The MTPL insurance policy is a guarantor of protection for many citizens. Motorists are confident that if unpleasant situations arise on the roads, they will receive legal and financial assistance. Imagine their surprise when insurers do not fulfill their obligations. The only way out in this case is a complaint against the organization that issued the MTPL policy.

To achieve results, you need to draw up the document correctly. In a complaint against an insurance company under compulsory motor liability insurance, it is important to describe the situation and requirements in as much detail as possible. The paper is submitted to several competent authorities. It is worth considering the main conditions and stages of the procedure.

When can I complain to the insurance company under compulsory motor liability insurance?

Insurance companies with which citizens have entered into an agreement must fulfill their obligations under it. The insurer's responsibilities include inspecting property damaged in an accident, determining the amount of damage and the cost of repairs, and calculating compensation for damage caused to the victim and the car. These standards are prescribed in Federal Law No. 40-FZ dated April 25, 2002. Chapters 2 and 3 are devoted to the procedure.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

If a citizen does not receive services in full, the actions of the insurance company under compulsory motor liability insurance are considered unlawful. They can be appealed in several instances. There are cases when it is necessary to file a complaint against the MTPL insurer:

- refusal to sign an agreement for the provision of insurance services;

- imposing additional services as part of the implementation of the policy;

- untimely and incomplete information to clients about determining the amount of insurance;

- establishing a longer payment period than provided by law;

- lower amount of insurance payments;

- inconvenient location of points that deal with claims settlement;

- missed deadlines for consideration of applications sent to the company by victims;

- refusal to repair or late payment for work under compulsory motor liability insurance;

- violation of the procedure for issuing directions for vehicle restoration;

- failure to comply with restoration work deadlines;

- a negative decision in considering an application for insurance payments in the absence of a complete package of documents;

- inflated amount of MTPL insurance premium;

- inconsistency of information within the bonus-malus coefficients.

Normative base

The main law that regulates the relationship between the policyholder and the insurer is the “Law on Compulsory Motor Liability Insurance” No. 40-FZ, which was issued on April 25, 2002. The latest edition of the regulatory legal act was completed on July 3, 2020.

Issues related to the settlement of MTPL disputes are reflected in Article 16.1. It sets out in detail the details of resolving issues and complaints if the insurance company fails to fulfill its obligations.

Paragraph 1 states that the policyholder must demand payment of the insurance in full before filing a claim. If a complaint is sent to the insurance company under compulsory motor liability insurance, it can be considered within 10 days. This is stated in paragraph. 2 p. 1.

The result of consideration of the complaint should be a reasoned refusal or satisfaction of the requirements. Based on paragraph 2, in the latter case, the return of the repaired car and payment of insurance amounts within the framework of the law are provided.

If the complaint does not resolve the issue of the policyholder, then he can contact the judicial authorities. It is prohibited to skip the moment of pre-trial regulation. This rule is stated in:

- Arbitration Procedure Code of the Russian Federation (Article 4);

- Code of Civil Procedure of the Russian Federation (Article 132);

- KASZ RF (Article 4).

The judicial authority will reject the claim if a complaint has not been sent to the insurer under MTPL. Moreover, within the framework of Law No. 47-FZ, which introduces amendments to the Arbitration Procedure Code of the Russian Federation, at least 30 days must pass from the date of filing a claim.

The outcome of the judicial review of the case is noted in paragraph 3. Insurers will have to pay a fine of 50% of the difference between the amount determined by the court and the amount of insurance paid.

The issue of penalties is dealt with in points four and five. It is charged at the rate of 1% of the insurance premium for each overdue day. But the penalty does not exceed the amount of the cost of the MTPL policy. If the insurer fulfilled its obligations in full or the terms were violated due to the fault of the policyholder, as a result of force majeure, the court has no right to charge it.

Also, controversial issues can be resolved in accordance with the Law “On the Protection of Consumer Rights” No. 2300-1 of February 7, 1992 (last amended July 3, 2018). This normative act is another one that can be used as a guide during pre-trial resolution of issues.

Where to contact the policyholder

The first point of contact is the insurance company, but if the issue remains unresolved, the driver must file a complaint with other organizations.

