How to legally deal with debt collectors and get rid of intrusive calls?

In the minds of Russian residents, collectors are bandits who “extort” debts from borrowers by illegal means. Unfortunately, people have this opinion for a reason. The actions of collection agencies often go beyond the law - threats, psychological pressure and strong intrusiveness appear. We'll tell you who debt collectors are, why they call about other people's debts, and how to deal with them legally.

Who are collectors?

Collectors are agencies involved in pre-trial debt collection. Many people mistakenly believe that the actions of such institutions are illegal, that they do not have the right to engage in any activity without the consent of the borrower. This is wrong. The Civil Code provides for the transfer of credit claims to third parties. This can be done without the borrower's consent. An agreement to assign claims is called an assignment.

How to check that the collector told you the real amount of the debt

— Here you need to understand that there are collectors from agencies, and there are bank employees from the pre-trial collection service. It is necessary to distinguish between these concepts. If the debt under the assignment of claim agreement was transferred to a collection agency, then there is no point in calling you to the bank, because your debt has already been sold.

Such organizations buy out the debt for a certain amount, after which they become its holders. And if someone goes to court against you, then it will be a collection agency, not a bank.

If we are talking about pre-trial collection of the bank, then you need to contact the credit institution itself and clarify the amount. You have the right to receive a certificate about the status of your debt for a specific period, because you still continue to be a client of the bank.

Why do banks give debt to collectors?

Before you get rid of sewers, you need to understand where they came from. Banks and credit institutions rarely collect debt themselves. This happens for several reasons:

- Lack of staff for pre-trial collection. That's why collectors call us, and not the bank employees from whom the loan was taken.

- Preserving reputation. Collection is accompanied by actions that often go beyond the law: employees carelessly said the wrong thing, called at the wrong time, did not introduce themselves properly, etc. A third-party company is another matter. It creates a reputation among credit institutions. Consequently, a negative assessment in society does not affect her income.

For these reasons, banks enter into assignment agreements. The conditions in each specific case are individual. In most cases, collection agencies buy debts in bulk, in batches, paying 10-15% of the value of the debt for them. It is more important for banks to get rid of unnecessary liabilities than to bargain with collectors, since the volume of overdue debts worsens their rating in the eyes of the Central Bank.

Is the activity of debt collectors legal?

Collection agencies are legal organizations whose purpose is to force the debtor to fulfill loan obligations. Often, agency employees “cross the line” and instead of civilized communication with the debtor and persuasion to get rid of the overdue loan, they sometimes descend to threats, blackmail and outright extortion. Of course, not all agency representatives adhere to this style of work, but there are many overzealous employees among them.

Collection services can act on the basis of two types of agreements with credit institutions:

- Assignment agreements.

This is what is officially called the assignment of claims. In simple terms, the financial institution resells your debt to debt collectors, giving them the legal right to demand repayment of the debt. - Agency agreement.

In this case, the bank simply hires debt collectors to interact with debtors. In this case, the citizen remains in debt to the bank, but demands for payment of loans will come from collectors, and not from specialists of the financial organization.

Considering the basis on which the collection service operates, there are various options for how to protect yourself from annoying debt collectors. Let's consider all the ways available to citizens to solve the problem.

What does a borrower need to know about an assignment agreement?

It is important to know that the borrower himself cannot influence the assignment agreement. This means that such a concession is completely legal. How to get rid of collectors in this case? The fact is that the borrower must be notified that the lender has changed. According to the civil code, this is the responsibility of the credit institution that issued the loan. In other words, if your debt was transferred to a third party, then the bank, and not the collectors, is obliged to notify you about this. In practice this rarely happens. Banks sell loans, especially small ones, in bulk. Consequently, they rarely follow the letter of the Law and warn the borrower properly. How to get rid of collectors in this case? It is enough to declare officially, in writing, to the agency that demands repayment of the debt that their demands are illegal, citing the fact of ignorance.

How to find out how much you really owe

- To find out for sure, collectors need to be forced to sue you. Otherwise, there will be no guarantee that you were not asked to pay more. It is important that they are the ones suing, not you. Collectors apply to the magistrates' court for a court order - there is a document that collects a debt from you for a certain period. But again, it does not guarantee termination of the loan agreement. You have the right to cancel this court order within 10 days.

Credit. Wallet.

