debt.

What is this statement?

If we talk about it purely within the framework of the law, then all the requirements regarding its preparation and submission are contained in Articles 123 - 124 of the Code of Civil Procedure of the Russian Federation.

This is also important to know:

What consequences await the debtor in case of bankruptcy of individuals

We will tell you about this more simply.

An application for a debt collection order is a document that you submit to the court in cases where you have become a creditor and are faced with a debt. Simply put, you were not returned the money you lent or the money you were required to pay.

So that you do not have to seek justice for a long time, the legislation of the Russian Federation provides for the submission of applications for the issuance of an order, which will help you resolve the conflict in a matter of days.

Where to apply with this application?

To find out where to submit an application, let’s look at the Code of Civil Procedure, Article 123. According to the rules of jurisdiction, applications for an order must be submitted to magistrates.

But, of course, not to any judicial body you like. As a general rule, the application is presented in the territory of residence of the debtor, that is, the defendant. In this case, the automated system “Justice” will help you find the court address.

How long does it take to process an application?

Since we are talking about summary proceedings, when the magistrate has all the circumstances of the case that clearly indicate the defendant’s guilt in the debt, the process of issuing an order takes only 5 days.

But keep in mind that the application must actually have grounds for issuing an order. If there is even the slightest inaccuracy in the case or there is a dispute, then you will have to file a statement of claim. Claims are processed as usual and may take much longer due to the circumstances of the case.

What kind of debt can I apply for? Unfortunately, not everyone who is faced with debt can file a petition.

To have this opportunity, you need to take into account all the requirements for submitting such a document:

- You can only receive an order to collect debt if the amount of the debt does not exceed 500 thousand rubles.

- In order for a judge to issue a writ of execution in your favor, he must have grounds to confirm your words, that is, some evidence documents. They may be an agreement on the provision of a debt or the calculation of a certain salary. In general, all those papers that actually confirm the transfer of funds by you in debt. The main condition is that these documents must be in written form. The judge will not consider applications that involve oral agreements. Only contracts that are in simple written form or certified by a notary are accepted.

- Debt collection is subject to situations where the debt was not repaid, the employer evaded paying wages, or the debtor did not pay for utilities for a long time. We will look at examples of statements regarding these situations a little later.

Now let’s answer one of the most important questions - what is needed to approach the judge with such a petition?

Firstly, you definitely need to compose the application itself correctly. It is better to do this by referring to the Code of Civil Procedure of the Russian Federation, which clearly states what the application should contain.

The text of the statement consists of several paragraphs:

Document paragraphDescription

| 1. Hat (upper right corner) | • Name of the court where the application is being filed. • Name of the plaintiff, that is, the creditor submitting the application (full name and place of residence). • Name of the defendant, that is, the debtor (full name and place of residence). |

| 2. Applicant's requirements | A brief explanation of the situation and reasonable claims against the defendant. |

| 3. Document on the basis of which the application is submitted | A brief description of the drawn up agreement on the basis of which you are making your demands. |

| 4. List of documents | A list of documents with which you support the application (agreement, receipt of payment of state duty). |

In addition to fulfilling the mandatory conditions for drawing up the document, it is important to pay for its presentation. After that, attach a receipt for payment of the state fee.

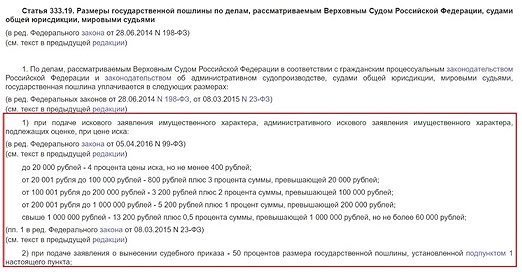

The cost will depend on the cost of the claim you could file against the debt. What does it mean?

The Tax Code of the Russian Federation, Article 333.19 states that in such situations the state duty must be paid 50% of the cost of the claim, if there were one. The cost of claims of this nature is determined by the first subparagraph of the named article. In your case, you need to calculate what the cost of the claim could be and pay half of it.

Before moving on to sample statements regarding debt collection, I would like to clarify an important detail. All such petitions are submitted to magistrates, and the rules regarding their filing are the same. But there are also exceptions.

If the case relates to a debt that is subject to consideration in an arbitration court, then the paper must be submitted to the arbitration court. The processing time for applications in such authorities is faster - in just 5 days. The difference also lies in the maximum allowable amount of debt - no more than 400 thousand rubles.