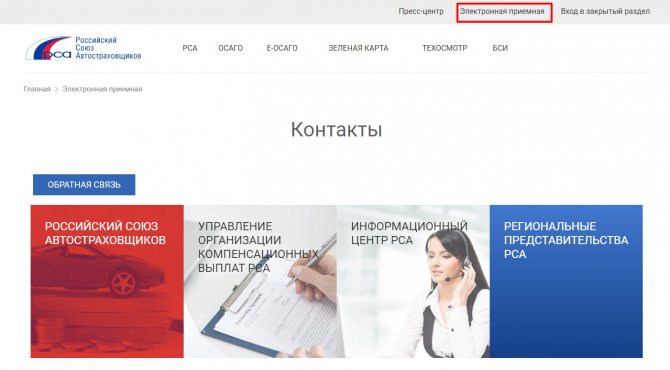

In RSA

The Russian Union of Insurers is responsible for maintaining a unified database, which is used in calculating the CBM for compulsory motor liability insurance, and also participates in the process of resolving disputes in the field of insurance.

RSA does not have the right to make changes independently. All data in a single database comes from insurers, but he can fine the insurance company for violations or expel it from the union. In general, the activities of the RSA consist of supervision and consulting activities.

The official website of RSA indicates the procedure for filing a complaint in case of incorrect calculation by the insurer KBM. The driver will need to fill out the proposed application form and send it by email indicated on the website, and then wait for confirmation of receipt of the application and the result of the review.

Central Bank of the Russian Federation

The Central Bank of the Russian Federation (CBRF) exercises control over insurance in general and, to a greater extent than other organizations, influences insurers. The powers of the Central Bank of the Russian Federation include the most severe measure of influence - revocation of the license.

The driver can file a complaint against the insurance company on the official website of the Central Bank of the Russian Federation. To send citizen requests, the portal has an online reception. The policyholder selects the “Insurance” section among the proposed options, and then clicks on the link “Incorrect use of KBM”.

To file a complaint, the driver will need to fill out a complaint form and attach supporting documents.

Rospotrebnadzor

Since an MTPL policy is a certain type of service that the policyholder purchases from the insurer for a monetary reward, he has the right to complain against the insurance company as a consumer. So, in Art. 16 of the Law “On Protection of Consumer Rights” No. 2300-1 indicates situations in which consumer rights are violated.

So, if, due to incorrect use of the KBM, the driver suffered a loss when concluding an MTPL insurance contract (the discount was not taken into account, the price of the policy increased), then he has the right to demand compensation from the insurer (clause 2 of article 16 of Law No. 2300-1).

A complaint about a specific branch of an insurance company to Rospotrebnadzor should be sent to the territorial division, since it is there that the appeal for a specific region will be considered.

If appealing to all of the above authorities does not produce results, then the policyholder should file a claim in court.

Who can complain about the insurance company under compulsory motor liability insurance?

There is a certain agreement between the insurer and the policyholder to ensure civil liability guarantees. If the company does not fulfill its obligations, the main affected person is the owner of the MTPL policy.

The main method of influencing contract violators is a complaint to the insurance company under compulsory motor liability insurance. It can be submitted by a citizen who has suffered from the inaction of insurers.

A common situation is the appeal of persons who have not received payment after the occurrence of an insured event. For example, a citizen submits an application and expects the amount to be transferred. But after contacting the insurance company, he is informed that payments were denied. In this case, the reasons for such a decision are stated in a letter sent by mail.

You should not wait for the document to arrive, because it does not have legal force. You can find out the reasons for the refusal directly at the company’s office. It is important that the decision is motivated in accordance with the legislation of the Russian Federation.

A citizen who does not agree with the verdict may request an inspection report of the car and an application for acceptance of documents. After this, he has the right to send a complaint against the insurance company under MTPL to the appropriate authorities.

Also, the amount of payments may be underestimated. If a person, having correlated the amount of damage with the funds received, notes their lack, then the policyholder has the right to familiarize himself with the calculation of the cost of repairs. It is important to take an insurance claim certificate, a car inspection paper and an application for acceptance of documents.

Citizens who do not receive money on time suffer. If funds have not been received after 30 days, then an official delay is recognized. In this case, a complaint against the MTPL insurance company will be justified.

Complaint against KBM under compulsory motor liability insurance to the Central Bank: all the details of the process from A to Z

The procedure for setting tariffs for MTPL policies is regulated by documents at the federal level. When calculating the insurance premium, insurance company employees must take into account the KBM - a bonus for those drivers who drive without accidents. If it was calculated incorrectly or was not used at all by the insurer, then the car owner can always appeal these actions to the RSA or the Central Bank.

