The reasons why banks send notification messages are difficult to count. If we develop the topic of banks further, then authorized representatives of these same banks have the right to send a reminder about the return of funds.

Such a note also contains a list of various actions that can be applied to the debtor in case of refusal or unwillingness to return the amount taken.

The banking organization, in this scenario, has every right to go to court to collect funds from the borrower, and this paper will serve as a guarantor for resolving the financial issue without going to court as such.

Why is it necessary to send a letter of claim for debt repayment?

The borrower may “finish the game”, and at this moment the banking organization is already preparing a court application, and it does not matter who is on the other side of the barricades: an ordinary person or a commercial organization.

The decision that the court comes to in the process of resolving this issue will be binding for each defendant. Now let’s imagine a situation where it is not banks, but their clients who go to court. This act is utopian, because even the most resilient and authoritative judge would not be able to cope with such a load, since the number of claims received would be simply cosmic.

The authorities have taken this into account, which is why in our civil proceedings that hints at something that needs to be done before filing a claim. This something is our letter. It must clearly describe the procedure for returning funds. If the bank did not receive the desired reaction from the client, then God himself ordered him to go to court.

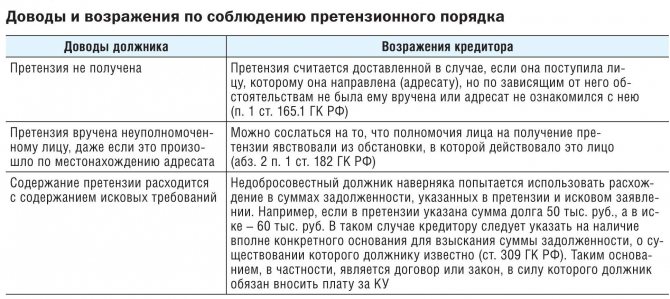

Delivery of the claim to the debtor

You should also pay attention to the method of delivery of the document to the person who is the debtor. In this case, you can use one of the following methods:

- Deliver the letter personally. Not the most convenient way, but reliable. If the claim is submitted personally, the citizen will know for sure that the addressee received it.

- Use the services of a courier. You can also use an intermediary, which is a courier. The services of such specialists have to be paid, but delivery will be carried out as soon as possible.

- Use a valuable letter with a description of the attachment and notification. This method is suitable if the debtor is located in another region. Notification is required for two reasons. Firstly, thanks to it the creditor will have evidence that the claim was received by the debtor. Secondly, the period allotted for a response is counted from the moment the document is transmitted.

An important nuance is that the document must have the recipient’s signature. Therefore, if the letter is delivered personally or a courier is used, two copies are made. Upon receipt, the debtor must sign both papers. One remains with him, the second with the creditor. Thanks to this, the person who is in arrears will not be able to deny the fact of receiving a claim in court.

Thus, in some cases, before filing a lawsuit, it is necessary to send a letter of claim to the debtor for repayment of the debt. The sample document posted above will help you avoid mistakes when drafting it. If the debtor ignores the document or refuses to comply with it, legal proceedings can be initiated. When drawing up a document, it is recommended to avoid threats, blackmail, and obscene words. Such nuances can play into the hands of the debtor. It is also important to choose the correct document delivery method. The creditor must have evidence in his hands indicating that the debtor received the claim.

General tips and tricks

Before receiving a loan, you should carefully read the agreement. There is no guarantee that there will be a claims clause, but there may be one. It describes exactly the exacting pre-trial work, which will be in the form of a letter of claim.

If this item exists, you should ask a few questions and try to choose a scenario that suits you, because you will have to pay later, and there will be a lot of various accidents and other troubles that will prevent you from paying the money without delay.

But there is one nuance in this matter . When, after all, it was written about the presence of a message with a reminder, but the pawnbroker, in turn, did not return the money, and the bank, knowing this, may not even try to file an application for consideration in court, if the same letter is not included with this claim . Without it, the bank will be refused almost immediately.

The judge can meet with the bank and force it to send a paper with a notice to the debtor; when a response is received from him (or not received), the bank will be able to file the claim again, but this time successfully.

Features of drawing up and filing a claim for debt payment

Any claim must be documented. In practice, this means that if the other party (the addressee of the claim) does not have the documents that became the basis for presenting the claims, they must be attached to the text of the main document. Otherwise, the correspondence may take a long time. If all documents are attached at once, then further delay in fulfilling the requirements of the claim will be regarded as dishonest behavior. In turn, such behavior indicates the need to go to court.