CC0

The creditor has the right to file a claim in court to collect this debt. This opportunity remains with him. And only when the court proceeds directly on this statement of claim, where the real amount of the debt is indicated accordingly, then the repayment of this amount guarantees you the termination of the loan agreement, or the direct termination of the agreement that is with the collectors. There will be a very detailed calculation of this amount.

Secondly, we mentioned this above, it will be possible to apply the consequences of missing the statute of limitations, that is, part of the amount (and sometimes the whole amount, we have this practice) simply write off. Because for each late payment you make, your statute of limitations expires. And, as a rule, collectors end up in court late - not always, of course, but very often.

The main argument is violation of notification

Anyone can call and demand any debts. It is therefore important that the borrower is formally and properly warned. The main mistake of citizens is that they try to please the collectors and begin to explain something to them, thinking that at the other end of the line there is an understanding and kind person who is able to put themselves in the position of the borrower. This is wrong. The collector's goal is to extract as much money from you as possible.

They are not interested in what difficult financial situation the borrower finds himself in, how many children he has, whether he is sick, etc.

Therefore, if possible, you need to talk to them as privately as possible, referring to various laws and codes. After the borrower submits an official statement to the collection agency, you need to hold out for 30 days. This is exactly how much time the organization has to agree on all the documents and make a decision. The appeal must indicate the illegality of the actions, since no one properly warned the borrower about the assignment agreement. Remember that the collectors themselves do not provide such information over the phone, no matter how convincingly they claim it.

How to build a conversation with a collector and what arguments to give?

No matter what you tell the collector, it will not lead to obvious and visible results. Let us remind you that the collector’s task is to exert the most severe psychological influence on the debtor. The collector's goal is to shame and intimidate. Be polite, but don't let your interlocutor know that you're nervous. The conversation needs to be structured in such a way that the collector does not want to call you again. Ask questions. Remember the rule - whoever asks is in charge.

During the first conversation, ask for the last name, first name, patronymic, position of the caller, and clarify how he plans to confirm that he is exactly the person he claims to be. Ask about the name of the collection agency, their INN and OGRN, the agency's landline telephone number, the name of the financial organization whose interests it represents, which is the basis for contacting you.

If the caller refuses to answer your questions, there is nothing more to say. We turn off the phone and add the number to the “black list”. With modern technical equipment, it costs nothing to record a conversation with a collector. Warn that the conversation is being recorded and you will provide the audio recording as evidence to the supervisory authorities. If you realize that the conversation has reached a dead end, and this most likely will happen, politely say goodbye and hang up. Why listen to insults and threats addressed to you? We are civilized people and will go a different way.

The best way is to contact the prosecutor's office

If after a month you have not received any notifications or responses from the agency, but collectors are still calling, then you can safely contact the prosecutor’s office. It is advisable to attach copies of the requests to the application, as well as notifications of their receipt by the collection agency. However, the lack of evidence is not at all an obstacle to filing a complaint with the prosecutor's office. In this case, law enforcement agencies will request all necessary documents from the organization. The main thing is to state the essence of the problem in the complaint in as much detail as possible.

We analyzed the problem that the debtor himself had. But how can you get rid of debt collectors forever if a citizen has not taken out any loans? More on this below.

How to interact with collectors correctly

- Let's start with the simplest thing. First of all, you must find out the name of the collector - understand who is contacting you. Next, you need to find out what organization this collector works for. This is necessary so that you have a clear understanding of whether you really owe something to these people or organizations.

An equally important point is to clarify the information about what exactly the collector wants to collect from you. You should get information from him about the loan, or about the loan, because collectors mainly collect this.

In addition, you have every right to clarify the contract number, the amount of debt and its structure. For example, the structure: 100 thousand rubles of the principal debt, 20 thousand - interest, and so on.

Wallet, debts.

CC0

Calls from debt collectors should be recorded. This is necessary so that you can subsequently attach them to the complaint, if necessary, and use them as evidence: use the voice recording of the call directly.

Don't forget that before recording a conversation, you must warn the other party about it.

I didn’t take out a loan, but there were problems with collectors

Calls and threats to citizens who have never taken out loans are a common occurrence in our country. There are different situations: they call relatives, neighbors, ex-spouses, employers with demands to influence the debtor. Particularly egregious precedents arise when collectors demand to repay the debt of other citizens from those who have nothing to do with these same debts. Sometimes it comes to threats and physical violence. So, let’s look at how to get rid of calls from collectors to those citizens who are not involved in the borrower’s debts.