Drawing up a complaint

KBM provides a careful driver with a 5% discount for each accident-free year of driving, but for a number of reasons insurers do not apply it. Among the most common options are the following:

- intentional actions of the insurer in the hope of receiving a larger fee when issuing a policy;

- changes in the personal data of the policyholder - after replacing the driver’s license, it is necessary to notify the insurance company about this so that adjustments can be made to the database for calculating the BMI;

- mistakes of the previous insurer, who did not send information to the RSA on time.

In these and other cases, it is necessary to file a complaint with the Central Bank to restore your legal right to the CBM in full.

What should I include?

The text of the application, drawn up in free form, must indicate:

- personal data of the driver according to his passport;

- driver's license details;

- data on MTPL policies for the previous period;

- the moment the coefficient is lost according to the RCA website.

If the poles themselves have not been preserved, then you can request a certificate from the insurance company that previously issued the policy for a certificate under the MTPL agreement. The company is obliged to prepare this document within 5 working days.

When clarifying the date of loss of the KBM on the RSA website, they search using the applicant’s personal data and driver’s license, indicating the period slightly after the expiration of the last contract. This is how all previous agreements are checked if a mistake in canceling or reducing the bonus was made before the conclusion of the last agreement.

In what form?

There is no single form for filing a complaint regarding the incorrect use of the KBM, so the complaint is filed as a standard business correspondence document:

- indicate in the addressee's header personal information about the applicant;

- the entire chronology of events is presented in a neutral emotional background;

- refer to legislative norms and clauses of the contract with the company;

- demand to recalculate and return the unreasonably accrued amount;

- put down a number and a signature - for a paper version of the complaint.

Complaint against KBM under compulsory motor liability insurance to the Central Bank

Incorrect application of the KBM when calculating the cost of an MTPL insurance policy is a reason to file a complaint against a negligent or unscrupulous insurer. When submitting, you can use any convenient method, a brief description of which is presented in the comparative table.

| Feeding method | Place of delivery | Submission nuances |

| Personal appeal | office of the regional branch of the Central Bank | 2 copies, one remains with the applicant after entering registration data |

| Mailing | post office to the address of the central office of the Central Bank | 3 copies (Central Bank, regional representative office, organization), by registered mail with acknowledgment of receipt and a list of attachments |

| Electronic form | official Internet resource of the Bank of Russia | filling out the form with attachments |

The Bank of Russia is the final point of appeal against the actions of the insurer. Before contacting the Central Bank, you should obtain motivated refusals from the insurance company and the RSA.

Where to apply?

The official website of the Central Bank contains the necessary contact information for filing an appeal:

- in person – in the “Territorial institutions” section, contact details of all regional branches are presented;

- by post – in the “Contact Information” section the address for postal correspondence is indicated;

- via the Internet - in the “Internet reception” section, fill out the form.

How to submit?

To send a complaint in real time, you need to go to the official Internet resource of the Central Bank of the Russian Federation and open the “Information about OSAGO” section. In the questions and answers section there is a clickable link “Submit a complaint”. In the form window that opens indicate:

- the essence of the claim is “Incorrect application of the KBM when drawing up an MTPL agreement”;

- description of the problem with compliance with the principles of business correspondence;

- upload scanned copies of documents for prompt consideration of the issue.

For the traditional paper version, follow the recommendations below.

How to write?

If there are no problems with the preparation of the header and the list of attached documents, then the formulation of the essence of the conflict often goes beyond the legal framework. To avoid this and present information in an emotionally neutral field in the body of the application, it is recommended to state the facts:

- series and number of the MTPL policy with incorrectly applied KBM;

- class assigned to the driver by an insurance company employee;

- accident-free driving experience and the class corresponding to this experience.

In the petition part, the applicant may claim:

- to carry out recalculation of the KBM;

- to return the overpaid amount;

- to make changes to the RSA database.

Thus, a complaint against KBM under compulsory motor liability insurance to the Central Bank is filed in free form on paper or electronically. You can submit it for consideration in person, by mail or online. The waiting period for a response should not exceed 30 days from the date of registration of the shipment.

Source: https://PotrebPrav.ru/zhalobi/zhaloba-na-kbm-po-osago-v-tsentrbank

Where can I file a complaint?