A feature of a claim for debt payment is the need to provide a calculation of the penalty. Mistakes are not advisable here (so as not to delay negotiations), so if you have any difficulties, you can use various online calculators or the help of a lawyer on our website.

The rules for filing a claim for debt payment are no different from the rules for filing a consumer claim or any other claim.

Contents and form of a letter of claim for debt repayment

When the question of sending a statement to the tribunal complete with a note is firmly raised, it is strongly recommended that you follow this rule : never send a sample letter of claim in the form of a computer file.

It will be almost impossible to prove that an email reached and was received by a specific addressee , because anything can happen during its transmission. It is advisable to send it as a registered letter in paper form. This method is good because it does not need to be proven in any way, and also, the borrower will treat banks with much more respect and seriousness.

strict requirements or rules for the design and writing of a letter. The bank has the right to write it in a form that is free and understandable to the client. The only main criterion here will be precise adherence to business style.

You shouldn’t focus on the name either, it doesn’t play a role here at all, only the content is important, which will be emphasized by the court and the client, who must understand it in order to return the funds.

What points should be reflected in the claim?

- The reason the client refuses is because there is no option. If the conditions were not met or violated in any way, then it is necessary to list the property that the debtor left as collateral;

- Amount of debt. Please note that the final amount cannot be specified. All its components must be taken into account. If there are also fines, criteria are indicated, based on which you need to get rid of fines. Also, do not forget to enclose the payment document;

- The time during which the client undertakes to repay the debt. The time allocated to the client is definitely in the summary;

- Fines and sanctions . Their size and reasons for their occurrence are located on the pages of the agreement.

If you don’t have time to compose a letter from scratch, you can download a “stencil” with empty columns. You should carefully consider the choice of writing sample; it must be relevant to the current situation.

There are things that you definitely should not do when composing a letter, namely, pointing to various excerpts and articles from various legal acts. A letter of claim is not an application to the prosecutor’s office; everything here must have meaning and be aimed at a specific meaning. Of course, turning them on nothing bad will happen.

The letter will take on a more serious and threatening appearance, but will make it more difficult to understand, so this question remains open.

Sample claim for debt collection

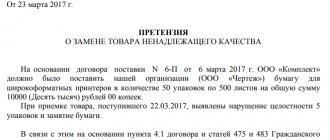

______________________________________________________________ [name of the commission agent, OGRN, TIN, location, telephone, email address and other details]

_______________________________________________________ [name of the principal, OGRN, TIN, location, telephone, email address and other details]

Ref. _______________________________ [outgoing message number, document date]

Claim

_____________ [date of conclusion of the agreement] between _____________ [name of the commission agent] and _____________ [name of the principal] a commission agreement was concluded _____________ [agreement number and its name] (hereinafter referred to as the Agreement) under which _____________ [indicate the essence of the obligation].

Commission agreement No. ___ dated “___”________ ___ [number and date of the agreement] was executed properly, which is confirmed by _____________ [document confirming the execution of the agreement].

According to Art. 991 of the Civil Code of the Russian Federation, the principal is obliged to pay the commission agent a remuneration, and in the case where the commission agent has assumed guarantee for the execution of the transaction by a third party (del credere), also an additional remuneration in the amount and in the manner established in the commission agreement.

According to clause _____________ [clause of the agreement establishing the procedure and terms for payment of commission].

Based on the above, _____________ [name of the commission agent] demands within _____________ [period under the contract or law] from the receipt of this claim:

- pay the commission agent remuneration under the agreement in the amount of: _____________ [amount of debt];

- pay the penalty under the contract (if the penalty is provided for by the contract or law).

Details for transferring funds:

_____________ [indicate bank details of the commission agent]

If the debt is not paid within the specified period, _____________ [name of the commission agent] will, in turn, be forced to apply to _____________ [name of the arbitration court] to collect the specified amount, and the amount will increase by the amount of the state duty and payment for the work of a lawyer (representative).

A peaceful settlement of this issue will save your time and money.

_____________ (signature) / _____________ (full name)

Other sample refund claims

How to send a claim to a debtor?

It has already been written before: send the paper to the borrower before the trial. According to statistics, there are 2 most popular and effective methods:

- Send it by mail as a registered letter with the opportunity to receive a report;

- Hand it over personally. The bank client will have to sign for it.

When using method No.2, you need to create a copy of the letter. One of them will remain in the bank with a signature and a number assigned, and the second will be with the borrower. You should take the number seriously, because the slightest typo can radically change the court's decision.