In what cases is a court order issued?

A prerequisite is the indisputability of the requirements put forward by the applicant. This means that his claims are legitimate, and there are no objections from the debtor. For example, the company does not pay wages, although the employer is required by law to do so. In this case, the claims are indisputable, the arguments of the organization’s management are unprincipled and the obligation must be fulfilled.

Legal situations in which a court order can be used are defined in Article 122 of the Civil Procedure Code of the Russian Federation (Civil Procedure Code of the Russian Federation):

- Transactions certified by a notary. It does not matter whether notarization is required by law or whether it is provided for by agreement of the parties (for example, if the money was lent against a receipt).

- When a notary challenges securities (bills, acceptances, etc.).

- Collection of alimony for minor children, when there is no need to establish or challenge paternity, the demand is stated in hard cash and agreement has been reached on the place of residence of the children.

- Fully or partially unpaid wages. A prerequisite is that the organization’s accounting department must accrue this money.

- Transactions in simple written form. The contract must necessarily have the components established by law (date and place of conclusion, payment deadline, etc.)

- Compensation for her delay in wages, vacation pay and other amounts due to employees by law.

- Debt in payments for apartment maintenance, utilities, telephone communications.

- Debts on payments, membership fees to partnerships or cooperatives.

Possible difficulties in debt collection

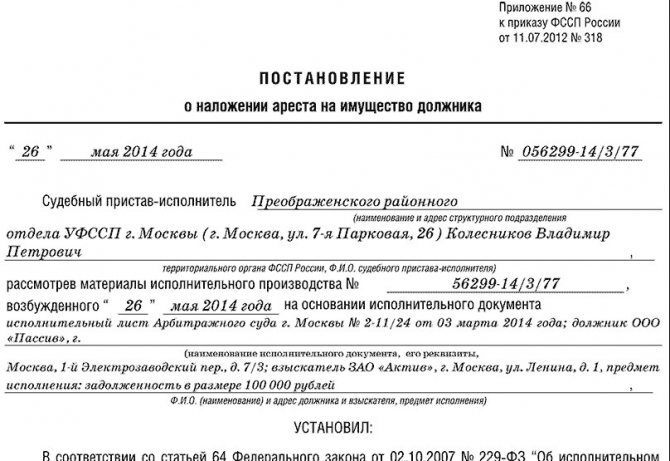

In cases where a debtor is hiding from paying a debt, the bailiff has the right to put the citizen on the wanted list, as well as to involve the Ministry of Internal Affairs and the tax office. The search for the debtor is carried out thoroughly, starting from the place of residence and addresses of relatives, and ending with the workplace. Representatives of the FSSP are authorized to conduct searches from 6 a.m. to 10 p.m. If the debtor is absent from his place of residence, the bailiff undertakes to send the citizen’s property for storage.

Bailiffs have the right to seize any property that is not “vitally necessary” or “a means of earning money.” It is also impossible to seize an apartment if it is the only home of the debtor and his family, with the exception of collecting mortgage debt. The seized property is recorded in the inventory report and signed by attesting witnesses.

This is also important to know:

What is the on-site collection group from Sberbank?

If the bailiffs cannot collect the debt within three years, they will be forced to close the enforcement case and notify the plaintiff that it is impossible to collect the debt. But debt obligations do not have a statute of limitations, so the plaintiff has the right to go to court to extend the writ of execution and re-transfer the case to the bailiffs.

Issuance procedure

- Submitting an application from the claimant to the magistrate.

- Initiation of production. Having received the necessary papers (applications, loan agreement, etc.), the judge considers the circumstances of the case. A mandatory condition for starting legal proceedings is payment of the state fee.

- Making a decision to issue a court order. The judge may refuse if the formalities of the application were not observed (for example, the application for the order was drawn up with violations). After correcting these shortcomings and resubmitting the documents, a court decision can be made.

Consequences of cancellation

The main consequences of canceling a court order:

- Debt collection stops.

- The management company receives the right to go to court through legal proceedings.

- The debtor receives the right to challenge the amount charged by the applicant.

Thus, it is advisable to initiate the cancellation of a court order for utility payments only if you have evidence of the unlawfulness of the debt accrual.

Example. Irina and Kirill are the owners of the apartment with ½ share. Irina regularly pays utility bills. And Kirill created a debt. The management company went to court and collected the debt from the two owners jointly and severally. Irina challenged the court order. When the management company applied for legal action, the woman presented receipts for payment. The court refused to satisfy the applicant's demands.