Several organizations are involved in regulating relations between policyholders and insurers. If unresolved issues arise, a citizen has the right to seek help by sending a complaint to one of them against the insurance company under compulsory motor liability insurance.

But at the initial stage it is necessary to resolve issues at the level of the organization itself. Therefore, official written complaints about unlawful actions of specialists are sent to the head of the territorial department of the insurance company. If the procedure does not give the desired effect, you can visit the organization’s central office.

Claims are often handled and resolved at the local level. But if there is no response within the given two weeks, the person has the right to appeal to higher authorities.

In addition, other authorities may consider the case if the insurance company has confirmed a negative decision. The policyholder must have an official refusal. In the absence of one, only a claim is sent, with a mark indicating registration with the insurer.

A positive result can be observed when contacting the head office. If there is no answer or it contradicts the law, this option is the only correct one.

There are also other authorities that control the insurance procedure.

- Policyholders who have been denied a compulsory motor liability insurance agreement can contact the Central Bank. The body also considers complaints related to the imposition of additional services, increasing the terms of reimbursement, and the requirement to provide documents not according to the list. The organization deals with legislative issues, therefore it checks the legality of the actions of insurers.

- Rospotrebnadzor does not have the authority to monitor compliance with the MTPL law. However, the organization makes sure that consumer rights are not infringed. Only citizens using cars for personal purposes can apply to it.

- In case of violation of the clauses of the MTPL agreement by policyholders and third parties, you can contact the Federal Insurance Supervision Service. The last ones are citizens who can testify to the illegal activities of insurance companies. This option is the only correct one to bring them to justice without trial.

- If legal norms are violated, a citizen has the right to file a complaint with the Russian Union of Auto Insurers. The organization does not consider requests related to understatement of payments. It is necessary to visit it in case of incorrect calculation of the CBM, for direct settlement of losses and for issues of compensation under the Euro Protocol.

- The final authority is the judicial authorities. They will help compensate for losses and punish insurers who violated the law. It is possible to recover both material and moral damage.

How to restore the KBM through the official website of the Central Bank

You can submit an application to restore your accident-free driving record online using the services of the official website of the Central Bank of the Russian Federation.

To do this you need:

- on the Home page, go to the “Internet reception” section by clicking on the button at the top of the website.

- In this section, select the “Submit a complaint” option.

- Select the subject of the appeal “Incorrect application of the CBM (discounts for accident-free driving) when concluding a contract” in the “Insurance organizations” section by clicking on the active link.

- Before you start filling out the form, you need to read the background information. Then click on the “No, I want to file a complaint” button.

- If you wish, you can take a survey asking why the above information was not useful, or you can skip this formality.

- Click “Proceed to file a complaint.”

- Fill out all fields of the application. When entering the name of the organization, you can select the one you need from the pop-up list. To clarify, you can enter the organization's TIN. If there are several organizations, add an additional window by clicking on the appropriate button. Below is a field for stating a complaint and selecting a region. It is also recommended to fill out additional information fields indicating the date and address of purchase of the policy.

- Upload scans of documents confirming information about the KBM, as well as the refusal of restoration from the insurance company, if any.

- Express your agreement with the procedure for accepting the application, enter the code from the picture and click “Next”.

- Enter your contact information.

After sending the electronic application, the Central Bank of the Russian Federation will contact the Investigative Committee to clarify and correct all data.

Step-by-step instructions for filing a complaint against an insurance company under MTPL

There is a certain algorithm for filing a complaint against an insurance company under compulsory motor liability insurance to each organization. It is important to follow certain steps to prove that insurers are breaking the law.

Insurance Company

Before contacting higher authorities, it is necessary to resolve the issue with the insurance company. You need to follow the instructions below. It is provided if the amount of payments under compulsory motor liability insurance was underestimated.

- You need to contact insurers to obtain two documents. The organization’s specialists must provide a report indicating the details of the vehicle inspection after the accident has been registered. You also need a document describing the insured event. This is necessary to determine the amount of damage caused. Acts are transferred only after payment has been transferred.

- If a citizen chooses to have the car repaired under compulsory motor liability insurance, then from the service center you need to take a work order and a certificate of work performed.

- It is necessary to find an independent expert. Previously received documents are handed over to him. If there are errors in the papers, the examination should be carried out based on newly prepared acts.

- On the appointed date, representatives of the insurer must arrive at a certain location to conduct an assessment. The policyholder must present the vehicle.