How to deal with debt collectors if you are being persecuted for someone else's debts?

No one is safe from calls regarding other people's loans. Even if you didn’t take out loans, your number may end up on the collection list as follows:

- You recently purchased a SIM card that was previously registered to a defaulter.

If a number is not used for a certain time, then mobile operators put it up for sale again. And the new subscriber has every chance to experience the “delights” of communicating with debt collectors, even if they do not have loans as such, not to mention late ones; - If, when applying for a loan, a person was indicated as a guarantor or contact person

. When guaranteeing a loan, the issue will have to be resolved directly with the banking organization, since by law the guarantor is responsible for the debtor’s fulfillment of loan obligations; - A stranger indicated your number when applying for a loan

. There are often situations when clients specifically or accidentally indicate incorrect numbers in their loan application. Usually in this case it is enough to explain that you have nothing to do with this debt and the borrower himself.

We defend ourselves legally

The legislation provides for various cases in this regard, depending on the situation:

- If a citizen who has not taken out a loan is simply pestered with annoying phone calls, then you can submit an application to the prosecutor’s office under Art. 13.11 Code of Administrative Offenses – violation of the legislation on personal data.

- The actions of collectors can be qualified as petty hooliganism (Article 20.1 of the Administrative Code). To do this, you need to call the police and demand that a report be drawn up. Law enforcement officers will not be very happy about this, because they already have a lot of work to do. Therefore, you should not expect happy faces. However, it is still necessary to demand the drawing up of a protocol and to defend your rights.

- It is advisable to install an automatic voice recorder on your phone. This will allow you to have evidence. Collectors are on duty, therefore, recording a conversation with them on a voice recorder does not violate the law. If during a conversation, and this happens often, a citizen begins to be insulted, then this falls under Article 5.61 of the Code of Administrative Offences.

- The collectors' demand can be qualified as extortion. This is a very serious violation that receives the status of a crime and is regulated by the criminal code (Article 163 of the Criminal Code).

Other ways to get rid of calls

When there is no time or energy to engage in evidence and writing statements, you can use the following methods:

- Contact the management of the collection company. If the company is reputable and values its own reputation, then it will take responsibility for the actions of its employees and prevent further calls.

- Request written representation of the authority of the company and the individual employee.

- Block incoming calls from a subscriber on a cell phone. You can change your mobile number. This option is not the most convenient and will cause additional hassle and inconvenience.

- Turn off your home phone for a while. True, there is no guarantee that after turning it on, calls will not be repeated.

If you cannot solve the problem yourself, you can turn to professional lawyers for help.

It is illegal to call relatives

It is important to know that the interaction of creditors with third parties is illegal, despite the fact that debtors leave additional phone numbers of friends, relatives, and acquaintances. This is done with the aim of checking the debtor, and not in order to demand a debt from relatives in case of non-payment. Now we know how to get rid of debt collectors legally. Recent media uproar has prompted the emergence of a new Law. Let's look at it in more detail.

If debt collectors call about someone else's loan

When they call from an unfamiliar number and ask if we know the fictitious Fyodor Mikhailovich, who owes the bank 10 million, many people’s blood pressure rises and jitters begin. Although if you are not Fyodor Mikhailovich and did not vouch for him, they will definitely not “sew” anything on you.

People often behave incorrectly - they begin to wonder where the collectors got the number from or loudly demand that they not call. At the other end of the line is a person whose powers are severely limited. He is probably sitting on an auto-dialer via IP telephony and does not even see the number he was connected to. He cannot simply delete a number from the call database. The maximum is to convey information about your dissatisfaction. But he won’t do this either until you explain why he should do this.

People who receive calls about other people's debts are victims of imperfections in the system for distributing telephone numbers.

The previous owner of the number was in debt, the collectors were fed up with him, and he refused the SIM card. The number went on sale, a new owner appeared, but it remained in the collectors' calling database - that's why they call about other people's debts. The operator is not to blame - in Russia the system for monitoring the “cleanliness” of rooms is completely absent. The operator does not even have the right to find out from the subscriber the reason for refusing the SIM card.

If they call about someone else's debt, you need to act like this:

- Ask the debt collector to introduce himself and name the company he represents.

- Explain that you just bought a SIM card, you don’t know the former owner, and calmly ask that the number be removed from the database.