Application for initiation of writ proceedings

According to Article 124 of the Code of Civil Procedure of the Russian Federation it must be indicated:

- The name of the judicial authority to which the appeal is being made.

- Information about the creditor and debtor.

- Specific requirements for debt repayment.

- Mention of documents providing grounds for recovery.

- The value of the property (if the foreclosure is directed to it, and not to finances).

- List of attached documentation that must confirm the applicant’s requirements.

The application is signed by the claimant himself or a person authorized to do so. If the document is submitted by a legal representative, a copy of the passport must be attached. By law, a submitted application is considered within 5 days.

For an individual

The peculiarity of this type of application is that it must include:

- Last name, first name, patronymic of the person applying to the court.

- Date of his birth.

- Registration address.

- Contact information – phone and/or email.

Depending on the specific situation, you must attach:

- Collection of alimony – marriage certificate, child birth document.

- A transaction between citizens is the original contract. In cases provided for by law, it must be certified by a notary.

- Issuance of wages - a copy of the work record book, a certificate of unpaid funds (it must be signed by the head of the organization or the chief accountant).

- Contesting a bill is a copy of this security.

Collection of credit debt by a bank

If the loan is overdue for more than two months, the financial institution can apply to the court for an order to collect the debt.

The application must include:

- Full name of the credit institution.

- License number.

- Legal and actual address, contact numbers, last name, first name and patronymic of the responsible person.

- Details of the loan agreement.

- Information about credit conditions and the amount of debt.

- Last name, first name, patronymic of the debtor, his registered address and contact phone number.

Regulations for issuance and execution

To obtain an order to collect money or return property at the disposal of an unscrupulous debtor, you need to submit an application in the prescribed form to the court. Lawyers and practicing consultants will help in drawing up this form and will take into account all the requirements and nuances of the laws. The form can be downloaded via the Internet on open portals absolutely free of charge. A sample document is also issued at the court office.

We list the basic details that are required in this application:

- Full name of the court, claimant, defendant.

- The amount of real debt, the volume of claims.

- Documentary substantiation of the claim.

- Calculation of penalties, penalties.

- List of applications.

- Date, signature of the applicant.

The court will refuse to satisfy the application if the form, deadlines, and conditions for its submission are not observed. The arbitrator makes a decision on the return of the appeal without execution within three days. The claimant is sent a copy of the relevant determination. In this case, the creditor is not deprived of the right to apply again for protection of his rights. Then a new case will be opened.

The application must be drawn up in accordance with established rules

Form structure

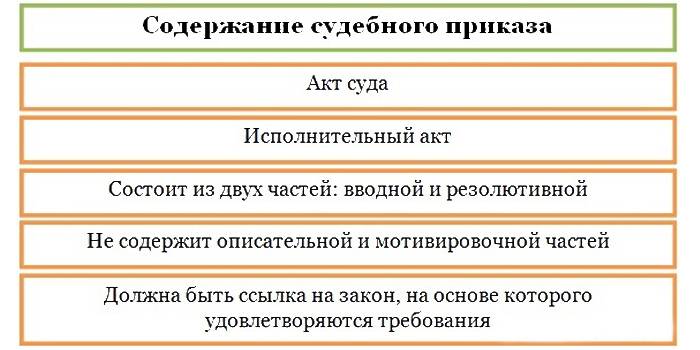

The order is drawn up according to a standard template and contains the following information:

- Number of writ proceedings, date of publication of the decision.

- Name of the territorial judicial authority, name of the executor.

- Information about the parties to the dispute.

- A legal act that allows the claim to be satisfied.

- The amount of debt to be repaid, the list of objects to be returned.

- The amount of sanctions, penalties, fines.

- State duty collected in favor of the creditor, the state.

- Payment details of the collector.

- Arrears repayment scheme.

- Deadlines for debt formation.

In relation to disputes regarding the collection of alimony, information about the children, the debtor’s passport details and place of employment are entered into the document. The form is published in two copies on a sheet with special protection, one remains in the case materials, and the second is transferred to the creditor. The debtor receives a copy of the form, certified in accordance with the established procedure. The amount of deduction is stated as a percentage or hard currency.

Entry into force

When the debtor does not raise objections to the court decision within ten days, it enters into legal force. The procedure for issuing a document is regulated by Art. 130 Code of Civil Procedure of the Russian Federation. The form is certified with an official seal and handed over to the creditor. To obtain the form, the claimant must contact the court office after the deadline for appeal has expired. It is important that the creditor must control the time period independently; a notice will not be sent to him.