- During the examination, it is necessary to insist that the calculation is made on the basis of loss of marketable value.

- The applicant must prepare a copy of the PTS, a copy of the vehicle inspection report when conducting an assessment without a car, as well as a service book if the car is under warranty. The certificate is issued within three days at the request of the MTPL policyholder. In the absence of a car, you can conduct an assessment without it or contact the judicial authorities.

complaints to the insurance ]can be here[/anchor].

Russian Union of Auto Insurers (RUA)

The Russian Union of Auto Insurers (RUA) is a corporate non-profit organization. It considers appeals related to violations of the MTPL legislation.

- It is necessary to file a complaint against the insurance company under MTPL electronically. It contains the name of the organization, data, date of birth of the applicant, series and number of his passport, number and date of application, details of the MTPL policy. It is also important to clearly describe all claims.

- Scanned copies of documents confirming the infringement of rights are attached to the complaint.

- The complete package is sent to the RSA email. Employees who receive a complaint against an insurance company under compulsory motor liability insurance register it on the same day.

- Within the allotted time, the applicant is given a response to the appeal. It arrives by email.

If a person does not have access to the Internet, he can file a complaint against insurers by mail or in person. To do this, you need to come to the organization’s office. Citizens are received on Tuesday afternoons and Thursdays until noon.

Complaints to the RSA about insurance under compulsory motor liability insurance can be found here.

Antimonopoly Service

The federal executive body monitors compliance with legislation in the field of competition in product markets. If additional services are imposed, you can file an insurance claim under MTPL with the FAS.

The citizen draws up an application. It must indicate the name of the organization and the full name of the applicant. The claim, requirements for insurers and FAS are described in detail.

Documents confirming the fact of violation are attached to the application. It is important to provide any evidence that will help initiate a case.

There are several ways to send a document. A citizen can transfer it:

- personally;

- by email;

- through the portal of state and municipal services State Services;

- through the form on the official website of the FAS.

Rospotrebnadzor

A citizen whose rights as a consumer have been violated should contact the organization. You can choose one of the proposed options for filing a complaint against the insurance company under MTPL.

- A written complaint is permitted. It is sent to the address of the territorial office.

- You can send your request by email.

- Public reception specialists deal with issues of consideration of citizens' complaints. Its work schedule can be found on the Rospotrebnadzor website.

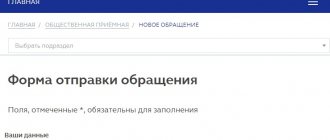

- You can submit your request for consideration using the feedback form. It is important to provide accurate and complete information. The text must be no more than 2 thousand characters. It is prohibited to use profanity, insults, or threats.

Complaints against the insurance company under compulsory motor liability insurance to the FAS and Rospotrebnadzor can be found here.

Federal Insurance Supervision Service

Contacting the Federal Insurance Supervision Service is one of the steps in pre-trial settlement. It is important to correctly file a complaint against the insurance company under compulsory motor liability insurance in order to get a positive result.

The complaint against the insurance company must indicate:

- details of all participants in the case;

- a detailed description of the problem, noting all the nuances;

- laws, regulations violated by the insurer.

The appeal will be considered within a month. After the decision is made, the document is handed over to the applicant in person or sent by mail.

Central bank

A complaint against the insurance company under compulsory motor liability insurance is being prepared to the Central Bank of Russia. He defends the rights of victims of negligent organizations. There are several ways to do this.

The claim in the form of a letter can be sent by mail. The document can also be sent by fax to the number indicated on the Central Bank website.

The application is registered through the online reception desk of the Bank of Russia. To do this, you need to go to the official website of the institution.

- You need to select the “Submit a complaint” option.

- You must fill out a preliminary form by selecting the “Insurance Organizations” section. The policyholder must indicate the type of problem. Message points on this topic are automatically generated. You need to study the information and click on the “Proceed to file a complaint” button.

- Next, fill out the main form.

- To confirm the data specified in the complaint, you must attach relevant documents.

- You must enter the security code shown in the picture. The form is then submitted by clicking the “Submit” button.

A complaint against an insurance company under compulsory motor liability insurance will be considered by the territorial branch of the Bank of Russia. To speed up the procedure, you can immediately contact the regional office at your place of residence. A response will be given within 30 days.

Complaints against the insurance company under compulsory motor liability insurance with the Central Bank can be found here.

a statement of claim for recovery of the lost amount of insurance payment under compulsory motor liability insurance can be found here.