- If they continue to call, send a written statement to the management of the collection agency that you have nothing to do with the debt. It is better to attach to the application the contract that was given at the phone shop when purchasing the number, or a copy.

Usually this is enough, since collection agencies cannot afford to waste employees’ time. However, if the agency ignored the letter, it will have to involve the “heavy artillery” - NAPKA and the prosecutor’s office (if the collectors violated Federal Law No. 230). Statistics show that punctuality is not the strong point of debt collectors; 31% of complaints are about early/late calls. You can get caught up in this when filing an application with the prosecutor's office. It is important to attach evidence to the application - printouts of telephone calls, screenshots of correspondence.

New Law on Collectors

So, how to get rid of calls from debt collectors? And not only from them. How to completely protect yourself from illegal actions? There is only one answer – by increasing legal literacy. Collectors, as a rule, find people who are illiterate in the field of law. This is what they use. Let's list the required minimum to understand how to get rid of debt collector threats:

- The debtor has the right to call no more than twice a week. Time is also limited. Calls can be made between 8am and 10pm on weekdays. On weekends - between 9 and 20 hours.

- Third parties must not be affected. Therefore, any conversation with relatives or friends must be stopped immediately through the prosecutor’s office.

- Whenever contacting someone, the collector must introduce himself and name his company.

- You can only meet the debtor in person once. And this is provided that the borrower gives his consent to this.

- Any violence by debt collectors against debtors is prohibited. Although this point only causes misunderstanding among professional lawyers. Why was it even included in the new law on collectors? After all, even without it, any violence is considered a criminal punishment. But, apparently, legislators want to toughen the punishment for debt collectors who commit violence, for which ordinary citizens are entitled to a shorter sentence.

Now we know how to get rid of calls from collectors, as well as personal meetings. It is enough to simply contact the prosecutor’s office if one of the five above requirements is violated.

What to do if debt collectors break the law?

If collectors:

- they call more often than the law allows;

- use obscene language;

- threaten physical harm;

- use psychological violence;

- are stalking your family;

- disclose loan information to third parties;

- indulge in damage to property;

- they come and call at night;

- intimidated.

Do not panic!

Let's figure out where you can file a complaint about the actions of debt collectors. Below are legal methods of struggle recommended by experienced lawyers.

Option 1: Contact the office

If you really have credit obligations and an overdue loan, then communication with debt collectors can be kept to a minimum. To do this, you need to send a letter to the central office of the collection agency in which you require only written communication regarding debt issues. It can take place either by e-mail or in the form of postal correspondence. The main thing is not to forget to sign and date the letter.

In this case, the collectors are obliged to comply with the debtor’s demands, and have no right to officially call or visit him. In addition, you will have all the correspondence in your hands and in the event of threats, blackmail, annoying calls or simply rude treatment from them, you will have all the evidence in your hands to start a lawsuit with debt collectors. And this is a huge deterrent.

The pre-trial procedure is as follows:

- you make a written claim (it is better to contact a credit lawyer for help);

- send it to the collection agency's address by registered mail;

- waiting for a response within a month;

- if no response is received, the actions have not stopped, the issue can be resolved by filing a claim in court.

Next, a court date is set for the case, where you can count on support and protection of your interests.

Option 2: Contact the bank

If the bank has not sold your debt to collectors, then an excellent way to quickly and effectively get rid of bank collectors is to interact with a financial institution. You just need to contact the creditor and try to peacefully resolve the problem with the problem debt.

There are several options to solve the problem:

- Debt restructuring.

It consists of revising the schedule and amount of monthly payments. At the same time, the bank can note part of the interest accrued for overdue payments, which will reduce the total cost of the debt; - Write-off of debt at the expense of the debtor's property.

Banks often accommodate clients halfway and take certain property to pay off the debt. Typically, this procedure is used for secured loans; - Assignment of credit holidays.

This is the name of deferment of fulfillment of debt obligations to the bank. If the reason for non-payment of debts and overdue loan was loss of job or temporary disability, then the bank may provide the debtor with a deferment of several months.

In addition, the debtor can refinance the loan with another bank. In this case, a person takes out a loan from another financial organization and uses it to pay off the current debt. But you can count on this option if the borrower’s credit history is not yet hopelessly damaged.