After the decision is made, the bailiffs begin work

Upon additional application, the order may be sent to bailiffs for execution. Modern technologies in 2020 make it possible to do this through electronic communication channels, which will significantly reduce the time frame for debt repayment.

If the state duty is not subject to compensation by the debtor, but is due for payment to the federal or regional budget, a writ of execution is simultaneously issued. The template is also submitted for execution to the FSSP, but at the initiative of the court, and not the claimant. It does not matter to the addressee who the form came from.

Implementation of the solution

The execution of a court order for the forced collection of outstanding debt is the prerogative of a special service - the FSSP. A court order is the basis for initiating enforcement proceedings, about which the bailiff issues a corresponding resolution. As part of the case, the civil servant searches for the debtor, his property, housing, assets, and, if necessary, children. The bailiff can visit the defendant’s home address and call him to give explanations.

Next, you should find out, if there is a court decision to collect the debt, what awaits the debtor next. First of all, the recovery is directed to cash. The bailiff sends a request to credit organizations and the tax service to find out whether the defendant owns current accounts, deposits, and whether there is a free balance on them.

When there is not enough money or there is no money, the executor sends a resolution to withhold debts from the income of the defaulter, including wages, pensions, and profits from business activities. Pensioners will not be able to evade legal measures; deductions will come from social benefits. Unemployed citizens will pay off debts using benefits from the state. For workers, a limit on collections from wages has been established: up to 50% for all arrears and no more than 70% for alimony and moral damage.

The last resort for debt collection is the arrest, confiscation and sale of property. In this case, there are restrictions on assets, the recovery of which is prohibited. The full list is contained in Art. 446 Code of Civil Procedure of the Russian Federation. You cannot take away the borrower’s only home, vital items, or awards. The law prohibits the confiscation of seeds and vehicles necessary for the movement of disabled people.

There are special points regarding the execution of orders during bankruptcy proceedings. In this case, the bankruptcy trustee pays off the organization’s debts in register order. Sources of repayment are determined based on balance sheet data.

Bailiffs can withhold funds from almost any source of income of the debtor

At any stage of the dispute, the parties may come to a decision to conclude a forgiveness agreement. Then the debtor’s accounting department will write off the arrears and reflect the transaction with the appropriate entries. Necessary adjustments are also made in the lender's accounting.

Validity period for debt collection proceedings

The order is drawn up on a special form in two copies, certified with the official seal - for the court office and the applicant. A copy is sent to the debtor. If there are no objections from him within 10 days, the document comes into force. The period for submitting a court order for execution is 3 years from the date of issue. If this time is missed, but the claimant has a good reason (illness, injury, etc.), upon re-applying to the court, enforcement proceedings can be resumed.

Collection measures: step by step

Next, we will consider the procedure for debt collection by bailiffs based on a court decision.

Enforcement proceedings

The proceedings begin at the initiative of the plaintiff after filing a corresponding application with the attachment of a court ruling to the SSP (Article 30 of the Federal Law No. 229). Within three days, the service is obliged to consider the application and accept it for work.

If there are similar claims by one or more persons against the defendant, it is possible to combine the cases into consolidated enforcement proceedings (i/p). Enforcement actions are carried out during the day or by agreement of the parties to the claim. The joint venture has the right, on its own initiative and at the request of the claimant, to suspend the progress of the case or extend it.

Notice to Parties

The joint venture is obliged to send to the debtor and the collector a copy of the decision to initiate i/p within the prescribed period. In this case, a five-day period is established for the defendant to voluntarily fulfill his obligations to the plaintiff. If after this period the debt has not been repaid, the enforcement procedure begins and the enforcement fee is calculated.

Assessment of property status

The SSP is authorized to send a request to the debtor to provide information about property, as well as to receive information from government agencies (State Traffic Safety Inspectorate, Rosreestr, Federal Tax Service, etc.) about the availability of property in the person’s possession. The defendant’s property includes real estate, cars, money, shares, jewelry, land, etc.

This is also important to know:

Collection of expenses for a representative in arbitration proceedings

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Organization of integrity and protection of property

The executor has the right to impose restrictions on registration actions, the rights of the debtor to dispose of property, bank accounts in order to ensure their safety. It is worth noting that the total restrictions cannot exceed the amount of debt presented for collection. Seizure can be an independent enforcement measure (the decree is an order to the bank to collect money from the account) and interim as a tool for protecting property.