Complaints against an insurance company under compulsory motor liability insurance to the prosecutor's office can be found here.

How to file a complaint with the RSA

To file a complaint or claim with the RSA, you can use one of the following methods:

- visit the office of the Union of Auto Insurers, voice your request orally or submit an application in writing. Reception of individuals is held every Tuesday and Thursday from 9 to 18 hours at the address: Moscow, st. Lyusinovskaya, 27, building 3;

- draw up a complaint in writing, attach copies of all relevant documents to it, and send a letter to the address indicated above;

- contact RSA employees through the “Electronic Reception” service on the structure’s website;

- scan all documents and signed application, send to one of the email addresses or [email protected]

All feedback formats of the Union of Insurers work in active mode. The main thing is to follow the algorithm for submitting requests and do not forget to indicate the necessary information (personal data, MTPL policy number, contacts, essence of the problem). Anonymous, incomplete, or threatening applications will not be considered.

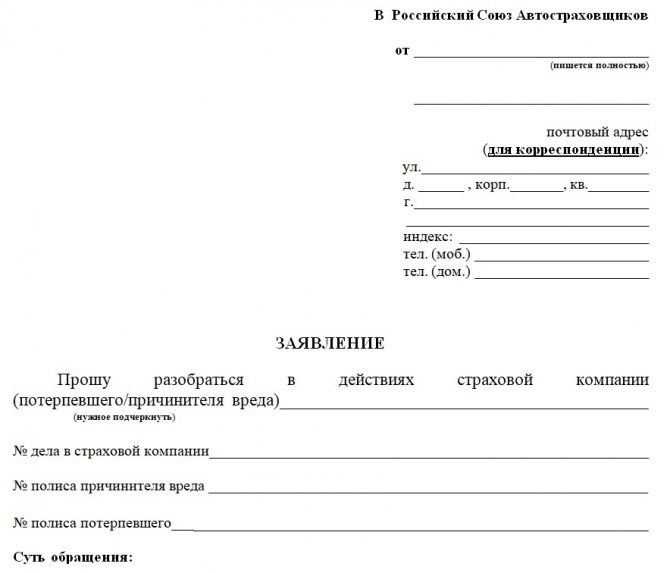

How to write a complaint to RSA

There are no strict requirements for filing a claim with the Union of Auto Insurers. The main thing is that the document is current, complete, and does not contain unacceptable phrases. Experts highlight a number of recommendations, compliance with which will increase the likelihood of a quick consideration of the application.

In the upper right corner of the application, you must indicate detailed information about the recipient (RSA) and the applicant (full name, contacts, OSAGO policy number). In the main part of the document it is necessary to indicate which company there are claims against. It is recommended to indicate the policyholder's date of birth, series, number and date of issue of the driver's license. The following describes in detail, but without unnecessary digressions, the situation and the essence of the complaint. It is desirable that the words be supported by facts (links to clauses of the agreement, attached documents). The claim must be signed and dated.

Sample 2019

All valid forms for applications to the RSA are available on the Union’s website here. There you can find information on how to write a standard application, there are samples of specialized applications. There are also links to articles with data that you need to know before filing a complaint against KBM under compulsory motor liability insurance, payment of compensation under the European Protocol, and direct compensation for losses.

Outcome of a complaint against an insurance company under compulsory motor liability insurance

Insurers who receive a claim must respond to it within 10 calendar days. Previously, the period was five days. Holidays are excluded from this period.

In the absence of a timely response, insurers will have to pay a penalty. In accordance with paragraph 4 of Article 19 of the Law “On Compulsory Motor Liability Insurance”, the amount is determined by the professional association of insurers (POI). The application to the PIC is considered within 20 days.

Supervisory organizations should contact the insurance company for clarification after receiving a complaint. They must do this within 30 days. After this, the answer is communicated to the policyholder.

If violations are detected, an order will be issued to enforce the decision. If there are no facts of illegal actions, the policyholder will receive a refusal.

Satisfaction of complaints at this stage is carried out if the insurer is 100% wrong. This is usually associated with situations where the organization refuses or delays payments.

If there are no obvious violations, supervisory authorities prefer not to make a decision favorable to the policyholder. If there are any controversial issues, it is recommended to contact the judicial authorities.