In any case, the bank will notify the collectors about the resolution of the problem debt issue, after which they will be obliged to stop interacting with the debtor. If the debt belongs to a collection agency, then all issues will have to be resolved only with them.

Option 3: Contact NAPCA

We are talking about the National Association of Professional Collection Agencies. This organization controls the activities of members, monitors them and, if necessary, applies penalties.

What to do if debt collectors call you, despite all legal limits on calls and other types of interaction with debtors? You can contact NAPCA with an official complaint, providing evidence:

- call printouts;

- printouts of SMS messages;

- audio and video recordings of communication with collectors.

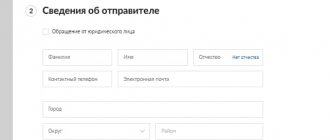

You can complain about debt collectors by filling out the form on the website.

Based on the evidence base, NAPCA is obliged to take measures: fines, penalties, contacting law enforcement agencies, removing the agency from the register.

Option 4: Contact government agencies

What should you do if debt collectors came to your home in the middle of the night and started threatening you? If the actions of the collectors have crossed all acceptable limits, then the only way out of the situation will be to contact the police, the prosecutor's office or directly to the court. This should be done in the following cases:

- employees of the collection agency blackmail the debtor or his relatives, threaten, or their actions led to damage to the debtor’s property;

- collectors harass the debtor with calls and visits after hours;

- collectors annoy you with frequent calls and visits, infringing on a citizen’s legal rights to rest and work;

- collectors have disclosed or transferred the debtor’s personal data: publishing information about his debt in the public domain, transferring it to third parties, etc.

In these cases, the debtor has the legal right to appeal to government authorities

. But at the same time, it is advisable to collect an evidence base: a printout of calls received on the phone, photos and video evidence of violations of citizen’s rights by collectors, and witness testimony.

Option 5: Declare yourself bankrupt

Bankruptcy of a citizen is one of the most effective and legal ways to write off debt. Despite the fact that this procedure lasts on average about a year, an application to declare a citizen bankrupt is reliable protection not only from debt collectors, but also from bailiffs. If you are looking for an answer to the question of how to get rid of loan debts, declare yourself bankrupt.

From the moment the bankruptcy procedure of an individual is initiated, all actions regarding debts are suspended, including the accrual of penalty interest for late payments. And the appeal of collectors to the debtor during bankruptcy is unlawful.

What you need to know about the actions of collectors

Citizens need to know the minimum rights in order to protect themselves and their loved ones from unlawful actions:

- Collectors do not have the right to seize any items. This can only be done by bailiffs by court order.

- Collectors have no right to invade private homes. This right is also given either by the court or the prosecutor's office. Such permissions are given to government services. And then, for this there must be very weighty arguments.

- The bank loan agreement may not contain a clause that allows you to assign ownership rights to third parties. This is rare, because banks must include it in the contract. However, such cases still occur.

Is it possible to independently distinguish debt collectors from scammers?

- It's practically impossible. This is not a government body that is engaged in collection, like, for example, a bailiff who has a certificate - you can look at it and check it. The bailiffs are required to show you papers in order to understand with whom you are communicating, what position the person occupies, and why he came in the first place.

The situation is the opposite with collectors. It is very difficult to check whether you are dealing with scammers or not, because first and last names are always fictitious. They do not reveal their real names.

Bankruptcy as a way to get rid of debt collectors

Bankruptcy is the most radical way to escape collection persecution. And it is not suitable for everyone, because

- The amount of debt must exceed 500 thousand rubles, and the duration of the delay must be more than 3 months.

- The bankrupt will face significant restrictions - he will lose the ability to manage money in bank accounts and travel abroad.

- Lawyers will have to pay about 50 thousand rubles for the bankruptcy procedure.

Bankruptcy is not an option for those who have accumulated loans and do not want to repay. This is a way to get out of debt for people who find themselves unable to pay due to changes in life circumstances. Upon completion of the bankruptcy procedure, the collectors will stop calling, but until it is completed, the calls will continue, because the outcome is unknown - bankruptcy may be denied.

Do debt collectors have the right to call about a debt?

All kinds of credits and loans are a great way to solve sudden financial problems, but the availability of this kind of help has led to the fact that many do not think about debt repayment options. If you needed money, you received a loan or credit and used the funds for their intended purpose. But you will have to pay a certain amount within the terms clearly specified in the contract, and then make the next payment. Ideally, there should be no late payments. But what to do if the solution to financial difficulties turned out to be only temporary, and there is still no money to return what you borrowed?