Imposition of temporary restrictions and penalties

The joint venture may, at its discretion or at the initiative of the plaintiff, establish a temporary ban on the debtor from crossing the state border of the Russian Federation, as well as limit the right to drive transport.

Regarding the debtor's funds, there are several options for withdrawal in favor of the plaintiff:

- direct debit from an account at a credit institution (bank);

- confiscation from the organization's storage (cash);

- application for wages and other income.

In relation to the debtor's property, there is a forced putting up for auction with subsequent sale and allocation of funds to satisfy the requirements. If the amount of debt is within 30 thousand rubles. the right to sell assets remains with the defendant. Property used to pay off debts is subject to restrictions established by the Code of Civil Procedure of the Russian Federation. The assessment of seized objects is carried out in accordance with Art. 85 Federal Law No. 229.

As part of the restructuring measures, the introduction of supervision in the event of bankruptcy of the debtor, the SSP suspends the validity of enforcement documents, with the exception of the i/p specified in clause 1 of Art. 63, paragraph 2 of Art. 213.11 Federal Law No. 127. The joint venture has the right to foreclose on other assets of the debtor, for example, securities, receivables of counterparties.

Compensation fee

Collection of debts from individuals by bailiffs involves the payment of an enforcement fee. According to current legislation, it is calculated at seven percent of the debt amount. For claims of a property nature, a minimum fee has been established in the amount of one thousand for individuals, individual entrepreneurs and ten thousand rubles for legal entities. Non-property claims will cost debtors between five and fifty thousand, respectively, for citizens and organizations.

Completion

Satisfaction of requirements occurs in legal order. Expenses for enforcement actions and services of involved persons are subject to reimbursement at the expense of the debtor. If there is insufficient funds, the transfer occurs in the order in which claims are filed with the SSP.

This is also important to know:

How interest is calculated for using someone else’s money

After the debtor’s obligations to the creditor are fulfilled, the joint venture issues a resolution on the completion of the i/p.

Appeal and cancellation of a court order

To appeal the decision to collect, the debtor needs to file an application objecting to the court order. If it is significant and weighty, it will be accepted as a basis for canceling the prepared document.

If you agree with the court's decision, the execution of the court order to collect the debt begins. Depending on the situation, this is done by the applicant himself or the bailiff service.

Consequences of cancellation

In accordance with Article 129 of the Code of Civil Procedure of the Russian Federation, the judge will be obliged to:

- Explain to the applicant that his demand can only be fulfilled through a lawsuit. In this case, the court will hear both sides of the case and make a decision based on their testimony.

- Send the applicant and the debtor a copy of the document canceling the court order. No more than three days are allotted for this.

Positive and negative points for the defendant

Writ proceedings do not involve the direct participation of the conflicting parties in the court hearing, so the borrower receives a copy of the document after the fact. Next, you should find out what to do if you receive a court order to collect an overdue debt on a bank loan.

The legislation provides a period for challenging the contents of the document, the amount of claims, and the circumstances of the transaction. This is precisely the first positive aspect of such a trial. The second advantage is that the claimant did not involve collectors in collection. Therefore, no one will intrusively call, write, or threaten. In addition, writ proceedings protect the defaulter from loss of the apartment, since the debt is insignificant.

A big mistake of a defaulter is accepting the contents of the order for granted. You need to carefully familiarize yourself with the amount of debt and the validity of the conclusions. If there is a possibility that the debt arrears will be overstated, you must immediately file a petition with the judge. It is profitable for banks to lend to citizens and then collect debts by order, since most debtors are absolutely unaware of their rights and do not delve into the nuances of claims.

Undoubtedly, it is more profitable for debtors to bring the matter to enforcement proceedings, since in this case the defendant participates in the proceedings and files counterclaims. In addition, the court examines in detail the circumstances of the dispute and confirms the validity of the debt. The borrower will be able to ask for a deferment, installment plan, restructuring of outstanding debt, submit a request for a reduction in penalties, penalties.

Credit organizations are not interested in delaying debt repayment, since the rating and profitability of their activities as a whole depend on the effectiveness of their work. Therefore, banks, in an effort not to delay collection, turn to the magistrate’s court as quickly as possible and, fifteen days later, begin to repay the loans. And the debtor faces the most negative consequences: from loss of money to confiscation of property.