The policyholder's statement may be a signal that there are serious irregularities in the work of insurers. Then an audit of the company’s activities can be initiated, after which a decision is made. In some cases, the company's activities are suspended. The organization may also lose its license.

Sometimes complaints against insurance companies under compulsory motor liability insurance are filed with authorities that cannot consider them due to lack of competence. Then the claim is sent to the competent authority.

The last option when resolving issues is to go to court. A claim can be filed at any time. However, it is better to contact higher authorities and receive written answers. They will guarantee confirmation of the plaintiff’s words in court.

Time limit for consideration of a complaint by the Central Bank of Russia

Complaint to the Central Bank of Russia against an insurance company:

- It is considered much faster than court proceedings, which usually take several months and often require financial costs for legal support.

- The progress of the complaint can be found online on the official website of the regulator or by phone.

The Central Bank of Russia considers complaints, like any government body, within a month from the date of receipt of the complaint. If the consideration of the complaint requires any additional requests for documents from third parties, then by decision of the commission the period for consideration may be extended.

Nuances of the procedure

To protect your own rights that have been violated, you need to remember some advice from practitioners.

- If the insurer is refused to issue an MTPL policy or is imposed additional services, then it should contact the Central Bank of the Russian Federation.

- No body other than a court can oblige insurers to pay a sum of money.

- All disagreements regarding insurance issues should be resolved in court only after an attempt at pre-trial settlement. The claim is sent to the insurers.

- If an application for payment of insurance compensation under compulsory motor liability insurance is not considered within 20 days, then the policyholder has the right to appeal to the Central Bank or court. In the latter case, you can recover a fine, penalty, penalty and compensation for moral damage.

- If repairs under compulsory motor liability insurance are not completed on time, measures are taken by the Central Bank of the Russian Federation. Insurers may be deprived of the right to issue referrals for restoration work. Then compensation will be made in monetary terms.

- It is important to have two sample claims to the insurance company under compulsory motor liability insurance, one of which contains registration marks. In this case, it will be easier for the citizen to prove his case if the insurers lose the complaint or have to prove the fact of its absence.

A complaint against an insurance company under compulsory motor liability insurance usually gives results before going to court. It is important to compose it correctly and submit it to the required authority.

How to submit applications to the Central Bank of the Russian Federation in writing

You can submit an application on paper in person at the territorial branch of the Central Bank or send it by registered mail with notification and inventory.

When applying in person, it will be enough to fill out a special form in two copies. One copy is handed over to the Central Bank, the second remains in the hands of the applicant, it must be marked that the letter has been accepted and the registration date must be set.

Three copies are sent by mail to the head office of the Central Bank. The applicant remains in possession of a receipt to confirm the shipment, which must be retained until a response is received.

Important! When applying to the Central Bank directly or by mail, copies of documents confirming violations on the part of the insurance company and the correctness of the applicant should be attached to the application.

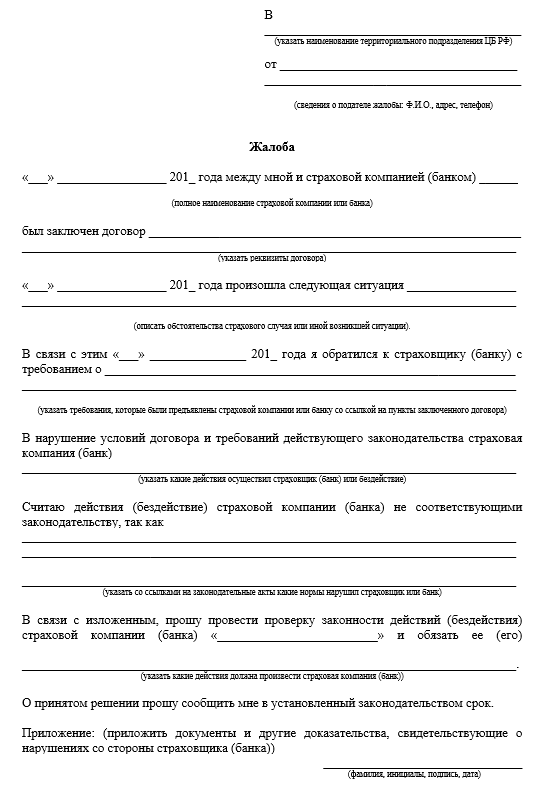

Sample complaint to the Central Bank of the Russian Federation

You can file complaints against an insurance company