How to get rid of debt collectors if you really have a debt?

If you really have an overdue debt and the collectors do not violate Law 230, you will not be able to complain about the calls - you will have to either talk or drop the calls. However, the second is ineffective, since debt collectors do not always call with only evil intentions. The agency may offer a compromise - for example, debt restructuring. It's worth talking to them at least once.

If you absolutely want to protect yourself from conversations with debt collectors, you can use the phone functionality:

- Install the Anti Collector application. The application blocks calls from numbers on the “black list” (from which collectors previously called). The number database is updated twice a day.

- Block incoming calls from unknown numbers through settings. Many smartphones have similar functionality. If you don’t find the function, you can again download the application - for example, Calls Blacklist.

There is another loophole that can be used if the overdue payment is long overdue.

The debtor may submit an application to refuse to interact with debt collectors 4 months after the formation of the overdue debt.

This right is given by Federal Law No. 230. In addition, you can write a statement according to which negotiations regarding the debt must be conducted through an official representative. Whatever statement the debtor chooses, he will sleep peacefully, since collectors will lose the right to call. The application must be sent to the creditor through a notary or by registered mail.

There is a catch: the debtor provokes collectors to take a drastic measure - to go to court. He actually gives up the opportunity to negotiate for the sake of a quiet life now, but his quiet life will later be disrupted by a subpoena from the court. The “blind ignore” option is perhaps only suitable for those who find themselves in a deep credit hole and do not expect to get back out.

After the court makes a decision in favor of the collection agency, the application for refusal to cooperate is suspended for 2 months. Collectors again receive the right to call the debtor.

Where do other people's loans come from?

To answer this question, you need to turn to the current legislation and understand the very definition of “someone else's loan”.

So, the law allows the collection of debts from strangers in three cases:

- Guarantee. Everything is clear here: the person acts as a guarantor for the loan and shares financial obligations with the main borrower. This nuance is spelled out in the loan agreement, which is signed by the person who decides to act as a guarantor.

- Marital debts. According to some loan programs, spouses automatically become co-borrowers, even if only one of them signs the agreement. First of all, this concerns the mortgage lending sector. In such situations, the law allows the collection of debts from the second spouse, including at the expense of jointly acquired property.

- Inheritance. Banking rules are structured in such a way that debts can be inherited. For example, if the parents took out a loan to purchase real estate, but were unable to repay it due to death, this obligation passes to the children, along with the right to the property.

In other cases, a citizen is not obliged to answer for other people’s debt obligations, even if close relatives have them: brothers, sisters, children, etc. Such collection is considered illegal.

Let's consider a number of specific situations.

The person is listed as a guarantor

In this case, the recovery will be legal.

According to the provisions of Art. 363 of the Civil Code, the financial liability of the guarantor and the borrower is recognized as joint and several. Therefore, if you have been asked to vouch for someone in front of a bank, you should not treat the procedure as a mere formality. The fact is that if the main borrower does not pay the loan, the guarantor will have to do it. In cases where the guarantor also avoids fulfilling financial obligations, the bank can legally delegate debt collection through a collection agency. People who find themselves in this situation should under no circumstances “run” from the bank.

The best option is to try to come to an agreement with the borrower, or discuss options for repaying the loan debt with a banking organization. For example, carry out loan restructuring.

Important! If the guarantor pays the debts of the main borrower, he has the right to recover the entire amount from the latter in court.

Article 363 of the Civil Code of the Russian Federation “Liability of the guarantor”

Read also: Fisheries Law 2020

False information

This also happens. Collection agency databases are a real mess. Some borrowers may leave a fictitious phone number or provide a deliberately false contact. This number is entered into the database, and it can only be deleted at the initiative of the borrower.

As a result, collectors will call a random person and demand that he pay off his debts. The situation is unpleasant, but completely solvable. True, to solve the problem, the victim of collectors will have to run around the authorities quite a bit.

When you first call with a demand to pay off someone else’s debt, you need to explain to the collector that the debtor does not live here, and ask which financial institution the caller represents. Unfortunately, this will not be enough, and the calls will most likely continue.