Additional benefits

According to Art. 129 of the Code of Civil Procedure of the Russian Federation, the debtor has the right to appeal the judge’s decision and demand its cancellation. To cancel a document, it is enough to present justified claims, evidence of innocence, and absence of debts. After this, the court cancels the form and invites the parties to the dispute to initiate legal proceedings to resolve the problem.

The debtor can challenge the decision

A big plus of collecting debts by order is the reduced amount of state duty. If a positive decision is made, legal costs are borne by the debtor, therefore, in writ proceedings, the payer will return half the amount of the standard budget fee.

If the defendant fully agrees with the demands presented by the claimant and is ready to pay them forcibly, the order will be the optimal solution. First of all, the borrower does not need to spend time and money on visits to court, and secondly, potential risks and costs are reduced. This means that the debtor will get away with minimal costs compared to the standard court procedure, and will not have to pay lawyers to protect their rights.

Application for a court order for debt collection: 3 main samples

If you are in a situation where you need to return a certain amount of borrowed funds, then it is very easy to do this by applying to the court for an order. The information provided makes this clear.

But so that the case does not drag on, and so that the judge does not deny your claims due to an incorrectly drawn up document, you need to see examples of how such statements are written correctly.

Due to the fact that cases are different, and the types of debts are different, we will consider the most common situations of debt collection and provide current examples of applications for the issuance of a court order.

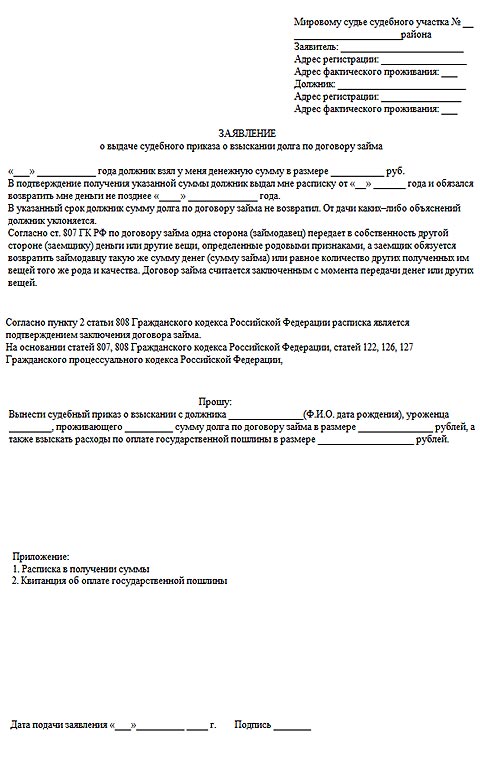

Situation No. 1. Debt collection from citizens who have borrowed money

The most common case of debt collection, for which the issuance of a court order is necessary, is the usual lending of money to acquaintances, friends, etc.

Unfortunately, very often it is these creditors who cannot repay the debt for a long time due to the fact that the debtor either delays the repayment period or simply does not answer phone calls.

If you find yourself in such an unpleasant situation, the judge will issue a writ of execution, so you can quickly return the missing amount.

But in order to appeal to a judicial authority, you need to have grounds for this:

- The amount of debt to be collected must be in the range of 10-500 thousand rubles.

- To confirm what happened, you must have written confirmation that you lent money. This does not have to be a notarized agreement. It will be enough if it is a simple loan agreement, or at least a receipt.

If one of these conditions does not meet the requirements, then, alas, you are unlikely to be able to prove anything. Because always remember the basic rule - issuing an order is possible when there is accurate evidence of the incident.

If they are not there, then all you have to do is write a statement of claim and contact the authorized body with it.

Let's assume that you have evidence and all the requirements in your case are met. Then you send an application to the judge, and after 5 days you receive a ruling. It is addressed to the debtor, and he has 10 days to appeal the conclusion. If it has not been appealed and the debt is still not repaid, the bailiffs begin to act.

Sometimes these things can take a little longer. For example, when the debtor received the notice late or when your application was not accepted due to non-compliance with the requirements.