It is also possible that the company will take on the debt. The task becomes a little more difficult, since now you will have to find an authorized person of the company who is responsible in this area. It is unlikely that anyone will disclose identification documents and positions held at work.

Here you need to take into account the size of the organization, and if it is small, then the best option would be a personal meeting with the manager. This is done solely to get rid of pitfalls.

There will be a 100% guarantee that the addressee will receive the notification using a special postal stamp. The judge, most likely, will be guided by the seal, and not by the words that he, the client, just learned about the shipment.

This happens because the postman is obliged to deliver the parcel exclusively to the person whose area of responsibility it falls. There will definitely not be any misunderstandings about the number, rest assured.

But you can’t do without various “starred points”. There is a possibility that the final recipient will know that such a parcel will soon be delivered to him. The postman, naturally, will not run after him, but will simply leave him at the post office.

After a certain period of time, the letter will be sent back to the sender, who will have to show these envelopes with the remaining documents. They contain the address of the recipient, which the judge will see. During the meeting, the actual address of the debtor will be determined.

Debt repayment period

The repayment period of the debt may vary depending on the type of payment.

Parties to the contract may consider the following options:

- Paying off utility debt . In accordance with Decree of the Government of the Russian Federation of 2011 No. 354, the notification provides for a deadline for payment. It is 20 days from the date of delivery.

- Full repayment of debt for other types of debt . In this case, the lender sets a specific payment period. In accordance with the Arbitration Procedure Code of the Russian Federation, the period cannot be less than 30 days. If the payer is an individual, then the period is set at the discretion of the creditor.

- Installment plan In such a situation, it is necessary to decide on a repayment schedule. The parties agree on specific terms and amounts of collection. Depending on the situation, interest may be provided for the use of other people's funds.

When filing a claim, the deadline is an essential condition. It begins to be calculated from the moment the document is served. Moreover, for the court it is necessary to prove the fact of receipt of the demand.

Therefore, it is advisable to send it in a way that allows you to record the fact of transmission. For example, a registered letter with notification.

And management companies for such purposes use notifications that are delivered to the debtor personally against signature.

Important! If the debtor deliberately avoids receiving the document, the creditor has no choice but to send the documents to the court. The claim is accompanied by envelopes containing the claim and a mark of non-delivery. In such a situation, the court will already deal with it.

Example . Due to the debt that has arisen, we are sending you a request for repayment of the debt. In case of refusal of voluntary payment within 30 days, we reserve the right to collect the debt in court.

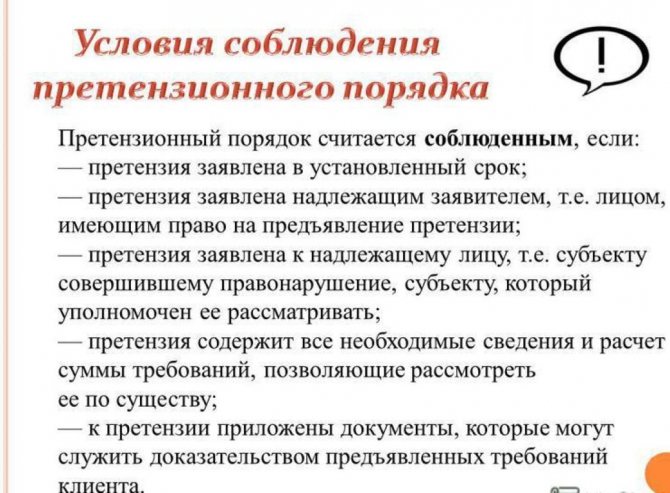

Requirements for filing a pre-trial claim for debt repayment

By filing a claim, an interested party can express dissatisfaction with non-compliance with the terms of the agreement and present their demands to the debtor.

As a rule, compliance with the claim procedure for resolving a dispute is mandatory if the text of the agreement concluded by the parties contains a provision for the pre-trial settlement of any issues.

The claim must be made in simple written form. If the creditor is a legal entity, the text indicates the personal signature of the manager and the seal of the organization (the same applies to an individual entrepreneur if he has the appropriate seal). The applicant-citizen only needs to put his signature at the bottom of the document.

It is recommended that the claim be drawn up in two copies, one of which is given to the debtor, and the second remains with the creditor (it must bear a signature indicating acceptance of the papers by the defaulter). Lawyers also advise submitting a claim in the presence of at least two witnesses.

Did the debtor refuse to read the text of the appeal? Witnesses will be able to confirm this fact with their signatures.