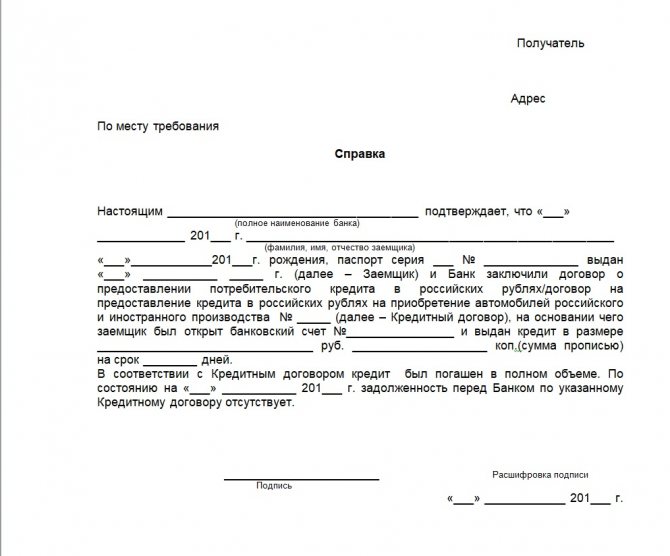

Therefore, you need to pay a visit to the bank that has your phone number in its database. A statement is written here demanding that the phone be excluded from the database. Then the bank obtains a certificate confirming the absence of credit debt, which is transferred to the collection agency. If the calls continue, a police report is filed.

Sample certificate of no debt

When the debtor's spouse

If the debtor is the husband, the wife will have to answer for the loan obligations, and vice versa. In this case, collectors have the right to remind you of the need to repay the debt, but only within the legal framework. Threats and psychological pressure are unacceptable here.

If collectors have chosen this particular debt collection tactic, feel free to contact the police or prosecutor’s office. Despite the fact that the debt will have to be repaid in any case, such actions by debt collectors are classified as extortion, and can result in punishment of up to 7 years in prison.

The debt is attributed to a work colleague or acquaintance

The situation is quite common: a person applies for microloans, and as an additional phone number, leaves the contact of his workmate. If such a “friend” does not repay the debt and stops communicating, the collectors begin to pester the person whose number is indicated in the contract.

This does not threaten anything except hassle. No one is obliged to answer for the debts of strangers, so threats from collectors to take you to court are one of the methods of psychological influence. The caller needs to explain that you have no connection with the debtor. If pressure continues, you should contact the national association of professional debt collectors, the prosecutor's office or the police.

Calls from collectors at work

If you can still explain the situation with your debt to friends and relatives and ask them to adequately respond to calls with possible threats, then the question of how to stop calls from collectors at work is very pressing, because no employer wants to get into trouble with the law. Do debt collectors have the right to call at work? Unfortunately, yes, because if they have your work number at their disposal, it means that you left it yourself, providing the opportunity for additional communication with you.

If collectors call the work of a debtor who became such due to insurmountable circumstances (injury, illness, unforeseen situation that required investment of money), then it is quite acceptable to talk with the employer and explain the situation to him. It is quite possible that you will no longer be tormented by the question of whether microfinance organizations have the right to call at work: your manager will solve this problem by informing you that you no longer work for him.

What the law says

As mentioned above, other people’s debts are collected only in cases where they were transferred under a surety agreement, inherited, or registered with the spouse.

In other situations, the bank and collectors do not have the right to bother a person, demanding the return of money that he did not take. If we talk about specifics, a person who is pestered with calls from a bank or collection agency can operate with the following legislative norms:

- Federal Law No. 353-FZ - regulates the procedure for consumer lending, including the assignment of rights and debt collection;

- Article 13.11 of the Code of Administrative Offenses - implies liability for violations of the rules for processing personal data;

- Federal Law No. -FZ - regulates banking activities and prohibits banks from disclosing their client data to third parties;

- Federal Law No. 152-FZ guarantees the confidentiality of personal data and implies liability for violations in this area.

Read also: Deprivation of employee bonus

Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”

Federal Law of 05.05.2014 N 97-FZ “On Amendments to the Federal Law “On Information, Information Technologies and Information Protection” and certain legislative acts of the Russian Federation on the issues of streamlining the exchange of information using information and telecommunication networks”

Article 13.11 of the Code of Administrative Offenses of the Russian Federation “Violation of the legislation of the Russian Federation in the field of personal data”

Federal Law of December 21, 2013 N 353-FZ “On consumer credit (loan)”