Application for issuance of a court order for debt collection - sample:

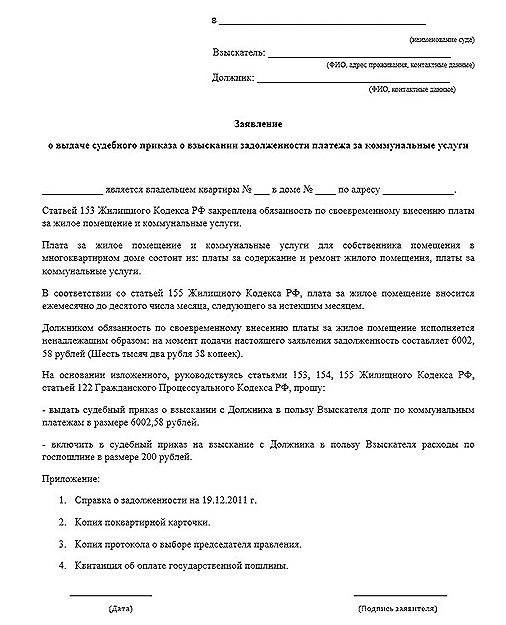

Situation No. 2. Debt collection for non-payment of utilities

Not only individuals, but also organizations can submit a petition to the judge to issue a ruling. Another common story is that a citizen does not pay for utilities, and a housing construction cooperative or management company demands repayment of the debt.

Such debts include non-payment:

- Utilities.

- Telephone connection.

- House contents.

- Mandatory contributions to housing and communal services.

Such organizations can go to court when the debtor has not paid all of the above for more than 3 months, and the amount of his debt has not yet exceeded 500 thousand rubles.

The organization, according to the Code of Civil Procedure of the Russian Federation, must confirm the debt with receipts or invoices, and also provide a document indicating its authority.

In all other respects, the application procedure remains the same.

But it is worth noting that such situations are often very conflicting, and here’s why. The fact is that the person indicated in the contract does not always live in the apartment. And then a dispute arises, because the actual owner or shared owner has been living in another city for a long time.

Remember, if in such a situation you are a debtor, then you need to write an objection so that the order is issued for each individual share owner, and not just for you.

As an example, here is a sample application from the housing cooperative:

This is also important to know:

How compensation for moral damage is calculated and how it is collected

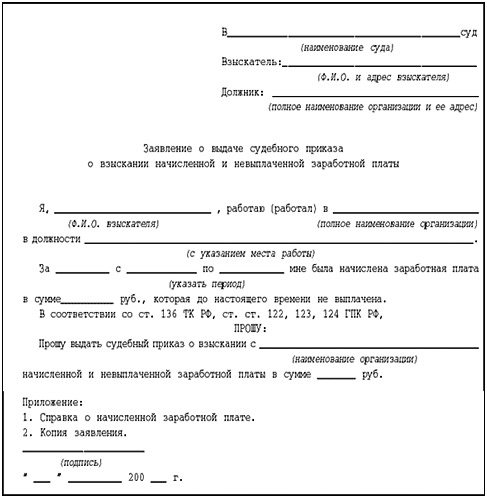

Situation No. 3. Debt collection due to delayed wages

Today, employers try to pay their employees wages on time to avoid conflicts. But different things happen, for example, the company is on the verge of bankruptcy and is unable to pay salaries. What should the employee do then?

In such cases, the employee has the right to apply for a court order, but only if the salary was accrued by the employer, but was not actually paid. What does this mean?

If your employer refuses to pay you at all or claims that you have not yet worked enough time, in short, if there is a clear conflict, then you need to go to court of general jurisdiction. You must defend your interests: you can address a statement of claim or contact the state labor inspectorate.

Let us repeat, if the salary was accrued but not paid, an application for the issuance of an order by a magistrate will be sufficient. The received writ of execution will be sufficient grounds to force the employer to return your honestly earned money to you.

In addition to the accrued salary, you also have the right to ask for financial compensation. This right on your part is enshrined in the Labor Code, Article 236.

Having submitted an application, you wait for the issuance of an order, after which the bailiffs carry out their actions, if the case has not been appealed.

An important nuance: remember that in all cases of debt collection through the court, you agree to pay a state fee. But if you are an employee who has not been paid a salary, then you have some benefits and are exempt from paying it (Article 333.36 of the Tax Code of the Russian Federation).

Sample of a current statement when wages are not paid:

Procedure for notifying the debtor

Most often, courts notify defendants of their decision by mail. A copy of the order is sent to your home address by registered mail with notification. As soon as the debtor signs for its receipt, the 10-day period sufficient for appeal begins.

If the defendant did not receive the letter (ignored the notification), then it is returned to the court, and the period for the order to enter into force begins from this date.

In practice, the creditor rarely waits 10 days and is not at all interested in whether the defendant has received his copy of the order from the court. He simply takes it to the bailiffs, and they open production.

If the borrower does not agree with the court decision, then failure to comply with the terms of entry into force will serve as one of the reasons for canceling the court proceedings. However, the order itself will need to be challenged separately.

The statute of limitations for the order is 3 years. If during this period the creditor does not take any action to collect the debt, then it becomes invalid.

Where to see if there is a court order for debt collection

There are several options for where to view a court order for debt collection:

- on the FSSP website in the Enforcement proceedings section;

- on the website of the local magistrates court;

- at the clerk's office in court.

You can view the availability of a court order to collect a debt in your name on the website of the bailiff service

The lender also has its own copy. Most often, debtors find out that they became defendants in court and lost the case from the creditor or from the bailiffs. And the only document they see is the bank's copy.

To get your sample and try to protest it, you need to contact the office and apply for a court order to collect the debt. Since the court sent the original by mail, such applicant will be issued a duplicate, about which there will be a special notification.

But from a legal point of view, the original and the duplicate are equivalent, so there is no problem with this.

Actions of the debtor when issuing a court order

Having received their sample court order to collect the amount of debt, defendants begin to panic and do not know what to do.

Strictly speaking, there are only two options to respond here:

- repay all outstanding debt within the specified time frame;

- appeal the decision and get the court order overturned.

Most often, debtors, having seen the order, prefer not to get into trouble and pay everything due. This is done simply by transferring funds to the bank details attached to the document.

Be sure to take your copy of the order signed by the cashier or a check - this will serve as proof that the debt has actually been repaid (it will help if the payment got stuck somewhere and did not reach the creditor).

Statistically, debt collection through a court order is the most effective way to achieve payment. People prefer not to deal with the courts and urgently find the money they need.

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

But in fact, it is possible to appeal the order. And it’s even necessary if the lender charged too much interest or made a mistake. This will help achieve a more adequate consideration of the situation.

It happens that a court order is issued to the wrong person - in this case, of course, there is no need to pay anything.

What to pay attention to when applying to the Magistrates' Court

For a document for issuing a court order, only if the requirements can be supported by documents that prove the existence of a debt.

Such documents include:

- a contract or agreement certified by a notary;

- cash loan receipt;

- alimony obligations that are confirmed by documents (not disputed in court).

You can also recover arrears of tax payments or other mandatory payments, wages, benefits, pensions and other payments that are delayed.

Although in the case of a court order, the collection of alimony in a fixed sum of money and compensation for moral damage is unacceptable. These claims are collected through a statement of claim; other grounds for applying for a court order are specified in the Code of Civil Procedure of the Russian Federation.

If a statement of claim is drawn up, the parties are called the plaintiff and the defendant, and in the case of a court order, the claimant and the debtor. The application for the issuance of a court order is signed by the claimant or the claimant's representative, then a power of attorney must be attached to the application.

The state fee for issuing a court order is 2 times less than for considering a claim, and it depends on the amount of recovery.

Attention! Once a court order is issued, legal costs can be reimbursed.

Court orders are issued by a magistrate, and a request for its issuance is submitted at the place of residence of the person from whom the debt is required to be collected. In some cases, it is possible to send an application to the place of residence/location of the person on whose account the collection will be made.

This is also important to know:

How receivables are written off due to impossibility of collection

After the court district receives an application for a court order, the judge examines in detail its compliance with the law, the availability of all necessary documents and the grounds for its issuance.

If everything corresponds, then a court order is issued within five days from the receipt of the application, which must be sent to the applicant and the debtor. After it enters into legal force, the document is transferred to the bailiff service to initiate enforcement proceedings.

Watch the video. How to obtain a court order for alimony:

Benefits for the borrower-debtor

For the claimant, summary proceedings have undeniable advantages: the state duty is 50% of the standard amount, the decision is made quickly, and the stated claims are satisfied in full.

This is also important to know:

How interest is calculated for using someone else’s money

For the defendant, the form of traditional litigation is more beneficial.

This is explained by the opportunity to participate in court hearings, get acquainted with the plaintiff’s demands and the evidence presented by him, file a claim with counterclaims, ask for a deferment or installment plan for the execution of a court decision, and seek a reduction in the amount of fines and compensation payments.

If the debtor fully agrees with the nature of the claimant’s claims, then the simplified legal procedure will suit him, since it will halve the cost of paying the state duty, save time and nerves, because there is no need to appear in court. In addition, the claimant will not be able to increase the amount of the claim.